Press Release for Early Warning Report Regarding Condor Gold plc

July 29 2019 - 10:13AM

Jim Mellon, of Viking House, Nelson Street, Douglas, Isle of Man,

IMI 2AH, today announced that on July 15, 2019, he acquired,

through Galloway Limited, a limited company that is wholly-owned by

Burnbrae Group Limited, which is in turn wholly-owned by Mr.

Mellon, 6,250,000 units (the “

Units”) of Condor

Gold plc (“

Condor” or the

“

Company”). The Units were acquired by Mr. Mellon

from the Company pursuant to a private placement transaction at a

price of £0.20 per Unit for a total purchase price of £1,250,000

(approximately C$0.33 and C$2,041,000, respectively, based on the

Bank of Canada daily average exchange rate on July 15, 2019). Each

Unit consists of one ordinary share of £0.20 each in the capital of

the Company (an “

Ordinary Share”) and one-third of

one share purchase warrant (a “

Warrant”). Each

such whole Warrant is exercisable at a price of £0.25 for a period

of 36 months following the date on which the shares are admitted to

trading on AIM. The Units were acquired by Mr. Mellon on the same

terms and as part of a larger non-brokered private placement by the

Company of 20,192,520 Units (the “

Private

Placement”) which closed on July 26, 2019.

Pursuant to the acquisition of the Units, Mr.

Mellon acquired ownership and control of 6,250,000 Ordinary Shares

and 2,083,333 Warrants of the Company. Prior to acquiring the

Units, Mr. Mellon owned, directly or indirectly, or exercised

control or direction over, 7,828,105 Ordinary Shares, 1,200,000

stock options (“Options”) and 1,933,842 Warrants,

with each Option and Warrant entitling the holder to purchase one

Ordinary Share.

The 7,828,105 Ordinary Shares held by Mr. Mellon

prior to the acquisition of the Units represented 10.51% of the

total number of issued and outstanding Ordinary Shares prior to

giving effect to the Private Placement and 8.27% of the issued and

outstanding Ordinary Shares after giving effect to the Private

Placement. If all of the Options and Warrants were exercised, Mr.

Mellon would have owned, directly or indirectly, or exercised

control or direction over, approximately: (i) 14.72% of the total

number of issued and outstanding Ordinary Shares on a partially

diluted basis prior to giving effect to the Private Placement; and

(ii) 11.58% of the total number of issued and outstanding Ordinary

Shares on a partially diluted basis after to giving effect to the

Private Placement.

Immediately following the acquisition of the

Units and after giving effect to the Private Placement, Mr. Mellon

owned, directly or indirectly, or exercised control or direction

over, a total of (i) 14,078,105 Ordinary Shares representing

approximately 14.9% of the Company’s issued and outstanding

Ordinary Shares; (ii) 4,017,175 Warrants; and (iii) 1,200,000

Options. Mr. Mellon owns and controls 11,188,222 of such Ordinary

Shares indirectly through Galloway Limited. Assuming exercise of

all of the Warrants and Options held by Mr. Mellon, an aggregate of

18,995,280 Ordinary Shares would be owned, directly or indirectly,

or directed or controlled, by Mr. Mellon, representing

approximately 20.38% of the Company’s issued and outstanding

Ordinary Shares on a partially diluted basis.

Mr. Mellon acquired the Units for investment

purposes. Mr. Mellon may from time to time acquire additional

securities, dispose of some or all of the existing or additional

securities or may continue to hold the securities of the

Company.

Condor’s head office is located at 7/8

Innovation Place, Douglas Drive, Godalming, Surrey, GU7 1JX.

To obtain a copy of the early warning report

filed under applicable Canadian securities laws in connection with

the transactions hereunder, please see Condor’s profile on the

SEDAR website www.sedar.com.

For further information and to obtain a copy of

the early warning report, please contact:

Jim MellonViking House, Nelson StreetDouglas,

Isle of Man, IMI 2AH

Telephone: +44 (0)1624 639395

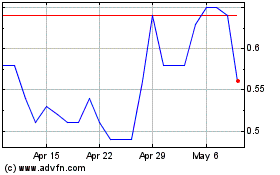

Condor Gold (TSX:COG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Condor Gold (TSX:COG)

Historical Stock Chart

From Dec 2023 to Dec 2024