Condor Gold (AIM: CNR; TSX: COG) announces that pursuant to receipt

of a notice for the exercise of share options at 22 pence per

share, it is issuing 300,000 New Ordinary Shares with a nominal

value of 20p each in the capital of the Company

(“

Shares”). The options were issued under the

Company’s employee share option scheme. The Company confirms it has

received an exercise consideration of £66,000.

Application has been made for the Shares to be

admitted to trading on AIM (“Admission”), with

Admission expected to occur on or around 20 January 2022.

The Shares will rank pari passu with the

existing Ordinary Shares, including the right to receive all

dividends and other distributions declared after the date of their

issue.

Following Admission, the Company will have

146,930,715 ordinary shares with a nominal value of 20p each in

issue with voting rights and admitted to trading on AIM and the

TSX. This figure may then be used by shareholders in the Company as

the denominator for the calculation by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the share capital of the Company under the Financial

Conduct Authority's Disclosure and Transparency Rules and National

Instrument 62-103 – The Early Warning System and Related Take-Over

Bid and Insider Reporting Rules of the Canadian securities

administrators.

For further information please visit

www.condorgold.com or contact:

| Condor Gold plc |

Mark Child, Chairman and CEO+44

(0) 20 7493 2784 |

|

| Beaumont Cornish Limited |

Roland Cornish and James

Biddle+44 (0) 20 7628 3396 |

|

| SP Angel Corporate Finance

LLP |

Ewan Leggat +44 (0) 20 3470

0470 |

|

| H&P Advisory Limited |

Andrew Chubb and Nilesh Patel+44

207 907 8500 |

|

| Blytheweigh |

Tim Blythe and Megan Ray+44 (0)

20 7138 3204 |

|

About Condor Gold plc:

Condor Gold plc was admitted to AIM in May 2006 and dual listed

on the TSX in January 2018. The Company is a gold exploration and

development company with a focus on Nicaragua.

On 25 October 2021 Condor announced the filing of a Preliminary

Economic Assessment Technical Report (“PEA”) for its La India

Project, Nicaragua on SEDAR https://www.sedar.com. The highlight of

the technical study is a post-tax, post upfront capital expenditure

NPV of US$418 million, with an IRR of 54% and 12 month pay-back

period, assuming a US$1,700 per oz gold price, with average annual

production of 150,000 oz gold per annum for the initial 9 years of

gold production. The open pit mine schedules have been optimised

from designed pits, bringing higher grade gold forward resulting in

average annual production of 157,000 oz gold in the first 2 years

from open pit material and underground mining funded out of

cashflow.

In August 2018, the Company announced that the Ministry of the

Environment in Nicaragua had granted the Environmental Permit

(“EP”) for the development, construction and operation of a

processing plant with capacity to process up to 2,800 tonnes per

day at its wholly-owned La India gold Project (“La India Project”).

The EP is considered the master permit for mining operations in

Nicaragua. Condor has purchased a new SAG Mill, which has mainly

arrived in Nicaragua. Site clearance and preparation is at an

advanced stage.

Environmental Permits were granted in April and May 2020 for the

Mestiza and America open pits respectively, both located close to

La India. The Mestiza open pit hosts 92 Kt at a grade of 12.1 g/t

gold (36,000 oz contained gold) in the Indicated Mineral Resource

category and 341 Kt at a grade of 7.7 g/t gold (85,000 oz contained

gold) in the Inferred Mineral Resource category. The America open

pit hosts 114 Kt at a grade of 8.1 g/t gold (30,000 oz) in the

Indicated Mineral Resource category and 677 Kt at a grade of 3.1

g/t gold (67,000 oz) in the Inferred Mineral Resource category.

Following the permitting of the Mestiza and America open pits,

together with the La India Open Pit Condor has 1.12 M oz gold open

pit Mineral Resources permitted for extraction.

Disclaimer

Neither the contents of the Company's website

nor the contents of any website accessible from hyperlinks on the

Company's website (or any other website) is incorporated into, or

forms part of, this announcement.

Qualified Persons

The technical and scientific information in this

press release has been reviewed, verified and approved by Andrew

Cheatle, P.Geo., who is a “qualified person” as defined by NI

43-101 and Gerald D. Crawford, P.E., who is a “qualified person” as

defined by NI 43-101 and is the Chief Technical Officer of Condor

Gold plc.

Technical Information

Certain disclosure contained in this news

release of a scientific or technical nature has been summarised or

extracted from the technical report entitled “Technical Report on

the La India Gold Project, Nicaragua, October 2021”, dated October

22, 2021 with an effective date of September 9, 2021 (the

“Technical Report”), prepared in accordance with NI 43-101. The

Qualified Persons responsible for the Technical Report are Dr Tim

Lucks of SRK Consulting (UK) Limited, and Mr Fernando Rodrigues, Mr

Stephen Taylor and Mr Ben Parsons of SRK Consulting (U.S.) Inc. Mr

Parsons assumes responsibility for the MRE, Mr Rodrigues the open

pit mining aspects, Mr Taylor the underground mining aspects and Dr

Lucks for the oversight of the remaining technical disciplines and

compilation of the report.

Forward Looking Statements

All statements in this press release, other than

statements of historical fact, are ‘forward-looking information’

with respect to the Company within the meaning of applicable

securities laws, including statements with respect to: the ongoing

mining dilution and pit optimisation studies, and the incorporation

of same into any mining production schedule, future development and

production plans at La India Project. Forward-looking information

is often, but not always, identified by the use of words such as:

"seek", "anticipate", "plan", "continue", “strategies”, “estimate”,

"expect", "project", "predict", "potential", "targeting",

"intends", "believe", "potential", “could”, “might”, “will” and

similar expressions. Forward-looking information is not a guarantee

of future performance and is based upon a number of estimates and

assumptions of management at the date the statements are made

including, among others, assumptions regarding: future commodity

prices and royalty regimes; availability of skilled labour; timing

and amount of capital expenditures; future currency exchange and

interest rates; the impact of increasing competition; general

conditions in economic and financial markets; availability of

drilling and related equipment; effects of regulation by

governmental agencies; the receipt of required permits; royalty

rates; future tax rates; future operating costs; availability of

future sources of funding; ability to obtain financing and

assumptions underlying estimates related to adjusted funds from

operations. Many assumptions are based on factors and events that

are not within the control of the Company and there is no assurance

they will prove to be correct.

Such forward-looking information involves known

and unknown risks, which may cause the actual results to be

materially different from any future results expressed or implied

by such forward-looking information, including, risks related to:

mineral exploration, development and operating risks; estimation of

mineralisation and resources; environmental, health and safety

regulations of the resource industry; competitive conditions;

operational risks; liquidity and financing risks; funding risk;

exploration costs; uninsurable risks; conflicts of interest; risks

of operating in Nicaragua; government policy changes; ownership

risks; permitting and licencing risks; artisanal miners and

community relations; difficulty in enforcement of judgments; market

conditions; stress in the global economy; current global financial

condition; exchange rate and currency risks; commodity prices;

reliance on key personnel; dilution risk; payment of dividends; as

well as those factors discussed under the heading “Risk Factors” in

the Company’s annual information form for the fiscal year ended

December 31, 2020 dated March 31, 2021 and available under the

Company’s SEDAR profile at www.sedar.com.

Although the Company has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

forward-looking information, there may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended. There can be no assurance that such information will

prove to be accurate as actual results and future events could

differ materially from those anticipated in such statements. The

Company disclaims any intention or obligation to update or revise

any forward-looking information, whether as a result of new

information, future events or otherwise unless required by law.

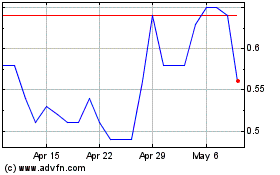

Condor Gold (TSX:COG)

Historical Stock Chart

From Dec 2024 to Jan 2025

Condor Gold (TSX:COG)

Historical Stock Chart

From Jan 2024 to Jan 2025