Cenovus Energy Inc. (TSX: CVE) (NYSE: CVE) continued to deliver

strong operational performance across the portfolio in the fourth

quarter of 2023. The company's upstream assets performed

exceptionally well, achieving the second-highest quarterly

production rates in Cenovus’s history. In its downstream business,

the company continued to build operating momentum at its

wholly-owned refineries. Upstream and downstream results were

negatively impacted by a rapid decline in commodity prices and

refinery crack spreads in the quarter. This was compounded by the

cost of processing crude oil in the downstream that was purchased

in prior periods at higher prices.

“As expected, upstream operating performance was excellent

through the final months of the year. This period also marked the

second full quarter that our full suite of operated refining assets

were available to us and I am very pleased with our progress,” said

Jon McKenzie, Cenovus President & Chief Executive Officer.

“With the work done in 2023, we are well positioned to continue

capturing more margin across our businesses.”

Fourth-quarter and year-end highlights

- Achieved a strong upstream exit rate in 2023, with fourth

quarter average production of 809,000 barrels of oil equivalent per

day (BOE/d)1.

- Returned a total of $731 million to shareholders in the fourth

quarter, including the payment of the remaining warrant purchase

liability. In 2023, returned $2.8 billion to shareholders,

including $1.1 billion through share buybacks, $1.0 billion through

common and preferred share dividends and $711 million on the

purchase and cancellation of common share warrants.

- Reduced net debt by $916 million in the fourth quarter, to $5.1

billion. Long-term debt, including the current portion, was $7.1

billion at the end of the fourth quarter, a reduction of $1.6

billion compared with year-end 2022, and reflects the continued

strengthening of our capital structure with the repurchase of US$1

billion of long-term debt in 2023.

|

Financial, production & throughput

summary |

|

For the period ended December 31 |

2023 Q4 |

2023 Q3 |

2022 Q4 |

2023 FY |

2022 FY |

|

|

Financial ($ millions, except per share

amounts) |

|

Cash from (used in) operating activities |

2,946 |

2,738 |

2,970 |

7,388 |

11,403 |

|

Adjusted funds flow2 |

2,062 |

3,447 |

2,346 |

8,803 |

10,978 |

|

Per share (diluted)2 |

1.09 |

1.81 |

1.19 |

4.57 |

5.47 |

|

Capital investment |

1,170 |

1,025 |

1,274 |

4,298 |

3,708 |

|

Free funds flow2 |

892 |

2,422 |

1,072 |

4,505 |

7,270 |

|

Excess free funds flow2 |

471 |

1,989 |

786 |

|

|

|

Net earnings (loss) |

743 |

1,864 |

784 |

4,109 |

6,450 |

|

Per share (diluted) |

0.39 |

0.97 |

0.39 |

2.12 |

3.20 |

|

Long-term debt, including current portion |

7,108 |

7,224 |

8,691 |

7,108 |

8,691 |

|

Net debt |

5,060 |

5,976 |

4,282 |

5,060 |

4,282 |

|

|

Production and throughput (before royalties, net to

Cenovus) |

|

Oil and NGLs (bbls/d)1 |

662,600 |

652,400 |

664,900 |

640,000 |

641,900 |

|

Conventional natural gas (MMcf/d) |

876.3 |

867.4 |

852.0 |

832.6 |

866.1 |

|

Total upstream production (BOE/d)1 |

808,600 |

797,000 |

806,900 |

778,700 |

786,200 |

|

Total downstream throughput (bbls/d) |

579,100 |

664,300 |

473,300 |

560,400 |

493,700 |

1 See Advisory for production by product type.2 Non-GAAP

financial measure or contains a non-GAAP financial measure. See

Advisory.

Fourth-quarter results

Operating

results1

Cenovus’s total revenues were approximately $13.1 billion in the

fourth quarter of 2023, down from $14.6 billion in the third

quarter. Upstream revenues were about $6.9 billion, a decrease from

$7.6 billion in the previous quarter, while downstream revenues

were approximately $8.4 billion, compared with $9.7 billion in the

third quarter of 2023. Total operating margin3 was about $2.2

billion, compared with $4.4 billion in the third quarter. Upstream

operating margin4 was approximately $2.5 billion, a decrease from

$3.4 billion in the previous quarter, primarily driven by a wider

light-heavy differential and lower Brent and West Texas

Intermediate (WTI) crude oil prices. Cenovus had a downstream

operating margin4 shortfall of $304 million, compared with an

operating margin of $922 million in the third quarter. Operating

margin in U.S. Refining was impacted by approximately $430 million

comprising first-in, first-out (FIFO) losses and a non-cash

write-down of refined product and crude oil inventory.

Total upstream production was 808,600 BOE/d in the fourth

quarter, an increase of approximately 12,000 barrels per day

(bbls/d) from the third quarter, as the company progressed the

start-up of new oil sands well pads and the Terra Nova field

returned to production in November. Foster Creek volumes increased

to 198,800 bbls/d, from 189,300 bbls/d in the third quarter and

Christina Lake production was 239,600 bbls/d, in line with the

third quarter. Sunrise produced 50,100 bbls/d and continued to show

strong results from its redevelopment program. At the Lloydminster

thermal projects, production of 106,600 bbls/d was in line with the

prior quarter. Overall, Oil Sands operating costs per barrel were

$10.96, a reduction of 13% from the third quarter of 2023,

reflecting higher sales volumes and lower natural gas prices.

Production in the Conventional segment was 123,800 BOE/d in the

fourth quarter, a decrease from 127,200 BOE/d in the third quarter.

Cenovus experienced higher production rates from certain wells in

the third quarter following shut-ins that occurred in the second

quarter of 2023 due to the Alberta wildfires.

In the Offshore segment, production was 70,200 BOE/d compared

with 66,400 BOE/d in the third quarter. In Asia Pacific, sales

volumes increased in the fourth quarter, reflecting production from

the MAC field in Indonesia that began in the third quarter of 2023.

In the Atlantic region, production was 9,700 bbls/d compared with

8,900 bbls/d in the prior quarter as the non-operated Terra Nova

floating production, storage and offloading (FPSO) vessel resumed

production offshore Newfoundland and Labrador.

Crude throughput in the Canadian Refining segment was 100,300

bbls/d in the fourth quarter, compared with crude throughput of

108,400 bbls/d in the third quarter. Throughput was reduced

primarily due to an unplanned outage at the Lloydminster Upgrader

in October, which returned to full rates in November.

In U.S. Refining, crude throughput was 478,800 bbls/d in the

fourth quarter, compared with crude throughput of 555,900 bbls/d in

the third quarter. Throughput was reduced primarily due to planned

turnaround activity at the non-operated Borger Refinery and an

unplanned outage delaying the start-up of the refinery

post-turnaround. The Lima Refinery also underwent planned

maintenance in the fourth quarter and a temporary unplanned outage.

In response to the exceptionally weak refined products pricing

environment in December, the company took the opportunity to

economically optimize throughput across its refining network.

3 Non-GAAP financial measure. Total operating margin is the

total of Upstream operating margin plus Downstream operating

margin. See Advisory.4 Specified financial measure. See

Advisory.

Financial results

Fourth-quarter cash from operating activities, which includes

changes in non-cash working capital, was about $2.9 billion,

compared with $2.7 billion in the third quarter of 2023. Adjusted

funds flow was approximately $2.1 billion, compared with $3.4

billion in the prior period and free funds flow was $892 million, a

decrease from $2.4 billion in the third quarter. Fourth-quarter

financial results were impacted by lower refined product pricing in

the U.S. and lower price realizations in the Oil Sands segment,

driven by wider light-heavy crude oil differentials. The December

2023 average Chicago 3-2-1 crack was US$7.65 per barrel, the lowest

monthly average since 2020.

Net earnings in the fourth quarter were $743 million, compared

with $1.9 billion in the previous quarter. The decrease in net

earnings was primarily due to lower operating margin, which

includes a non-cash write-down of $89 million in refined product

inventory and crude oil inventory as a result of lower market

pricing anticipated in the first quarter of 2024. These factors

were partially offset by lower income taxes, lower general and

administrative expenses due to lower long-term incentive costs and

an unrealized foreign exchange gain compared with an unrealized

loss in the third quarter.

Long-term debt, including the current portion, was reduced to

$7.1 billion at December 31, 2023 compared with $7.2 billion at

September 30, 2023 and $8.7 billion at December 31, 2022, mainly as

a result of the company’s purchase of US$1.0 billion of outstanding

notes in the third quarter of 2023. Net debt was approximately $5.1

billion at December 31, 2023, a decrease from $6.0 billion at

September 30, 2023, primarily due to a draw in non-cash working

capital in the quarter as a result of decreasing commodity prices

and a volumetric draw of product in inventory as well as free funds

flow of $892 million offset by shareholder returns of $731 million.

Cenovus continues to make progress towards its net debt target of

$4.0 billion.

Capital investment of $1.2 billion in the fourth quarter was

primarily directed towards sustaining production in the Oil Sands

segment, tie-ins and infrastructure projects in the Conventional

business and sustaining activities in the Downstream segments. In

addition, the company continues to progress its growth and

optimization projects, including the West White Rose project, the

tie-back of Narrows Lake to Christina Lake and Sunrise and Foster

Creek optimizations.

Full-year results

In 2023, Cenovus’s total upstream production averaged 778,700

BOE/d, compared with 786,200 BOE/d in 2022, which reflects the

impact of wildfire activity in Alberta in the second quarter of

2023 as well as the timing of sustaining well pads in the Oil Sands

segment. Oil Sands crude oil production was 593,400 bbls/d,

including 186,300 bbls/d at Foster Creek and 237,400 bbls/d at

Christina Lake. Full-year production from the Lloydminster thermal

projects was 104,100 bbls/d compared with 99,900 bbls/d in 2022,

reflecting a full year of production from the company’s Spruce Lake

North facility. Production from Sunrise was 48,900 bbls/d compared

with 31,300 bbls/d in 2022, with the increase largely driven by the

acquisition of the remaining 50% working interest in Sunrise, which

closed in August 2022. Conventional production was 119,900 BOE/d

compared with 127,200 BOE/d in 2022, with the decrease mainly

related to the wildfire activity in Alberta in 2023. Offshore total

production was 63,400 BOE/d, compared with 70,300 BOE/d in the

prior year, reflecting lower production from the Atlantic region

primarily due to turnaround work in 2023 and the unplanned outage

in China in the second quarter of 2023.

U.S. Refining crude oil throughput increased to 459,700 bbls/d

in 2023 compared with 400,800 bbls/d in 2022, reflecting the

acquisition of the remaining 50% working interest in the Toledo

Refinery and the restart of the Superior Refinery in 2023. In

addition, 2022 throughput was impacted by higher levels of planned

and unplanned maintenance.

Total revenues were about $52.2 billion in 2023 and total

operating margin was $11.0 billion compared with revenues of

$66.9 billion and total operating margin of $14.3 billion

in 2022. Year-over-year decreases in both total revenues and total

operating margin were largely related to lower commodity

prices.

Cash from operating activities was $7.4 billion for 2023

compared with $11.4 billion in 2022. Adjusted funds flow was

$8.8 billion and free funds flow was $4.5 billion. Total

capital investment for 2023 was $4.3 billion, primarily

concentrated on sustaining production at the company’s upstream

assets, the construction of the West White Rose project and

refining reliability initiatives. Full-year net earnings for 2023

were about $4.1 billion compared with $6.5 billion in

2022, primarily due to lower commodity prices.

Reserves

Cenovus’s proved and probable reserves are evaluated each year

by independent qualified reserves evaluators. At the end of 2023,

Cenovus’s total proved and total proved plus probable reserves were

approximately 5.9 billion BOE and 8.7 billion BOE

respectively, relatively unchanged compared to the prior year.

Total proved and total proved plus probable bitumen reserves were

approximately 5.4 billion barrels and approximately

7.9 billion barrels respectively, both relatively unchanged

compared to the prior year. At year-end 2023, Cenovus had a proved

reserves life index of approximately 21 years and a proved plus

probable reserves life index of approximately 31 years.

More details about Cenovus’s reserves and other oil and gas

information are available in the Advisory and the Management’s

Discussion & Analysis (MD&A), Annual Information Form (AIF)

and Annual Report on Form 40-F for the year ended December 31,

2023, available on SEDAR+ at sedarplus.ca, EDGAR at sec.gov and

Cenovus’s website at cenovus.com.

Cenovus year-end disclosure documents

Today, Cenovus is filing its audited Consolidated Financial

Statements, MD&A and AIF with Canadian securities regulatory

authorities. The company is also filing its Annual Report on Form

40-F for the year ended December 31, 2023 with the U.S. Securities

and Exchange Commission. Copies of these documents will be

available on SEDAR+ at sedarplus.ca, EDGAR at sec.gov and the

company's website at cenovus.com under Investors. They can also be

requested free of charge by emailing

investor.relations@cenovus.com.

Dividend declarations and share purchases

The Board of Directors has declared a quarterly base dividend of

$0.14 per common share, payable on March 28, 2024, to shareholders

of record as of March 15, 2024. In addition, the Board has declared

a quarterly dividend on each of the Cumulative Redeemable First

Preferred Shares – Series 1, Series 2, Series 3, Series 5 and

Series 7 – payable on April 1, 2024, to shareholders of record as

of March 15, 2024 as follows:

|

Preferred shares dividend summary |

|

Share series |

Rate (%) |

Amount ($/share) |

| Series 1 |

2.577 |

0.16106 |

| Series 2 |

6.772 |

0.42094 |

| Series 3 |

4.689 |

0.29306 |

| Series 5 |

4.591 |

0.28694 |

| Series 7 |

3.935 |

0.24594 |

| |

|

|

All dividends paid on Cenovus’s common and preferred shares will

be designated as “eligible dividends” for Canadian federal income

tax purposes. Declaration of dividends is at the sole discretion of

the Board and will continue to be evaluated on a quarterly

basis.

Cenovus’s shareholder returns framework has a target of

returning 50% of excess free funds flow to shareholders for

quarters where the ending net debt is between $9.0 billion and $4.0

billion. In the fourth quarter, the company returned $731 million

to shareholders, composed of $111 million for the remaining payment

of the common share warrants obligation, $350 million through its

normal course issuer bid (NCIB) and $270 million through common and

preferred share dividends. In 2023, the company returned $2.8

billion to shareholders through its NCIB, common and preferred

share dividends and the purchase and cancellation of common

share warrants.

2024 planned maintenance

The following table provides details on planned maintenance

activities at Cenovus assets through 2024 and anticipated

production or throughput impacts.

|

2024 planned maintenance |

|

Potential quarterly production/throughput impact

(Mbbls/d) |

|

|

Q1 |

Q2 |

Q3 |

Q4 |

Annualized impact |

|

Upstream |

|

|

|

|

|

| Oil

Sands |

— |

2 - 3 |

50 - 60 |

— |

13 - 16 |

|

Atlantic |

8 - 10 |

8 - 10 |

8 - 10 |

— |

5 - 7 |

|

Conventional |

— |

3 - 5 |

4 - 6 |

— |

2 - 4 |

|

Downstream |

|

|

|

|

| Canadian

Refining |

— |

42 - 46 |

— |

— |

10 - 12 |

| U.S.

Refining |

20 - 24 |

12 - 16 |

30 - 34 |

56 - 60 |

30 - 35 |

|

|

|

|

|

|

|

Sustainability

In 2023, Cenovus made progress in several of its environmental,

social and governance focus areas. The company announced a new

milestone to reduce absolute methane emissions in its upstream

operations by 80 percent by year-end 2028, from a 2019 baseline. In

addition, Cenovus has reached its target of spending at least $1.2

billion with Indigenous businesses between 2019 and year-end 2025

and has achieved its aspiration to have at least 40% representation

from designated groups among non-management members of the Board of

Directors, including at least 30% women, by year-end 2025.

Cenovus continues to work with its peers in the Pathways

Alliance to advance company-specific projects in order to achieve

its overall emissions reduction target. Additional certainty about

shared funding commitments from governments is required for Cenovus

and the Pathways Alliance to move forward with the large-scale

capital investments necessary to meet their emissions reduction

goals.

Chief Sustainability Officer update

Cenovus Chief Sustainability Officer & Executive

Vice-President, Stakeholder Engagement, Rhona DelFrari, will be

taking a one-year sabbatical starting May 2, 2024. Jeff Lawson,

Cenovus Senior Vice-President, Corporate Development, will take on

Rhona’s responsibilities and join the executive team during her

absence.

| Conference call

today9 a.m. Mountain Time (11 a.m. Eastern

Time)Cenovus will host a conference call today, February

15, 2024, starting at 9 a.m. MT (11 a.m. ET).To join the conference

call without operator assistance, please register here

approximately 5 minutes in advance to receive an automated

call-back when the session begins.Alternatively, you can dial

888-664-6383 (toll-free in North America) or 416-764-8650 to reach

a live operator who will join you into the call. A live audio

webcast will also be available and will be archived for

approximately 90 days. |

| |

Advisory

Basis of Presentation

Cenovus reports financial results in Canadian dollars and

presents production volumes on a net to Cenovus before royalties

basis, unless otherwise stated. Cenovus prepares its financial

statements in accordance with International Financial Reporting

Standards (IFRS) Accounting Standards.

Barrels of Oil Equivalent

Natural gas volumes have been converted to barrels of oil

equivalent (BOE) on the basis of six thousand cubic feet (Mcf) to

one barrel (bbl). BOE may be misleading, particularly if used in

isolation. A conversion ratio of one bbl to six Mcf is based on an

energy equivalency conversion method primarily applicable at the

burner tip and does not represent value equivalency at the

wellhead. Given that the value ratio based on the current price of

crude oil compared with natural gas is significantly different from

the energy equivalency conversion ratio of 6:1, utilizing a

conversion on a 6:1 basis is not an accurate reflection of

value.

Product types

|

Product type by operating segment |

|

|

Three months endedDecember 31,

2023 |

Full year endedDecember 31,

2023 |

|

Oil Sands |

|

|

Bitumen (Mbbls/d) |

595.1 |

576.7 |

|

Heavy crude oil (Mbbls/d) |

17.5 |

16.7 |

|

Conventional natural gas (MMcf/d) |

12.3 |

11.9 |

|

Total Oil Sands segment production (MBOE/d) |

614.6 |

595.4 |

|

Conventional |

|

|

|

Light crude oil (Mbbls/d) |

6.1 |

5.9 |

|

Natural gas liquids (Mbbls/d) |

22.8 |

21.7 |

|

Conventional natural gas (MMcf/d) |

569.6 |

554.1 |

|

Total Conventional segment production

(MBOE/d) |

123.8 |

119.9 |

|

Offshore |

|

|

|

Light crude oil (Mbbls/d) |

9.7 |

8.2 |

|

Natural gas liquids (Mbbls/d) |

11.4 |

10.8 |

|

Conventional natural gas (MMcf/d) |

294.4 |

266.6 |

|

Total Offshore segment production (MBOE/d) |

70.2 |

63.4 |

|

Total upstream production (MBOE/d) |

808.6 |

778.7 |

Forward‐looking Information

This news release contains certain forward‐looking statements

and forward‐looking information (collectively referred to as

“forward‐looking information”) within the meaning of applicable

securities legislation about Cenovus’s current expectations,

estimates and projections about the future of the company, based on

certain assumptions made in light of the company’s experiences and

perceptions of historical trends. Although Cenovus believes that

the expectations represented by such forward‐looking information

are reasonable, there can be no assurance that such expectations

will prove to be correct.

Forward‐looking information in this document is identified by

words such as “anticipate”, “continue”, “deliver”, “focus”,

“progress”, and “will” or similar expressions and includes

suggestions of future outcomes, including, but not limited to,

statements about: performance for the rest of 2024 and beyond;

market pricing; capturing margin; achieving net debt of $4.0

billion; excess free funds flow under the shareholder returns

framework; progressing growth and optimization projects; planned

turnaround activities; dividend payments; advancing

company-specific and Pathways Alliance emissions reductions

projects; and Cenovus’s 2024 corporate guidance available on

cenovus.com.

Developing forward‐looking information involves reliance on a

number of assumptions and consideration of certain risks and

uncertainties, some of which are specific to Cenovus and others

that apply to the industry generally. The factors or assumptions on

which the forward‐looking information in this news release are

based include, but are not limited to: the allocation of free funds

flow to reducing net debt; commodity prices, inflation and supply

chain constraints; Cenovus’s ability to produce on an unconstrained

basis; Cenovus’s ability to access sufficient insurance coverage to

pursue development plans; Cenovus’s ability to deliver safe and

reliable operations and demonstrate strong governance; and the

assumptions inherent in Cenovus’s 2024 Guidance available on

cenovus.com.

The risk factors and uncertainties that could cause actual

results to differ materially from the forward‐looking information

in this news release include, but are not limited to: the accuracy

of estimates regarding commodity production and operating expenses,

inflation, taxes, royalties, capital costs and currency and

interest rates; risks inherent in the operation of Cenovus’s

business; and risks associated with climate change and Cenovus’s

assumptions relating thereto and other risks identified under “Risk

Management and Risk Factors” and “Advisory” in Cenovus’s

Management’s Discussion and Analysis (MD&A) for the year ended

December 31, 2023.

Except as required by applicable securities laws, Cenovus

disclaims any intention or obligation to publicly update or revise

any forward‐looking statements, whether as a result of new

information, future events or otherwise. Readers are cautioned that

the foregoing lists are not exhaustive and are made as at the date

hereof. Events or circumstances could cause actual results to

differ materially from those estimated or projected and expressed

in, or implied by, the forward‐looking information. For additional

information regarding Cenovus’s material risk factors, the

assumptions made, and risks and uncertainties which could cause

actual results to differ from the anticipated results, refer to

“Risk Management and Risk Factors” and “Advisory” in Cenovus’s

MD&A for the period ended December 31, 2023, and to the risk

factors, assumptions and uncertainties described in other documents

Cenovus files from time to time with securities regulatory

authorities in Canada (available on SEDAR+ at sedarplus.ca, on

EDGAR at sec.gov and Cenovus’s website at cenovus.com).

Specified Financial Measures

This news release contains references to certain specified

financial measures that do not have standardized meanings

prescribed by IFRS. Readers should not consider these measures in

isolation or as a substitute for analysis of the company’s results

as reported under IFRS. These measures are defined differently by

different companies and, therefore, might not be comparable to

similar measures presented by other issuers. For information on the

composition of these measures, as well as an explanation of how the

company uses these measures, refer to the Specified Financial

Measures Advisory located in Cenovus’s MD&A for the period

ended December 31, 2023 (available on SEDAR+ at sedarplus.ca, on

EDGAR at sec.gov and on Cenovus's website at cenovus.com) which is

incorporated by reference into this news release.

Upstream Operating Margin and Downstream Operating

Margin

Upstream Operating Margin and Downstream Operating Margin, and

the individual components thereof, are included in Note 1 to the

interim Consolidated Financial Statements.

Total Operating Margin

Total Operating Margin is the total of Upstream Operating Margin

plus Downstream Operating Margin.

| |

Upstream(1) |

|

Downstream(1) |

|

Total |

|

($ millions) |

Q4 2023 |

|

Q3 2023 |

|

|

Q4 2022 |

|

Q4 2023 |

|

|

Q3 2023 |

|

Q4 2022 |

|

|

Q4 2023 |

|

Q3 2023 |

|

Q4 2022 |

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross Sales |

7,797 |

|

8,783 |

|

|

8,251 |

|

8,404 |

|

|

9,658 |

|

8,302 |

|

|

16,201 |

|

18,441 |

|

16,553 |

| Less: Royalties |

902 |

|

1,135 |

|

|

875 |

|

— |

|

|

— |

|

— |

|

|

902 |

|

1,135 |

|

875 |

| |

6,895 |

|

7,648 |

|

|

7,376 |

|

8,404 |

|

|

9,658 |

|

8,302 |

|

|

15,299 |

|

17,306 |

|

15,678 |

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchased Product |

663 |

|

900 |

|

|

1,079 |

|

7,888 |

|

|

7,947 |

|

6,993 |

|

|

8,551 |

|

8,847 |

|

8,072 |

| Transportation and Blending |

2,894 |

|

2,397 |

|

|

2,984 |

|

— |

|

|

— |

|

— |

|

|

2,894 |

|

2,397 |

|

2,984 |

| Operating |

864 |

|

914 |

|

|

955 |

|

826 |

|

|

778 |

|

759 |

|

|

1,690 |

|

1,692 |

|

1,714 |

| Realized (Gain) Loss on Risk

Management |

19 |

|

(10 |

) |

|

134 |

|

(6 |

) |

|

11 |

|

(8 |

) |

|

13 |

|

1 |

|

126 |

| Operating

Margin |

2,455 |

|

3,447 |

|

|

2,224 |

|

(304 |

) |

|

922 |

|

558 |

|

|

2,151 |

|

4,369 |

|

2,782 |

(1) Found in the December 31, 2023, or the

September 30, 2023, interim Consolidated Financial Statements.

| |

Upstream(1) |

|

Downstream(1) |

|

Total |

|

($ millions) |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

| Gross Sales |

31,082 |

|

41,142 |

|

32,626 |

|

38,010 |

|

63,708 |

|

79,152 |

| Less: Royalties |

3,270 |

|

4,868 |

|

— |

|

— |

|

3,270 |

|

4,868 |

| |

27,812 |

|

36,274 |

|

32,626 |

|

38,010 |

|

60,438 |

|

74,284 |

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

| Purchased Product |

3,152 |

|

6,741 |

|

28,273 |

|

32,409 |

|

31,425 |

|

39,150 |

| Transportation and Blending |

11,088 |

|

12,301 |

|

— |

|

— |

|

11,088 |

|

12,301 |

| Operating |

3,690 |

|

3,789 |

|

3,201 |

|

3,050 |

|

6,891 |

|

6,839 |

| Realized (Gain) Loss on Risk

Management |

12 |

|

1,619 |

|

— |

|

112 |

|

12 |

|

1,731 |

| Operating

Margin |

9,870 |

|

11,824 |

|

1,152 |

|

2,439 |

|

11,022 |

|

14,263 |

(1) Found in the December 31, 2023, Consolidated

Financial Statements.

Adjusted Funds Flow, Free Funds Flow and

Excess Free Funds Flow

The following table provides a reconciliation of cash from (used

in) operating activities found in Cenovus’s Consolidated Financial

Statements to Adjusted Funds Flow, Free Funds Flow and Excess Free

Funds Flow. Adjusted Funds Flow per Share – Basic and Adjusted

Funds Flow per Share – Diluted are calculated by dividing Adjusted

Funds Flow by the respective basic or diluted weighted average

number of common shares outstanding during the period and may be

useful to evaluate a company’s ability to generate cash.

| |

Three Months Ended |

|

Twelve Months Ended |

|

($ millions) |

Dec. 31, 2023 |

|

Sept. 30, 2023 |

|

Dec. 31, 2022 |

|

|

Dec. 31, 2023 |

|

Dec. 31, 2022 |

|

|

Cash From (Used in) Operating Activities(1) |

2,946 |

|

2,738 |

|

2,970 |

|

|

7,388 |

|

11,403 |

|

| (Add) Deduct: |

|

|

|

|

|

|

| Settlement of Decommissioning

Liabilities |

(65 |

) |

(68 |

) |

(49 |

) |

|

(222 |

) |

(150 |

) |

| Net Change in Non-Cash Working

Capital |

949 |

|

(641 |

) |

673 |

|

|

(1,193 |

) |

575 |

|

| Adjusted Funds

Flow |

2,062 |

|

3,447 |

|

2,346 |

|

|

8,803 |

|

10,978 |

|

| Capital Investment |

1,170 |

|

1,025 |

|

1,274 |

|

|

4,298 |

|

3,708 |

|

| Free Funds

Flow |

892 |

|

2,422 |

|

1,072 |

|

|

4,505 |

|

7,270 |

|

| Add (Deduct): |

|

|

|

|

|

|

| Base Dividends Paid on Common

Shares |

(261 |

) |

(264 |

) |

(201 |

) |

|

|

|

| Dividends Paid on Preferred

Shares |

(9 |

) |

— |

|

— |

|

|

|

|

| Settlement of Decommissioning

Liabilities |

(65 |

) |

(68 |

) |

(49 |

) |

|

|

|

| Principal Repayment of

Leases |

(72 |

) |

(70 |

) |

(74 |

) |

|

|

|

| Acquisitions, Net of Cash

Acquired |

(14 |

) |

(32 |

) |

(7 |

) |

|

|

|

| Proceeds From Divestitures |

— |

|

1 |

|

45 |

|

|

|

|

|

Excess Free Funds Flow |

471 |

|

1,989 |

|

786 |

|

|

|

|

(1) Found in the December 31, 2023, or the September 30, 2023,

interim Consolidated Financial Statements.

Cenovus Energy Inc.

Cenovus Energy Inc. is an integrated energy company with oil and

natural gas production operations in Canada and the Asia Pacific

region, and upgrading, refining and marketing operations in Canada

and the United States. The company is focused on managing its

assets in a safe, innovative and cost-efficient manner, integrating

environmental, social and governance considerations into its

business plans. Cenovus common shares and warrants are listed on

the Toronto and New York stock exchanges, and the company’s

preferred shares are listed on the Toronto Stock Exchange. For more

information, visit cenovus.com.

Find Cenovus on Facebook, X, LinkedIn, YouTube and

Instagram.

Cenovus contacts

|

Investors |

Media |

|

Investor Relations general line403-766-7711 |

Media Relations general line403-766-7751 |

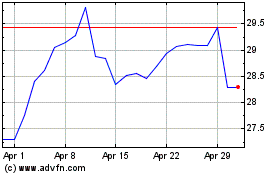

Cenovus Energy (TSX:CVE)

Historical Stock Chart

From Oct 2024 to Nov 2024

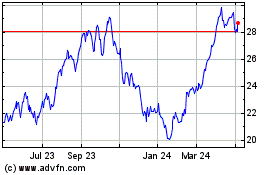

Cenovus Energy (TSX:CVE)

Historical Stock Chart

From Nov 2023 to Nov 2024