Dominion Lending Centres Inc. (TSX:DLCG) (“DLCG” or the

“Corporation”), along with Mauris Family Investments Inc. (an

entity controlled by Gary Mauris) and 603908 BC Ltd. (an entity

controlled by Chris Kayat and family), announced today that they

have entered into an agreement with Desjardins Capital Markets as

sole bookrunner and lead agent (the “Agent”), on behalf of a

syndicate of agents (together “the Agents”), in respect of a fully

marketed offering of up to 7,782,400 class “A” common shares (the

“Offered Shares”) to be completed by the Selling Shareholders (as

defined below) at a price of $7.60 per Offered Share for gross

proceeds to the Selling Shareholders of approximately $59.15

million (the “Offering”). DLCG will not receive any proceeds from

the Offering. Mauris Family Investments Ltd. (“MaurisCo”) and

603908 BC Ltd. (“KayatCo”) are collectively referred to herein as

the “Selling Shareholders”.

Gary Mauris, Executive Chairman and CEO,

commented, “DLCG has been built by forging strong partnerships;

partnerships with owners, brokers, lenders and employees. Today, we

are announcing a small sale of shares by Chris and I to make room

for a few select shareholders who we believe will make good long

term partners as DLCG continues to grow. We will continue to hold

more than 50% of the outstanding shares and remain fully committed

to stewarding DLCG. We look forward to completing the transaction

and welcoming our new institutional shareholders to

DLCG.”

Prior to the Offering, MaurisCo beneficially

owns or controls, directly or indirectly, an aggregate of

23,979,733 class “A” common shares, representing approximately

30.5% of the total issued and outstanding class “A” common shares.

Prior to the Offering, KayatCo beneficially owns or controls,

directly or indirectly, an aggregate of 23,253,532 class “A” common

shares, representing approximately 29.5% of the total issued and

outstanding class “A” common shares. Following the

closing of the Offering, MaurisCo will beneficially own or control,

directly or indirectly, 20,088,533 class “A” common shares and

KayatCo will beneficially own or control, directly or indirectly,

19,362,332 class “A” common shares, representing 25.5% and 24.6%,

respectively, of the issued and outstanding class “A” common

shares.

Closing of the Offering is expected to be on or

about February 28, 2025 and is subject to certain conditions

including, but not limited to, the receipt of all necessary

approvals.

The Offered Shares will be offered on a “best

efforts” basis in each of the provinces of Canada by way of private

placement to “accredited investors” or pursuant to other available

prospectus exemption under National Instrument 45-106 – Prospectus

Exemptions. The Offered Shares may also be offered to accredited

investors in the United States pursuant to Section 4(a)(2) of the

U.S. Securities Act of 1933, as amended, (the “U.S. Securities

Act”) or in such other manner as to not require registration under

the U.S. Securities Act, and on a private placement to other

international purchasers. The Offered Shares will be subject to a

four month hold period under applicable securities laws.

Preliminary Year-End and Fourth Quarter

2024 Results

The Corporation is pleased to announce the

following preliminary (unaudited) results:

- Funded mortgage

volume for the fiscal year ended December 31, 2024 was $67.4

billion and total funded mortgage volume for the three months ended

December 31, 2024 (“Q4”) was $19.6 billion, with momentum

continuing as January 2025’s volume of over $5.7 billion was a

record for any January in the Corporation’s history;

- Revenue for the year is expected to be

between $76.5 million and $77.0 million and total revenue for Q4 is

expected to be between $22.0 million and $22.5 million; and

- Adjusted EBITDA for the year is

expected to be between $35.4 million and $36.1 million and adjusted

EBITDA for Q4 is expected to be between $9.6 million and $10.4

million.(1)

Note:

(1) Estimated “Adjusted EBITDA” for the

year ended December 31, 2024 and for the three months ended

December 31, 2024 are non-IFRS measures. As contemplated by

National Instrument 51-112 – Non-GAAP and Other Financial Measure

Disclosure of the Canadian Securities Administrators (“NI 51-112”),

because the Adjusted EBITDA for the year ended December 31, 2024

and for the three months ended December 31, 2024 are preliminary

calculations, they also may be considered forward-looking non-IFRS

financial measures. As required by NI 51-112, the “equivalent

historical non-GAAP financial measure” for the Corporation is

“Adjusted EBITDA” for the nine months ended September 30, 2024 of

$25.746 million and for the three months ended September 30, 2024

of $12.218 million, as disclosed in the Corporation’s MD&A

dated November 5, 2024 (the “Interim MD&A”). See “Non-IFRS

Financial Performance Measures” in the Interim MD&A for a

reconciliation of Adjusted EBITDA to Income Before Income Tax,

which is the most directly-comparable measure calculated in

accordance with IFRS.

As previously announced, the Corporation

acquired (the “Preferred Share Acquisition”) all issued and

outstanding series I class B preferred shares in exchange for class

“A” common shares and cash on December 17, 2024 (the “Preferred

Share Closing Date”). The Preferred Share Acquisition was initially

announced on October 2, 2024 (the “Preferred Share Announcement

Date”). During the time between the Preferred Share Announcement

Date and the Preferred Share Closing Date, the closing price for

the class “A” common shares increased. This closing price was

applied to the share consideration issued, creating a significant

non-cash loss on the Preferred Share Acquisition, due to the

difference between the consideration granted for the preferred

shares and their book value (which had been recorded at their

amortized cost). As such, the Corporation expects to record a net

loss for the year ended December 31, 2024 of between $125.8 million

and $128.8 million.

Final revenue, adjusted EBITDA and net loss

amounts will be included in the Corporation’s audited annual

financial statements, which the Corporation anticipates will be

released on or about March 27, 2025.

Forward-Looking Non-IFRS Financial

Performance Measures Management presents adjusted EBITDA,

a non-IFRS financial performance measure, which we use as a

supplemental indicator of our operating performance. This non-IFRS

measure does not have any standardized meaning, and therefore is

unlikely to be comparable to the calculation of similar measures

used by other companies and should not be considered in isolation

or as a substitute for measures of performance prepared in

accordance with IFRS. Non-IFRS measures are defined and reconciled

to the most directly-comparable IFRS measure. Although the

Corporation has provided forward-looking non-IFRS measures,

management is unable to reconcile, without unreasonable efforts,

forward-looking adjusted EBITDA to the most comparable IFRS

measure, due to unknown variables and uncertainty related to future

results. See “Non-IFRS Financial Performance Measures” in the

Interim MD&A for a reconciliation of Adjusted EBITDA for the

three and nine months ended September 30, 2024, which is the

“equivalent historical non-GAAP financial measure”, to Income

Before Income Tax, which is the most directly-comparable measure

calculated in accordance with IFRS. The Corporation’s MD&A is

available on SEDAR+ at www.sedarplus.ca.

Forward-Looking Information

Certain statements in this document constitute forward-looking

information under applicable securities legislation.

Forward-looking information typically contains statements with

words such as “anticipate,” “believe,” “estimate,” “will,”

“expect,” “plan,” or similar words suggesting future outcomes or

outlooks. Forward-looking information in this document includes,

but is not limited to: the timing and anticipated closing of the

Offering; the obtaining of all necessary approvals, and the

expected revenue, adjusted EBITDA and net loss for the three months

and year ended December 31, 2024.

Such forward-looking information is based on

many estimates and assumptions, including material estimates and

assumptions, related to the following factors below that, while

considered reasonable by the Corporation as at the date of this

press release considering management’s experience and perception of

current conditions and expected developments, are inherently

subject to significant business, economic, and competitive

uncertainties and contingencies. Known and unknown factors could

cause actual results to differ materially from those projected in

the forward-looking statements. Such factors include, but are not

limited to:

- Changes in interest rates;

- The DLC Group’s ability to maintain its existing number of

franchisees and add additional franchisees;

- Changes in overall demand for Canadian real estate (via factors

such as immigration);

- Changes in overall supply for Canadian real estate (via factors

such as new housing-start levels);

- At what period in time the Canadian real estate market

stabilizes;

- Changes in Canadian mortgage lending and mortgage brokerage

laws and regulations;

- Changes in the Canadian mortgage lending marketplace;

- Changes in the fees paid for mortgage brokerage services in

Canada;

- Demand for the Corporation’s products remaining consistent with

historical demand; and

- Demand for the Corporation’s class "A" common shares and the

satisfaction of the conditions to closing of the Offering

Many of these uncertainties and contingencies

may affect our actual results and could cause actual results to

differ materially from those expressed or implied in any

forward-looking statements made by, or on behalf of, us. Readers

are cautioned that forward-looking statements are not guarantees of

future performance. All forward-looking statements made in this

document are qualified by these cautionary statements. The

foregoing list of risks is not exhaustive. The forward-looking

information contained in this document is made as of the date

hereof and, except as required by applicable securities laws, we

undertake no obligation to update publicly or revise any

forward-looking statements or information, whether because of new

information, future events or otherwise.

About Dominion Lending Centres

Inc.Dominion Lending Centres Inc. is Canada’s leading

network of mortgage professionals. DLCG operates through Dominion

Lending Centres Inc. and its three main subsidiaries, MCC Mortgage

Centre Canada Inc., MA Mortgage Architects Inc. and Newton

Connectivity Systems Inc., and has operations across Canada. DLCG

extensive network includes over 8,500 agents and over 500

locations. Headquartered in British Columbia, DLC was founded in

2006 by Gary Mauris and Chris Kayat.

DLCG can be found on X (Twitter), Facebook and

Instagram and LinkedIn @DLCGmortgage and on the web at

www.dlcg.ca.

Contact information for the Corporation is as

follows:

|

Eddy CocciolloPresident647-403-7320eddy@dlc.ca |

James BellEVP, Corporate and Chief Legal

Officer403-560-0821jbell@dlcg.ca |

|

|

|

|

|

NEITHER THE TSX EXCHANGE NOR ITS REGULATION

SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE

TSX EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY

OF THIS RELEASE.

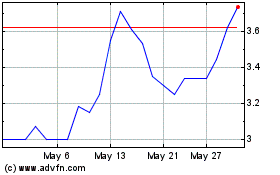

Dominion Lending Centres (TSX:DLCG)

Historical Stock Chart

From Feb 2025 to Mar 2025

Dominion Lending Centres (TSX:DLCG)

Historical Stock Chart

From Mar 2024 to Mar 2025