Dundee Precious Metals Announces Sale of Tsumeb Smelter for US$49 Million

March 07 2024 - 3:45AM

Dundee Precious Metals Inc. (TSX: DPM) (“DPM” or

“the Company”) today announced that it has entered into a

definitive share purchase agreement (the “SPA”) with a subsidiary

of Sinomine Resource Group Co. Ltd., (“Sinomine”) for the sale of

its interest in the Tsumeb smelter located in Namibia, including

all associated assets and liabilities, through the disposition of

all of the issued and outstanding shares it indirectly holds in

Dundee Precious Metals Tsumeb Holding (Pty) Ltd. (“DPMTH”) (“the

Transaction”) for consideration of US$49 million in cash.

“We are pleased to announce the sale of the

Tsumeb smelter, which is consistent with our strategic objective of

focusing on our gold mining assets and simplifying our portfolio

going forward. We are extremely proud of the investments that we

have made to transform Tsumeb’s operational and environmental

performance into a specialized custom smelter with a highly skilled

workforce,” said David Rae, President and Chief Executive

Officer.

“We would like to thank the government of

Namibia, the community of Tsumeb and our employees for their

support over the past 13 years. We will work closely with Sinomine

to ensure a smooth transition to support a successful future for

the operation and all of its stakeholders.”

DPM acquired the smelter in 2010 to secure a

processing outlet for the complex concentrate produced by the

Company’s Chelopech mine in Bulgaria. With developments in the

global smelting market and changes in the quality of the Chelopech

concentrate, DPM is able to place its Chelopech concentrate at

several other third-party facilities, providing secure and reliable

processing alternatives at favourable terms.

Key terms of the

transaction

Under the terms of the SPA, DPM, through the

sale of the shares of DPMTH, will transfer, on a debt-free and

cash-free basis, all assets and liabilities associated with the

Tsumeb smelter to Sinomine for consideration of US$49 million in

cash, subject to normal working capital adjustments following

closing (“the purchase price”). The Company has made limited

representations and warranties and provided certain indemnities to

Sinomine customary with transactions of this nature, subject to a

liability cap equal to 50% of the purchase price. The cash received

by DPM on closing will be less a US$5 million holdback to be held

in escrow for a period of six months to secure the Company’s

indemnity obligations under the SPA.

In addition, pursuant to the SPA, DPM is

entitled to be paid all cash collected from IXM S.A. with respect

to a positive balance in metals exposure outstanding at Tsumeb,

currently estimated to be approximately US$17.2 million, which will

constitute an increase in the purchase price.

The Transaction is subject to customary closing

conditions, including approval under the Namibia Competition Act

and approvals required from Chinese regulatory authorities for

overseas investments, and is expected to close in Q3 2024. DPM

expects to use the proceeds from the Transaction to further

strengthen its balance sheet and to support its core mining

business in line with its disciplined capital allocation

framework.

Cutfield Freeman & Co. Ltd. acted as

financial adviser to DPM in the Transaction.

About Dundee Precious Metals Inc.

Dundee Precious Metals Inc. is a Canadian-based

international gold mining company with operations and projects

located in Bulgaria, Namibia, Serbia and Ecuador. The Company’s

purpose is to unlock resources and generate value to thrive and

grow together. This overall purpose is supported by a foundation of

core values, which guides how the Company conducts its business and

informs a set of complementary strategic pillars and objectives

related to ESG, innovation, optimizing our existing portfolio, and

growth. The Company’s resources are allocated in-line with its

strategy to ensure that DPM delivers value for all of its

stakeholders.

For further information please contact:

|

David RaePresident and Chief Executive OfficerTel:

(416) 365-5191investor.info@dundeeprecious.com |

Jennifer CameronDirector, Investor RelationsTel:

(416) 219-6177jcameron@dundeeprecious.com |

|

|

|

Cautionary Note Regarding Forward Looking

Statements

This news release contains “forward looking

statements” or “forward looking information” (collectively,

“Forward Looking Statements”) that involve a number of risks and

uncertainties. Forward Looking Statements are statements that are

not historical facts and are generally, but not always, identified

by the use of forward looking terminology such as “plans”,

“expects”, “is expected”, “budget”, “scheduled”, “estimates”,

“forecasts”, “outlook”, “intends”, “anticipates”, “believes”, or

variations of such words and phrases or that state that certain

actions, events or results “may”, “could”, “would”, “might” or

“will” be taken, occur or be achieved, or the negative of any of

these terms or similar expressions. Forward looking statements in

this news release include, without limitation, statements with

respect to the potential timing of the closing of the Transaction;

expected benefits to the Company from the Transaction; expected

additional payments for cash collected from IXM S.A. with respect

to a positive balance in metals exposure outstanding at Tsumeb; the

Company’s expectation regarding Namibian competition approval and

other regulatory approvals for the Transaction; the Company’s

expectations with respect to its ability to place its Chelopech

concentrate at several other third-party facilities without the

need to own and operate the Tsumeb smelter; the Company’s expected

use of proceeds; and the impact on its balance sheet. Forward

Looking Statements are based on certain key assumptions and the

opinions and estimates as of the date such statements are made, and

they involve known and unknown risks, uncertainties and other

factors which may cause the actual results, performance or

achievements of the Company to be materially different from any

other future results, performance or achievements expressed or

implied by the Forward Looking Statements. In addition to factors

already discussed in this news release, such factors include, among

others, there being no assurance that the Transaction will close,

the Transaction being subject to regulatory risks and

uncertainties, including without limitation, uncertainties with

respect to obtaining all required Namibian and other regulatory

approvals, discretion of the Company with respect to the use of

proceeds from the sale, uncertainties with respect to realizing the

benefits of the Transaction and/or collect additional payments in

full as estimated, risks relating to the Company’s business

generally, as well as those risk factors discussed or referred to

in any other documents (including without limitation the Company’s

most recent Annual Information Form and its most recent

Management’s Discussion & Analysis) filed from time to time

with the securities regulatory authorities in all provinces and

territories of Canada and available on SEDAR+ at www.sedarplus.com.

The reader has been cautioned that the foregoing list is not

exhaustive of all factors which may have been used. Although the

Company has attempted to identify important factors that could

cause results to differ materially from those described in Forward

Looking Statements, there may be other factors that cause actions,

events or results not to be anticipated, estimated or intended.

There can be no assurance that Forward Looking Statements will

prove to be accurate, as actual results and future events could

differ materially from those anticipated in such statements. The

Company’s Forward Looking Statements reflect current expectations

regarding future events and speak only as of the date hereof.

Unless required by securities laws, the Company undertakes no

obligation to update Forward Looking Statements if circumstances or

management’s estimates or opinions should change. Accordingly,

readers are cautioned not to place undue reliance on Forward

Looking Statements.

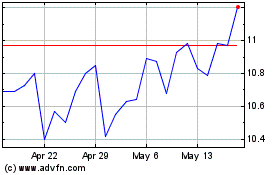

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Nov 2024 to Dec 2024

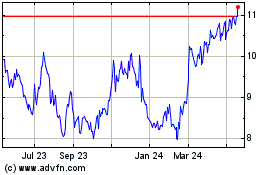

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Dec 2023 to Dec 2024