Dundee Precious Metals Inc. (TSX: DPM) (“DPM” or

“the Company”) today reported wide intercepts from drilling at the

copper-gold-silver Dumitru Potok prospect, located on the Čoka

Rakita exploration licence. Based on these strong results, DPM is

accelerating its systematic target delineation drilling campaign at

Dumitru Potok to further extend these high-grade zones. The Company

also reported additional results from Rakita North and early

results from the new Valja Saka target, which are located on the

Čoka Rakita and Potaj Čuka licences, respectively. All three

prospects are located near planned Čoka Rakita project

infrastructure.

Highlights(Refer to Tables 1, 2

and 3 for full results)

- New

high-grade intercepts, including:

- DPDD025A – 190

metres 2.07% Cu, 1.23 g/t Au and 12.19 g/t Ag from 808 metres

downhole, including 49 metres at 4.18% Cu, 1.48 g/t Au and 21.7 g/t

Ag from 842 metres downhole at the Dumitru Potok prospect

- DPDD026 – 36 metres

at 1.8% Cu, 1.4 g/t Au and 11.76 g/t Ag from 953 metres downhole

and 115 metres at 1.47% Cu, 2.73 g/t Au and 9.69 g/t Ag from 1,170

metres downhole including 38 metres at 2.59% Cu, 4.05 g/t Au and 17

g/t Ag from 1,195 metres downhole at the Dumitru Potok

prospect

- RADD050 – 40 metres

at 0.64% Cu, 0.49 g/t Au and 1.81 g/t Ag from 780 metres downhole

and 140 metres at 0.88% Cu, 0.6 g/t Au and 2.94 g/t Ag from 990

metres downhole at the Rakita North prospect

- RADDHG008 – 30

metres at 0.52% Cu, 0.42 g/t Au and 2.31 g/t Ag from 1,074 metres

downhole and 105 metres at 0.69% Cu, 0.51 g/t Au and 2.81 g/t Ag

from 1,120 metres downhole at the Rakita North prospect

- VSDD010 – 8.3 metres

at 5.31 g/t Au from 325 metres downhole, and 15 metres at 0.62 %

Cu, 0.66 g/t Au and 21.9 g/t Ag from 808 metres downhole, and 20

metres at 0.17 % Cu, 93 g/t Ag, 5.15 % Zn and 1.48 % Pb from 848

metres downhole at Valja Saka prospect

-

Dumitru Potok prospect: Recent drilling confirms

the presence of a large, high-grade copper-gold-silver skarn system

with mineralization concentrated along both the eastern and western

sides of a causative intrusion. Based on drilling to date,

mineralization has been detected over a one-kilometre strike

length, up to 300 metres vertically and up to 500 metres away from

the causative intrusion. The Dumitru Potok prospect is

characterised by long intercepts of continuous high-grade

mineralization that currently remains open in multiple

directions.

-

Rakita North prospect: New drill results from the

Rakita North prospect confirm presence of significant marble-hosted

copper-gold-silver mineralization on the northern flank of the Čoka

Rakita deposit. This is best demonstrated by drillhole RADD050,

which is proximal to the Čoka Rakita planned underground

development (see Figure 3). These drill results confirm a

relatively higher-grade core of approximatively 300 metres by 150

metres developed over a vertical extent of approximately 300

metres, which remains open in multiple directions.

-

Valja Saka prospect: Scout exploration drilling

encountered strong skarn-altered sediments with garnet and

magnetite and occasional visible gold, analogous to the Čoka Rakita

style of mineralization. Additionally, drillhole VSDD010 confirmed

the potential for polymetallic carbonate replacement mineralization

with significant silver, copper, zinc and lead grades.

-

Preliminary metallurgical tests: Achieved copper

rougher recoveries associated with samples from the Dumitru Potok,

Rakita North and Frasen prospects of over 90% at a grind size of

75µm. These preliminary results indicate the potential for lower

energy consumption and consistent copper concentrate grades. This

aligns with the average bond work index figures and indicates

promising characteristics for ore processing.

-

Next steps: DPM is pursuing potential skarn and

manto-like stratabound targets with a 55,000-metre scout and target

delineation drilling campaign, focused on the Čoka Rakita licence,

including the Dumitru Potok prospect, as well as the Potaj Čuka and

Pešter Jug licences. Based on these positive results, dedicated

target delineation drilling will be allocated to high priority

targets with up to 15 rigs expected to be deployed by early

spring.

“These impressive results at Dumitru Potok

clearly demonstrate the existence of a large copper-gold deposit

that has the potential to provide additional high-grade mineral

resources adjacent to the planned infrastructure of Čoka Rakita.

The drill program continues to expand the Dumitru Potok discovery,

and we have yet to define its limits as it remains open in multiple

directions and at depth,” said David Rae, President and Chief

Executive Officer of Dundee Precious Metals.

“Our exploration team and strong financial

position has continued to add value through the drill bit,

supported by our strategy to create a robust platform for growth to

deliver above-average returns for our shareholders.”

Scout Drilling Program Overview

The Company has continued to progress its scout

drilling program, completing over 18,000 metres and 23 drill holes

since the previous update on September 11, 2024, with nine drill

holes in progress.

See Figures 1, 2 and 3 for plan, section and 3D

views highlighting recent drilling at the Dumitru Potok, Rakita

North and Valja Saka prospects.

At the Dumitru Potok prospect,

located approximately one kilometre northeast of Čoka Rakita, a

directional target delineation drilling program is ongoing with

multiple daughter holes outlining a sub-vertical monzodiorite

intrusive body, with proximal high-grade stratabound

copper-gold-silver mineralization on the conglomerate-marble

unconformity and along the marble-intrusive contact zone.

Based on the drilling to date, stratabound

conglomerate-marble unconformity hosted mineralization extends

outward from the eastern and western margins of the causative

intrusion. Mineralization can be traced for more than one kilometre

of strike length and up to 500 hundred metres away from the

causative intrusion and varies in thickness from five metres to up

to 40 metres. Mineralization on the marble-intrusive contact zone

is developed for more than 300 metres vertically, either as contact

skarns or as stratabound lenses within reactive marbles, including

on the lower marble-basement contact. The mineralization is open in

all directions and its full footprint and grade continuity have yet

to be defined.

On the east flank of the Dumitru Potok

intrusive, DPDD025A was collared to test below holes DPDD012 and

DPDD012A, and encountered a wide zone of strong skarn alteration

and mineralization developed on marbles and returned an intercept

of 190 metres at 2.07% Cu, 1.23 g/t Au and 12.19 g/t Ag, which

includes a higher grade zone of 49 metres at 4.18% Cu, 1.48 g/t Au

and 21.7 g/t Ag.

See Figure 4 for details of the mineral

assemblage in DPDD025A.

On the west flank of Dumitru Potok intrusive,

drill hole DPDD026 confirmed the extension of strong mineralization

to the south on the upper marble contact, returning 36 metres at

1.8% Cu, 1.4 g/t Au and 11.76 g/t Ag from 953 metres downhole. The

extension of the hole aimed to test the potential of the lower

marble-basement contact target and successfully intercepted a wide

zone of strong skarn alteration and mineralization of 115 metres at

1.47% Cu, 2.73 g/t Au and 9.69 g/t Ag from 1,170 metres downhole,

including 38 metres at 2.59% Cu, 4.05 g/t Au and 17 g/t Ag from

1,195 metres.

These new intercepts confirm the potential for

more than 300 metres of vertical extension in proximity to the

causative intrusion when viewed in conjunction with other

drillholes.

See Figure 5 for details of the mineral assemblage in

DPDD026.

Table 1. Drill holes results from the scout

drilling campaign testing stratabound and marble-intrusive contact

hosted targets at Dumitru Potok.

|

HOLEID |

EAST |

NORTH |

RL |

AZ |

DIP |

FROM |

TO |

LENGTH |

CuEq |

Cu |

Au |

Ag |

|

(m) |

(m) |

(m) |

(%) |

(%) |

(g/t) |

(g/t) |

|

DPDD015A |

573499 |

4896700 |

124 |

238 |

-49 |

completed / awaiting results |

|

DPDD019 |

573268 |

4897247 |

697 |

213 |

-82 |

no significant intervals |

|

DPDD019C |

573239 |

4897198 |

258 |

216 |

-84 |

no significant intervals |

|

DPDD020* |

573262 |

4897014 |

722 |

241 |

-55 |

508 |

513 |

5 |

0.84 |

0.75 |

0.11 |

0.28 |

|

DPDD021 |

573115 |

4897637 |

680 |

240 |

-65 |

condemnation hole / no significant intervals |

|

DPDD022 |

572687 |

4896993 |

775 |

64 |

-81 |

aborted for technical reasons / no significant intervals |

|

DPDD023 |

573665 |

4897081 |

698 |

250 |

-71 |

1122 |

1161 |

39 |

1.03 |

0.58 |

0.56 |

4.07 |

|

DPDD023A |

573562 |

4897055 |

152 |

229 |

-80 |

completed / awaiting results |

|

DPDD024 |

573267 |

4897528 |

669 |

50 |

-55 |

54 |

60 |

6 |

0.89 |

0.43 |

0.62 |

0.77 |

|

DPDD025 |

573700 |

4897659 |

726 |

229 |

-67 |

completed / awaiting results |

|

DPDD025A |

573537 |

4897525 |

219 |

220 |

-65 |

808 |

998 |

190 |

3.09 |

2.07 |

1.23 |

12.19 |

|

including |

|

|

|

|

|

826 |

834 |

8 |

5.77 |

1.95 |

4.96 |

17.00 |

|

including |

|

|

|

|

|

842 |

891 |

49 |

5.47 |

4.18 |

1.48 |

21.70 |

|

including |

|

|

|

|

|

911 |

924 |

13 |

3.45 |

1.95 |

1.80 |

18.40 |

|

including |

|

|

|

|

|

935 |

977 |

42 |

3.16 |

2.06 |

1.35 |

12.20 |

|

DPDD025B |

573544 |

4897533 |

243 |

233 |

-67 |

in progress |

|

DPDD026 |

573268 |

4897012 |

713 |

279 |

-69 |

953 |

989 |

36 |

2.94 |

1.80 |

1.40 |

11.76 |

|

including |

|

|

|

|

|

961 |

984 |

23 |

3.79 |

2.34 |

1.77 |

15.50 |

|

and |

|

|

|

|

|

1142 |

1148 |

6 |

1.00 |

0.64 |

0.44 |

4.60 |

|

and |

|

|

|

|

|

1170 |

1285 |

115 |

3.57 |

1.47 |

2.73 |

9.69 |

|

including |

|

|

|

|

|

1195 |

1233 |

38 |

5.74 |

2.59 |

4.05 |

17.00 |

|

including |

|

|

|

|

|

1259 |

1267 |

8 |

4.74 |

2.51 |

2.84 |

14.40 |

|

DPDD026A |

573082 |

4897041 |

204 |

278 |

-71 |

in progress |

|

DPDD027 |

573118 |

4897637 |

680 |

50 |

-55 |

condemnation hole / no significant intervals |

|

DPDD028 |

572983 |

4897760 |

699 |

238 |

-70 |

752 |

788 |

36 |

1.43 |

1.13 |

0.29 |

8.57 |

|

DPDD029 |

573267 |

4897527 |

670 |

96 |

-50 |

condemnation hole / awaiting results |

|

DPDD030 |

573859 |

4896932 |

649 |

179 |

-48 |

condemnation hole / no significant intervals |

|

DPDDHG001 |

572904 |

4897220 |

746 |

150 |

-89 |

887 |

922 |

35 |

1.67 |

1.02 |

0.79 |

7.61 |

|

including |

|

|

|

|

|

888 |

893 |

5 |

3.62 |

1.85 |

2.24 |

13.1 |

|

and |

|

|

|

|

|

1024 |

1035 |

11 |

0.8 |

0.61 |

0.18 |

5.64 |

|

1) |

|

Coordinates are in UTM Zone 34 North WGS84 datum. |

|

2) |

|

Intervals are reported at a cut-off grade of 0.8% CuEq using 5

metres minimum length and 10 metres maximum internal dilution.

Higher grade sub-intervals denoted with ‘including’ are reported at

a cut-off grade of 3% CuEq using 5 metres minimum length and 5

metres maximum internal dilution. |

|

3) |

|

The CuEq calculation is based on the following formula: Cu % + Au

g/t x 0.74 + Ag g/t x 0.009 based on a copper price of $2.75/lb,

gold price of $1,400/oz and silver price of $17/oz; and assumes

metallurgical recoveries of 90% all metals within the equivalency

calculation. Metallurgical assumptions are based on initial

floatation testwork completed on the stratabound hosted Cu-Au-Ag

mineralization at Čoka Rakita North and ongoing metallurgical

testing. |

|

4) |

|

No upper cuts have been applied. |

|

5) |

|

Based on the limited understanding of the geometry of the

mineralized body, true widths are considered to be 90% or more of

the reported downhole interval, assuming strata-bound control on

the mineralization. For holes DPDD026 and DPDD025A due of potential

vertical extent of the mineralization along the contact, the true

width cannot be evaluated at this time. |

|

6) |

|

Daughter holes identified with “A” (e.g., DPDD025A) are

navigational holes with collar coordinates and depth indicating the

exit point from the parent hole. |

|

|

|

|

Based on these strong results, DPM is

accelerating the systematic target delineation drilling campaign at

Dumitru Potok to further extend these high-grade zones and build

additional confidence on the shape, size and grade tenor of the

encountered mineralization.

At the Rakita North target,

located on the northwestern flank of the Čoka Rakita deposit and

proximal to planned underground development, two deep holes have

been completed that intercepted significant copper-gold

mineralization over most of the 300-metre thickness of the marbles.

Mineralization is a combination of manto-like skarn mineralization

on the upper and lower contact, as well as more discrete

replacement and stockwork veins over the entire marble lithological

package.

These results include hole RADDHG008, which

reported 30 metres at 0.52% Cu, 0.42 g/t Au and 2.31 g/t Ag from

1,074 metres downhole and 105 metres at 0.69% Cu, 0.51 g/t Au and

2.81 g/t Ag from 1,120 metres downhole. Additional results include

hole RADD050, which returned 40 metres at 0.64% Cu, 0.49 g/t Au and

1.81 g/t Ag from 780 metres downhole and 140 metres at 0.88% Cu,

0.6 g/t Au and 2.94 g/t Ag from 990 metres downhole. These drill

intercepts are approximately 500 metres below the Čoka Rakita

planned underground infrastructure (see Figure 3).

These new drill intercepts show significant

copper-gold mineralization developed over an up to 300-metre

vertical section, by more than 300 metres by 150 metres laterally,

and remains open in multiple directions. Further drilling is

ongoing, including daughter holes to follow-up hole RADD050 as well

as additional scout holes from surface aimed to test continuity

towards Dumitru Potok and the larger potential extensions to east

and southeast.

Table 2. Drill holes results

from the scout drilling campaign testing the copper-gold-silver

marble hosted targets at Rakita North.

|

HOLEID |

EAST |

NORTH |

RL |

AZ |

DIP |

FROM |

TO |

LENGTH |

CuEq |

Cu |

Au |

Ag |

|

(m) |

(m) |

(m) |

(%) |

(%) |

(g/t) |

(g/t) |

|

RADD046* |

572948 |

4896594 |

791 |

210 |

-67 |

1007 |

1068 |

61 |

0.84 |

0.55 |

0.36 |

2.58 |

|

RADD050 |

572970 |

4896087 |

903 |

313 |

-82 |

780 |

820 |

40 |

1.02 |

0.64 |

0.49 |

1.81 |

|

and |

|

|

|

|

|

990 |

1130 |

140 |

1.34 |

0.88 |

0.60 |

2.94 |

|

RADDHG008 |

572992 |

4896006 |

917 |

275 |

-85 |

863 |

869 |

6 |

1.52 |

0.91 |

0.78 |

3.65 |

|

and |

|

|

|

|

|

944 |

958 |

14 |

0.95 |

0.47 |

0.58 |

4.92 |

|

and |

|

|

|

|

|

962 |

990 |

28 |

0.80 |

0.48 |

0.41 |

1.94 |

|

and |

|

|

|

|

|

1002 |

1007 |

5 |

0.92 |

0.58 |

0.44 |

1.99 |

|

and |

|

|

|

|

|

1018 |

1026 |

8 |

0.82 |

0.54 |

0.35 |

2.29 |

|

and |

|

|

|

|

|

1074 |

1104 |

30 |

0.85 |

0.52 |

0.42 |

2.31 |

|

and |

|

|

|

|

|

1120 |

1225 |

105 |

1.10 |

0.69 |

0.51 |

2.81 |

|

1) |

|

Coordinates are in UTM Zone 34 North WGS84 datum. |

|

2) |

|

Intervals are reported at a cut-off grade of 0.8% CuEq using 5

metres minimum length and 10 metres maximum internal dilution.

Higher grade sub-intervals denoted with ‘including’ are reported at

a cut-off grade of 3% CuEq using 5 metres minimum length and 5

metres maximum internal dilution. |

|

3) |

|

The CuEq calculation is based on the following formula: Cu % + Au

g/t x 0.74 + Ag g/t x 0.009 based on a copper price of $2.75/lb,

gold price of $1,400/oz and silver price of $17/oz; and assumes

metallurgical recoveries of 90% all metals within the equivalency

calculation. Metallurgical assumptions are based on initial

floatation testwork completed on the stratabound hosted Cu-Au-Ag

mineralization at Čoka Rakita North and ongoing metallurgical

testing. |

|

4) |

|

No upper cuts have been applied. |

|

5) |

|

Based on the limited understanding of the geometry of the

mineralized body true widths cannot be calculated at this

time. |

|

6) |

|

RADD046* was re-reported due of additional silver assays (ICP)

being received. |

|

|

|

|

Scout exploration drilling commenced at the

Valja Saka prospect, which is located

approximately two kilometres north of Čoka Rakita, targeting

shallow skarn-altered marble and sandstone-hosted gold-silver-base

metals mineralization, previously mapped in the area. Several holes

from the program encountered strong skarn-altered sediments with

garnet and magnetite and occasionally with visible gold, analogous

to the Čoka Rakita style of mineralization.

Of note is VSDD010 drillhole which was collared

as a long scout hole to follow-up on a magneto-telluric (“MT”)

conductivity anomaly. This hole intersected a zone of skarn

alteration with visible gold that returned 8.3 metres at 5.31 g/t

Au from 325 metres downhole. The hole continued into a weakly

mineralized copper-gold porphyry, which then passed into a zone of

polymetallic, carbonate replacement mineralization that returned 15

metres at 0.62 % Cu, 0.66 g/t Au and 21.9 g/t Ag from 808 metres

downhole, and 20 metres at 0.17 % Cu, 93 g/t Ag, 5.15 % Zn and 1.48

% Pb from 848 metres downhole.

The shallow gold skarn target was followed up by

VSDD011 that reported a narrow interval with coarse visible gold of

4.6 metres at 43.95 g/t Au and 0.15% Cu from 302.4 metres downhole

and by VSDD012 that reports 9 metres at 2.69 g/t Au and 0.14 % Cu

from 237 metres downhole.

Table 3. Drill

holes results from the scout drilling campaign at Valja Saka skarn

gold target.

|

HOLEID |

EAST |

NORTH |

RL |

AZ |

DIP |

FROM |

TO |

LENGTH |

AuEq |

Au |

Cu |

Ag |

Pb |

Zn |

|

(m) |

(m) |

(m) |

(g/t) |

(g/t) |

(%) |

(g/t) |

(%) |

(%) |

|

VSDD010 |

572343 |

4898290 |

713 |

241 |

-60 |

325 |

333.3 |

8.3 |

5.45 |

5.31 |

0.09 |

0.30 |

- |

- |

|

and |

|

|

|

|

|

349 |

367 |

18 |

1.02 |

0.63 |

0.28 |

0.80 |

- |

- |

|

and |

|

|

|

|

|

808 |

823 |

15 |

2.16 |

0.66 |

0.62 |

21.90 |

0.04 |

0.63 |

|

and |

|

|

|

|

|

848 |

868 |

20 |

5.14 |

0.08 |

0.17 |

93.00 |

1.48 |

5.15 |

|

including |

|

|

|

|

|

849 |

864 |

15 |

5.91 |

0.09 |

0.18 |

109.10 |

1.85 |

5.83 |

|

VSDD011 |

572345 |

4898290 |

713 |

222 |

-51 |

302.4 |

307 |

4.6 |

44.15 |

43.95 |

0.15 |

- |

- |

- |

|

VSDD012 |

572178 |

4898313 |

703 |

235 |

-50 |

237 |

246 |

9 |

2.92 |

2.69 |

0.14 |

2.90 |

- |

- |

|

|

|

|

|

|

|

598 |

613 |

15 |

1.35 |

0.06 |

0.21 |

53.00 |

0.63 |

0.20 |

|

VSDD013 |

572343 |

4898294 |

713 |

266 |

-62 |

completed / awaiting results |

|

1) |

|

Coordinates are in UTM Zone 34 North WGS84 datum. |

|

2) |

|

Intervals are reported at a cut-off grade of 1g/t AuEq using 5

metres minimum length and 5 metres maximum internal dilution.

Higher grade sub-intervals denoted with ‘including’ are reported at

a cut-off grade of 5 g/t AuEq using 5 metres minimum length and 5

metres maximum internal dilution. |

|

3) |

|

The AuEq calculation is based on the following formula: Au g/t + Cu

% x 1.35 + Ag g/t x 0.012 + Pb % x 0.39 + Zn % x 0.61 based on a

copper price of $2.75/lb, gold price of $1,400/oz, silver price of

$17/oz, lead prices of $0.8/lb and zinc price of 1.25$/lb; and

assumes metallurgical recoveries of 90% all metals within the

equivalency calculation. Metallurgical assumptions are based on

testing of other polymetallic showings within the license

area. |

|

4) |

|

No upper cuts have been applied. |

|

5) |

|

Based on the limited understanding of the geometry of the

mineralized body, true widths cannot be calculated at this

time. |

|

|

|

|

The mineralization remains open in multiple directions and will

be tested as part of DPM’s upcoming 55,000-metre drilling

campaign.

See Figure 3 for a better understanding of the spatial

disposition of different targets.

Preliminary Metallurgical Testwork Results

Metallurgical testing is ongoing, with five

representative 30 kilogram composite samples from the Frasen,

Dumitru Potok and Rakita North discoveries. Refer to Table 4 for

key parameters of the composites. Testing is being undertaken at

the Wardel Armstrong International laboratory in the United

Kingdom.

Table 4. Description, bond work

index and head assay values from composite samples taken from of

copper-gold-silver mineralization at Dumitru Potok, Frasen and

Rakita North.

|

Sample ID |

Prospect |

Geological Description |

BWi(KWhr/t) |

Head Assay (%, *ppm) |

|

Cu |

Zn |

Fe |

Au* |

Ag* |

S(TOT) |

|

BI1 |

Frasen |

Carbonate replacement in marble, (semi) massive

pyrite-chalcopyrite-sphalerite-galena mineralization |

10.27 |

2.03 |

5.14 |

24.84 |

2.43 |

92.05 |

21.80 |

|

DP1 |

Dumitru Potok East |

Magnetite-calcite-chlorite skarn, chalcopyrite-bornite

mineralization |

11.30 |

3.58 |

- |

20.82 |

2.78 |

22.58 |

3.63 |

|

DP2 |

Dumitru Potok East |

Patchy hematite-iron-oxide-hydroxide-garnet altered skarn,

chalcopyrite-bornite mineralization |

12.44 |

1.17 |

- |

7.82 |

1.36 |

5.57 |

1.17 |

|

DP3 |

Dumitru Potok West |

Hematite-garnet, silica, locally magnetite altered skarn,

bornite-covellite-digenite-native Cu mineralization |

13.27 |

2.77 |

- |

8.23 |

1.65 |

18.90 |

1.16 |

|

RA1 |

Rakita North |

Hematite-garnet-silica altered marbles with

pyrite-chalcopyrite-bornite mineralization |

12.70 |

1.18 |

- |

13.16 |

0.95 |

6.21 |

1.65 |

Initial bulk rougher tests at a grind size of

75µm indicate that copper responds well to flotation with

recoveries above 90% after the first ten minutes of testing. These

preliminary results indicate the potential for lower energy

consumption and consistent copper concentrate grades. This aligns

with the average bond work index figures and indicates promising

characteristics for ore processing. However, pyrite (for sample

BI1) and non-sulphide gangue (for the rest of the samples)

recoveries increase into the concentrate in the last ten minutes of

float, which is suspected to be diluting rougher concentrate copper

grades and will be an area for improvement in subsequent

metallurgical testing programs.

Table 5.

Preliminary results of Rougher Flotation tests on four samples from

the Dumitru Potok and Rakita North prospects.

|

Sample ID |

Mass Recovery (%) |

Rougher Concentrate Assay (%, *ppm) |

Recovery (%) |

|

Cu |

Fe |

Au* |

Ag* |

S(TOT) |

Cu |

Fe |

Au |

Ag |

S(TOT) |

|

DP1 |

20.0 |

17.5 |

24.8 |

13.3 |

101.4 |

17.6 |

97.5 |

23.8 |

96.0 |

89.7 |

96.7 |

|

DP2 |

19.1 |

5.9 |

16.1 |

6.5 |

27.1 |

5.7 |

96.5 |

39.2 |

91.1 |

92.7 |

92.4 |

|

DP3 |

21.2 |

12.8 |

9.6 |

7.4 |

84.6 |

5.4 |

98.4 |

24.6 |

94.7 |

95.0 |

98.4 |

|

RA1 |

19.5 |

5.8 |

18.0 |

4.2 |

27.3 |

8.1 |

96.5 |

26.8 |

86.4 |

85.8 |

95.2 |

Table 6. Preliminary selective

Rougher Flotation test results from polymetallic mineralization

from the Frasen prospect.

|

BI1 |

Rougher concentrate grade (%, *ppm) |

Recovery (%) |

|

Cu |

Pb |

Zn |

Au* |

Ag* |

Mass |

Cu |

Pb |

Zn |

Au |

Ag |

|

Cu concentrate |

6.88 |

2.02 |

5.31 |

5.75 |

260.7 |

25.3 |

88.1 |

70.3 |

28.1 |

70.9 |

69.4 |

|

Zn Concentrate |

0.48 |

0.56 |

9.36 |

1.23 |

71.4 |

36.0 |

8.7 |

27.9 |

70.4 |

21.6 |

27.0 |

|

Total |

|

|

|

|

|

61.3 |

96.8 |

98.2 |

98.5 |

92.5 |

96.3 |

Initial gravity testing indicated a variable

gravity gold recoverable component from between 22.3% to 57.6% for

the DP1 sample. Copper losses to gravity concentrate also vary,

with BI1 having a low copper loss of only 1.6% whilst DP2, DP3 and

RA1 lost 9.2%, 16.4% and 12.3% respectively. The results

indicate limited amounts of freely recoverable gold, which

generally aligns with the flotation testwork where both the silver

and gold appeared to respond well to flotation. Importantly, silver

and gold experienced relatively quick recovery to the concentrates,

suggesting an association with sulphides.

Table 7. Preliminary results of Knelson Gravity

tests from representative copper-gold-silver mineralization at

Dumitru Potok, Frasen and Rakita North.

|

Sample ID |

Mass Recovery (%) |

Assay (%, *ppm) |

Recovery (%) |

|

Cu |

Zn |

Au* |

Ag* |

Cu |

Zn |

Au |

Ag |

|

BI1 |

2.11 |

1.4 |

2.9 |

28.0 |

428.9 |

1.6 |

1.3 |

25.8 |

8.8 |

|

DP1 |

1.49 |

5.8 |

- |

89.0 |

73.0 |

2.4 |

- |

57.6 |

4.4 |

|

DP2 |

1.49 |

7.1 |

- |

21.1 |

65.3 |

9.2 |

- |

27.8 |

16.1 |

|

DP3 |

1.75 |

25.5 |

- |

43.1 |

218.4 |

16.4 |

- |

36.7 |

18.5 |

|

RA1 |

1.59 |

8.7 |

- |

12.3 |

81.9 |

12.3 |

- |

22.3 |

19.7 |

The results to date demonstrate high recoveries

are achievable, albeit with a significant mass pull, attributed to

elevated levels of pyrite in certain samples, while others exhibit

a higher presence of unspecified gangue. Future testing will focus

on reducing mass pull by examining the effects of grind size on

non-sulphide gangue and pyrite recovery, as well as exploring the

advantages of incorporating a cleaning circuit for concentrate

enhancement. Ongoing testwork includes a detailed mineralogical

investigation to determine a range of key mineralogical

criteria.

Significant 2025 Exploration Program

Ongoing

DPM’s exploration program includes

approximatively 55,000 metres of drilling to follow-up on positive

results to extend existing zones of mineralization and to continue

testing enhanced targeting models. A portion of this drilling will

be dedicated to the Dumitru Potok and Frasen target delineation

programs, which will aim to define the stratabound-hosted

mineralization, which is open in multiple directions, and to better

understand the continuity of the mineralization along strike and

away from the causative intrusions.

Furthermore, the Company is following up on a

full-tensor MT survey that has been conducted over Dumitru Potok

and the eastern portion of the northmost Potaj Čuka licence, which

highlighted several significant conductive targets that can be

traced over six kilometres along strike north of the Dumitru Potok

prospect. The Potaj Čuka licence shares the same geological setting

as the Dumitru Potok and Frasen prospects and is highly prospective

for skarn, carbonate replacement and porphyry style

mineralization.

The mineralized domains at Dumitru Potok are

identified as distinct conductive areas, likely influenced by

intrusive rocks such as dykes and sills, as well as the surrounding

skarn alteration and mineralization. In most cases, the intercepted

mineralization spatially aligns with the edges of conductive

anomalies or directly with the most conductive sections. The

resistivity model indicates the presence of subvertical conductive

"channels" extending to depths greater than two kilometres.

A 3D seismic survey, using irregular source grid

and >9000 Stryde geophones at 25 metres by 25 metres, was

completed over Dumitru Potok that aimed to evaluate the

relationship between structures, intrusive bodies and the

sedimentary unconformities that are coincident with the wide,

high-grade mineralization zones encountered to date. The analysis

of the 3D seismic model is ongoing and it is expected that this

model will provide information concerning the system architecture

to guide scout and target delineation drilling campaigns.

The Company has budgeted between $23 million and

$25 million for exploration activities in Serbia in 2025.

Figure 1. Project scale map

highlighting the updated targets and results from the ongoing scout

drilling.

Figure 2. Cross section looking

north at the Frasen and Dumitru Potok targets, located

approximately one kilometre north of the Čoka Rakita deposit,

showing scout drilling, the conceptual geology model and

interpretation of target mineralization styles.

Figure 3. Snapshot of 3D model

looking west displaying the positions of different geological

targets relative to the Čoka Rakita orebody and the planned

underground development pre-feasibility study design, as well as

highlights from the reported intercepts. The target shapes were

generated using currently available drilling information, which

provides limited geological understanding and may change as

additional drilling is conducted.

Figure 4. Images showing the

core photos of copper-gold-silver skarn mineralization from hole

DPDD025A, taken from the start of the interval reporting 49 metres

at 4.18 % Cu, 1.48 g/t Au and 21.7 g/t Ag from 842 metres

downhole.

|

a) |

|

NQ-size (47.6 mm core diameter) core boxes from DPDD025A starting

at 841 metres downhole and ending at 858.2 metres downhole,

displaying copper and gold assay values for each metre. |

|

|

|

|

|

b) |

|

Macro images of NQ-size half-core selected from the same interval

displaying textural variability, from garnet – magnetite – hematite

dominated skarn with disseminated and sheeted veins to

chalcopyrite-bornite-covellite-digenite dominated mineralization

assemblages at deeper depths. Abbreviations: Cpy – chalcopyrite; Bo

– bornite; Cov – covellite; Dig - digenite; Hem – hematite; Mt –

magnetite; FeOx – iron oxide-hydroxides; Gn – garnet. |

|

|

|

|

Figure 5. Images showing the

core photos of copper-gold-silver skarn mineralization from hole

DPDD026, taken from within the interval reporting 38 metres at

2.59% Cu, 4.05 g/t Au and 17 g/t Ag from 1,195 metres downhole.

|

a) |

|

NQ-size (47.6 mm core diameter) core boxes from DPDD026, showing an

interval starting at 1210.9 metres downhole and ending at 1228.5

metres downhole, displaying copper and gold assay values for each

metre. |

|

|

|

|

|

b) |

|

Macro images of NQ-size half-core selected from the same interval,

displaying textural variability, from garnet – hematite dominated

skarn with disseminated chalcopyrite and bornite on upper right to

late iron oxides oxide-hydroxides – digenite skarn fragments

(paleo-karst sediment infill?) on centre right and covellite –

digenite replacement on lower right. Abbreviations: Cpy –

chalcopyrite; Bo – bornite; Cov – covellite; Dig - digenite; Hem –

hematite; Mt – magnetite; FeOx– iron oxide-hydroxides; Px -

pyroxene; Gn – garnet. |

|

|

|

|

Sampling, Analysis and QAQC of Exploration Drill Core

Samples

Most exploration diamond drill holes are

collared with PQ size, continued with HQ, and are sometimes

finished with NQ and BQ diameters. Triple tube core barrels and

short runs are used whenever possible to improve recovery. All

drill core is cut lengthwise into two halves using a diamond saw:

one half is sampled for assaying and the other half is retained in

core trays. The common length for sample intervals within

mineralized zones is one metre. Weights of drill core samples range

from three to eight kilograms (“kg”), depending on the size of

core, rock type, and recovery. A numbered tag is placed into each

sample bag, and the samples are grouped into batches for laboratory

submission.

Drill core samples are shipped to the Company’s

own exploration laboratory in Bor, Serbia, which is independently

managed by SGS. SGS methods and procedures are accredited at SGS

hub labs and independent internal lab QAQC check samples are sent

to an SGS accredited laboratory. The Bor lab also participates in

SGS monthly round robins, and other international Round Robins.

Quality control samples, comprising certified reference materials,

blanks, and field duplicates, are inserted into each batch of

samples and locations for crushed duplicates and pulp replicates

are specified. All drill core and quality control samples are

tabulated on sample submission forms that specify sample

preparation procedures and codes for analytical methods. For

internal quality control, the laboratory includes its own quality

control samples comprising certified reference materials, blanks

and pulp duplicates. All QAQC monitoring data are reviewed,

verified and signed off by an independent QAQC geologist. Chain of

custody records are maintained from sample shipments to the

laboratory until analyses are completed and remaining sample

materials are returned to the Company. The chain of custody is

transferred from the Company to SGS at the laboratory door.

At the SGS Bor laboratory, the submitted drill

core samples are dried at 105°C for a minimum of 12 hours and then

jaw crushed to approximately 80% passing four millimetres. Sample

preparation duplicates are created by riffle splitting crushed

samples on a 1-in-20 basis. Larger samples are riffle split prior

to pulverizing, whereas smaller samples are pulverized entirely.

Pulverization specifications are 90% passing 75 microns. Gold

analyses are done using a conventional 50-gram fire assay and AAS

finish. Multi-element analyses for 49 elements, including Ag, Cu,

Mo, As, Bi, Pb, Sb, and Zn, are done using a four-acid digestion

and an ICP-MS finish at SGS Bor and SGS Ankara laboratories.

Samples returning over 10 ppm for Ag and 1% for Cu, Pb or Zn are

analyzed with AAS finish. Sulphur is analyzed using an Eltra

Analyzer equipped with an induction furnace.

Technical Information

Ross Overall, Director, Corporate Technical

Services of the Company, who is a Qualified Person as defined under

NI 43-101, and Paul Ivascanu, Vice President Exploration of the

Company, have reviewed, and approved the scientific and technical

content of this news release. Mr. Overall has verified the accuracy

of the information presented in this disclosure.

About Dundee Precious

Metals

Dundee Precious Metals Inc. is a Canadian-based

international gold mining company with operations and projects

located in Bulgaria, Serbia and Ecuador. Our strategic objective is

to become a mid-tier precious metals company, which is based on

sustainable, responsible and efficient gold production from our

portfolio, the development of quality assets, and maintaining a

strong financial position to support growth in mineral reserves and

production through disciplined strategic transactions. This

strategy creates a platform for robust growth to deliver

above-average returns for our shareholders. DPM’s shares are traded

on the Toronto Stock Exchange (symbol: DPM).

For further information please contact:

Jennifer CameronDirector,

Investor RelationsTel: (416)

219-6177jcameron@dundeeprecious.com

Cautionary Note Regarding Forward Looking

Statements

This news release contains “forward looking

statements” or “forward looking information” (collectively,

“Forward Looking Statements”) that involve a number of risks and

uncertainties. Forward Looking Statements are statements that are

not historical facts and are generally, but not always, identified

by the use of forward looking terminology such as “plans”,

“expects”, “is expected”, “budget”, “scheduled”, “estimates”,

“forecasts”, “outlook”, “intends”, “anticipates”, “believes”, or

variations of such words and phrases or that state that certain

actions, events or results “may”, “could”, “would”, “might” or

“will” be taken, occur or be achieved, or the negative of any of

these terms or similar expressions. The Forward Looking Statements

in this news release relate to, among other things: the geology and

metallurgy at exploration prospects located near to the Company’s

Čoka Rakita project and the future exploration potential at each

such prospect; next steps in the Company’s exploration activities

in Serbia and the anticipated results thereof; amounts of

expenditures expected to be incurred in connection with the

Company’s exploration activities in Serbia; and the price of

commodities. Forward Looking Statements are based on certain key

assumptions and the opinions and estimates of management and the

Qualified Persons, as of the date such statements are made, and

they involve known and unknown risks, uncertainties and other

factors which may cause the actual results, performance or

achievements of the Company to be materially different from any

other future results, performance or achievements expressed or

implied by the Forward Looking Statements. In addition to factors

already discussed in this news release, such factors include, among

others, uncertainties with respect to actual results of current and

future exploration activities; variations in mineralization;

uncertainties inherent with conducting business in foreign

jurisdictions where corruption, civil unrest, political instability

and uncertainties with the rule of law may impact the Company’s

activities; accidents, labour disputes and other risks of the

mining industry; fluctuations in metal prices; delays in obtaining

governmental approvals for exploration activities; opposition by

social and non-governmental organizations to exploration activities

and mining operations; unanticipated title disputes; claims or

litigation; increased costs and physical risks, including extreme

weather events and resource shortages, related to climate change;

cyber-attacks and other cybersecurity risks; as well as those risk

factors discussed or referred to in any other documents (including

without limitation the Company’s most recent Annual Information

Form) filed from time to time with the securities regulatory

authorities in all provinces and territories of Canada and

available on SEDAR+ at www.sedarplus.ca. The reader has been

cautioned that the foregoing list is not exhaustive of all factors

which may have been used. Although the Company has attempted to

identify important factors that could cause actual actions, events

or results to differ materially from those described in Forward

Looking Statements, there may be other factors that cause actions,

events or results not to be anticipated, estimated or intended.

There can be no assurance that Forward Looking Statements will

prove to be accurate, as actual results and future events could

differ materially from those anticipated in such statements. The

Company’s Forward Looking Statements reflect current expectations

regarding future events and speak only as of the date hereof.

Unless required by securities laws, the Company undertakes no

obligation to update Forward Looking Statements if circumstances or

management’s estimates or opinions should change. Accordingly,

readers are cautioned not to place undue reliance on Forward

Looking Statements.

Figures accompanying this announcement are available

at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/4744cf82-9d8f-4004-a2dd-c86ec6c5c65a

https://www.globenewswire.com/NewsRoom/AttachmentNg/1545a618-3334-4ba8-90df-c80512867eae

https://www.globenewswire.com/NewsRoom/AttachmentNg/59e4f236-e837-4d53-82f2-9c9a76f5d79b

https://www.globenewswire.com/NewsRoom/AttachmentNg/e187dff1-9546-43a7-8fda-e8ee8926370e

https://www.globenewswire.com/NewsRoom/AttachmentNg/fcbcfcd9-0abb-44b1-b231-453ed10d781d

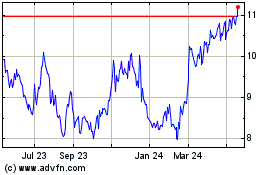

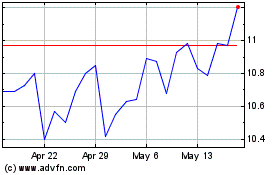

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jan 2025 to Feb 2025

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Feb 2024 to Feb 2025