Endeavour Silver Corp. (NYSE:EXK)(TSX:EDR) announced today its financial results

for the year ended December 31, 2013, based on the Company's ninth consecutive

year of growing silver and gold production. Endeavour owns and operates three

underground silver-gold mines in Mexico: the Guanacevi mine in Durango state,

and the Bolanitos and El Cubo mines in Guanajuato state.

The complete financial statements and Management's Discussion & Analysis can be

viewed on the Company's website, on SEDAR at www.sedar.com and EDGAR at

www.sec.gov. All amounts are reported in US$.

Highlights of Fiscal 2013 (Compared to Fiscal 2012)

Financial

-- Net loss of $89.5 million ($0.90 per share) compared to net earnings of

$42.1 million ($0.45 per share)

-- Adjusted earnings(1)decreased 72% to $11.1 million ($0.11 per share)

compared to $40.2 million ($0.43 per share)

-- EBITDA(1)increased 10% to $100.0 million

-- Cash flow from operations before working capital changes decreased 2% to

$81.6 million

-- Mine operating cash flow(1)increased 2% to $116.9 million

-- Revenue increased 33% to $276.8 million

-- Realized silver price fell 25% to $23.10 per ounce (oz) sold (consistent

with 2013 average spot price)

-- Realized gold price fell 18% to $1,375 per oz sold (consistent with 2013

average spot price)

-- Cash costs(1)rose 8% to $7.92 per oz silver payable (net of gold

credits)

-- All-in sustaining costs fell 21% to $18.31 per oz silver payable (net of

gold credits)

-- Cash and equivalents rose 88% to $35 million at year-end compared to $19

million

Operations

-- Silver production increased 52% to 6,813,069 oz

-- Gold production jumped 95% to 75,578 oz

-- Silver equivalent production escalated 67% to 11.3 million oz (at a 60:1

silver:gold ratio)

-- Bullion inventory at year-end included 51,000 oz silver and 198 oz gold

-- Concentrate inventory available for sale at year-end was nil

-- Successfully completed the El Cubo plant reconstruction on time and

budget

-- Plant throughputs, ore grades and metal recoveries were higher at all

three mines

Highlights of Fourth Quarter 2013 (Compared to Fourth Quarter 2012)

Financial

-- Net loss of $115.8 million ($1.16 per share) compared to net earnings of

$14.8 million ($0.15 per share)

-- Adjusted loss of $12.1 million ($0.12 per share) compared to adjusted

earnings of $12.9 million ($0.13 per share)

-- EBITDA(1) fell 18% to $23.0 million

-- Cash flow from operations before working capital changes decreased 12%

to $18.0 million

-- Revenue increased 2% to $67.9 million on 2,155,326 silver oz sold and

18,960 gold oz sold

-- Realized silver price fell 38% to $20.52 per oz sold

-- Realized gold price fell 28% to $1,246 per oz sold

-- Cash costs(1) fell 39% to $7.46 per oz silver payable (net of gold

credits)

-- El Cubo cash costs(1) fell 83% to $6.65 per oz silver payable (net of

gold credits)

-- All-in sustaining costs fell 49% to $14.24 per oz silver payable (net of

gold credits)

Operations

-- Silver production up 56% to 1,931,717 oz

-- Gold production up 37% to 17,686 oz

-- Silver equivalent production up 49% to 3.0 million oz (at a 60:1

silver:gold ratio)

-- Plant throughputs, ore grades and metal recoveries were higher at all

three mines

(1) Adjusted earnings, mine operating cash flow, EBITDA and cash costs are

non-IFRS measures. Please refer to the definitions in the Company's Management

Discussion & Analysis.

Endeavour CEO Bradford Cooke stated: "We delivered another record year of silver

and gold production and revenue in 2013. In spite of achieving higher

throughput, grades and recoveries at all three mines, our earnings were hit by

lower metal prices and reduced carrying values at El Cubo and Guanacevi plus a

deferred tax liability related to the new mining taxes in Mexico.

"Nonetheless, significant progress was made in 2013, particularly in the El Cubo

mine performance and operating costs. The single digit cash costs are what

management originally modelled long term for El Cubo when it acquired the mine

in 2012. The operating turn-around at El Cubo still has two quarters to

completion but the transformation thus far has been very satisfying."

Financial Results (Consolidated Statement of Operations appended below)

For the year ended December 31, 2013, the Company generated revenue totaling

$276.8 million (2012 - $208.1 million). During the year, the Company sold

7,151,963 oz silver and 81,119 oz gold at realized prices of $23.10 and $1,375

per oz respectively, compared to sales of 4,815,073 oz silver and 35,167 oz gold

at realized prices of $30.99 and $1,674 per oz respectively in 2012.

After cost of sales of $219.9 million (2012 - $130.1 million), mine operating

earnings amounted to $56.9 million (2012 - $78.0 million) from mining and

milling operations in Mexico.

Excluding depreciation and depletion of $53.6 million (2012 - $29.7 million),

stock-based compensation of $0.5 million (2012- $0.5 million), and a write-down

of inventory of $5.9 million (2012 - $6.2), mine operating cash flow before

taxes was $116.9 million (2012 - $114.4 million) in 2013. Operating loss was

$102.9 million (2012 - earnings of $53.6 million) driven by impairment charges

of $95.8 million on the Guanacevi and El Cubo mines and a $39.2 million

impairment of El Cubo goodwill.

At December 31, 2013, the Company determined there were several indicators of

potential impairment of its producing mineral properties which include the

sustained decline in precious metal prices, the Mexican tax reform and a

reduction of the Guanacevi estimated reserves and resources. The net after-tax

impairment totaled $104.3 million. As a result, net earnings fell from $42.1

million to a loss of $89.5 million in 2013.

Net earnings also included a mark-to-market derivative liabilities gain related

to share purchase warrants issued in 2009 denominated in Canadian dollars, while

the Company's functional currency is the US dollar. Under IFRS, these warrants

are classified and accounted for as financial liability at fair market value

with adjustments recognized through net earnings. The appreciation of these

warrants resulted in a derivative liability gain of $3.8 million (2012 - loss of

$1.9 million).

Excluding the net impairment charges and the mark-to market derivative

liabilities gain, adjusted earnings were $11.1 million ($0.11 per share)

compared to $40.2 million ($0.43 per share) in 2012. The drop in precious metal

prices was the primary reason for the decrease in the Company's earnings year

over year.

In December 2013, the Mexican President passed tax reform legislation that took

effect January 1, 2014. The tax reform includes, among other items, an increase

of the Mexican corporate tax rate from 28% to 30%, removal of the flat tax

regime, a Special Mining Duty of 7.5% on taxable mine revenue, less allowable

deductions excluding interest and capital depreciation, and an 0.5%

Environmental Tax on gold and silver revenue. The tax reform is expected to have

a material impact on the Company's future earnings and cash flow.

Consolidated operating costs increased 5% to $97 per tonne due to rising wage

pressures, significant restructuring costs, additional use of contractors and

higher refining costs, partly offset by the additional economies of scale with

the higher output. Cash cost per ounce, net of by-product credits, which is a

non- IFRS measure and a standard of the Silver Institute, rose 8% to $7.92 per

ounce of payable silver compared to $7.33 per ounce in 2012. The lower

by-product credit because of the lower gold price was the primary contributor to

the higher cash costs, offset by higher consolidated grades and recoveries. All-

in sustaining costs fell 21% as mine development and exploration expenditures

were curtailed in response to falling precious metal prices and these costs were

allocated over more ounces of silver production.

The Company invested a total of $88.6 million in property, plant and equipment

during 2013. Of this, $48.5 million was invested at El Cubo, $21.4 million at

Bolanitos, and $15.9 million at Guanacevi. The El Cubo plant refurbishment was

completed on time and budget, while the 10.6 kilometres of accelerated mine

development should allow the El Cubo mine output to rise to the 1,550 tonnes per

day plant capacity by year-end. The Guanacevi and Bolanitos capital investments

continued to focus primarily on sustaining mine development and tailings dam

expansions.

2014 Outlook

Endeavour plans to hold silver production relatively steady in the range of

6.5-6.9 million oz in 2014 compared to the 6.8 million oz silver produced in

2013. Gold production is expected to be in the 65,000-69,000 oz range and silver

equivalent production is anticipated to be 10.4-11.0 million oz (at a

silver:gold ratio of 60:1) as shown in the table below.

Ag Eq. Prod. Tonnes/Day

Mine Ag Prod. (M oz) Au Prod. (K oz) (K oz) (tpd)

----------------------------------------------------------------------------

Guanacevi 2.6-2.7 7.0-8.0 3.0-3.2 1,200-1,300

Bolanitos 2.2-2.4 36.0-38.0 4.4-4.7 1,450-1,600

El Cubo 1.7-1.8 22.0-23.0 3.0-3.1 1,200-1,550

----------------------------------------------------------------------------

Total 6.5-6.9 65.0-69.0 10.4-11.0 3,850-4,450

----------------------------------------------------------------------------

In 2014, Bolanitos production will pull back to the 1,600 tpd plant capacity as

management has elected not to continue extra mine production for processing at

the El Cubo plant as it did in 2013. At Bolanitos, production will continue

primarily from the Daniela, Karina, Lana and Bolanitos veins and mine

development will open up the La Luz- Asuncion deposit.

In 2013, El Cubo production will expand to fill the 1,550 tpd plant to capacity

through a steady ramp-up of mine output as mine development opens up the new

Villalpando-Asuncion deposit. At El Cubo, the remaining 2014 production will

continue to come primarily from the Dolores, Villalpando, San Nicolas and Santa

Cecilia veins.

Bolanitos and El Cubo are both producing silver-gold concentrates for sale under

one year contracts to smelters because their attractive terms offer lower costs

and higher profit margins compared to producing dore bars from the El Cubo leach

plant at the current low metal prices.

At Guanacevi, production will continue primarily from the Porvenir Norte,

Porvenir Cuatro and Santa Cruz veins. Underground development of the new Milache

discovery is awaiting permitting for development to start in 2014 and production

to start in 2015.

Operating Costs

Direct operating costs are forecast at $95 per tonne, and consolidated

by-product cash costs of silver production (net of gold credits) are anticipated

to be in the $9-$10 per oz range in 2014. The increase from 2013 is primarily

driven by the lower gold price and reduced gold production. Consolidated co-

product cash costs of silver and gold production are anticipated to be around

$13-14 and $800-850 per oz respectively.

All-in by-product sustaining costs of production (including sustaining capex,

exploration and G&A costs) are forecasted to be approximately $19 per oz of

silver produced.

Capital Budget

Endeavour plans to invest $43.9 million on capital projects in 2014, including

$34.6 million on mine development, infrastructure, equipment and exploration

plus $9.3 million on plant upgrades, infrastructure, equipment and buildings.

The Company has budgeted $20.9 million at El Cubo, $9.9 million at Bolanitos,

$11.7 million at Guanacevi and $1.4 million for general capital, all of which

should be funded by the Company's anticipated 2014 operating cash flow.

Because of Endeavour's reserve depletion last year, management will look for

opportunities to allocate additional funds for accelerated mine development to

convert measured and indicated resources into proven and probable reserves in

2014.

Exploration Expenditures

In 2014, Endeavour plans to spend $10.7 million on exploration. A total of

54,000 metres of drilling in about 120 holes are budgeted to test multiple

exploration targets in addition to the underground mine exploration drilling. As

in previous years, management will look for opportunities to stretch and also

augment this budget in order to fuel accelerated resource expansion.

The Company will focus on brownfields exploration around the three operating

mines in order to replenish reserves and grow resources and mine lives, as well

as expanding and permitting the emerging new high grade silver-gold discovery in

the Terronera vein on the San Sebastian property in Jalisco State.

Conference Call

A conference call to discuss the results will be held Tuesday, March 11 at

8:00am PST (11:00am EST). To participate in the conference call, please dial the

following:

Toll-free in Canada and the US: 1-800-319-4610

Local Vancouver: 604-638-5340

Outside of Canada and the US: 1-604-638-5340

No pass-code is necessary to participate in the conference call.

A replay of the conference call will be available by dialing 1-800-319-6413 in

Canada and the US (toll- free) or 1-604-638-9010 outside of Canada and the US.

The required pass-code is 4890 followed by the # sign. The replay will also be

available on the Company's website at www.edrsilver.com.

All shareholders can receive a hard copy of the Company's complete audited

financial statements free of charge upon request. To receive this material in

hard copy, please contact Meghan Brown, Director Investor Relations at

604-640-4804 or toll free 1-877-685-9775.

About Endeavour - Endeavour is a mid-tier silver mining company focused on

growing its profits, production, reserves and resources in Mexico. Since

start-up in 2004, Endeavour has posted nine consecutive years of accretive

growth of its silver mining operations. The organic expansion programs now

underway at Endeavour's three silver-gold mines in Mexico combined with its

strategic acquisition and exploration programs should facilitate Endeavour's

goal to become a premier senior silver producer.

Cautionary Note Regarding Forward-Looking Statements

This news release contains "forward-looking statements" within the meaning of

the United States private securities litigation reform act of 1995 and

"forward-looking information" within the meaning of applicable Canadian

securities legislation. Such forward-looking statements and information herein

include but are not limited to statements regarding Endeavour's anticipated

performance in 2014 and the timing and results of exploration drill programs.

The Company does not intend to, and does not assume any obligation to update

such forward-looking statements or information, other than as required by

applicable law.

Forward-looking statements or information involve known and unknown risks,

uncertainties and other factors that may cause the actual results, level of

activity, performance or achievements of Endeavour and its operations to be

materially different from those expressed or implied by such statements. Such

factors include, among others, changes in national and local governments,

legislation, taxation, controls, regulations and political or economic

developments in Canada and Mexico; operating or technical difficulties in

mineral exploration, development and mining activities; risks and hazards of

mineral exploration, development and mining; the speculative nature of mineral

exploration and development, risks in obtaining necessary licenses and permits,

and challenges to the Company's title to properties; fluctuations in the prices

of commodities and their impact on reserves and resources as well as those

factors described in the section "risk factors" contained in the Company's most

recent form 40F/Annual Information Form filed with the S.E.C. and Canadian

securities regulatory authorities.

Forward-looking statements are based on assumptions management believes to be

reasonable, including but not limited to: the continued operation of the

Company's mining operations, no material adverse change in the market price of

commodities, mining operations will operate and the mining products will be

completed in accordance with management's expectations and achieve their stated

production outcomes, and such other assumptions and factors as set out herein.

Although the Company has attempted to identify important factors that could

cause actual results to differ materially from those contained in

forward-looking statements or information, there may be other factors that cause

results to be materially different from those anticipated, described, estimated,

assessed or intended. There can be no assurance that any forward-looking

statements or information will prove to be accurate as actual results and future

events could differ materially from those anticipated in such statements or

information. Accordingly, readers should not place undue reliance on

forward-looking statements or information.

ENDEAVOUR SILVER CORP.

COMPARATIVE HIGHLIGHTS

Three Months Ended Dec. 31 Year Ended Dec. 31

Q4 2013

% Highlights %

2013 2012 Change 2013 2012 Change

----------------------------------------------------------------------------

Production

----------------------------------------------------------------------------

Silver ounces

1,931,717 1,235,026 56% produced 6,813,069 4,485,476 52%

Gold ounces

17,686 12,917 37% produced 75,578 38,687 95%

Payable silver

1,855,108 1,222,705 52% ounces produced 6,593,805 4,440,619 48%

Payable gold

16,612 12,800 30% ounces produced 72,562 38,311 89%

Silver

equivalent

ounces produced

2,992,877 2,010,046 49% (1) 11,347,749 6,806,696 67%

Cash costs per

silver

7.46 12.25 -39% ounce(2)(3) 7.92 7.33 8%

Total production

costs per

14.59 18.88 -23% ounce(2)(4) 15.69 13.80 14%

All-in

sustaining

costs per

14.24 28.06 -49% ounce(2)(5) 18.31 23.06 -21%

379,480 362,779 5% Processed tonnes 1,148,894 1,065,689 8%

Direct

production

costs per

90.72 90.39 0% tonne(2)(6) 97.00 92.74 5%

Silver co-

product cash

11.45 18.82 -39% costs (7) 13.19 14.87 -11%

Gold co-product

695.47 987.70 -30% cash costs (7) 785.01 807.67 -3%

----------------------------------------------------------------------------

Financial

----------------------------------------------------------------------------

Revenue ($

67.9 66.7 2% millions) 276.8 208.1 33%

Silver ounces

2,155,326 1,345,832 60% sold 7,151,963 4,815,073 49%

18,960 13,037 45% Gold ounces sold 81,119 35,167 131%

Realized silver

20.52 32.87 -38% price per ounce 23.10 30.99 -25%

Realized gold

1,246 1,725 -28% price per ounce 1,375 1,674 -18%

Net earnings

(loss) ($

(115.8) 14.8 -881% millions (89.5) 42.1 -312%

Adjusted net

earnings (8) ($

(12.1) 12.9 -194% millions) 11.1 40.2 -72%

Mine operating

earnings ($

9.9 17.9 -45% millions) 56.9 78.0 -27%

Mine operating

cash flow(9) ($

26.4 34.8 -24% millions) 116.9 114.4 2%

Operating cash

flow before

working capital

18.0 20.4 -12% changes (10) 81.6 82.9 -2%

Earnings before

23.0 28.2 -18% ITDA (11) 100.0 90.5 10%

Working capital

32.2 50.9 -37% ($ millions) 32.2 50.9 -37%

----------------------------------------------------------------------------

Shareholders

----------------------------------------------------------------------------

Earnings (loss)

per share -

(1.16) 0.15 -100% basic (0.90) 0.45 -300%

Adjusted

earnings per

share - basic

(0.12) 0.13 -193% (8) 0.11 0.43 -74%

Operating cash

flow before

working capital

changes per

0.18 0.20 -12% share (10) 0.82 0.89 -8%

Weighted average

shares

99,720,704 99,539,282 0% outstanding 99,770,293 93,266,038 7%

----------------------------------------------------------------------------

ENDEAVOUR SILVER CORP.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(expressed in thousands of U.S. dollars)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Years Ended

December 31, December 31,

2013 2012

----------------------------------------------------------------------------

Operating activities

Net earnings (loss) for the year $ (89,465) $ 42,117

Items not affecting cash:

Share-based compensation 3,544 4,724

Impairment of non-current assets 95,815 -

Impairment of goodwill 39,245 -

Depreciation and depletion 53,898 29,952

Deferred income tax provision (20,464) 2,135

Unrealized foreign exchange loss (gain) 682 (1,208)

Mark-to-market loss (gain) on derivative

liability (3,750) (1,928)

Mark-to-market loss (gain) on contingent

liability (8,398) 589

Finance costs 1,513 484

Write down of inventory to net realizable value 5,874 6,221

Loss (gain) on marketable securities 3,091 (158)

Net changes in non-cash working capital (5,041) (6,907)

----------------------------------------------------------------------------

Cash from operating activities 76,544 76,021

----------------------------------------------------------------------------

Investing activites

Property, plant and equipment expenditures (88,518) (66,236)

Acquisition of Mexgold Resources Inc. - (100,000)

Investment in short term investments (130) (28,267)

Proceeds from sale of short term investments 5,328 50,373

Investment in long term deposits (65) (190)

----------------------------------------------------------------------------

Cash used in investing activities (83,385) (144,320)

----------------------------------------------------------------------------

Financing activities

Proceeds from revolving credit facility 30,000 9,000

Repayment of revolving credit facility (6,000) -

Debt issuance costs (144) (732)

Interest paid (1,101) (381)

Common shares issued on exercise of options and

warrants 528 2,591

Share issuance costs - (204)

----------------------------------------------------------------------------

Cash from financing activites 23,283 10,274

----------------------------------------------------------------------------

Effect of exchange rate change on cash and cash

equivalents (55) 1,208

Increase (decrease) in cash and cash equivalents 16,442 (58,025)

Cash and cash equivalents, beginning of year 18,617 75,434

----------------------------------------------------------------------------

Cash and cash equivalents, end of year $ 35,004 $ 18,617

----------------------------------------------------------------------------

This statement should be read in conjunction with the audited consolidated

financial statements for the year ended December 31, 2013 and the related notes

contained therein.

ENDEAVOUR SILVER CORP.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME/(LOSS)

(expressed in thousands of US dollars, except for shares and per share

amounts)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Years Ended

December 31, December 31,

2013 2012

----------------------------------------------------------------------------

Revenue $ 276,783 $ 208,079

Cost of sales:

Direct production costs 158,582 91,800

Royalties 1,328 1,866

Share-based compensation 515 545

Depreciation and depletion 53,569 29,694

Write down of inventory to net realizable

value 5,874 6,221

----------------------------------------------------------------------------

219,868 130,126

Mine operating earnings 56,915 77,953

Expenses:

Exploration 13,168 11,185

Impairment of non-current assets 95,815 -

Impairment of goodwill 39,245 -

General and administrative 11,605 13,136

----------------------------------------------------------------------------

159,833 24,321

Operating earnings (loss) (102,918) 53,632

Mark-to-market loss/(gain) on derivative

liabilities (3,750) (1,928)

Mark-to-market loss/(gain) on contingent

liability (8,398) 589

Finance costs 1,513 484

Other income (expense):

Foreign exchange (2,597) 3,447

Investment and other income (1,079) 2,152

----------------------------------------------------------------------------

(3,676) 5,599

Earnings (loss) before income taxes (95,959) 60,086

Income tax expense:

Current income tax expense 13,970 15,834

Deferred income tax expense (recovery) (20,464) 2,135

----------------------------------------------------------------------------

(6,494) 17,969

----------------------------------------------------------------------------

Net earnings (loss) for the year (89,465) 42,117

----------------------------------------------------------------------------

Other comprehensive income (loss), net of tax

Net change in fair value of available for

sale investments 1,250 (3,631)

----------------------------------------------------------------------------

Comprehensive income (loss) for the year $ (88,215) $ 38,486

----------------------------------------------------------------------------

Basic earnings (loss) per share based on net

earnings $ (0.90) $ 0.45

----------------------------------------------------------------------------

Diluted earnings (loss) per share based on net

earnings $ (0.90) $ 0.42

----------------------------------------------------------------------------

Basic weighted average number of shares

outstanding 99,720,704 93,266,038

----------------------------------------------------------------------------

Diluted weighted average number of shares

outstanding 99,720,704 95,728,031

----------------------------------------------------------------------------

This statement should be read in conjunction with the audited consolidated

financial statements for the year ended December 31, 2013 and the related notes

contained therein.

ENDEAVOUR SILVER CORP.

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

(expressed in thousands of US dollars)

----------------------------------------------------------------------------

December 31, December 31,

2013 2012

----------------------------------------------------------------------------

ASSETS

Current assets

Cash and cash equivalents $ 35,004 $ 18,617

Investments 1,463 8,520

Accounts receivable 23,749 20,526

Inventories 23,647 40,797

Prepaid expenses 3,341 9,940

----------------------------------------------------------------------------

Total current assets 87,204 98,400

Non-current deposits 1,186 1,451

Mineral property, plant and equipment 278,533 338,431

Goodwill - 39,245

----------------------------------------------------------------------------

Total assets $ 366,923 $ 477,527

----------------------------------------------------------------------------

----------------------------------------------------------------------------

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities

Accounts payable and accrued liabilities $ 17,221 $ 34,631

Income taxes payable 3,259 3,854

Derivative liabilities 1,491 -

Revolving credit facility 33,000 9,000

----------------------------------------------------------------------------

Total current liabilities 54,971 47,485

Provision for reclamation and rehabilitation 6,652 6,496

Derivative liabilities - 5,336

Contingent liability 99 8,497

Deferred income tax liability 49,053 69,517

----------------------------------------------------------------------------

Total liabilities 110,775 137,331

----------------------------------------------------------------------------

Shareholders' equity

Common shares, unlimited shares authorized, no par

value, issued and outstanding 99,784,409 shares

(Dec 31, 2012 - 99,541,522 shares) 358,408 357,296

Contributed surplus 14,836 12,828

Accumulated comprehensive income (loss) (4,081) (5,331)

Retained earnings (deficit) (113,015) (24,597)

----------------------------------------------------------------------------

Total shareholders' equity 256,148 340,196

----------------------------------------------------------------------------

Total liabilities and shareholders' equity $ 366,923 $ 477,527

----------------------------------------------------------------------------

This statement should be read in conjunction with the audited consolidated

financial statements for the year ended December 31, 2013 and the related notes

contained therein.

FOR FURTHER INFORMATION PLEASE CONTACT:

Endeavour Silver Corp.

Meghan Brown

Director Investor Relations

Toll free: 1-877-685-9775 Tel: 604-640-4804

604-685-9744 (FAX)

mbrown@edrsilver.com

www.edrsilver.com

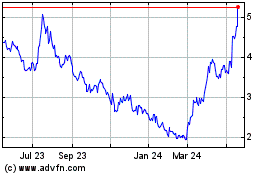

Endeavour Silver (TSX:EDR)

Historical Stock Chart

From Nov 2024 to Dec 2024

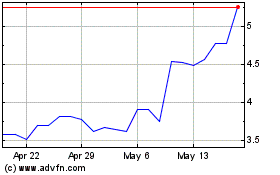

Endeavour Silver (TSX:EDR)

Historical Stock Chart

From Dec 2023 to Dec 2024