Element Demonstrates Ready Access to Cost-Effective Capital

April 25 2023 - 4:01PM

Element Fleet Management Corp. (TSX:EFN) (“Element” or the

“Company”), the largest pure-play automotive fleet manager in the

world, today announced its issuance of U.S. vehicle management

asset-backed term notes, the Company’s Q1 2023 U.S. syndication

volume, as well as the expansion of the Company’s two senior

unsecured revolving credit facilities in the first quarter of this

year.

Element enjoys ready access to the deep U.S.

fleet ABS market. Today, the Company issued $USD 750 million of

vehicle management asset-backed term notes to a wide selection of

institutional investors. The offering was Element’s first of the

year and greeted by strong investor demand, allowing the Company to

increase the offering size from $USD 500 million while improving

pricing.

The Company also enjoyed continued robust demand

for its fleet lease receivables throughout the first quarter from

its growing list of syndication investors. Element advanced its

capital-lighter business model in the quarter by syndicating $690

million of U.S. assets including $371 million in the last two weeks

of March despite U.S. banking turmoil.

In January, Element renewed its primary

multi-currency senior unsecured revolving credit facility -- which

is underwritten by a syndicate of leading Canadian, U.S. and

international banks -- and expanded this “senior bank line” by $USD

500 million in the process. Last month (in late March), Element

also extended its secondary multi-currency senior unsecured

revolving credit and expanded its capacity by $USD 100 million.

As previously communicated, in Q4 2022, Element

renewed its U.S. variable funding notes (vehicle management

asset-backed debt) through March 2024 and expanded the facility by

$USD 500 million.

“As always, Element maintains ready access to

ample cost-effective capital for our clients, from a diversified

roster of lenders and investors across funding sources,” said Frank

Ruperto, Executive Vice President and Chief Financial Officer of

Element. “We are very pleased with the U.S. fleet ABS market’s

reception to our term note offering, as well as our lending

syndicate partners’ appetite to expand their funding capacity

commitments to Element. Off balance sheet, we continue to enjoy

robust demand for our assets from syndication investors in the U.S.

and Canada and expect to syndicate between $3.0 and $4.0 billion of

volume in 2023. Our expectations underscore our confidence in the

attractiveness of our fleet lease receivables to syndication

investors irrespective of broader market movements.”

About Element Fleet

Management

Element Fleet Management (TSX: EFN) is the

largest pure-play automotive fleet manager in the world, providing

the full range of fleet services and solutions to a growing base of

loyal, world-class clients – corporates, governments and

not-for-profits – across North America, Australia and New Zealand.

Element enjoys proven resilient cash flow, a significant proportion

of which is returned to shareholders in the form of dividends and

share buybacks; a scalable operating platform that magnifies

revenue growth into earnings growth; and an evolving

capital-lighter business model that enhances return on equity.

Element’s services address every aspect of clients’ fleet

requirements, from vehicle acquisition, maintenance, accidents and

remarketing, to integrating EVs and managing the complexity of

gradual fleet electrification. Clients benefit from Element’s

expertise as the largest fleet solutions provider in its markets,

offering unmatched economies of scale and insight used to reduce

fleet operating costs and improve productivity and performance. For

more information, visit www.elementfleet.com/investors.

This press release includes forward-looking

statements regarding Element and its business. Such statements are

based on the current expectations and views of future events of

Element’s management. In some cases the forward-looking statements

can be identified by words or phrases such as “may”, “will”,

“expect”, “plan”, “anticipate”, “intend”, “potential”, “estimate”,

“believe” or the negative of these terms, or other similar

expressions intended to identify forward-looking statements,

including, among others, statements regarding Element’s

enhancements to clients’ service experience and service levels;

enhancement of financial performance; improvements to client

retention trends; reduction of operating expenses; increases in

efficiency; EV strategy and capabilities; global EV adoption rates;

redemption of the Series I Shares; dividend policy and the payment

of future dividends; creation of value for all stakeholders;

expectations regarding syndication; growth prospects and expected

revenue growth; level of workforce engagement; improvements to

magnitude and quality of earnings; executive hiring and retention;

focus and discipline in investing; balance sheet management and

plans to reduce leverage ratios; anticipated benefits of the

balanced scorecard initiative; Element’s proposed share purchases,

including the number of common shares to be repurchased, the timing

thereof and TSX acceptance of the NCIB and any renewal thereof; and

expectations regarding financial performance. No forward-looking

statement can be guaranteed. Forward-looking statements and

information by their nature are based on assumptions and involve

known and unknown risks, uncertainties and other factors which may

cause Element's actual results, performance or achievements, or

industry results, to be materially different from any future

results, performance or achievements expressed or implied by such

forward-looking statement or information. Accordingly, readers

should not place undue reliance on any forward-looking statements

or information. Such risks and uncertainties include those

regarding the ongoing COVID-19 pandemic, risks regarding the fleet

management and finance industries, economic factors and many other

factors beyond the control of Element. A discussion of the material

risks and assumptions associated with this outlook can be found in

Element's annual MD&A, and Annual Information Form for the year

ended December 31, 2021, each of which has been filed on SEDAR and

can be accessed at www.sedar.com. Except as required by applicable

securities laws, forward-looking statements speak only as of the

date on which they are made and Element undertakes no obligation to

publicly update or revise any forward-looking statement, whether as

a result of new information, future events, or otherwise.

Contact:

Michael Barrett

Vice President, Investor Relations

(416) 646-5698

mbarrett@elementcorp.com

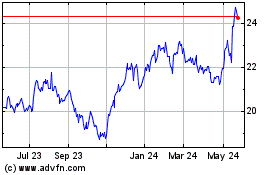

Element Fleet Management (TSX:EFN)

Historical Stock Chart

From Dec 2024 to Jan 2025

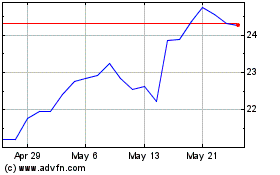

Element Fleet Management (TSX:EFN)

Historical Stock Chart

From Jan 2024 to Jan 2025