Element Announces Pricing of Private Offering of Senior Notes

November 27 2023 - 4:01PM

Element Fleet Management Corp. (TSX: EFN) (“Element” or the

“Company”), the largest publicly traded pure-play automotive fleet

manager in the world, today announced that it has agreed to sell

US$750 million aggregate principal amount of 6.319% Senior Notes

due 2028 (the “Notes”) in a private offering that will not be

registered under the Securities Act of 1933, as amended (the

“Securities Act”). The Notes will mature on December 4, 2028.

The net proceeds from the offering are expected

to be used (i) to repay all of Element's outstanding indebtedness

under its existing bilateral term loan facilities with Bank of

Montreal and Canadian Imperial Bank of Commerce and pay related

fees and expenses and (ii) for working capital and general

corporate purposes. The offering is expected to close on December

4, 2023, subject to customary closing conditions.

The Notes will not be registered under the

Securities Act or any state securities laws in the United States

and may not be offered or sold in the United States absent

registration or an applicable exemption from the registration

requirements under the Securities Act and applicable state

securities laws. Accordingly, the Notes are being offered and sold

only to persons reasonably believed to be qualified institutional

buyers in accordance with Rule 144A under the Securities Act and to

non-U.S. persons outside the United States in accordance with

Regulation S under the Securities Act. Additionally, in Canada the

offering will be made pursuant to exemptions from the prospectus

requirements of applicable Canadian securities laws.

This press release does not constitute an offer

to sell or a solicitation of an offer to buy any securities, nor

shall there be any sale of securities in any state or jurisdiction

in which such offer, solicitation or sale would be unlawful prior

to registration or qualification under the securities laws of any

such state or jurisdiction.

About Element Fleet

Management

Element Fleet Management (TSX: EFN) is the

largest publicly traded pure-play automotive fleet manager in the

world, providing the full range of fleet services and solutions to

a growing base of loyal, world-class clients – corporates,

governments and not-for-profits – across North America, Australia

and New Zealand. Element’s services address every aspect of

clients’ fleet requirements, from vehicle acquisition, maintenance,

accidents and remarketing, to integrating EVs and managing the

complexity of gradual fleet electrification. Clients benefit from

Element’s expertise as the largest fleet solutions provider in its

markets, offering unmatched economies of scale and insight used to

reduce fleet operating costs and improve productivity and

performance.

Forward-Looking Statements

This press release includes forward-looking

statements regarding Element and its business. Such statements are

based on the current expectations and views of future events of

Element’s management. In some cases the forward-looking statements

can be identified by words or phrases such as “may”, “will”,

“expect”, “plan”, “anticipate”, “intend”, “potential”, “estimate”,

“believe” or the negative of these terms, or other similar

expressions intended to identify forward-looking statements,

including, among others, statements regarding the use of proceeds

from the offering of the Notes; Element’s enhancements to clients’

service experience and service levels; enhancement of financial

performance; improvements to client retention trends; reduction of

operating expenses; increases in efficiency; EV strategy and

capabilities; global EV adoption rates; dividend policy and the

payment of future dividends; creation of value for all

stakeholders; expectations regarding syndication; growth prospects

and expected revenue growth; level of workforce engagement;

improvements to magnitude and quality of earnings; executive hiring

and retention; focus and discipline in investing; balance sheet

management and plans to reduce leverage ratios; anticipated

benefits of the balanced scorecard initiative; and expectations

regarding financial performance. No forward-looking statement can

be guaranteed. Forward-looking statements and information by their

nature are based on assumptions and involve known and unknown

risks, uncertainties and other factors which may cause Element’s

actual results, performance or achievements, or industry results,

to be materially different from any future results, performance or

achievements expressed or implied by such forward-looking statement

or information. Accordingly, readers should not place undue

reliance on any forward-looking statements or information. Such

risks and uncertainties include those regarding the fleet

management and finance industries, economic factors and many other

factors beyond the control of Element. A discussion of the material

risks and assumptions associated with this outlook can be found in

Element’s annual MD&A, and Annual Information Form for the year

ended December 31, 2022, each of which has been filed on SEDAR and

can be accessed at www.sedar.com. Except as required by applicable

securities laws, forward-looking statements speak only as of the

date on which they are made and Element undertakes no obligation to

publicly update or revise any forward-looking statement, whether as

a result of new information, future events, or otherwise.

Contact:

Rocco Colella

Director, Investor Relations

(437) 349-3796

rcolella@elementcorp.com

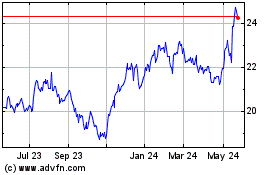

Element Fleet Management (TSX:EFN)

Historical Stock Chart

From Dec 2024 to Jan 2025

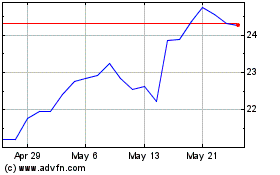

Element Fleet Management (TSX:EFN)

Historical Stock Chart

From Jan 2024 to Jan 2025