Emera (TSX: EMA) today reported results for the fourth

quarter of 2016 and the year ended December 31, 2016.

Q4 2016 Highlights:

Reported Net Income:

- Reported Q4 2016 net income was $70

million, compared with net income of $192 million in Q4 2015.

- Reported net income included a $34

million after-tax mark-to-market loss primarily at Emera Energy,

compared to a $105 million gain in Q4 2015 primarily the result of

TECO acquisition forward hedges.

- Reported earnings per common share in

Q4 2016 were $0.34, compared with $1.31 per common share in Q4

2015.

Adjusted Net Income (1)

- Adjusted Q4 2016 net income was $104

million, compared with $87 million in Q4 2015.

- Adjusted earnings per common share in

Q4 2016 were $0.51, compared with $0.59 in Q4 2015.

(1)See “Non-GAAP Measures” noted below.

2016 Highlights

Reported Net Income

- Reported 2016 net income was $227

million, compared with net income of $397 million in 2015.

- Reported net income included a $248

million after-tax mark-to-market loss at Emera Energy and Corporate

and Other, compared with a $67 million after-tax mark-to-market

gain in 2015.

- Reported earnings per common share in

2016 were $1.33, compared with $2.72 in 2015.

Adjusted Net Income (1)

- Adjusted 2016 net income was $475

million, compared with $330 million in 2015.

- Adjusted earnings per common share in

2016 were $2.77, compared with $2.26 in 2015.

(1)See “Non-GAAP Measures” noted below.

“2016 was a transformational year for Emera, we closed our

acquisition of TECO Energy, and we delivered strong financial

results. We continued to grow our dividend with a 10% annualized

increase in 2016, and extended our dividend growth target to 8% per

year through 2020,” said Chris Huskilson, President and CEO of

Emera Inc. “We have achieved a significant rebalancing of our

portfolio of businesses. Our geographic diversification has been

enhanced by entering new growth markets and the percentage of our

earnings from regulated business has increased to greater than 90%.

Specifically, the TECO Energy acquisition diversifies our

geographic and regulatory profiles and provides us with a new

strategic growth platform. The opportunity to implement our

strategy of delivering affordable, lower carbon forms of energy to

customers enables us to implement a combined growth and capital

investment plan for Emera and TECO that drives a very positive

outlook for Emera through to the end of the decade.”

Financial Highlights (in millions of

$CAD, except per share amounts; which are in $CAD)

Three months endedDecember

31

Year ended

December 31

2016 2015 2016 2015

Net income attributable to common shareholders $ 70 $ 192 $

227 $ 397

After-tax mark-to-market gain (loss)

(34) 105 (248) 67

Adjusted

net income attributable to common shareholders(1)(2) $ 104 $

87

$

475

$

330

Earnings per common share - basic $ 0.34 $ 1.31 $

1.33 $ 2.72

Adjusted earnings per common share -

basic(1)(2) $ 0.51 $ 0.59 $ 2.77 $ 2.26

Weighted average shares of common stock outstanding - basic

(millions of shares)

204

147

171

146

(1)See “Non-GAAP Measures” noted below.(2) Adjusted net

income(1) and Adjusted earnings per common share(1) exclude the

effect of mark-to-market adjustments.

Adjusted Net Income (excluding after-tax mark-to-market

impacts):

- Adjusted net income(1) was $104

million, or $0.51 per common share, in Q4 2016, compared with net

income of $87 million or $0.59 per common share in Q4 2015.

Adjusted net income in 2016 was $475 million, or $2.77 per common

share, compared with $330 million, or $2.26 per common share in

2015.

- TECO Energy acquisition costs included

a tax benefit of $13 million after tax in Q4 2016, or a $0.06 per

common share benefit, compared with $30 million after-tax, or a

$0.21 per common share, cost in Q4 2015. In 2016, TECO acquisition

costs were $166 million after-tax, or a $0.97 per common share

cost, compared with $53 million, or a $0.36 per common share, cost

in 2015. The 2016 acquisition costs included legal, banking and

advisory fees, New Mexico Gas Company stipulation commitments,

accelerated vesting of TECO Energy stock based compensation,

acquisition related financing, non-cash accounting related costs

associated with the conversion of the convertible debentures, and

convertible debenture related interest.

- Gain (loss) on sale of APUC common

shares – In Q2, Emera completed the sale of 50.1 million common

shares of APUC, resulting in an after-tax gain of $146 million, or

$0.97 per common share. In Q2, Emera exchanged 12.9 million APUC

subscription receipts and dividend equivalents into 12.9 million

APUC common shares, resulting in an after-tax gain of $53 million

or $0.35 per common share. In December, Emera sold its remaining

4.7 percent interest, or 12.9 million common shares of APUC, which

resulted in gross proceeds of $142 million, and an after-tax loss

of $10 million, or $0.06 per common share loss. The net effect of

the three transactions was a $189 million after-tax gain, or $1.26

per common share benefit. Emera no longer holds an interest in

APUC.

- Gain on BLPC SIF regulatory

liability – In Q2, BLPC secured support from the Government of

Barbados and the Trustees of the SIF to reduce the contingency

funding in the SIF to $29 million. Using third party risk advisors,

Emera reduced the SIF regulatory liability and recorded an

after-tax gain of $43 million or $0.29 per common share, and

received a $65 million distribution in Q3 2016.

Consolidated Financial

Review:

Below is a table highlighting significant changes between

adjusted net income from 2015 to 2016 in the fourth quarter and

full-year periods.

For the

Three months endedDecember 31

Year endedDecember 31

millions of Canadian dollars

Adjusted net income – 2015

$ 87 $ 330 Emera Florida and New Mexico

63 172 Emera Caribbean (6) 16 Emera Energy(1) (30) (82) NSPML and

LIL AFUDC earnings 7 21 Acquisition and financing costs related to

the acquisition of TECO Energy 43 (113) TECO Energy

post-acquisition financing costs (44) (93) Gain (loss) on sale of

APUC common shares (10) 136

Gain on conversion of APUC subscription

receipts and dividend equivalents to common shares of APUC

- 53 Gain on BLPC SIF regulatory liability - 43 2015 gain on sale

of NWP - (12) Emera Energy's recognition of fuel taxes for 2013

through March 2016 - (12) Other (6) 16

Adjusted

net income – 2016 $ 104 $ 475

(1) excludes the effect of mark-to-market adjustments.

Q4 2016

Segmented Results

Emera reports its results in six operating segments: Emera

Florida and New Mexico, Nova Scotia Power Inc., Emera Maine, Emera

Caribbean, Emera Energy, and Corporate & Other. The Pipelines

segment is now included in Corporate & Other.

Quarterly and 2016 Segmented Results

(in millions of $CAD, except per share amounts; which are in

$CAD)

Adjusted Net Income(1)

Q4 2016

Q4 2015 2016 2015

Emera Florida and New Mexico $ 63 $ -- $ 172 $

--

Nova Scotia Power Inc. 34 40 130 130

Emera Maine

11 5 47 45

Emera Caribbean 8 14 100 41

Emera

Energy(2) 5 35 24 130

Corporate &

Other(2) (17) (7) 2 (16)

Total adjusted

net income $ 104 $ 87 $

475 $ 330 After-tax mark-to-market gain (loss)

(34)

105

(248)

67

Net income attributable to common shareholders

$

70

$

192

$

227

$

397

Adjusted EPS (basic)(1)

$ 0.51 $

0.59 $ 2.77 $ 2.26

(1)See “Non-GAAP Measures” noted below.(2)Adjusted net income(1)

excludes after-tax mark-to-market loss in Pipelines, Emera Energy,

and Corporate and Other

Emera Florida and New Mexico’s net income was $63 million

in Q4 2016. Energy sales increased due to customer growth, offset

by winter weather that was warmer than normal in Florida and New

Mexico and higher OM&G primarily timing related at Tampa

Electric. Emera Florida and New Mexico had net income of $172

million for the six-month 2016 ownership period. These results

reflect strong customer growth in Florida and a focus on cost

control in New Mexico. Net of $43 million and $93 million of

permanent financing costs, Emera Florida and New Mexico contributed

$19 million and $79 million in Q4 and for the six month ownership

period, respectively.

Nova Scotia Power Inc.’s net income was $34 million in Q4

2016, a decrease of $6 million from $40 million in Q4 2015. The

decrease was primarily due to higher OM&G expense due to higher

storm costs and the timing of planned generating plant maintenance.

2016 earnings were unchanged from 2015 earnings of $130

million.

Emera Maine’s net income was $11 million in Q4 2016,

compared to Q4 2015 net income of $5 million. Emera Maine’s 2016

net income was $47 million compared to $45 million for 2015.

Results in Q4 2016 were driven by lower OM&G and higher

transmission rates, partially offset by the loss of two large

industrial customers.

Emera Caribbean’s net income of $8 million in Q4 2016

represents a decrease of $6 million compared to Q4 2015 net income

of $14 million. The decrease was primarily due to lower energy

sales at GBPC following Hurricane Matthew. Emera Caribbean’s net

income in 2016 was $100 million compared to $41 million for the

same period last year. The 2016 increase was due to lower OM&G

as a result of restructuring actions in 2015, and the gain from the

BLPC SIF as a result of the reduction in the regulatory liability

recorded in Q2 2016. GBPC received regulatory approval to defer all

costs related to Hurricane Matthew restoration efforts.

Emera Energy’s net income, adjusted to exclude

mark-to-market changes, was $5 million in Q4 2016 compared to net

income of $35 million in the same quarter last year due to lower

realized spark spreads in the New England Gas Generating

facilities, reflecting very favorable short term economic hedges

that were in place in Q4 2015; and lower marketing and trading

margin reflecting continued low natural gas prices and volatility

across the Northeast US. Emera Energy’s adjusted 2016 net income

was $24 million compared to $130 million in 2015 driven by the same

factors as Q4 and the expiration of a favorable gas contract at

Bayside Power in 2016.

Corporate and Other’s net loss, adjusted to exclude

mark-to-market changes, was $(17) million in Q4 2016 compared to a

net loss of $(7) million in Q4 2015. The increased loss was

primarily due to higher interest expense as a result of interest on

the permanent financing of the TECO acquisition. Corporate and

Other’s 2016 adjusted net income was $2 million compared to a loss

of $(16) million for 2015. Results in 2016 include $166 million of

after-tax TECO acquisition costs, which were more than offset by

the $189 million of after-tax gains, net of the Q4 $10 million

loss, on the sale of the APUC shares and the conversion of the APUC

subscription receipts in the second quarter of 2016.

(1) Non-GAAP Measures

Emera uses financial measures that do not have standardized

meaning under USGAAP and may not be comparable to similar measures

presented by other entities. Emera calculates the non-GAAP measures

by adjusting certain GAAP and non-GAAP measures for specific items

the Company believes are significant, but not reflective of

underlying operations in the period. Refer to the Non-GAAP

Financial Measures section of our Management's Discussion and

Analysis ("MD&A") for further discussion of these items.

Forward Looking Information

This news release contains forward-looking information within

the meaning of applicable securities laws. By its nature,

forward-looking information requires Emera to make assumptions and

is subject to inherent risks and uncertainties. These statements

reflect Emera management’s current beliefs and are based on

information currently available to Emera management. There is a

risk that predictions, forecasts, conclusions and projections that

constitute forward-looking information will not prove to be

accurate, that Emera’s assumptions may not be correct and that

actual results may differ materially from such forward-looking

information. Additional detailed information about these

assumptions, risks and uncertainties is included in Emera’s

securities regulatory filings, including under the heading

“Business Risks and Risk Management” in Emera’s annual Management’s

Discussion and Analysis, and under the heading “Principal Risks and

Uncertainties” in the notes to Emera’s annual and interim financial

statements, which can be found on SEDAR at www.sedar.com.

Teleconference Call

The company will be hosting a teleconference Monday, February

13, 2017 at 11:00am Atlantic time (10:00am Toronto/Montreal/New

York; 9:00am Winnipeg; 8:00am Calgary; 7:00am Vancouver) to discuss

the Q4 and 2016 financial results.

Analysts and other interested parties in North America wanting

to participate in the call should dial 1 (866) 521-4909 at least 10

minutes prior to the start of the call. International participants

wanting to participate should dial (627) 427-2311. No pass code is

required. The teleconference will be recorded. If you are unable to

join the teleconference live, you can dial for playback, toll-free

at 1-855-859-2056. The Conference ID is 50895046 (available until

midnight, March 4, 2017).

The teleconference will also be web cast live at emera.com and

available for playback for one year.

Annual General Meeting

Emera’s Annual General Meeting is scheduled to be held May 12,

2017 at 2:00 pm Atlantic time, at Dalhousie University, Halifax

Nova Scotia.

About Emera

Emera Inc. is a geographically diverse energy and services

company headquartered in Halifax, Nova Scotia with approximately

$29 billion in assets and 2016 revenues of more than $4 billion.

The company invests in electricity generation, transmission and

distribution, gas transmission and distribution, and utility energy

services with a strategic focus on transformation from high carbon

to low carbon energy sources. Emera has investments throughout

North America, and in four Caribbean countries. Emera continues to

target having 75-85% of its adjusted earnings come from

rate-regulated businesses. Emera’s common and preferred shares are

listed on the Toronto Stock Exchange and trade respectively under

the symbol EMA, EMA.PR.A, EMA.PR.B, EMA.PR.C, EMA.PR.E, and

EMA.PR.F. Depositary receipts representing common shares of Emera

are listed on the Barbados Stock Exchange under the symbol EMABDR.

Additional Information can be accessed at http://www.emera.com or

at www.sedar.com

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170210005611/en/

Emera Inc.Mark Kane, 813-228-1772Vice President, Investor

RelationsorNeera Ritcey, 902-428-6059Manager, Investor

Relations

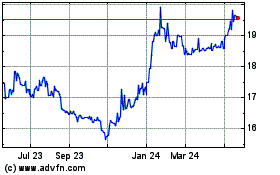

Emera (TSX:EMA.PR.F)

Historical Stock Chart

From Oct 2024 to Nov 2024

Emera (TSX:EMA.PR.F)

Historical Stock Chart

From Nov 2023 to Nov 2024