Euro Sun Mining Inc. (TSX: ESM) (“Euro Sun” or the

“Company”) is pleased to announce it has filed a technical report

pursuant to National Instrument 43-101 supporting the Updated

Definitive Feasibility Study (“DFS”) on the Colnic and Rovina open

pits - the initial phase of development of its Rovina Valley Gold

and Copper Project (the “Rovina Valley Project”) in Romania (the

“Technical Report”). Included in the updated DFS is an updated

mineral reserve and resource estimate for the open pit deposits,

namely Colnic and Rovina, incorporating current metal prices and

operating parameters. All amounts are in US dollars unless

otherwise indicated.

Key Highlights Include (summary table set out in Table

1):

- Pre-Tax NPV increased 41%

to $630 million, with an IRR of 22.7%, based on $1,675/oz gold and

$3.75/lb copper

- Estimated to produce

1.47Moz of gold and 403Mlbs of copper over the life of the project

at an AISC of $787/gold equivalent ounce

- Approximately 43 million

tonnes or 19% less waste material expected to be mined resulting in

a 1.45:1 strip ratio over LOM

- The updated study

incorporates the most current cost and capital expenditure data,

with initial CAPEX of $448 million

- The Rovina Valley Project

incorporates dry stack tailings and is a cyanide free

operation

Scott Moore, Chief Executive Officer Euro Sun

Mining Inc. comments, “Filing of the full DFS is a key milestone

for one of Europe’s largest undeveloped Copper-Gold projects. The

substantially improved economics are based upon conservative long

term commodity prices and include the full impact from cost

escalation since the original study. With operating after-tax

cashflows anticipated to be of more than US$1 billion and a highly

competitive AISC of US$787 gold equivalent ounce oz, this is

clearly a high-quality project. We continue to advance methodically

along the permitting path and look forward to providing further

positive updates throughout 2022.”

The optimized and updated DFS for the Rovina

Valley Project continues to focus on responsible mining procedures

including, dry stacking, continuous revegetation, and a cyanide

free processing facility. The enhanced project benefits from

positive geotechnical study results, reducing waste removal and

strip ratios, driving a 9% increase in gold production and a 41%

increase in pre-tax NPV. The DFS also incorporated updated cost

estimates and metal price assumptions.

Euro Sun is incorporating strong responsible

mining procedures into every aspect of the project and is utilizing

a phased development approach for the Rovina Valley Project. The

Rovina Valley Project consists of two open pit gold-copper

deposits, Colnic and Rovina, and the underground Ciresata

gold-copper deposit. The Ciresata underground deposit is expected

to be phased in following the completion of the Colnic and Rovina

pits, assuming future mining studies are completed, and positive

results are obtained.

Table 1: Updated Definitive Feasibility

Highlights

|

Study Version |

DFS Update (Jan 2022) |

|

Base Case Assumptions |

Life of Mine |

First 10 years |

|

Gold price (base case) |

$1675 /oz |

|

|

Copper price (base case) |

$3.75 /lb |

|

|

Gold recovery |

79.7% |

|

|

|

Copper recovery |

91.3% |

|

|

|

Mine life |

17.2 years |

|

|

Mining rate |

55,000 tonnes per day |

|

|

Plant life |

17.4 years |

|

|

Plant rate |

21 000 tonnes per day |

|

|

Mine Parameters |

|

|

|

Average annual gold production |

82,000 ounces |

107,000 ounces |

|

Average annual copper production |

23.2 million pounds |

14.0 million pounds |

|

Average annual gold equivalent production |

136,000 ounces |

139,000 ounces |

|

Average gold grade |

0.44 g/t |

0.55 g/t |

|

Average copper grade |

0.15% |

|

0.11% |

|

|

Total gold production |

1,472,000 troy ounces |

1,074,000 troy ounces |

|

Total copper production |

403 million pounds |

140 million pounds |

|

Total equivalent gold production |

2,375,000 troy ounces |

1,387,000 troy ounces |

|

Colnic LOM strip ratio (waste to ore) |

1.15 |

|

1.19 |

|

|

Rovina LOM Strip ratio (waste to ore) |

1.89 |

|

N/A |

|

Pre strip tonnes |

7.7 million tonnes |

7.7 million tonnes |

|

Capital Costs |

|

|

|

Pre-strip Capital |

$14.1 million |

|

|

Initial Capital |

$447.7 million |

|

|

Total initial Capital |

$464.2 million |

|

|

Sustaining Capital |

$68.3 million |

|

|

Total CAPEX |

$516 million |

|

|

Operating Costs |

|

|

|

All-in sustaining costs |

$787/oz Au eq |

$823/oz Au eq |

|

Mining costs |

$1.71 /tonne moved |

$1.76 /tonne moved |

|

Milling costs |

$8.8 /tonne milled |

$8.83 /tonne milled |

|

Waste and water management |

$0.36 /tonne milled |

$0.42 /tonne milled |

|

G&A costs |

$0.29 /tonne milled |

$0.29 /tonne milled |

|

Cash Flow |

|

|

|

Pre-Tax NPV (5% discount rate) |

$630 million |

|

|

Pre-Tax IRR |

22.7% |

|

|

|

Post-Tax NPV (5% discount rate) |

$512 million |

|

|

Post-Tax IRR |

20.5% |

|

|

The technical report related to the updated DFS

results has been filed on SEDAR, in accordance with National

Instrument 43-101 (“NI 43-101”). The study has been prepared with

input from the following independent consultants:

|

Caracle Creek International Consulting MINRES – CCIC (South

Africa) |

Mineral resources |

|

DRA (South Africa) |

Mining, mineral reserves |

|

ERM (Romania) |

Environmental and social |

|

Knight Piésold (South Africa) |

Tailings facilities, and Hydrogeology |

|

Middindi Consulting (South Africa) |

Geotechnical |

|

Lawrence Consulting (Canada) |

Geochemistry |

|

SENET (South Africa) |

Processing plant and infrastructure |

|

SENET and Sidus Consulting |

Economic valuation / financial modelling |

Rovina Valley Gold-Copper Project Overview

The Rovina Valley Project is situated in the

Hunedoara County of Transylvania in western – central Romania. The

Rovina Valley Project consists of three deposits, Rovina to the

North, Colnic Central and the Ciresata deposit to the south. The

DFS only incorporates the Rovina and the Colnic deposits and does

not include the Ciresata deposit, which the Company expects will be

brought into the project for development later, assuming future

mining studies are completed, and positive results are obtained.

The Rovina exploration licence is held by Samax Romania S.R.L., a

Romanian registered company which is a wholly owned subsidiary of

ESM. Since November 2018, ESM possesses an exploitation permit and

mining licence with a renewable 20-year validity.

The Colnic and Ciresata deposits are described

as gold-copper porphyries while the Rovina deposit is termed a

copper-gold porphyry. All three of these deposits are located such

that they can access a central processing plant. The Rovina Valley

Project processing facility is being designed to produce a gold and

copper concentrate from the Colnic and Rovina deposits.

The Rovina Valley Project is within the Golden

Quadrilateral Mining District of the South Apuseni Mountains, an

area with a history of mining dating back to Roman times. This has

supported the development of excellent infrastructure including

rail, power and paved access roads. In addition, there are two

international airports less than 180km from the project location.

These being in the cities of Timisoara and Sibiu. The town of Brad

is within 5km of the project site from where there will be a good

source of local skilled labour. Sourcing the right skills and

resources locally supports ESM community upliftment

opportunities.

The Rovina Valley Project is expected to be

mined with a standard open-pit mining method using rigid dump

trucks and hydraulic loaders. The open pit mining operation is

anticipated to last approximately seventeen years, during which the

lower-grade material will be stockpiled if possible, for treatment

at the tail end of mining operations.

Over the life of the project, it is planned that 140.0 Mt

of ore will be mined. Of this ore, 123.3 Mt will be delivered

to the processing facility, including 13,9 Mt of LG ore which will

have been stockpiled for future processing. A total of 16,7Mt of LG

ore will be sent to waste due to insufficient space to store this

LG ore for future processing. A total of 203,1 Mt of waste

will be mined and placed on the waste facility combined with

tailings. This represents a life of mine stripping ratio of

1.45:1.

Waste Rock and Tailings

Management

Knight Piésold have advanced the design of a

waste management facility within the project area for the

co-deposition of waste rock and filtered rougher tailings. Process

plant rougher tailings will be filtered in the plant where the

resultant filter cake will be transported by conveyors and will be

co-mingled with waste rock prior to deposition. The cleaner tails

will be filtered separately from the rougher tailings and the

resultant filter cake will be transported by conveyors and

deposited separately within a lined zone contained within the

boundary of the co-mingled facility. This design has been

engineered to reduce the risk of development of impacted seepage

from potentially acid generating waste rock and capture the

impacted seepage from the cleaner tailings. After completion of

mining the Colnic pit, the waste rock and rougher tailings will be

preferentially backfilled into the Colnic pit, while the cleaner

tails will continue to report to the lined zone of the waste

management facility.

Operating Costs

Chief Operating Officer Sam Rasmussen adds, “The final report

supporting the updated DFS further demonstrates the robustness of

the project as the majority of capital costs were calculated on

supplier quotations and built-up versus factoring. Operating

costs were also built-up using updated consumables pricing further

increasing the confidence of project economics.”

Capital Costs

The estimated capital costs for the Rovina

Valley Project were in almost all cases built up from quotations

and proposals from equipment and service providers. The updated DFS

costs currently utilize an owner purchased and operated mining

fleet. All financial analysis for the Life of Mine includes the

total design, construction and commissioning, production, and

closure.

Project Opportunities

The updated DFS has been completed based upon

the development of the Colnic and Rovina pits only. Further

developing and treating the resource at Ciresata could further

extend the life of the operation while utilising the infrastructure

and processing capabilities anticipated to be in operation for the

Rovina and Colnic deposits.

Permitting Update

The Company is currently completing the draft of

the Planul Urbanistic Zonal (PUZ, Urban Zoning Plan) and expects to

file with the County of Hunedoara presently. It is expected to have

the public audience on the draft plan sometime in early Q2, 2022

with final submission and approval of the PUZ in Q3 2022. Once the

PUZ has been approved, submittal of the notification to complete

the Environmental Impact Assessment (EIA) procedure will be filed

with the Ministry of Environment.

Rovina Valley Project 2022 Resource and Reserve

Update

Table 2: Rovina Valley 2022 Mineral Reserve

Estimate Colnic and Rovina Deposits

|

Deposit |

Classification |

Tonnage (Mt) |

Au(g/t) |

Cu (%) |

Au(koz) |

Cu(t) |

|

Colnic |

Proven |

25.60 |

0.65 |

0.11% |

|

535.0 |

28,158.7 |

|

Probable |

47.99 |

0.55 |

0.09% |

|

848.6 |

43,190.4 |

|

Rovina |

Proven |

22.58 |

0.34 |

0.29% |

|

243.3 |

67,005.8 |

|

Probable |

27.13 |

0.24 |

0.22% |

|

211.6 |

60,166.7 |

|

Colnic & Rovina |

Proven |

48.18 |

0.50 |

0.20% |

|

778.3 |

94,164.6 |

|

Probable |

75.12 |

0.44 |

0.14% |

|

1,060.2 |

103,357.2 |

|

Total |

Proven & Probable |

123.30 |

0.47 |

0.16% |

|

1,838.5 |

197,522 |

The Mineral reserve estimate uses a base gold price of $1,550/oz

and a base copper price of $3.30/lb

Notes:

- All tonnes quoted are dry tonnes.

Differences in the addition of deposit tonnes to the total

displayed is due to rounding.

- The estimate of Rovina Valley

Gold Project Mineral Reserves are not at this stage materially

affected by any known environmental, permitting, legal, title,

taxation, socioeconomic, marketing, political, or other relevant

issue. Furthermore, the estimate of Project Reserves is not

materially affected by any known mining, metallurgical,

infrastructure, or other relevant factor.

- Mineral Reserve estimates follow

the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM")

definitions standards for Mineral Resources and Reserves and have

been completed in accordance with NI 43-101.

- Effective date of reserves are

January 31, 2022

Table 3: Rovina Valley 2022 Mineral

Resource Estimate Update Colnic and Rovina Deposits

|

Deposit |

Classification |

Tonnage(Mt) |

Au(g/t) |

Cu(%) |

Au(Moz) |

Cu(Mlb) |

Au Eq*(g/t) |

Au Eq*(Moz) |

|

Colnic |

Measured |

29.2 |

0.65 |

0.12 |

0.61 |

74 |

0.81 |

0.76 |

|

Indicated |

103.6 |

0.48 |

0.10 |

1.61 |

224 |

0.62 |

2.07 |

|

Rovina |

Measured |

33.2 |

0.36 |

0.29 |

0.38 |

213 |

0.77 |

0.82 |

|

Indicated |

79.1 |

0.26 |

0.22 |

0.67 |

384 |

0.57 |

1.46 |

|

Colnic & Rovina |

Measured |

62.4 |

0.49 |

0.21 |

0.99 |

288 |

0.79 |

1.58 |

|

Indicated |

182.7 |

0.39 |

0.15 |

2.28 |

607 |

0.60 |

3.53 |

|

Total |

Measured & Indicated |

245.1 |

0.42 |

0.17 |

3.27 |

895 |

0.65 |

5.11 |

|

Notes: • *Au and Cu Equivalent

determined by using a long-term gold price of US$1,700/oz and a

copper price of US$3.50/lb with metallurgical recoveries not taken

into account. • Mineral Resources are reported

inclusive of Mineral Reserves. Mineral Resources that are not

Mineral Reserves do not have demonstrated economic

viability. • Mineral Resources are contained within

a conceptual pit shell that are generated using the same economic

and technical parameters as used for Mineral Reserves but at gold

price of US$1,700/oz and a copper price of

US$3.50/lb. • Colnic and Rovina deposits are

amenable to open pit mining and Mineral Resources are Pit

constrained and tabulated at a base case cut-off grade of 0.35 g/t

AuEq for Colnic and 0.25 % CuEq for Rovina • Minor

summation differences may occur, because of

rounding. • Mineral Resource estimates follow the

CIM definition standards for Mineral Resources and Reserves and

have been completed in accordance with NI 43-101. With and

effective date of January 31, 2022 |

Table 4: Rovina Valley 2019 Mineral Resource Estimate

Ciresata Deposit

|

Deposit |

Classification |

Tonnage(Mt) |

Au(g/t) |

Cu(%) |

Au(Moz) |

Cu(Mlb) |

Au Eq*(g/t) |

Au Eq*(Moz) |

|

Ciresata |

Measured |

28.5 |

0.88 |

0.16 |

0.81 |

102 |

1.13 |

1.03 |

|

Indicated |

125.9 |

0.74 |

0.15 |

3.01 |

413 |

0.97 |

3.92 |

|

Total |

Measured & Indicated |

154.4 |

0.77 |

0.15 |

3.82 |

515 |

1.00 |

4.95 |

|

Notes: • From Table 14-20,

Technical Report “Rovina Valley Project, Preliminary Economic

Assessment, NI 43-101, Feb. 20, 2019“ from AGP Mining Consultants

Inc (available on SEDAR). This preliminary economic assessment is

preliminary in nature and there is no certainty that the

preliminary economic assessment will be realized.

• Au and Cu Equivalent determined by using a

long-term gold price of US$1,500/oz and a copper price of

US$3.50/lb with metallurgical recoveries not taken into

account. • The Ciresata deposit is amenable to bulk

underground mining and resources are tabulated at a base case 0.65

g/t Au eq • No Mineral Reserves have been defined

at the Ciresata deposit. Mineral Resources that are not Mineral

Reserves do not have demonstrated economic

viability. • Minor summation differences may occur,

as a result of rounding. • Mineral Resource

estimates follow the CIM definition standards for Mineral Resources

and Reserves and have been completed in accordance with the

Standards of Disclosure for Mineral Projects as defined by NI

43-101. |

On a consolidated basis of measured and indicated

resources, the Rovina Valley Project includes 399.5 Mt containing

7.09 Moz gold and 1,410 Mlbs copper equal to 10.06 M gold

equivalent ounces.

Qualified Persons

The mineral reserve estimate stated in this

press release have been reviewed and approved by Mr. David Alan

Thompson (ECSA No. 201190010), Principal Mining Engineer for DRA

Projects (Pty) Ltd, who is an independent Qualified Person as

defined by National Instrument 43-101. Mr. D Thompson was

responsible for the mineral reserve estimate of the RVP Feasibility

Study that supports this press release. Mr. D Thompson confirmed

that he has reviewed the information in this press release as it

relates to the mineral reserve estimate.

The mineral resources estimate stated in this

press release have been reviewed and approved by Mr. Sivanesan

(Desmond) Subramani (Pri. Sci. Nat - 400184/06), Principal for

Mineral Resources at Caracle Creek International Consultants, who

is an independent qualified person as defined by NI 43-101. Mr. D

Subramani was responsible for the mineral resource estimate of the

DFS. Mr. D Subramani confirmed that he has reviewed and approved

the information in this press release as it relates to the mineral

resource estimate.

Mr. Randy Ruff, P. Geo., an employee of Euro Sun

and a qualified person as defined by NI 43-101 has reviewed and

approved the technical information in this press release other than

the mineral resource estimates and the mineral reserve

estimates.

About SENET

SENET is one of the leading project management

and engineering firms in the field of mineral processing. For

almost three decades, SENET has provided project management,

multidisciplinary engineering, procurement, logistics management,

and construction services to the mining, mineral processing,

infrastructure and materials handling industries. SENET is

committed to a policy of exceptional service and engineering

excellence with a strong emphasis on quality, safety and

environmental aspects.

About Euro Sun Mining Inc.

Euro Sun is a Toronto Stock Exchange listed mining company

focused on the exploration and development of its 100%-owned Rovina

Valley gold and copper project located in west-central Romania,

which hosts the second largest gold deposit in Europe.

For further information about Euro Sun Mining,

or the contents of this press release, please contact Investor

Relations at info@eurosunmining.com

Caution regarding forward-looking

information:This press release contains statements which

constitute “forward-looking information” within the meaning of

applicable securities laws, including statements regarding the

plans, intentions, beliefs and current expectations of the Company

with respect to future business activities and operating

performance. Forward-looking information is often identified by the

words “may”, “would”, “could”, “should”, “will”, “intend”, “plan”,

“anticipate”, “believe”, “estimate”, “expect” or similar

expressions and includes information regarding the Company’s

estimates, expectations, forecasts and guidance for production,

waste material, all-in sustaining cost, capital expenditures, cost

savings, project economics (including pre-tax net present value and

after tax cashflows) and other information contained in the updated

DFS; as well as references to other possible events, the future

price of gold and copper, the estimation of mineral reserves and

mineral resources, the realization of mineral reserve and mineral

resource estimates, the timing and amount of estimated future

production, costs of production, capital expenditures, costs and

timing of the development of the project and mining and processing

activities, requirements for additional capital, government

regulation of mining operations, environmental risks and the

anticipated timing for the filing of the updated DFS as a NI 43-101

compliant technical report.

Investors are cautioned that forward-looking

information is not based on historical facts but instead reflect

management’s expectations, estimates or projections concerning

future results or events based on the opinions, assumptions and

estimates of management considered reasonable at the date the

statements are made. Although the Company believes that the

expectations reflected in such forward-looking information are

reasonable, such information involves risks and uncertainties, and

undue reliance should not be placed on such information, as unknown

or unpredictable factors could have material adverse effects on

future results, performance or achievements of the Company. This

forward-looking information may be affected by risks and

uncertainties in the combined business of the Company and market

conditions, including (1) there being no significant disruptions

affecting the Company’s operations whether due to extreme weather

events and other or related natural disasters, labor disruptions,

supply disruptions, power disruptions, damage to equipment or

otherwise; (2) permitting, development, operations and production

for the Rovina Valley Project being consistent with the Company’s

expectations; (3) political and legal developments Romania being

consistent with current expectations; (4) certain price assumptions

for gold and copper; (5) prices for diesel, electricity and other

key supplies being approximately consistent with current levels;

(6) the accuracy of the Company’s mineral reserve and mineral

resource estimates; and (7) labor and materials costs increasing on

a basis consistent with the Company’s current expectations. This

information is qualified in its entirety by cautionary statements

and risk factor disclosure contained in filings made by the Company

with the Canadian securities regulators, including the Company’s

annual information form, financial statements and related MD&A

for the financial year ended December 31, 2020 filed with the

securities regulatory authorities in certain provinces of Canada

and available at www.sedar.com.

Should one or more of these risks or

uncertainties materialize, or should assumptions underlying the

forward-looking information prove incorrect, actual results may

vary materially from those described herein as intended, planned,

anticipated, believed, estimated or expected. Although the Company

has attempted to identify important risks, uncertainties and

factors which could cause actual results to differ materially,

there may be others that cause results not to be as anticipated,

estimated or intended. The Company does not intend, and do not

assume any obligation, to update this forward-looking information

except as otherwise required by applicable law.

The Company has included certain non-GAAP

financial measures in this press release, such as all-in sustaining

costs (“AISC”) per gold equivalent ounce, net

present value (“NPV”). These non-GAAP financial

measures do not have any standardized meaning. Accordingly, these

financial measures are intended to provide additional information

and should not be considered in isolation or as a substitute for

measures of performance prepared in accordance with International

Financial Reporting Standards (“IFRS”). AISC, as

defined by the World Gold Council is a common financial

performance measure in the mining industry but have no standard

definition under IFRS. AISC include operating cash costs,

net-smelter royalty, corporate costs, sustaining capital

expenditure, sustaining exploration expenditure and capitalised

stripping costs. Other companies may calculate these measures

differently and should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with

IFRS.

The TSX does not accept responsibility for the

adequacy or accuracy of this news release.

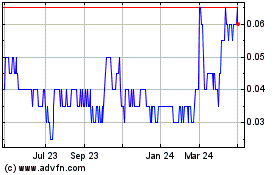

Euro Sun Mining (TSX:ESM)

Historical Stock Chart

From Jan 2025 to Feb 2025

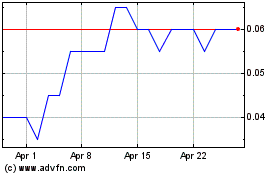

Euro Sun Mining (TSX:ESM)

Historical Stock Chart

From Feb 2024 to Feb 2025