Extendicare Inc. (“Extendicare” or the “Company”) (TSX: EXE) today

reported results for the three and nine months ended September 30,

2024, and the Company announced that it is exercising its option to

redeem all of the outstanding $126.5 million principal amount of

2018-1 5.00% convertible unsecured subordinated debentures (TSX:

EXE.DB.C) (the “2025 Debentures”).

Third Quarter 2024 Highlights

- Adjusted EBITDA(1) excluding

out-of-period items increased by $13.5 million or 64.9% to $34.3

million, largely driven by rate increases in long-term care (“LTC”)

and home health care and volume growth in home health care and

managed services.

- Home health care average daily

volume (“ADV”) grew to 30,181, up 10.2% from Q3 2023.

- SGP third-party and joint venture

serviced beds increased 11.4% from Q3 2023 to 143,500 beds, driven

by continued organic growth.

- Commenced construction of a new

256-bed LTC redevelopment project in St. Catharines, Ontario to

replace Extendicare’s 152-bed Class C home in the same city and

anticipate commencing construction on two additional homes in

Q4.

Subsequent to Q3

- As previously announced, established

a new $275 million senior secured credit facility to support growth

and redeem the 2025 Debentures, which, as announced today, are

being redeemed in full on December 16, 2024.

“Our strategy continues to deliver robust growth across our

operating segments and improved operating results. Sequential

growth in home health care volumes was especially notable given the

third quarter typically experiences a seasonal pullback in service

demand,” said Dr. Michael Guerriere, President and Chief Executive

Officer.

Dr. Guerriere added, “We are pleased with the continued progress

of our redevelopment program. We commenced construction on a new

256-bed home in St. Catharines and we look forward to opening our

new Kingston and Stittsville homes in the Axium JV before year end.

And the close of our new credit facility gives us the balance sheet

flexibility we need to continue to pursue our growth strategy.”

Redevelopment Program Advances with up to Three

Additional Projects Starting in 2024

In September 2024, the Company began construction on a new

256-bed LTC home in St. Catharines, under the time-limited enhanced

construction funding subsidy provided by the Government of Ontario.

The home is anticipated to open in Q1 2027. It will replace the

existing Extendicare home which comprises 152 Class C beds in the

same city. Extendicare entered into a $72.3 million fixed-price

construction contract in connection with the home and estimates the

total development costs for the project will be $106.4 million.

The Company anticipates starting two more redevelopment projects

under the enhanced construction funding subsidy before it expires

at the end of November, subject to receipt of applicable regulatory

approvals. The projects, in London and Port Stanley, together

consist of 320 total beds to replace 230 Class C beds in the homes

they will replace.

These projects, in addition to the St. Catharines development

project, are anticipated to be sold to Axium JV in Q1 2025, with

Extendicare retaining a 15% managed interest, subject to customary

closing conditions, including receipt of regulatory approvals from

the Ontario Ministry of Long-Term Care (“MLTC”).

In Q4 2024, the Company plans to open two new Axium JV homes

currently under construction. Limestone Ridge is a 192-bed home in

Kingston, Ontario, which will replace Extendicare Kingston, a

150-bed Class C home nearby. Following the opening of the new home,

the Company will sell Extendicare Kingston for proceeds of

approximately $3.7 million. Crossing Bridge is a 256-bed home in

Stittsville, Ontario, which will replace Extendicare West End

Villa, a home in Ottawa. Once Crossing Bridge is open, the Company

intends to list the Class C LTC home for sale.

Enhanced Overall Liquidity with New $275 Million Credit

Facility

As announced on November 8, 2024, the Company has entered into a

new senior secured credit facility for $275.0 million (the “Senior

Secured Credit Facility”) with a syndicate of Canadian chartered

banks, for a term of three years. The Senior Secured Credit

Facility consists of a revolving credit facility for up to $145.0

million (the “Revolving Facility”), which replaces the Company’s

former demand credit facilities of $112.3 million, and a delayed

draw term loan facility in an amount up to $130.0 million (the

“Delayed Draw Facility”). The Revolving Facility is available for

working capital and general corporate purposes, including capital

expenditures and acquisitions. The Delayed Draw Facility is

available until April 30, 2025, to redeem the 2025 Debentures.

Early Redemption of 2025 Debentures

The Company has exercised its option to redeem all of the

outstanding 2025 Debentures on December 16, 2024 (the “Redemption

Date”) using funds from the Delayed Draw Facility. The 2025

Debentures will be redeemed at par, plus accrued and unpaid

interest up to but excluding the Redemption Date, for a total of

$1,006.3013699 per $1,000 principal amount of 2025 Debentures. All

interest on the 2025 Debentures will cease from and after the

Redemption Date and the 2025 Debentures will be delisted from the

facilities of the Toronto Stock Exchange at the close of markets on

December 16, 2024.

Q3 2024 Financial Highlights (all comparisons

with Q3 2023)

- Revenue increased 11.3%, or $36.5

million, to $359.1 million, driven primarily by LTC funding

increases, home health care ADV growth and rate increases, and

growth in managed services.

- NOI(1) increased $14.9 million to

$50.1 million; excluding out-of-period LTC funding of $1.8 million

recognized in Q3 2024, NOI improved by $13.1 million, or 37.1%, to

$48.3 million, reflecting revenue growth, partially offset by

higher operating costs across all segments.

- Adjusted EBITDA(1) increased $15.3

million to $36.1 million, reflecting the increase in NOI noted

above and lower administrative costs.

- Other expense was $1.1 million

compared with income of $5.0 million, reflecting a pre-tax gain on

the sale of assets of $9.1 million in Q3 2023, partially offset by

a $3.0 million decline in strategic transformation costs in

connection with the Revera and Axium transactions.

- Net earnings increased $4.5 million

to $16.3 million, largely driven by the increase in Adjusted

EBITDA, partially offset by the decline in other expense

(income).

- AFFO(1) increased to $23.1 million

($0.28 per basic share) from $12.3 million ($0.14 per basic share),

largely reflecting the improvement in Adjusted EBITDA and lower

maintenance capex, partially offset by increased current taxes.

Excluding the out-of-period LTC funding recognized in Q3 2024, AFFO

improved by $9.5 million to $21.8 million ($0.26 per basic

share).

Nine Months 2024 Financial Highlights (all

comparisons with Nine Months 2023)

- Revenue increased 12.6%, or $119.9

million, to $1,074.6 million, driven primarily by LTC funding

increases, home health care ADV growth, rate increases and $13.6

million in retroactive funding to support one-time compensation

costs incurred in Q1 2024, and growth in managed services,

partially offset by lower COVID-19 and out-of-period LTC

funding.

- NOI(1) increased $39.4 million to

$147.7 million; excluding a net recovery of COVID-19 costs of $12.1

million in 2023 and the increase in out-of-period LTC funding of

$7.3 million, NOI improved by $44.2 million, or 49.3%, to $133.7

million, reflecting revenue growth, partially offset by higher

operating costs across all segments.

- Adjusted EBITDA(1) increased $38.3

million to $104.9 million, reflecting the increase in NOI noted

above, partially offset by higher administrative costs.

- Other income was $2.7 million

compared with a nominal amount, reflecting a $4.3 million decline

in strategic transformation costs in connection with the Revera and

Axium transactions, partially offset by a $1.6 million decrease in

pre-tax gains on the sale of assets.

- Share of profit from joint ventures

was up $1.2 million to $1.8 million, including the impact of

one-time funding for Ontario LTC homes in Q1 2024, of which $0.7

million related to prior periods.

- Net earnings increased $29.9 million

to $55.3 million, largely driven by the increase in Adjusted

EBITDA.

- AFFO(1) increased to $63.8 million

($0.76 per basic share) compared with $42.2 million ($0.49 per

basic share), largely reflecting the improvement in Adjusted

EBITDA, partially offset by increased current taxes and higher

maintenance capex. Excluding a $2.8 million year-over-year

reduction in AFFO related to a net recovery of COVID-19 costs in

2023, partially offset by out-of-period LTC funding and share of

profit from joint ventures, AFFO improved by $24.5 million to $52.9

million ($0.63 per basic share) from $28.4 million ($0.33 per basic

share).

Business Updates

The following is a summary of Extendicare’s revenue, NOI(1) and

NOI margins(1) by business segment for the three and nine months

ended September 30, 2024 and 2023.

|

(unaudited) |

Three months ended September 30 |

|

Nine months ended September 30 |

|

(millions of dollars |

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

| unless

otherwise noted) |

Revenue |

NOI |

Margin |

|

Revenue |

NOI |

Margin |

|

Revenue |

NOI |

Margin |

|

Revenue |

NOI |

Margin |

|

Long-term care |

201.8 |

24.6 |

12.2 |

% |

|

191.7 |

16.6 |

8.7 |

% |

|

602.5 |

75.6 |

12.5 |

% |

|

581.7 |

64.2 |

11.0 |

% |

| Home health care |

138.4 |

15.6 |

11.3 |

% |

|

118.1 |

11.6 |

9.8 |

% |

|

418.3 |

43.5 |

10.4 |

% |

|

341.9 |

28.1 |

8.2 |

% |

| Managed

services |

18.8 |

9.9 |

52.6 |

% |

|

12.7 |

7.0 |

55.2 |

% |

|

53.9 |

28.6 |

53.2 |

% |

|

31.2 |

15.9 |

51.1 |

% |

|

|

359.1 |

50.1 |

14.0 |

% |

|

322.5 |

35.2 |

10.9 |

% |

|

1,074.6 |

147.7 |

13.7 |

% |

|

954.8 |

108.2 |

11.3 |

% |

|

Note: Totals may not sum due to rounding. |

Long-term Care

LTC average occupancy increased to 98.4% in Q3 2024, an increase

of 60 bps from 97.8% in Q3 2023.

Revenue increased by $10.1 million or 5.3% to $201.8 million in

Q3 2024. During the quarter, LTC funding increases were announced

in both Alberta and Manitoba, retroactive to April 1, 2024,

resulting in an aggregate annualized revenue increase of $11.1

million. Excluding $1.8 million in out-of-period funding related to

these retroactive rate increases, revenue increased by $8.3

million, largely driven by funding increases, timing of spend and

improved occupancy.

NOI and NOI margin in Q3 2024 were $24.6 million and 12.2%,

compared to $16.6 million and 8.7% in Q3 2023. Excluding $1.8

million in out-of-period funding recognized in the quarter, NOI

improved to $22.8 million or 11.4% of revenue, reflecting funding

enhancements, timing of spend and increased occupancy, partially

offset by higher operating costs.

Home Health Care

Home health care ADV of 30,181 in Q3 2024 increased 10.2% from

Q3 2023.

Revenue increased to $138.4 million in Q3 2024, an increase of

17.2% from Q3 2023, driven by growth in ADV and rate increases.

NOI and NOI margin were $15.6 million and 11.3% in Q3 2024, an

increase from $11.6 million and 9.8% in Q3 2023, reflecting higher

volumes and rates, partially offset by increased wages and

benefits.

Managed Services

At the end of Q3 2024, Extendicare Assist had management

contracts with 70 homes comprising 9,717 beds. Extendicare Assist

also provides a further 52 homes with consulting and other

services. The number of third-party and joint venture beds served

by SGP increased to approximately 143,500 at the end of Q3 2024, up

11.4% from the prior year period.

Revenue increased by $6.1 million or 48.0% to $18.8 million from

Q3 2023. NOI increased by 41.1% to $9.9 million with an NOI margin

of 52.6%, an increase from $7.0 million and 55.2% in Q3 2023. These

results were largely driven by the Revera and Axium transactions

and new SGP clients, partially offset by Extendicare Assist clients

that reduced their scope of services.

Financial Position

Extendicare has strong liquidity with cash and cash equivalents

on hand of $154.3 million as at September 30, 2024. Subsequent to

quarter end, the Company improved its capital flexibility with the

new Senior Secured Credit Facility, providing access to additional

undrawn credit capacity of $32.7 million under the new $145.0

million Revolving Facility and $130.0 million under the Delayed

Draw Facility, which will be used to fund the redemption of the

2025 Debentures on December 16, 2024. Additionally, subsequent to

the quarter, the Company used cash on hand to purchase for

approximately $30.0 million, 9 Class A Ontario LTC homes that have

been under long-term leases. The purchase price represents the

balance of the remaining lease payments plus accrued interest and

other costs, and fully satisfies the remaining lease liability

(carrying interest rates from 6.4% to 7.2%).

Select Financial Information

The following is a summary of the Company’s consolidated

financial information for the three and nine months ended September

30, 2024 and 2023.

|

(unaudited) |

Three months ended September

30 |

|

|

Nine months ended September

30 |

|

|

(thousands of dollars unless otherwise noted) |

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

|

Revenue |

359,061 |

|

322,529 |

|

|

1,074,638 |

|

954,776 |

|

|

Operating expenses |

308,944 |

|

287,319 |

|

|

926,971 |

|

846,532 |

|

|

NOI(1) |

50,117 |

|

35,210 |

|

|

147,667 |

|

108,244 |

|

|

NOI margin(1) |

14.0% |

|

10.9% |

|

|

13.7% |

|

11.3% |

|

|

Administrative costs |

14,010 |

|

14,440 |

|

|

42,817 |

|

41,720 |

|

|

Adjusted EBITDA(1) |

36,107 |

|

20,770 |

|

|

104,850 |

|

66,524 |

|

|

Adjusted EBITDA margin(1) |

10.1% |

|

6.4% |

|

|

9.8% |

|

7.0% |

|

|

Other (expense) income |

(1,082 |

) |

5,048 |

|

|

2,704 |

|

28 |

|

| Share

of profit from investment in joint ventures |

431 |

|

598 |

|

|

1,826 |

|

598 |

|

|

Net earnings |

16,295 |

|

11,831 |

|

|

55,281 |

|

25,362 |

|

|

per basic share ($) |

0.20 |

|

0.14 |

|

|

0.66 |

|

0.30 |

|

|

per diluted share ($) |

0.19 |

|

0.14 |

|

|

0.63 |

|

0.30 |

|

|

AFFO(1) |

23,125 |

|

12,290 |

|

|

63,828 |

|

42,166 |

|

|

per basic share ($) |

0.28 |

|

0.14 |

|

|

0.76 |

|

0.49 |

|

|

per diluted share ($) |

0.25 |

|

0.14 |

|

|

0.70 |

|

0.47 |

|

|

Maintenance capex |

4,093 |

|

4,895 |

|

|

12,333 |

|

9,670 |

|

|

Cash dividends declared per share |

0.12 |

|

0.12 |

|

|

0.36 |

|

0.36 |

|

|

Payout ratio(1) |

43% |

|

82% |

|

|

47% |

|

72% |

|

|

Weighted average number of shares (000’s) |

|

|

|

|

|

| Basic |

84,237 |

|

85,009 |

|

|

84,202 |

|

85,218 |

|

|

Diluted |

95,556 |

|

95,870 |

|

|

95,537 |

|

96,106 |

|

Extendicare’s disclosure documents, including its Management’s

Discussion and Analysis (“MD&A”), may be found on SEDAR+ at

www.sedarplus.ca under the Company’s issuer profile and on the

Company’s website at www.extendicare.com under the

“Investors/Financial Reports” section.

November Dividend Declared

The Board of Directors of Extendicare today declared a cash

dividend of $0.04 per share for the month of November 2024, which

is payable on December 16, 2024, to shareholders of record at the

close of business on November 29, 2024. This dividend is designated

as an “eligible dividend” within the meaning of the Income Tax Act

(Canada).

Conference Call and Webcast

Extendicare will hold a conference call to discuss its 2024

third quarter results on November 13, 2024, at 11:30 a.m. (ET). The

call will be webcast live and archived online at

www.extendicare.com under the “Investors/Events &

Presentations” section. Alternatively, the call-in number is

1-844-763-8274. A replay of the call will be available

approximately two hours after completion of the live call until

midnight on November 29, 2024, by dialing 1-855-669-9658 followed

by the passcode 2798337#.

About Extendicare

Extendicare is a leading provider of care and services for

seniors across Canada, operating under the Extendicare, ParaMed,

Extendicare Assist, and SGP Purchasing Network brands. We are

committed to delivering quality care to meet the needs of a growing

seniors’ population, inspired by our mission to provide people with

the care they need, wherever they call home. We operate a network

of 122 long-term care homes (52 owned, 70 under management

contracts), deliver approximately 10.7 million hours of home health

care services annually, and provide group purchasing services to

third parties representing approximately 143,500 beds across

Canada. Extendicare proudly employs approximately 22,000 qualified,

highly trained and dedicated team members who are passionate about

providing high-quality care and services to help people live

better.

Non-GAAP Measures

Certain measures used in this press release, such as “net

operating income”, “NOI”, “NOI margin”, “Adjusted EBITDA”,

“Adjusted EBITDA margin”, “AFFO”, and “payout ratio”, including any

related per share amounts, are not measures recognized under GAAP

and do not have standardized meanings prescribed by GAAP. These

measures may differ from similar computations as reported by other

issuers and, accordingly, may not be comparable to similarly titled

measures as reported by such issuers. These measures are not

intended to replace earnings (loss) from continuing operations, net

earnings (loss), cash flow, or other measures of financial

performance and liquidity reported in accordance with GAAP. Such

items are presented in this document because management believes

that they are relevant measures of Extendicare’s operating

performance and ability to pay cash dividends.

Management uses these measures to exclude the impact of certain

items, because it believes doing so provides investors a more

effective analysis of underlying operating and financial

performance and improves comparability of underlying financial

performance between periods. The exclusion of certain items does

not imply that they are non-recurring or not useful to

investors.

Detailed descriptions of these measures can be found in

Extendicare’s Q3 2024 MD&A (refer to “Non-GAAP Measures”),

which is available on SEDAR+ at www.sedarplus.ca and on

Extendicare’s website at www.extendicare.com.

Reconciliations for certain non-GAAP measures included in this

press release are outlined below.

The following table provides a reconciliation of AFFO, which

includes discontinued operations, to “net cash from operating

activities”, which the Company believes is the most comparable GAAP

measure to AFFO.

|

(unaudited) |

Three months ended September

30 |

|

|

Nine months ended September

30 |

|

|

(thousands of dollars) |

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

|

Net cash from operating activities |

42,518 |

|

7,223 |

|

|

126,089 |

|

4,244 |

|

| Add

(Deduct): |

|

|

|

|

|

| Net change in operating assets

and liabilities, including interest, and taxes |

(16,829 |

) |

5,901 |

|

|

(56,553 |

) |

39,935 |

|

| Other expense |

1,082 |

|

4,072 |

|

|

4,810 |

|

9,092 |

|

| Current income tax on items

excluded from AFFO |

(287 |

) |

(679 |

) |

|

(918 |

) |

(2,009 |

) |

| Depreciation for office

leases |

(741 |

) |

(791 |

) |

|

(2,167 |

) |

(2,388 |

) |

| Depreciation for FFEC

(maintenance capex) |

(1,959 |

) |

(3,455 |

) |

|

(5,872 |

) |

(7,945 |

) |

| Additional maintenance

capex |

(1,863 |

) |

(1,240 |

) |

|

(5,597 |

) |

(1,525 |

) |

| Principal portion of

government capital funding |

396 |

|

534 |

|

|

1,255 |

|

2,037 |

|

|

Adjustments for joint ventures |

808 |

|

725 |

|

|

2,781 |

|

725 |

|

|

AFFO |

23,125 |

|

12,290 |

|

|

63,828 |

|

42,166 |

|

The following table provides a reconciliation of “earnings

before income taxes” to Adjusted EBITDA and “net operating

income”.

|

(unaudited) |

Three months ended September

30 |

|

|

Nine months ended September

30 |

|

|

(thousands of dollars) |

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

|

Earnings before income taxes |

22,657 |

|

13,668 |

|

|

73,142 |

|

32,539 |

|

| Add

(Deduct): |

|

|

|

|

|

| Depreciation and

amortization |

8,635 |

|

9,023 |

|

|

24,839 |

|

23,547 |

|

| Net finance costs |

4,164 |

|

3,725 |

|

|

11,399 |

|

11,064 |

|

| Other expense (income) |

1,082 |

|

(5,048 |

) |

|

(2,704 |

) |

(28 |

) |

| Share

of profit from investment in joint ventures |

(431 |

) |

(598 |

) |

|

(1,826 |

) |

(598 |

) |

|

Adjusted EBITDA |

36,107 |

|

20,770 |

|

|

104,850 |

|

66,524 |

|

|

Administrative costs |

14,010 |

|

14,440 |

|

|

42,817 |

|

41,720 |

|

|

Net operating income |

50,117 |

|

35,210 |

|

|

147,667 |

|

108,244 |

|

Forward-looking Statements

This press release contains forward-looking statements

concerning anticipated future events, results, circumstances,

economic performance or expectations with respect to Extendicare

and its subsidiaries, including, without limitation: statements

regarding redemption of the 2025 Debentures, its business

operations, business strategy, growth strategy, results of

operations and financial condition, including anticipated timelines

and costs in respect of development projects; and statements

relating to the agreements entered into with Revera, Axium and its

affiliates, Axium JV and/or Axium JV II in respect of the

acquisition, disposition, ownership, operation and redevelopment of

LTC homes in Ontario and Manitoba. Forward-looking statements can

often be identified by the expressions “anticipate”, “believe”,

“estimate”, “expect”, “intend”, “objective”, “plan”, “project”,

“will”, “may”, “should” or other similar expressions or the

negative thereof. These forward-looking statements reflect the

Company’s current expectations regarding future results,

performance or achievements and are based upon information

currently available to the Company and on assumptions that the

Company believes are reasonable. The Company assumes no obligation

to update or revise any forward-looking statement, except as

required by applicable securities laws. These statements are not

guarantees of future performance and involve known and unknown

risks, uncertainties and other factors that may cause actual

results, performance or achievements of the Company to differ

materially from those expressed or implied in the statements. For

further information on the risks, uncertainties and assumptions

that could cause Extendicare’s actual results to differ from

current expectations, refer to “Risks and Uncertainties” and

“Forward-looking Statements” in Extendicare’s Q3 2024 MD&A and

latest Annual Information Form filed by Extendicare with the

securities regulatory authorities, available at www.sedarplus.ca

and on Extendicare’s website at www.extendicare.com. Given these

risks and uncertainties, readers are cautioned not to place undue

reliance on Extendicare’s forward-looking statements. Except as

required by applicable securities laws, the Company assumes no

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or

otherwise.

Extendicare contact:David Bacon, Senior Vice

President and Chief Financial OfficerT: (905) 470-4000E:

david.bacon@extendicare.comwww.extendicare.com

|

Endnote |

|

(1 |

) |

See the “Non-GAAP Measures” section of this press release and the

Company’s Q3 2024 MD&A, which includes the reconciliation of

such non-GAAP measures to the most directly comparable GAAP

measures. |

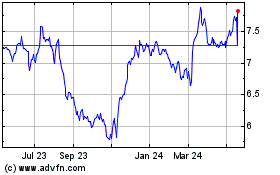

Extendicare (TSX:EXE)

Historical Stock Chart

From Dec 2024 to Jan 2025

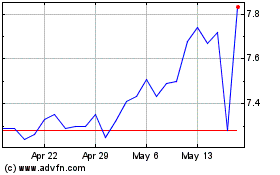

Extendicare (TSX:EXE)

Historical Stock Chart

From Jan 2024 to Jan 2025