Financial 15 Split Corp. II Announces Successful Overnight Offering

July 23 2014 - 8:50AM

Marketwired Canada

Financial 15 Split Corp. II (the "Company") is pleased to announce it has

completed the overnight marketing of up to 1,700,000 Preferred Shares and up to

1,700,000 Class A Shares. Total proceeds of the offering are expected to be

approximately $30.6 million. The Company has granted the dealers an

overallotment of 255,000 units if exercised, bringing the total proceeds to

$35.2 million.

The offering is being co-led by National Bank Financial Inc., CIBC, RBC Capital

Markets and will also include BMO Capital Markets, GMP Securities L.P.,

Canaccord Genuity Corp. and Raymond James.

The sales period of the overnight offering has now ended.

The Preferred Shares will be offered at a price of $10.00 per Preferred Share to

yield 5.25% on the issue price and the Class A Shares will be offered at a price

of $8.00 per Class A Share to yield 15% on the issue price. The closing price on

the TSX of each of the Preferred Shares and Class A Shares on July 22, 2014 was

$10.18 and $8.46, respectively.

The net proceeds of the secondary offering will be used by the Company to invest

in a high quality portfolio consisting of 15 financial services companies made

up of Canadian and U.S. issuers as follows:

Bank of Montreal National Bank of Canada Bank of America Corp.

The Bank of Nova Scotia Manulife Financial Citigroup Inc.

Corporation

Canadian Imperial Bank Sun Life Financial Goldman Sachs Group

of Commerce Services of Canada Inc. Inc.

Royal Bank of Canada Great-West Lifeco Inc. JP Morgan Chase & Co.

The Toronto-Dominion CI Financial Corp. Wells Fargo & Co.

Bank

The Company's investment objectives are:

Preferred Shares:

i. to provide holders of Preferred Shares with cumulative preferential

monthly cash dividends currently in the amount of 5.25% annually, to be

set by the Board of Directors annually subject to a minimum of 5.25%

until 2019; and

ii. on or about the termination date of December 1, 2019 (subject to further

5 year extensions thereafter), to pay the holders of the Preferred

Shares $10 per Preferred Share.

Class A Shares:

i. to provide holders of the Class A Shares with regular monthly cash

distributions in an amount to be determined by the Board of Directors;

and

ii. to permit holders to participate in all growth in the net asset value of

the Company above $10 per Unit, by paying holders on or about the

termination date of December 1, 2019 (subject to further 5 year

extensions thereafter) such amounts as remain in the Company after

paying $10 per Preferred Share.

The Company will today file an amended and restated preliminary short form

prospectus, containing important information relating to the Class A Shares and

the Preferred Shares, with securities commissions or similar authorities in all

provinces of Canada. The amended and restated preliminary short form prospectus

is still subject to completion or amendment. Copies of the amended and restated

preliminary short form prospectus may be obtained from your registered financial

advisor using the contact information for such advisor, or from representatives

of the underwriters listed above. Investors should read the prospectus before

making an investment decision. There will not be any sale or any acceptance of

an offer to buy the securities until a receipt for the final prospectus has been

issued.

FOR FURTHER INFORMATION PLEASE CONTACT:

Financial 15 Split Corp. II

Investor Relations

416-304-4443

Toll free at 1-877-4-Quadra (1-877-478-2372)

www.financial15.com

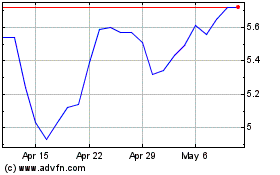

North American Financial... (TSX:FFN)

Historical Stock Chart

From Oct 2024 to Nov 2024

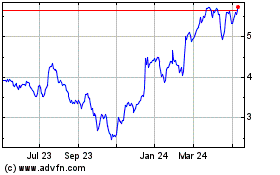

North American Financial... (TSX:FFN)

Historical Stock Chart

From Nov 2023 to Nov 2024