First Quantum Minerals Ltd. (“First Quantum” or the “Company”)

(TSX: FM) announces preliminary production for the three months

(“Q4”) and year ended December 31, 2024 and guidance for

production, capital expenditure and costs for the years 2025 to

2027.

“It is encouraging to see our Zambian operations

delivering strong results in 2024, supported by our focus on

operational excellence across copper, gold, and nickel production.

The S3 Expansion remains on track for completion in mid-2025,

representing an inflection point that will enhance the Company’s

financial resilience and support sustainable growth,” said Tristan

Pascall, Chief Executive Officer of First Quantum. “As we move into

2025, our priorities are centered on building balance sheet

strength and advancing key initiatives. These include managing

Zambian power challenges to ensure reliable energy for our

operations, maintaining a disciplined approach to hedging,

assessing the potential benefits of a minority stake sale in

Zambia, and working constructively with the Government of Panama on

responsible stewardship and progress toward a resolution for the

Cobre Panamá mine."

Highlights

- Q4 and

2024 Production: First Quantum achieved annual copper

production of 431 thousand tonnes (“kt”) in 2024, exceeding the

guidance range of 400 to 420kt. Kansanshi achieved its highest

copper and gold production since 2021 and 2022, respectively,

predominately driven by higher grades. Sentinel’s increased copper

production reflected higher grades and throughput, with the highest

average grades since 2017. Copper production in Q4 2024 was 112kt,

14kt above Q4 2023 (excluding Cobre Panamá) but 4kt below Q3

2024.

-

Three-Year Guidance: Guidance, when referring to

future and prior year production figures, is presented excluding

Cobre Panamá. 2025 and 2026 copper production guidance has been

slightly lowered to reflect a conservative ramp-up of S3 at

Kansanshi and a rescheduling of mining at Sentinel to de-risk

future ore supply. Guidance for gold production has increased due

to the continued discipline in the mining of high-veined areas that

contain higher gold grades at Kansanshi. Nickel production guidance

for Enterprise represents the ramp-up of operations as the orebody

becomes more accessible. Total C1 and AISC unit cost ranges are

marginally above previous guidance driven by higher contractor and

employee costs and imported power costs. 2025 capital expenditure

guidance has increased to reflect approximately $100 million of

expenditures carried over from 2024 along with higher cost

pressures, such as power costs and labour rates. The S3 Expansion

project remains on budget.

Cobre Panamá Update

Cobre Panamá currently remains in a phase of

Preservation and Safe Management (“P&SM”) with production

halted. Approximately 1,300 workers remain on site and further

workforce reductions may occur depending on the timing of the

P&SM program that would permit the shipment of 121 thousand dry

metric tonnes of copper concentrate that remains on site.

Implementation of the P&SM program continues to await approval

from the Panamanian authorities.

On January 6, 2025, Panama’s Ministry of

Environment (“MiAMBIENTE”) released the Terms of Reference for an

Environmental Audit of the Cobre Panamá mine, which will be

conducted by international experts to provide updated information

on the status of the site and support the Government of Panama’s

decision-making about the future of the mine. The Terms of

Reference for the Environmental Audit will be submitted to a public

consultation process, with a public comment period expected to

conclude February 7, 2025.

On January 12, 2025, the Minister of Environment

and the Minister of Security conducted a site visit of Cobre

Panamá. During the visit, the ministers were given a tour of the

mine site, highlighting the P&SM plan that is designed to

ensure site stability, protect the assets of the mine and ensure

the well-being of the workforce, communities and the environment.

The visit also enabled the ministers to inspect 7,960 tons of

ammonium nitrate stored at the mine’s Punta Rincón port. The

Minister of Environment has subsequently stated that the material

should be exported.

2024 Preliminary Production

Comparative figures will be quoted excluding

Cobre Panamá unless stated otherwise.

First Quantum achieved annual copper production

of 431kt for 2024, 54kt higher than 2023. Copper production in Q4

2024 was 112kt, 14kt above Q4 2023 but 4kt below Q3 2024. Copper

production for the full year benefited from higher grades and

recoveries at Kansanshi combined with higher grades and throughput

at Sentinel.

Kansanshi copper production of 171kt for the

full year was 36kt higher than 2023 due to improved grade control

practices, resulting in higher feed grades in particularly

high-grade domains. Additionally, a mill swap allowed for the

processing of a higher proportion of mixed material that contained

higher average feed grades. Copper production in Q4 2024 was 48kt,

a 16kt increase from Q4 2023 driven by the mill swap and higher

grades, but 2kt lower than Q3 2024 due to a planned total plant

shutdown in the sulphide and mixed circuits during the quarter.

Kansanshi production for 2024 was 6kt above the top end of the

revised guidance range of 155 to 165kt.

Sentinel copper production of 231kt for the full

year was 17kt higher than 2023. Production benefitted from higher

grades and throughput. Grades were 5% higher during the year as

mining activity was focused at the bottom of the high-grade Stage 1

pit, which was inaccessible for a significant portion of 2023 due

to the accumulation of water, with 2024 benefiting from an

increased focus on strategic planning and management of the

site-wide water balance and reduction of contact water generation.

Throughput was 4% higher than 2023 with the development of Stage 3

(Western Cut-back) that increased availability of the softer

material, improved availability of the primary crushers and

improved fragmentation of the ore. Q4 2024 copper production of

57kt was 3kt below Q4 2023 and 2kt lower than Q3 2024 from the

mining of lower grades from Stage 3. Sentinel production of 231kt

was above the top end of the revised guidance range of 220 to

230kt.

Other sites achieved consolidated copper

production of 29kt for the full year, a 1kt increase from 2023 and

4kt above revised guidance of 25kt.

Annual gold production for 2024 of 139 thousand

ounces (“koz”) was 42koz higher than 2023, driven by higher grades

at Kansanshi as more selective mining methods were employed on

high-vein areas which contained higher grades.

Nickel production for 2024 of 24kt was 2kt lower

than 2023 after Ravensthorpe was placed on care and maintenance

(“C&M”) in May 2024. This was mitigated by production from

Enterprise, which achieved commercial production in June 2024.

The production and sales figures provided herein

are preliminary and subject to final adjustment. The final

production and sales figures will be confirmed in the Company's

financial results for the fourth quarter and year ended December

31, 2024.

|

000’s |

Q4 2024 |

Q42023 |

Year2024 |

Year2023 |

| Copper production

(tonnes) |

112 |

160 |

431 |

708 |

| Gold production (ounces) |

39 |

53 |

139 |

227 |

| Nickel production (tonnes) |

4 |

7 |

24 |

26 |

|

|

|

|

|

|

|

Copper (000’s tonnes) |

Q4 2024 |

Q42023 |

Year2024 |

Year2023 |

| Cobre Panamá |

- |

63 |

- |

331 |

| Kansanshi |

48 |

32 |

171 |

135 |

| Trident – Sentinel |

57 |

60 |

231 |

214 |

| Other |

7 |

5 |

29 |

28 |

|

Production |

112 |

160 |

431 |

708 |

|

Gold (000’s ounces) |

Q4 2024 |

Q42023 |

Year2024 |

Year2023 |

|

Cobre Panamá |

- |

31 |

- |

130 |

|

Kansanshi |

30 |

17 |

105 |

69 |

|

Guelb Moghrein |

8 |

5 |

31 |

26 |

|

Other |

1 |

- |

2 |

2 |

|

Production |

39 |

53 |

139 |

227 |

|

Nickel production (000’s tonnes) |

Q4 2024 |

Q42023 |

Year2024 |

Year2023 |

|

Trident – Enterprise |

4 |

3 |

19 |

5 |

|

Ravensthorpe |

- |

5 |

5 |

22 |

|

Production |

4 |

7 |

24 |

26 |

|

Copper sales (000’s tonnes) |

Q4 2024 |

Q42023 |

Year2024 |

Year2023 |

|

Total copper |

112 |

128 |

420 |

674 |

|

|

|

|

|

|

*Tables may not cast due to rounding

2025 – 2027 Guidance

Guidance is based on a number of assumptions and

estimates as of December 31, 2024, including among other things,

assumptions about metal prices and anticipated costs and

expenditures. Guidance involves estimates of known and unknown

risks, uncertainties and other factors, which may cause the actual

results to be materially different.

Guidance for 2025 to 2027 is presented with

Cobre Panamá remaining in a phase of P&SM and Ravensthorpe in a

phase of C&M.

Production guidance

|

000’s |

2025 |

2026 |

2027 |

| Copper (tonnes) |

380 - 440 |

390 - 450 |

430 - 490 |

| Gold (ounces) |

135 - 155 |

215 - 240 |

200 - 225 |

| Nickel

(tonnes) |

15 - 25 |

30 - 40 |

30 - 40 |

Production guidance by operation

Copper

|

000’s tonnes |

2025 |

2026 |

2027 |

| Kansanshi |

160 - 190 |

180 - 210 |

210 - 240 |

| Trident - Sentinel |

200 - 230 |

200 - 230 |

210 - 240 |

| Other

sites |

20 |

10 |

10 |

Gold

|

000’s ounces |

2025 |

2026 |

2027 |

| Kansanshi |

100 - 110 |

135 - 145 |

140 - 150 |

| Guelb

Moghrein |

35 - 45 |

80 - 95 |

60 - 75 |

Nickel

|

000’s tonnes |

2025 |

2026 |

2027 |

| Trident

- Enterprise |

15 - 25 |

30 - 40 |

30 - 40 |

| |

|

|

|

Kansanshi copper production in 2025 and 2026 has

been adjusted lower from previous guidance to reflect a

conservative ramp-up profile for S3, which remains on track for

first production in the second half of 2025. The progressive

increase in copper production over the three-year guidance period

is attributable to production from S3. During 2024, the S3

Expansion project achieved 62% construction completion of the

process plant and commenced early commissioning work, including the

33kv power line and substation. Operational readiness achieved 62%

completion with training of new recruits on the process simulator

and field training at the Sentinel mine having commenced. The

majority of the initial feed for S3 will be sourced from low-grade

stockpiles before production increases in 2027 as increased ore

volumes of higher grade ore from the South East Dome deposit is fed

into the plant. Gold production at Kansanshi has increased from

previous guidance following the continued discipline of mining

high-veined areas that contain higher gold grades and the improved

understanding of the sulphide copper-gold mineralization at

depth.

Sentinel copper production in 2025 and 2026 has

been adjusted lower from previous guidance to reflect accelerated

mining in Stages 3 and 4, which contains a higher proportion of

oxidized and transitional ore that is lower grade. Bringing forward

production from Stages 3 and 4, along with a balanced and

responsible increase in waste stripping, is expected to de-risk

future ore supply to achieve an optimal and sustainable balance of

grades and volumes during the life of the mine. This approach is

underpinned by mining productivities, Quantum Electra-Haul™

trolley-assist technology and waste dump profiles which also

improves storm-water management and the sequencing of in-pit

crusher moves.

Enterprise production guidance is reflective of

strong operational results achieved during the first year of

commercial production, despite persistent power disruptions, and

demonstrates an increasing production profile as the orebody

becomes more accessible.

Guelb Moghrein gold production has increased to

reflect the inclusion of gold production from Oriental Hill, which

received mining approval in 2024. Mining activities will commence

in 2025 with the majority of the gold from Oriental Hill being

extracted in 2026. Gold will also be extracted from tailings

storage facilities and reprocessed through the newly commissioned

Carbon-in-Leach plant.

Cash cost and all-in sustaining cost

|

Total Copper ($/lb) |

2025 |

2026 |

2027 |

| C1 |

1.85 - 2.10 |

1.85 - 2.10 |

1.75 - 2.00 |

| AISC |

3.05 - 3.35 |

2.95 - 3.25 |

2.85 - 3.15 |

|

Total Nickel ($/lb) |

2025 |

2026 |

2027 |

| C1 |

5.00 - 6.50 |

3.75 - 5.00 |

3.75 - 5.00 |

|

AISC |

7.50 - 9.25 |

5.25 - 6.75 |

5.25 - 6.75 |

| |

|

|

|

2025 and 2026 C1 copper cash cost guidance

movement is reflective of the adjusted production profile, higher

contractor and employee costs combined with the impact of imported

power costs at the Zambian operations as a result of the drought

conditions. These increases are partially offset by increased

by-product gold credits from Kansanshi, higher capitalized costs

and a weaker Zambian kwacha.

AISC cash cost guidance has increased to reflect

the updated production profile combined with increased sustaining

capital expenditure at Kansanshi as a result of a refined fleet

replacement strategy and an increase in royalties driven by

increased copper price assumptions. AISC trends downwards as

production from S3 commences.

Unit cost guidance assumes a gold price of

$2,600 per ounce, average Brent crude oil price of $85 per barrel,

Zambian kwacha/US Dollar exchange rate of 26 and royalties based on

consensus copper prices.

Total nickel unit cost guidance relates solely

to the Enterprise operation while Ravensthorpe remains under a

state of C&M. Enterprise achieved commercial production in June

2024 with unit cost guidance decreasing year-on-year over the

guidance period as the production profile ramps up.

Capital expenditure

|

$ million |

2025 |

2026 |

2027 |

| Project Capital |

590 - 650 |

330 - 360 |

120 - 150 |

| Sustaining capital |

450 - 500 |

380 - 420 |

350 - 380 |

| Capitalized stripping |

260 - 300 |

240 - 270 |

330 - 370 |

|

Total capital expenditure |

1,300 - 1,450 |

950 - 1,050 |

800 - 900 |

|

|

|

|

|

2025 capital expenditure guidance has increased

from previous guidance to reflect approximately $100 million of

expenditure carried over from 2024. In addition, the guidance

period reflects higher cost pressures, such as power costs and

labour rates.

Total capital expenditure for the S3 Expansion

project remains unchanged at $1.25 billion with approximately $630

million spent in 2024 and approximately $840 million spent to date.

Across the three-year guidance period, capital expenditure for the

S3 Expansion project is expected to be approximately $400 million

and includes pre-strip activities for the South East Dome of

approximately $100 million.

In addition to the S3 Expansion project, project

capital in the three-year guidance period includes

approximately:

- $120 million at

Kansanshi for the expansion of the smelter and tailings facilities

and the installation of an in-pit crusher,

- $115 million for

La Granja development, with the majority of the spend occurring in

the back end of the guidance period, predominantly on mineral

rights as well as an Environmental Impact Assessment, drilling and

other environmental related activities,

- $60 million in

capital expenditures at Sentinel for the relocation of in-pit

crushers,

- $45 million for

additional Quantum Electra-Haul™ trolley line installations across

Kansanshi and Sentinel.

Within the three-year capital expenditure

guidance, approximately $600 million relates to sustainability

related project capital. Each of these projects are expected to

drive improved sustainability performance and also improve cost

structure and productivity of the business.

The three-year capital expenditure guidance

includes:

- Replacement of

the Kansanshi ex-pit mining fleet with more efficient and

trolley-compatible trucks,

- Continued

expansion of Quantum Electra-Haul™ trolley-assist infrastructure

across the Zambian operations to lower diesel consumption and

associated mine fleet greenhouse gas emissions, as well as offering

the potential for future integration with battery powered mining

trucks,

- Relocation and

installation of in-pit crushers at the Zambian operations to

optimize haul cycle efficiency and reduce mine fleet diesel

consumption,

- Investments at

Kansanshi to enhance the social infrastructure serving the

workforce,

- Investments to

further develop the healthcare infrastructure and housing at

Kalumbila town, adjacent to the Trident operation,

- Water

initiatives at various operations to optimise management of water

quality and reuse by operations,

- Installation of

a solar power plant at Enterprise to increase renewable energy use

and reduce reliance on generators, and

- Community

engagement in relation to the La Granja and Taca Taca development

projects in Peru and Argentina, respectively.

The Company continues to take tangible steps

towards lowering the carbon intensity of its mining operations and

has committed to invest a further $200 million on the Kansanshi

mining fleet over the next three years. This investment will

upgrade the existing ex-pit fleet to be entirely compatible with

the Company’s trolley-assist technology, Quantum Electra-Haul™.

Furthermore, the trucks will be fuel-source agnostic, more energy

efficient and with higher payload. This underlines the Company’s

commitment to continue investing in innovative technology required

to decarbonize its mining operations through pit

electrification.

For further information, visit our website at

www.first-quantum.com or contact:

Bonita To, Director, Investor Relations (416)

361-6400 Toll-free: 1 (888) 688-6577E-Mail: info@fqml.com

CAUTIONARY STATEMENT ON FORWARD-LOOKING

INFORMATION

Certain statements and information herein,

including all statements that are not historical facts, contain

forward-looking statements and forward-looking information within

the meaning of applicable securities laws. The forward-looking

statements include estimates, forecasts and statements as to the

Company’s expectations regarding the production of copper, gold and

nickel at its projects (excluding Cobre Panamá and Ravensthorpe),

capital expenditures and cash costs and all-in sustaining costs in

each of 2025, 2026 and 2027; expectations regarding total C1 and

AISC unit cost ranges; the C&M process at Ravensthorpe and the

P&SM program at Cobre Panamá and the Government of Panama’s

approval of the P&SM plan submitted in 2024; the mine plan for

S3; amounts and timing of production and total capital expenditures

for the S3 Expansion; anticipated capital expenditures associated

with project works and the effects thereof; and expectations

regarding the Company’s ability to decarbonise its mining

operations;. Often, but not always, forward-looking statements or

information can be identified by the use of words such as “plans”,

“expects” or “does not expect”, “is expected”, “budget”,

“scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or

“does not anticipate” or “believes” or variations of such words and

phrases or statements that certain actions, events or results

“may”, “could”, “would”, “might” or “will” be taken, occur or be

achieved.

With respect to forward-looking statements and

information contained herein, the Company has made numerous

assumptions including among other things, assumptions about

continuing production at all operating facilities (other than Cobre

Panamá and Ravensthorpe), the prices of copper, gold, nickel;

anticipated costs and expenditures (including the average Brent

crude oil price the amounts payable under certain royalties, and

the shipping rates, steel prices, labour rates, power costs and

general inflation); the mine plan at S3 and its other projects; the

timing of production at Oriental Hill at Guelb Moghrein; royalty

rates at Kansanshi; the Zambian kwacha-to-U.S. dollar exchange

rate; the Company’s ongoing commitment to invest in innovative

technology and the effects thereof; the timing of, and costs

associated with, the completion of the S3 Expansion; and the

ability to achieve the Company’s goals.

Forward-looking statements and information by

their nature are based on assumptions and involve known and unknown

risks, uncertainties and other factors which may cause the actual

results, performance or achievements, or industry results, to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements or information. These factors include, but are not

limited to, the prices of copper, gold and nickel, future

production volumes and costs, the temporary or permanent closure of

uneconomic operations, costs for inputs such as oil, power and

sulphur, political stability in Zambia, Peru, Mauritania, Finland,

Spain, Turkey, Argentina and Australia, adverse weather conditions

in Zambia, Finland, Spain, Turkey, Mauritania and Australia, labour

disruptions, potential social and environmental challenges

(including the impact of climate change), power supply, mechanical

failures, water supply, procurement and delivery of parts and

supplies to the operations, the production of off-spec material and

events generally impacting global economic, political and social

stability.

See the Company’s Annual Information Form for

additional information on risks, uncertainties and other factors

relating to the forward-looking statements and information.

Although the Company has attempted to identify factors that would

cause actual actions, events or results to differ materially from

those disclosed in the forward-looking statements or information,

there may be other factors that cause actual results, performances,

achievements or events not to be anticipated, estimated or

intended. Also, many of these factors are beyond First Quantum’s

control. Accordingly, readers should not place undue reliance on

forward-looking statements or information. The Company undertakes

no obligation to reissue or update forward-looking statements or

information as a result of new information or events after the date

hereof except as may be required by law. All forward-looking

statements and information made herein are qualified by this

cautionary statement.

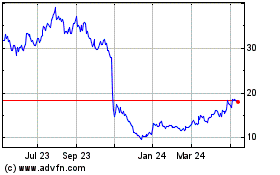

First Quantum Minerals (TSX:FM)

Historical Stock Chart

From Dec 2024 to Jan 2025

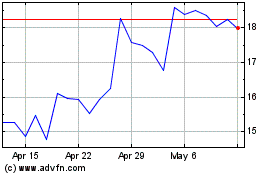

First Quantum Minerals (TSX:FM)

Historical Stock Chart

From Jan 2024 to Jan 2025