Colabor Group Inc. (TSX: GCL) (“Colabor” or the “Company”) reports

its results for the third quarter ended September 7, 2024.

Third Quarter

2024 Financial Highlights:

-

Sales decreased by 1.6% to $162.0 million, compared to $164.7

million for the corresponding period of 2023;

-

Net earnings from continuing operations were $1.2 million

compared to $3.5 million for the corresponding period of

2023;

-

Adjusted EBITDA(1) decreased by 14.0% to $9.5 million from $11.0

million for the corresponding period of 2023 with an adjusted

EBITDA(1) margin to 5.9% of sales compared to 6.7% of sales during

the corresponding period of 2023;

-

Cash flow from operating activities increased to $9.9 million

compared to $8.0 million for the third quarter of 2023;

-

Net debt(2) decreased to $50.7 million, compared to

$61.5 million as at December 30, 2023. The leverage

ratio(3) is 2.6x as at September 7, 2024, compared to 2.7x as

at December 30, 2023.

Table of Third

Quarter 2024 Financial

Highlights:

|

Financial highlights |

12 weeks |

36 weeks |

|

(in thousands of dollars, except percentages, per share data and

financial leverage ratio) |

2024 |

2023 |

2024 |

2023 |

|

$ |

$ |

$ |

$ |

|

Sales from continuing operations |

162,034 |

164,700 |

454,512 |

462,809 |

|

Adjusted EBITDA(1) |

9,484 |

11,034 |

24,084 |

25,902 |

|

Adjusted EBITDA(1) margin (%) |

5.9 |

6.7 |

5.3 |

5.6 |

|

Net earnings from continuing operations |

1,164 |

3,539 |

1,067 |

5,693 |

|

Net earnings |

1,113 |

3,539 |

996 |

5,693 |

|

Per share - basic and diluted ($) |

0.01 |

0.03 |

0.01 |

0.06 |

|

Cash flow from operating activities |

9,904 |

7,969 |

26,627 |

20,044 |

|

Financial position |

|

|

As at |

As at |

| |

|

|

September 7, |

December 30, |

| |

|

|

2024 |

2023 |

|

Net debt(2) |

|

|

50,749 |

61,481 |

|

Financial leverage ratio(3) |

|

|

2.6x |

2.7x |

(1) Non-IFRS measure. Refer to the table

Reconciliation of Net Earnings to adjusted EBITDA in MD&A

section 5 "Non-IFRS Performance Measures". Adjusted EBITDA

corresponds to net operating earnings before costs not related to

current operations, depreciation and amortization and expenses for

stock-based compensation plan. (2) Non-IFRS measure. Refer to

MD&A section 5 "Non-IFRS Performance Measures". Net debt

corresponds to bank indebtedness, current portion of long-term debt

and long-term debt, net of cash.(3) Financial leverage ratio is an

indicator of the Company's ability to service its long-term debt.

It is defined as net debt / adjusted EBITDA less lease liability

payments and interests on lease obligations for the last four

quarters. The corresponding figure for 2023 has been restated to

reflect the new calculation method established for 2024. Refer to

MD&A section 5 "Non-IFRS Performance Measures".

“The contribution of new customers and the

growth in purchasing volume among certain customers of the

distribution sector allowed us to gain market share and mitigate

the effect of headwinds currently operating in the restaurant and

retail industries,” said Louis Frenette, President and Chief

Executive Officer of Colabor.

“The sound management of our balance sheet and

our ability to generate operational cash flows position us well in

the current context, and allow us to continue to execute our

strategic plan with optimism and determination,” added Pierre

Blanchette, Senior Vice President and Chief Financial Officer.

Results for the

Third Quarter of

2024

Consolidated sales for the third quarter were

$162.0 million, a decrease of 1.6% compared to $164.7 million

during the corresponding quarter of 2023. Sales for the

distribution activities increased by 1.5%, primarily as a result of

a volume increase, part of which is related to the development of

new territories, as well as the recent acquisition and the impact

of inflation. This growth was mitigated by a more difficult

macroeconomic environment during the third quarter of 2024 directly

affecting the restaurant and retail industries. Wholesale sales

have declined by 10.1% mainly as a result of a more difficult

macroeconomic environment during the third quarter of 2024, as

explained previously, and mitigated by the impact of inflation.

Adjusted EBITDA(1) from continuing activities

was $9.5 million or 5.9% of sales from continuing activities

compared to $11.0 million or 6.7% during 2023. These variations

were the result of a sales decline and higher operating

expenses.

Net earnings from continuing operations and net

earnings for the third quarter were $1.2 million and $1.1 million

respectively, down from $3.5 million for the corresponding quarter

of the previous year, as a result of increased financial expenses

combined with a decreased adjusted EBITDA(1) and mitigated by lower

income taxes expenses. The increase in financial charges is a

result of the increased rental obligations, particularly for our

premises located in Saint-Bruno-de-Montarville.

Results for the

36-week period of

2024

Consolidated sales for the 36-week period were

$454.5 million compared to $462.8 million for the corresponding

period of 2023. Sales for the distribution activities grew by 1.0%

and the wholesale sales declined by 9.3%.

Adjusted EBITDA(1) from continuing operations

was $24.1 million or 5.3% of sales from continuing operations

compared to $25.9 million or 5.6% in 2023. These variations were

the result of a sales decrease and higher operating expenses.

Net earnings from continuing operations were

$1.1 million, down from $5.7 million in the previous fiscal year.

This variation is a result of increased financial expenses as

explained previously, combined with a decrease of adjusted

EBITDA(1) and mitigated by lower income taxes expenses.

Cash Flow and Financial

Position

Cash flows from operating activities were $9.9

million and $26.6 million for the 12 and 36-week periods of 2024

respectively, compared to $8.0 million and $20.0 million for the

corresponding periods of 2023. This increase is mainly due to lower

utilization of working capital(4), mitigated by the decrease of the

adjusted EBITDA(1). The lower utilization of working capital(4) is

explained by the improvement in the inventory turnover rate and the

timing in supplier payments.

As at September 7, 2024, the Company's

working capital(4) was $48.2 million, down from $54.0 million at

the end of the fiscal year 2023. This decrease is the result of an

improvement in the inventory turnover rate and the timing in

supplier payments.

As at September 7, 2024, the Company's net

debt(2) was down to $50.7 million, compared to $61.5 million at the

end of the fiscal year 2023, resulting from the credit facility

repayment of $5.5 million and an increase in cash.

Outlook

“While the restaurant and retail industries are

currently going through a more challenging period, we will continue

to act on several fronts to continue to improve our productivity

and operational efficiency. With our new distribution center in

Saint-Bruno-de-Montarville, we are well positioned to distinguish

ourselves in a competitive market. We will pursue a strategy of

prudent allocation of our cash flows by prioritizing debt

repayment, while remaining on the lookout for investment

opportunities that will maximize shareholder returns,” concluded

Mr. Frenette.

(4) Working capital is a non-IFRS performance

measure. Working capital is an indicator of the Company's ability

to hedge its current liabilities with its current assets. Refer to

MD&A section 3.2 "Financial Position" for detailed

calculation.

Non-IFRS Performance Measures

The information provided in this release

includes non-IFRS performance measures, notably adjusted earnings

before financial expenses, depreciation and amortization and income

taxes ("Adjusted EBITDA")(1). As these concepts are not defined by

IFRS, they may not be comparable to those of other companies. Refer

to Section 5 "Non-IFRS Performance Measures" in the Management's

Discussion and Analysis.

|

Reconciliation of Net Earnings to Adjusted

EBITDA(1) |

12 weeks |

|

36 weeks |

|

(in thousands of dollars) |

2024 |

2023 |

|

2024 |

2023 |

|

|

$ |

$ |

|

$ |

$ |

|

Net earnings from continuing operations |

1,164 |

3,539 |

|

1,067 |

5,693 |

|

Income taxes |

591 |

1,362 |

|

530 |

2,109 |

|

Financial expenses |

2,823 |

1,271 |

|

8,196 |

3,896 |

|

Operating earnings |

4,578 |

6,172 |

|

9,793 |

11,698 |

|

Expenses for stock-based compensation plan |

28 |

63 |

|

80 |

212 |

|

Costs not related to current operations |

154 |

99 |

|

276 |

150 |

|

Depreciation and amortization |

4,724 |

4,700 |

|

13,935 |

13,842 |

|

|

|

|

|

|

|

|

Adjusted EBITDA(1) |

9,484 |

11,034 |

|

24,084 |

25,902 |

Additional Information

The Management's Discussion and Analysis and the

consolidated financial statements of the Company are available on

SEDAR+ (www.sedarplus.ca). Additional information, including the

annual information form, about Colabor Group Inc. can also be found

on SEDAR+ and on the Company’s website at www.colabor.com.

Forward-Looking Statements

This press release contains certain

forward-looking statements as defined under applicable securities

law. Forward-looking information may relate to Colabor's future

outlook and anticipated events,

business, operations, financial

performance, financial condition or results and, in some

cases, can be identified by terminology such as "may"; "will";

"should"; "expect"; "plan"; "anticipate"; "believe"; "intend";

"estimate"; "predict"; "potential"; "continue"; "foresee"; "ensure"

or other similar expressions concerning matters that are not

historical facts. Particularly, statements regarding the

Company’s financial guidelines, future operating results and

economic performance, objectives and strategies are forward-looking

statements. These statements are based on certain factors and

assumptions including expected growth, results of operations,

performance and business prospects and opportunities, which

Colabor believes are reasonable as of the current

date. Refer in particular to section 2.2 "Development

Strategies and Outlook" of the Company's MD&A. While Management

considers these assumptions to be reasonable based on information

currently available to the Company, they may prove to be

incorrect. Forward-looking information is also subject to

certain factors, including risks and uncertainties that could cause

actual results to differ materially from what Colabor currently

expects. For more exhaustive information on these risks and

uncertainties, the reader should refer to section 6 "Risks and

Uncertainties" of the Company's MD&A. These factors are not

intended to represent a complete list of the factors that could

affect Colabor and future events and results may vary significantly

from what Management currently foresees. The reader should not

place undue importance on forward-looking information contained in

this press release, information representing Colabor's expectations

as of the date of this press release (or as of the date they are

otherwise stated to be made), which are subject to change after

such date. While Management may elect to do so, the Company is

under no obligation (and expressly disclaims any such obligation)

and does not undertake to update or alter this information at any

particular time, whether as a result of new information, future

events or otherwise, except as required by law.

Conference Call

Colabor will hold a conference call to discuss

these results on Friday, October 18, 2024, beginning at 9:30 a.m.

Eastern time. Interested parties can join the call by dialing

1-888-510-2154 (from anywhere in North America) or 1-437-900-0527.

If you are unable to participate, you can listen to a recording by

dialing 1-888-660-6345 or 1-289-819-1450 and entering the code

53065# on your telephone keypad. The recording will be available

from 1:30 p.m. on Friday, October 18, 2024, until 11:59 p.m.

on October 25, 2024. Note that the recording will be available

offline on our website at the following address:

https://colabor.com/en/investisseurs-en/evenements-et-presentations/

You can also use the QuickConnect link:

https://emportal.ink/4gfDA9p. This new link allows any participant

to access the conference call by clicking on the URL link and enter

their name and phone number.

About Colabor

Colabor is a distributor and wholesaler of food

and related products serving the hotel, restaurant and

institutional markets or "HRI" in Quebec and in the Atlantic

provinces, as well as the retail market. Within its two operating

activities, Colabor offers specialty food products such as meat,

fish and seafood, as well as food and related products through its

Broadline activities.

Further information:

|

Pierre BlanchetteSenior Vice President and Chief

Financial OfficerColabor Group IncTel.: 450-449-4911 extension

1308investors@colabor.com |

Danielle Ste-MarieSte-Marie Strategy and

Communications Inc.Investor RelationsTel.: 450-449-0026 extension

1180 |

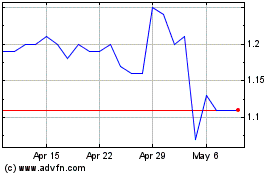

Colabor (TSX:GCL)

Historical Stock Chart

From Oct 2024 to Nov 2024

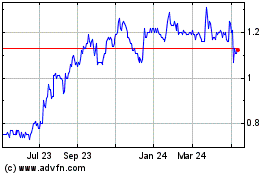

Colabor (TSX:GCL)

Historical Stock Chart

From Nov 2023 to Nov 2024