Ballantyne Strong Announces Public Filing of Registration Statement for Proposed Initial Public Offering of Strong Global Entertainment, Inc.

April 07 2022 - 4:00PM

Ballantyne Strong, Inc. (NYSE American: BTN) (“Ballantyne” or

the “Company”), the current parent of Strong Global Entertainment,

Inc. (“Strong Global Entertainment”) announced today that Strong

Global Entertainment has publicly filed a registration statement on

Form S-1 (file number: 333-264165) with the Securities and Exchange

Commission (the “SEC”) relating to a proposed initial public

offering of its Class A Common Voting Shares (the “Offering”). The

number of shares and price range for the proposed Offering have yet

to be determined. The Offering is expected to take place after the

SEC completes its review process, subject to market and other

customary conditions. Strong Global Entertainment has applied to

list its Class A Common Voting Shares on the NYSE American exchange

under the ticker symbol “SGE”.

ThinkEquity will serve as sole book-running

manager for the proposed Offering.

The proposed Offering will be made pursuant to a

prospectus. Copies of the preliminary prospectus related to the

Offering, when available, may be obtained on the SEC’s website,

www.sec.gov, or from ThinkEquity, 17 State Street, 22nd Floor, New

York, New York 10004, by telephone at (877) 436-3673, or by email

at prospectus@think-equity.com.

A registration statement relating to the

proposed sale of these securities has been filed with the SEC but

has not yet become effective. Securities offered under the

registration statement may not be sold, nor may offers to buy be

accepted, prior to the time the registration statement becomes

effective. This press release does not constitute an offer to sell,

or a solicitation of an offer to buy any securities, and shall not

constitute an offer, solicitation or sale in any jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of that

jurisdiction. Any offers, solicitations or offers to buy, or any

sales of securities will be made in accordance with the

registration requirements of the Securities Act or 1933, as

amended.

About Ballantyne

Strong, Inc.

Ballantyne Strong, Inc.

(www.ballantynestrong.com) is a diversified holding company with

operations and holdings across a broad range of industries.

Ballantyne holds equity stakes in Firefly Systems, Inc., GreenFirst

Forest Products Inc. (TSX: GFP), and FG Financial Group, Inc.

(Nasdaq: FGF), as well as real estate through its Digital Ignition

operating business.

Ballantyne’s Strong Entertainment segment, which

will become the primary operating business of Strong Global

Entertainment immediately prior to the consummation of the

Offering, is the largest premium screen supplier in North America,

and provides technical support services and related products and

services to the cinema exhibition industry. Ballantyne’s Strong

Entertainment segment manufactures and distributes premium large

format projection screens, provides comprehensive managed services,

technical support and related products and services primarily to

cinema exhibitors, theme parks, educational institutions, and

similar venues. In addition to traditional projection screens, it

manufactures and distributes its Eclipse curvilinear screens, which

are specially designed for theme parks, immersive exhibitions, as

well as simulation applications. It also provides maintenance,

repair, installation, network support services and other services

to cinema operators, primarily in the United States. Ballantyne

also recently launched Strong Studios, Inc. as part of the Strong

Entertainment segment, which develops and produces original feature

films and television series. Forward-Looking

Statements

This press release may contain “forward-looking

statements.” All statements, other than statements of historical

facts, are forward-looking statements. Ballantyne may, in some

cases, use words such as “project,” “believe,” “anticipate,”

“plan,” “expect,” “estimate,” “intend,” “should,” “would,” “could,”

“potentially,” “will” or “may”, or other words that convey

uncertainty of future events or outcomes, to identify these

forward-looking statements. Such forward-looking statements are

based on management’s current expectations, but actual results may

differ materially due to various factors. There can be no

guarantees that the initial public offering of Strong Global

Entertainment, Inc. will be consummated on the timeline anticipated

or at all, or that Ballantyne or Strong Global Entertainment will

achieve the anticipated benefits of such a transaction.

Ballantyne’s and Strong Global Entertainment’s ability to

consummate and achieve the anticipated benefits of the potential

initial public offering of Strong Global Entertainment may be

materially affected by certain factors outside their control that

could affect the advisability, pricing and timing of the potential

initial public offering of Strong Global Entertainment, as well as

a number of risks and uncertainties regarding the business, results

of operation or financial condition of Ballantyne or Strong Global

Entertainment, including but not limited to those discussed in the

“Risk Factors” sections contained in the registration statement,

prospectus and prospectus supplements related to the Offering, Item

1A in Ballantyne’s Annual Report on Form 10-K for the year ended

December 31, 2021, filed with the SEC on March 24, 2022, and

subsequent filings with the SEC, in addition to and including the

following risks and uncertainties: the negative impact that the

COVID-19 pandemic has already had, and may continue to have, on the

Company’s business and financial condition; the general economic

impact of the ongoing military conflict in Ukraine, including the

impact of related sanctions being imposed by the U.S. Government

and the governments of other countries, and the impact of potential

reprisals as a consequence of the military conflict in Ukraine and

any related sanctions; the Company’s ability to maintain and expand

its revenue streams to compensate for the lower demand for the

Company’s digital cinema products and installation services;

potential interruptions of supplier relationships or higher prices

charged by suppliers; the Company’s ability to successfully compete

and introduce enhancements and new features that achieve market

acceptance and that keep pace with technological developments; the

Company’s ability to successfully execute its capital allocation

strategy or achieve the returns it expects from these holdings; the

Company’s ability to maintain its brand and reputation and retain

or replace its significant customers; challenges associated with

the Company’s long sales cycles; the impact of a challenging global

economic environment or a downturn in the markets (such as the

current economic disruption and market volatility generated by the

ongoing COVID-19 pandemic and ongoing military conflict in Ukraine

and related sanctions); economic and political risks of selling

products in foreign countries (including tariffs); risks of

non-compliance with U.S. and foreign laws and regulations,

potential sales tax collections and claims for uncollected amounts;

cybersecurity risks and risks of damage and interruptions of

information technology systems; the Company’s ability to retain key

members of management and successfully integrate new executives;

the Company’s ability to complete acquisitions, strategic

investments, entry into new lines of business, divestitures,

mergers or other transactions on acceptable terms, or at all; the

impact of the COVID-19 pandemic on the Company’s portfolio

companies; the Company’s ability to utilize or assert its

intellectual property rights, the impact of natural disasters and

other catastrophic events (such as the ongoing COVID-19 pandemic

and ongoing military conflict in Ukraine and related sanctions);

the adequacy of insurance; the impact of having a controlling

stockholder and vulnerability to fluctuation in the Company’s stock

price. Given the risks and uncertainties, readers should not place

undue reliance on any forward-looking statement and should

recognize that the statements are predictions of future results

which may not occur as anticipated. Many of the risks listed above

have been, and may further be, exacerbated by the ongoing COVID-19

pandemic, its impact on the cinema and entertainment industry, the

ongoing military conflict in Ukraine and related sanctions, and the

worsening economic environment. Actual results could differ

materially from those anticipated in the forward-looking statements

and from historical results, due to the risks and uncertainties

described herein, as well as others not now anticipated. New risk

factors emerge from time to time and it is not possible for

management to predict all such risk factors, nor can it assess the

impact of all such factors on the Company’s business or the extent

to which any factor, or combination of factors, may cause actual

results to differ materially from those contained in any

forward-looking statements. Except where required by law, we

undertake no obligation to publicly update, withdraw, or revise any

forward-looking statements to reflect actual results or changes in

factors or assumptions on which any statement is based.

For Investor Relations

Inquiries:

| Mark Roberson |

John Nesbett / Jennifer Belodeau |

| Ballantyne Strong, Inc. - Chief Executive Officer |

IMS Investor Relations |

| 704-994-8279 |

203-972-9200 |

| IR@btn-inc.com |

jnesbett@institutionalms.com |

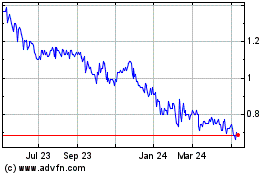

GreenFirst Forest Products (TSX:GFP)

Historical Stock Chart

From Nov 2024 to Dec 2024

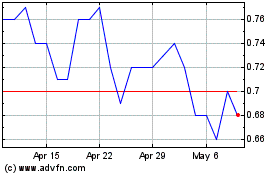

GreenFirst Forest Products (TSX:GFP)

Historical Stock Chart

From Dec 2023 to Dec 2024