FG Group Holdings Inc. (NYSE American: FGH) (the “Company” or “FG

Group Holdings”) today announced operating results for the fourth

quarter and full year ended December 31, 2022.

Operational Highlights

| |

● |

Strong Entertainment annual revenues increased 54% from 2021.

Quarterly revenue returned to pre-Covid levels with increasing

demand from cinema customers. Favorable industry outlook for 2023

with robust studio release schedule and accelerating laser

projection upgrades. |

| |

|

|

| |

● |

Strong Studios successfully launched during 2022. First revenue

producing project, Inside the Black Box, delivered in fourth

quarter. Completed production on first major series, Safehaven, and

expecting to complete postproduction and deliver in 2023. |

| |

|

|

| |

● |

Equity holdings continue to execute their business plans in

attractive markets. FG Financial Group, Inc (“FG Financial”)

launched a merchant banking platform and closed several

transactions. Firefly continues to execute on its growth plans,

both organically and through acquisition. GreenFirst Forest

Products Inc (“GreenFirst”) is well positioned as pure-play lumber

producer in Canada and continues to strengthen its balance sheet,

monetizing non-core assets and increasing its focus on its Ontario

operations. |

| |

|

|

| |

● |

Registration statement filed publicly with the Securities and

Exchange Commission for initial public offering of the Strong

Entertainment business. |

| |

|

|

| |

● |

Completed name change to FG Group Holdings Inc. in fourth quarter

to better reflect the company’s success executing its holding

company strategy. |

| |

|

|

Mark Roberson, Chief Executive Officer,

commented, “Our Strong Entertainment operating business continues

to strengthen its market position, securing new exclusive

relationships and increasing market share. The transition from

xenon projection to laser will continue to drive industry demand,

and with the studio release schedule returning to pre-pandemic

levels, we are exciting about the next several years for our screen

and services business.

“We are also very excited about the opportunity

to scale our entertainment business and create long-term value in

the content area. With the launch of Strong Studios, we are

positioned squarely at the forefront of a streaming and exhibition

industry that is rapidly evolving.”

Kyle Cerminara, Chairman of the Board,

commented, “We believe we are building a valuable portfolio of

businesses at FG Group Holdings. We remain focused on driving

long-term value for our shareholders.”

Fourth Quarter 2022 Financial Review

(Compared to Three Months Ended December 31, 2021)

| |

● |

Revenue increased 17.4% to $11.8 million from $10.0 million.

Revenue benefited from the continuing recovery in the cinema

industry with our services business serving as the primary driver

of the revenue increase from the prior year. We have increased the

scope of our services to better support our customers and to

increase market share in cinema services. Product revenue also

increased as higher cinema screen sales during the quarter more

than offset a large digital equipment order in the fourth quarter

of 2021 that didn’t repeat in 2022. We also recognized revenue of

$0.9 million from our first project in our new Strong Studios

business during the fourth quarter of 2022. |

| |

|

|

| |

● |

Gross profit increased 51.8% to $3.2 million in 2022 from $2.1

million in 2021. Gross profit margins were 27.5% as compared to

21.3%. The increase in gross profit was due to increased demand and

revenue from our entertainment customers and favorable trends in

product mix. |

| |

|

|

| |

● |

Loss from operations was $0.4 million as compared to $1.3 million

in the prior year. Operating results improved as a direct result of

the rebound in revenues and gross margin in our Strong

Entertainment business. Those improvements were partially offset by

increases in operating expenses related to the launch of the new

Strong Studios business. |

| |

|

|

| |

● |

Net income from continuing operations was $1.4 million, or $0.07

per basic and diluted share, as compared to net loss from

continuing operations of $0.4 million, or $0.03 per basic and

diluted share, in the prior year. The improvement in results from

continuing operations, was primarily the result of improved results

of operations from our Strong entertainment group and more

favorable gains from our equity holdings. |

| |

|

|

| |

● |

Adjusted EBITDA improved to $0.6 million as compared to negative

$0.7 million in the prior year. |

Full Year 2022 Financial Review

(Compared to Twelve Months Ended December 31, 2021)

| |

● |

Revenue increased 52.6% to $41.2 million from $27.0 million. The

recovery in the cinema industry progressed throughout 2022, which

resulted in increases in both product and services revenue. In

addition, increases in our market share for screens and services,

and expansion of our product offerings also contributed to the

increase. Exhibitors are in the early stages of a multi-year

upgrade cycle, transitioning their auditoriums from xenon

projection to laser projection, which helps drive demand for our

products and services. We have also increased the scope of our

services to better support our customers and to increase market

share in cinema services. We expect the upgrades from xenon to

laser to accelerate in 2023 and continue for at least the next

several years. We also recognized revenue of $0.9 million from our

first project in our new Strong Studios business during 2022. |

| |

|

|

| |

● |

Gross profit increased 33.0% to $10.9 million in 2022 from $8.2

million in 2021. Gross profit margins were 26.5% as compared to

30.4%. Excluding the impact of employee retention credits, which

favorably impacted the prior year period, gross profit would have

been 25.7% as compared to 26.5% in the current period. The increase

in gross profit, excluding the employee retention credits, was due

to increased demand and revenue from our entertainment

customers. |

| |

|

|

| |

● |

Loss from operations was $2.4 million as compared to $3.1 million

in the prior year. Excluding the impact of employee retention

credits, which favorably impacted the prior year period, loss from

operations during 2021 would have been $5.1 million. Operating

results improved as a direct result of the rebound in revenues and

gross margin in our Strong Entertainment business. Those

improvements were partially offset by increases in operating

expenses related to the launch of the new Strong Studios

business. |

| |

|

|

| |

● |

Net loss from continuing operations was $7.2 million, or $0.37 per

basic and diluted share, as compared to net income from continuing

operations of $3.4 million, or $0.19 per basic and diluted share in

the prior year. The increase in net loss from continuing

operations, despite the improvements in results from Strong

Entertainment’s operations, was primarily the result of recognition

of unrealized losses on our equity holdings in the current period

while the prior year period benefited from employee retention

credits and gains on equity holdings. |

| |

|

|

| |

● |

Adjusted EBITDA, which excludes the impact of losses on our equity

holdings and employee retention credits, among other things,

improved to $0.2 million as compared to negative $2.7 million in

the prior year. |

Conference Call

A conference call to discuss the Company’s 2022

fourth quarter and full year financial results will be held on

Wednesday, March 15, 2023 at 5:00 pm Eastern Time. Interested

parties can listen to the call via live webcast or by phone. To

access the webcast, visit the Company's website at

https://fg.group/investor-relations/ or use following link: FGH

Webcast Link. To access the conference call by phone, dial (888)

506-0062 (domestic) or (973) 528-0011 (international) and use

participant code 405126. Please access the webcast or dial in at

least five minutes before the start of the call to register.

A replay of the webcast will be available

following the conclusion of the live broadcast and accessible on

the Company's website at https://fg.group/investor-relations/.

About FG Group Holdings Inc.

FG Group Holdings Inc. (https://fg.group/) is a

diversified holding company with operations and holdings across a

broad range of industries. The Company’s Strong Entertainment

segment is the largest premium screen supplier in North America,

provides technical support services and related products and

services to the cinema exhibition industry, and recently launched

its studio operations to produce content for streaming and other

entertainment outlets. FG Group Holdings also holds equity stakes

in Firefly Systems, Inc., GreenFirst Forest Products Inc. (TSX:

GFP), and FG Financial Group, Inc. (Nasdaq: FGF), as well as real

estate through its Digital Ignition operating business.

About Fundamental Global®

Fundamental Global® is a private partnership

focused on long-term strategic holdings. Fundamental Global® was

co-founded by former T. Rowe Price, Point72 and Tiger Cub portfolio

manager Kyle Cerminara and former Chairman and CEO of TD

Ameritrade, Joe Moglia. Its current holdings include FG Financial

Group Inc. (Nasdaq:FGF), (NASDAQ: FGFPP), FG Group Holdings Inc.

(NYSE American:FGH), BK Technologies Corp. (NYSE American:BKTI),

GreenFirst Forest Products, Inc. (TSX:GFP), FG Merger Corp.

(Nasdaq:FGMC), FG Acquisition Corp. (TSX:FGAA), OppFi Inc., Hagerty

Inc., and FG Communities, Inc.

The FG® logo is a registered trademark of Fundamental

Global®.

Use of Non-GAAP Measures

FG Group Holdings prepares its consolidated

financial statements in accordance with United States generally

accepted accounting principles (“GAAP”). In addition to disclosing

financial results prepared in accordance with GAAP, the Company

discloses information regarding Adjusted EBITDA (“Adjusted

EBITDA”), which differs from the commonly used EBITDA (“EBITDA”).

Adjusted EBITDA both adjusts net income (loss) to exclude income

taxes, interest, and depreciation and amortization, and excludes

discontinued operations, share-based compensation, impairment

charges, equity method income (loss), fair value adjustments,

severance, foreign currency transaction gains (losses),

transactional gains and expenses, gains on insurance recoveries,

certain tax credits and other cash and non-cash charges and

gains.

EBITDA and Adjusted EBITDA are not measures of

performance defined in accordance with GAAP. However, Adjusted

EBITDA is used internally in planning and evaluating the Company’s

operating performance. Accordingly, management believes that

disclosure of these metrics offers investors, bankers and other

stakeholders an additional view of the Company’s operations that,

when coupled with the GAAP results, provides a more complete

understanding of the Company’s financial results.

EBITDA and Adjusted EBITDA should not be

considered as an alternative to net income (loss) or to net cash

from operating activities as measures of operating results or

liquidity. The Company’s calculation of EBITDA and Adjusted EBITDA

may not be comparable to similarly titled measures used by other

companies, and the measures exclude financial information that some

may consider important in evaluating the Company’s performance.

EBITDA and Adjusted EBITDA have limitations as

analytical tools, and you should not consider them in isolation, or

as substitutes for analysis of the Company’s results as reported

under GAAP. Some of these limitations are: (i) they do not reflect

the Company’s cash expenditures, or future requirements for capital

expenditures or contractual commitments, (ii) they do not reflect

changes in, or cash requirements for, the Company’s working capital

needs, (iii) EBITDA and Adjusted EBITDA do not reflect interest

expense, or the cash requirements necessary to service interest or

principal payments, on the Company’s debt, (iv) although

depreciation and amortization are non-cash charges, the assets

being depreciated and amortized will often have to be replaced in

the future, and EBITDA and Adjusted EBITDA do not reflect any cash

requirements for such replacements, (v) they do not adjust for all

non-cash income or expense items that are reflected in the

Company’s statements of cash flows, (vi) they do not reflect the

impact of earnings or charges resulting from matters management

considers not to be indicative of the Company’s ongoing operations,

and (vii) other companies in the Company’s industry may calculate

these measures differently than the Company does, limiting their

usefulness as comparative measures.

Management believes EBITDA and Adjusted EBITDA

facilitate operating performance comparisons from period to period

by isolating the effects of some items that vary from period to

period without any correlation to core operating performance or

that vary widely among similar companies. These potential

differences may be caused by variations in capital structures

(affecting interest expense), tax positions (such as the impact on

periods or companies of changes in effective tax rates or net

operating losses) and the age and book depreciation of facilities

and equipment (affecting relative depreciation expense). The

Company also presents EBITDA and Adjusted EBITDA because (i)

management believes these measures are frequently used by

securities analysts, investors and other interested parties to

evaluate companies in the Company’s industry, (ii) management

believes investors will find these measures useful in assessing the

Company’s ability to service or incur indebtedness, and (iii)

management uses EBITDA and Adjusted EBITDA internally as benchmarks

to evaluate the Company’s operating performance or compare the

Company’s performance to that of its competitors.

Forward-Looking Statements

In addition to the historical information

included herein, this press release includes forward-looking

statements, such as management’s expectations regarding its

portfolio companies, the Company’s intent to pursue an initial

public offering and separate listing of its Strong Entertainment

business, as well as future sales and financial performance, and

the production and release of content by our Strong Studios

division, which involve a number of risks and uncertainties,

including but not limited to those discussed in the “Risk Factors”

section contained in Item 1A in the Company’s Annual Report on Form

10-K for the year ended December 31, 2022 to be filed with the SEC

on or about March 16, 2023, and the following risks and

uncertainties: the Company’s ability to maintain and expand its

revenue streams to compensate for the lower demand for the

Company’s digital cinema products and installation services;

potential interruptions of supplier relationships or higher prices

charged by suppliers; the Company’s ability to successfully compete

and introduce enhancements and new features that achieve market

acceptance and that keep pace with technological developments; the

Company’s ability to successfully execute its capital allocation

strategy or achieve the returns it expects from these holdings; the

Company’s ability to maintain its brand and reputation and retain

or replace its significant customers; challenges associated with

the Company’s long sales cycles; the impact of a challenging global

economic environment or a downturn in the markets; the effects of

economic, public health, and political conditions that impact

business and consumer confidence and spending, including rising

interest rates, periods of heightened inflation and market

instability, the outbreak of any highly infectious or contagious

diseases, such as COVID-19 and its variants or other health

epidemics or pandemics, and armed conflicts, such as the ongoing

military conflict in Ukraine and related sanctions; economic and

political risks of selling products in foreign countries (including

tariffs); risks of non-compliance with U.S. and foreign laws and

regulations, potential sales tax collections and claims for

uncollected amounts; cybersecurity risks and risks of damage and

interruptions of information technology systems; the Company’s

ability to retain key members of management and successfully

integrate new executives; the Company’s ability to complete

acquisitions, strategic investments, entry into new lines of

business, divestitures, mergers or other transactions on acceptable

terms, or at all; the impact of economic, public health and

political conditions on the companies in which the Company

holds equity stakes; the Company’s ability to utilize or assert its

intellectual property rights, the impact of natural disasters and

other catastrophic events, whether natural, man-made, or otherwise

(such as the outbreak of any highly infectious or contagious

diseases, or armed conflict); the adequacy of the Company’s

insurance; the impact of having a controlling stockholder and

vulnerability to fluctuation in the Company’s stock price. Given

the risks and uncertainties, readers should not place undue

reliance on any forward-looking statement and should recognize that

the statements are predictions of future results which may not

occur as anticipated. Many of the risks listed above have been, and

may further be, exacerbated by the impact of economic, public

health (such as a resurgence of the COVID-19 pandemic) and

political conditions (such as the military conflict in Ukraine)

that impact consumer confidence and spending, particularly in the

cinema, entertainment, and other industries in which the Company

and the companies in which the Company holds an equity stake

operate, and the worsening economic environment. Actual

results could differ materially from those anticipated in the

forward-looking statements and from historical results, due to the

risks and uncertainties described herein, as well as others not now

anticipated. New risk factors emerge from time to time and it is

not possible for management to predict all such risk factors, nor

can it assess the impact of all such factors on our business or the

extent to which any factor, or combination of factors, may cause

actual results to differ materially from those contained in any

forward-looking statements. Except where required by law, the

Company assumes no obligation to update forward-looking statements

to reflect actual results or changes in factors or assumptions

affecting such forward-looking statements.

|

Investor Relations Contacts |

|

|

|

|

|

Mark Roberson |

John Nesbett / Jennifer Belodeau |

|

FG Group Holdings Inc. - Chief Executive Officer |

IMS Investor Relations |

|

(704) 994-8279 |

(203) 972-9200 |

|

IR@fg.group |

fggroup@imsinvestorrelations.com |

|

FG Group Holdings Inc. and Subsidiaries |

|

Consolidated Balance Sheets |

|

(In thousands, except par values) |

|

|

|

|

|

| |

December 31, 2022 |

|

December 31, 2021 |

|

|

|

|

|

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

3,789 |

|

|

$ |

8,731 |

|

|

Restricted cash |

|

- |

|

|

|

150 |

|

|

Accounts receivable, net |

|

6,167 |

|

|

|

4,631 |

|

|

Inventories, net |

|

3,389 |

|

|

|

3,271 |

|

|

Other current assets |

|

4,871 |

|

|

|

4,992 |

|

|

Total current assets |

|

18,216 |

|

|

|

21,775 |

|

|

Property, plant and equipment, net |

|

12,649 |

|

|

|

6,226 |

|

|

Operating lease right-of-use assets |

|

310 |

|

|

|

3,975 |

|

|

Finance lease right-of-use assets |

|

666 |

|

|

|

- |

|

|

Note receivable, net of current portion |

|

- |

|

|

|

1,667 |

|

|

Equity holdings |

|

37,522 |

|

|

|

41,133 |

|

|

Intangible assets, net |

|

5 |

|

|

|

69 |

|

|

Film and television programming rights, net |

|

1,501 |

|

|

|

- |

|

|

Goodwill |

|

882 |

|

|

|

942 |

|

|

Other assets |

|

2 |

|

|

|

22 |

|

|

Total assets |

$ |

71,753 |

|

|

$ |

75,809 |

|

| |

|

|

|

| Liabilities and

Stockholders' Equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

4,375 |

|

|

$ |

4,245 |

|

|

Accrued expenses |

|

5,167 |

|

|

|

2,994 |

|

|

Short-term debt |

|

2,510 |

|

|

|

2,998 |

|

|

Current portion of long-term debt |

|

216 |

|

|

|

23 |

|

|

Current portion of operating lease obligations |

|

116 |

|

|

|

577 |

|

|

Current portion of finance lease obligations |

|

117 |

|

|

|

- |

|

|

Deferred revenue and customer deposits |

|

1,787 |

|

|

|

3,292 |

|

|

Total current liabilities |

|

14,288 |

|

|

|

14,129 |

|

|

Operating lease obligations, net of current portion |

|

257 |

|

|

|

3,586 |

|

|

Finance lease obligations, net of current portion |

|

550 |

|

|

|

- |

|

|

Long-term debt, net of current portion |

|

5,004 |

|

|

|

105 |

|

|

Deferred income taxes |

|

4,851 |

|

|

|

5,594 |

|

|

Other long-term liabilities |

|

105 |

|

|

|

118 |

|

|

Total liabilities |

|

25,055 |

|

|

|

23,532 |

|

| |

|

|

|

| Commitments, contingencies and

concentrations |

|

|

|

| |

|

|

|

| Stockholders' equity: |

|

|

|

|

Preferred stock |

|

- |

|

|

|

- |

|

|

Common stock |

|

223 |

|

|

|

213 |

|

|

Additional paid-in capital |

|

53,882 |

|

|

|

50,807 |

|

|

Retained earnings |

|

16,437 |

|

|

|

23,591 |

|

|

Treasury stock |

|

(18,586 |

) |

|

|

(18,586 |

) |

|

Accumulated other comprehensive loss |

|

(5,258 |

) |

|

|

(3,748 |

) |

|

Total stockholders' equity |

|

46,698 |

|

|

|

52,277 |

|

|

Total liabilities and stockholders' equity |

$ |

71,753 |

|

|

$ |

75,809 |

|

|

FG Group Holdings Inc. and Subsidiaries |

|

Consolidated Statements of Operations |

|

(In thousands, except per share amounts) |

|

|

|

|

Three Months Ended December 31, |

|

Years Ended December 31, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

|

Net product sales |

$ |

8,043 |

|

|

$ |

7,820 |

|

|

$ |

30,119 |

|

|

$ |

19,631 |

|

|

Net service revenues |

|

3,751 |

|

|

|

2,229 |

|

|

|

11,118 |

|

|

|

7,399 |

|

|

Total net revenues |

|

11,794 |

|

|

|

10,049 |

|

|

|

41,237 |

|

|

|

27,030 |

|

|

Cost of products sold |

|

5,812 |

|

|

|

6,247 |

|

|

|

22,729 |

|

|

|

14,078 |

|

|

Cost of services |

|

2,737 |

|

|

|

1,664 |

|

|

|

7,592 |

|

|

|

4,742 |

|

|

Total cost of revenues |

|

8,549 |

|

|

|

7,911 |

|

|

|

30,321 |

|

|

|

18,820 |

|

|

Gross profit |

|

3,245 |

|

|

|

2,138 |

|

|

|

10,916 |

|

|

|

8,210 |

|

|

Selling and administrative expenses: |

|

|

|

|

|

|

|

|

Selling |

|

537 |

|

|

|

625 |

|

|

|

2,261 |

|

|

|

1,783 |

|

|

Administrative |

|

2,655 |

|

|

|

2,753 |

|

|

|

10,541 |

|

|

|

9,527 |

|

|

Total selling and administrative expenses |

|

3,192 |

|

|

|

3,378 |

|

|

|

12,802 |

|

|

|

11,310 |

|

|

Loss on disposal of assets |

|

(474 |

) |

|

|

(38 |

) |

|

|

(474 |

) |

|

|

(38 |

) |

|

Loss from operations |

|

(421 |

) |

|

|

(1,278 |

) |

|

|

(2,360 |

) |

|

|

(3,138 |

) |

|

Other income (expense): |

|

|

|

|

|

|

|

|

Interest income |

|

- |

|

|

|

21 |

|

|

|

7 |

|

|

|

75 |

|

|

Interest expense |

|

(109 |

) |

|

|

(24 |

) |

|

|

(347 |

) |

|

|

(308 |

) |

|

Foreign currency transaction (loss) income |

|

(118 |

) |

|

|

(10 |

) |

|

|

264 |

|

|

|

(67 |

) |

|

(Loss) gain on equity holdings |

|

(716 |

) |

|

|

2,208 |

|

|

|

(4,468 |

) |

|

|

12,273 |

|

|

Other income (loss), net |

|

7 |

|

|

|

(15 |

) |

|

|

(180 |

) |

|

|

143 |

|

|

Total other (loss) income |

|

(936 |

) |

|

|

2,180 |

|

|

|

(4,724 |

) |

|

|

12,116 |

|

|

(Loss) income from continuing operations before income taxes and

equity method holdings income (loss) |

|

(1,357 |

) |

|

|

902 |

|

|

|

(7,084 |

) |

|

|

8,978 |

|

|

Income tax expense |

|

(181 |

) |

|

|

(448 |

) |

|

|

(473 |

) |

|

|

(3,236 |

) |

|

Equity method holding income (loss) |

|

2,981 |

|

|

|

(903 |

) |

|

|

403 |

|

|

|

(2,371 |

) |

| Net income (loss) from

continuing operations |

|

1,443 |

|

|

|

(449 |

) |

|

|

(7,154 |

) |

|

|

3,371 |

|

| Net (loss) income from

discontinued operations |

|

- |

|

|

|

(83 |

) |

|

|

- |

|

|

|

14,566 |

|

| Net income (loss) |

$ |

1,443 |

|

|

$ |

(532 |

) |

|

$ |

(7,154 |

) |

|

$ |

17,937 |

|

| |

|

|

|

|

|

|

|

|

Basic net income (loss) per share |

|

|

|

|

|

|

|

| Continuing operations |

$ |

0.07 |

|

|

$ |

(0.03 |

) |

|

$ |

(0.37 |

) |

|

$ |

0.19 |

|

| Discontinued operations |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

0.81 |

|

|

Basic net income (loss) per share |

$ |

0.07 |

|

|

$ |

(0.03 |

) |

|

$ |

(0.37 |

) |

|

$ |

1.00 |

|

| |

|

|

|

|

|

|

|

|

Diluted net income (loss) per share |

|

|

|

|

|

|

|

| Continuing operations |

$ |

0.07 |

|

|

$ |

(0.03 |

) |

|

$ |

(0.37 |

) |

|

$ |

0.19 |

|

| Discontinued operations |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

0.80 |

|

|

Diluted net income (loss) per share |

$ |

0.07 |

|

|

$ |

(0.03 |

) |

|

$ |

(0.37 |

) |

|

$ |

0.99 |

|

|

FG Group Holdings Inc. and Subsidiaries |

|

Condensed Consolidated Statements of Cash

Flows |

|

(In thousands) |

|

(Unaudited) |

|

|

|

|

|

| |

Years Ended December 31, |

|

|

|

2022 |

|

|

|

2021 |

|

| Cash flows from operating

activities: |

|

|

|

|

Net (loss) income from continuing operations |

$ |

(7,154 |

) |

|

$ |

3,371 |

|

|

Adjustments to reconcile net (loss) income from continuing

operations to net cash (used in) provided by operating

activities: |

|

|

|

|

Recovery of doubtful accounts |

|

(30 |

) |

|

|

(263 |

) |

|

Provision for obsolete inventory |

|

49 |

|

|

|

95 |

|

|

Provision for warranty |

|

303 |

|

|

|

140 |

|

|

Depreciation and amortization |

|

1,397 |

|

|

|

1,306 |

|

|

Amortization and accretion of operating leases |

|

195 |

|

|

|

828 |

|

|

Equity method holding (income) loss |

|

(403 |

) |

|

|

2,371 |

|

|

Loss (gain) on equity holdings |

|

4,468 |

|

|

|

(10,584 |

) |

|

Adjustment to SageNet promissory note in connection with

prepayment |

|

202 |

|

|

|

- |

|

|

Loss on disposal of assets |

|

474 |

|

|

|

38 |

|

|

Deferred income taxes |

|

(653 |

) |

|

|

2,511 |

|

|

Stock-based compensation expense |

|

652 |

|

|

|

892 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Accounts receivable |

|

(1,614 |

) |

|

|

1,126 |

|

|

Inventories |

|

(309 |

) |

|

|

(1,095 |

) |

|

Current income taxes |

|

329 |

|

|

|

38 |

|

|

Other assets |

|

2,245 |

|

|

|

(2,072 |

) |

|

Accounts payable and accrued expenses |

|

(2,054 |

) |

|

|

2,095 |

|

|

Deferred revenue and customer deposits |

|

(1,476 |

) |

|

|

1,637 |

|

|

Operating lease obligations |

|

(193 |

) |

|

|

(822 |

) |

|

Net cash (used in) provided by operating activities from continuing

operations |

|

(3,572 |

) |

|

|

1,612 |

|

|

Net cash provided by operating activities from discontinued

operations |

|

- |

|

|

|

427 |

|

|

Net cash (used in) provided by operating activities |

|

(3,572 |

) |

|

|

2,039 |

|

| |

|

|

|

| Cash flows from investing

activities: |

|

|

|

|

Capital expenditures |

|

(915 |

) |

|

|

(1,527 |

) |

|

Acquisition of programming rights |

|

(459 |

) |

|

|

- |

|

|

Sale of equity holdings |

|

498 |

|

|

|

|

Purchase of common shares of FG Financial Group, Inc. |

|

(2,000 |

) |

|

|

- |

|

|

Receipt of SageNet promissory note |

|

2,300 |

|

|

|

|

Exercise of GreenFirst Forest Products, Inc. rights |

|

- |

|

|

|

(9,981 |

) |

|

Exercise of FG Financial Group, Inc. rights |

|

- |

|

|

|

(2,400 |

) |

|

Net cash used in investing activities from continuing

operations |

|

(576 |

) |

|

|

(13,908 |

) |

|

Net cash provided by investing activities from discontinued

operations |

|

- |

|

|

|

12,761 |

|

|

Net cash used in investing activities |

|

(576 |

) |

|

|

(1,147 |

) |

| |

|

|

|

| Cash flows from financing

activities: |

|

|

|

|

Principal payments on short-term debt |

|

(697 |

) |

|

|

(728 |

) |

|

Principal payments on long-term debt |

|

(164 |

) |

|

|

- |

|

|

Proceeds from stock issuance, net of costs |

|

- |

|

|

|

6,310 |

|

|

Payments of withholding taxes related to net share settlement of

equity awards |

|

(27 |

) |

|

|

(80 |

) |

|

Proceeds from exercise of stock options |

|

- |

|

|

|

9 |

|

|

Payments on capital lease obligations |

|

(36 |

) |

|

|

(2,106 |

) |

|

Net cash (used in) provided by financing activities from continuing

operations |

|

(924 |

) |

|

|

3,405 |

|

|

Net cash used in financing activities from discontinued

operations |

|

- |

|

|

|

(155 |

) |

|

Net cash (used in) provided by financing activities |

|

(924 |

) |

|

|

3,250 |

|

|

Effect of exchange rate changes on cash and cash equivalents |

|

(20 |

) |

|

|

(48 |

) |

|

Net decrease in cash and cash equivalents and restricted cash from

continuing operations |

|

(5,092 |

) |

|

|

(8,939 |

) |

|

Net increase in cash and cash equivalents and restricted cash from

discontinued operations |

|

- |

|

|

|

13,033 |

|

|

Net (decrease) increase in cash and cash equivalents and restricted

cash |

|

(5,092 |

) |

|

|

4,094 |

|

| Cash and cash equivalents and

restricted cash at beginning of year |

|

8,881 |

|

|

|

4,787 |

|

| Cash and cash equivalents and

restricted cash at end of year |

$ |

3,789 |

|

|

$ |

8,881 |

|

|

FG Group Holdings Inc. and Subsidiaries |

|

Summary by Business Segments |

|

(In thousands) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended December 31, |

Years Ended December 31, |

|

|

|

|

2022 |

|

|

|

2021 |

|

|

2022 |

|

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

| Strong

Entertainment |

|

|

|

|

|

|

|

|

Revenue |

|

$ |

11,421 |

|

|

$ |

9,766 |

|

$ |

39,867 |

|

|

$ |

25,886 |

|

|

Gross profit |

|

|

2,872 |

|

|

|

1,855 |

|

|

9,546 |

|

|

|

7,283 |

|

|

Operating income |

|

|

1,238 |

|

|

|

61 |

|

|

2,761 |

|

|

|

2,211 |

|

|

Adjusted EBITDA |

|

|

1,345 |

|

|

|

189 |

|

|

3,184 |

|

|

|

1,245 |

|

| |

|

|

|

|

|

|

|

| Corporate and

Other |

|

|

|

|

|

|

|

|

Revenue |

|

$ |

373 |

|

|

$ |

283 |

|

$ |

1,370 |

|

|

$ |

1,144 |

|

|

Gross profit |

|

|

373 |

|

|

|

283 |

|

|

1,370 |

|

|

|

927 |

|

|

Operating loss |

|

|

(1,659 |

) |

|

|

(1,339 |

) |

|

(5,121 |

) |

|

|

(5,349 |

) |

|

Adjusted EBITDA |

|

|

(784 |

) |

|

|

(913 |

) |

|

(2,978 |

) |

|

|

(3,957 |

) |

| |

|

|

|

|

|

|

|

|

Consolidated |

|

|

|

|

|

|

|

|

Revenue |

|

$ |

11,794 |

|

|

$ |

10,049 |

|

$ |

41,237 |

|

|

$ |

27,030 |

|

|

Gross profit |

|

|

3,245 |

|

|

|

2,138 |

|

|

10,916 |

|

|

|

8,210 |

|

|

Operating loss |

|

|

(421 |

) |

|

|

(1,278 |

) |

|

(2,360 |

) |

|

|

(3,138 |

) |

|

Adjusted EBITDA |

|

|

561 |

|

|

|

(724 |

) |

|

206 |

|

|

|

(2,712 |

) |

|

FG Group Holdings Inc. and Subsidiaries |

|

Reconciliation of Net Income (Loss) to Adjusted

EBITDA |

|

(In thousands) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

| |

Three Months Ended December 31, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Strong Entertainment |

Corporate and Other |

Discontinued Operations |

Consolidated |

|

Strong Entertainment |

Corporate and Other |

Discontinued Operations |

Consolidated |

|

Net income (loss) |

$ |

424 |

$ |

1,020 |

|

$ |

- |

$ |

1,444 |

|

|

$ |

773 |

|

$ |

(1,222 |

) |

$ |

(83 |

) |

$ |

(532 |

) |

|

Net loss from discontinued operations |

|

- |

|

- |

|

|

- |

|

- |

|

|

|

- |

|

|

- |

|

|

83 |

|

|

83 |

|

|

Net income (loss) from continuing operations |

|

424 |

|

1,020 |

|

|

- |

|

1,444 |

|

|

|

773 |

|

|

(1,222 |

) |

|

- |

|

|

(449 |

) |

|

Interest expense (income), net |

|

53 |

|

56 |

|

|

- |

|

109 |

|

|

|

23 |

|

|

(20 |

) |

|

- |

|

|

3 |

|

|

Income tax expense |

|

127 |

|

54 |

|

|

- |

|

181 |

|

|

|

350 |

|

|

98 |

|

|

- |

|

|

448 |

|

|

Depreciation and amortization |

|

176 |

|

182 |

|

|

- |

|

358 |

|

|

|

223 |

|

|

103 |

|

|

- |

|

|

326 |

|

|

EBITDA |

|

780 |

|

1,312 |

|

|

- |

|

2,092 |

|

|

|

1,369 |

|

|

(1,041 |

) |

|

- |

|

|

328 |

|

|

Stock-based compensation expense |

|

- |

|

142 |

|

|

- |

|

142 |

|

|

|

- |

|

|

205 |

|

|

- |

|

|

205 |

|

|

Equity method holdings (income) loss |

|

- |

|

(2,981 |

) |

|

- |

|

(2,981 |

) |

|

|

- |

|

|

903 |

|

|

- |

|

|

903 |

|

|

Loss (gain) on equity holdings |

|

447 |

|

269 |

|

|

- |

|

716 |

|

|

|

(1,190 |

) |

|

(1,018 |

) |

|

- |

|

|

(2,208 |

) |

|

Loss on disposal of assets and impairment charges |

|

- |

|

474 |

|

|

- |

|

474 |

|

|

|

- |

|

|

38 |

|

|

|

38 |

|

|

Foreign currency transaction loss |

|

118 |

|

- |

|

|

- |

|

118 |

|

|

|

10 |

|

|

- |

|

|

- |

|

|

10 |

|

|

Adjusted EBITDA |

$ |

1,345 |

$ |

(784 |

) |

$ |

- |

$ |

561 |

|

|

$ |

189 |

|

$ |

(913 |

) |

$ |

- |

|

$ |

(724 |

) |

| |

Years Ended Ended

December 31, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Strong Entertainment |

Corporate and Other |

Discontinued Operations |

Consolidated |

|

Strong Entertainment |

Corporate and Other |

Discontinued Operations |

Consolidated |

|

Net income (loss) |

$ |

98 |

|

$ |

(7,252 |

) |

$ |

- |

$ |

(7,154 |

) |

|

$ |

8,492 |

|

$ |

(5,121 |

) |

$ |

14,566 |

|

$ |

17,937 |

|

|

Net income from discontinued operations |

|

- |

|

|

- |

|

|

- |

|

- |

|

|

|

- |

|

|

- |

|

|

(14,566 |

) |

|

(14,566 |

) |

|

Net income (loss) from continuing operations |

|

98 |

|

|

(7,252 |

) |

|

- |

|

(7,154 |

) |

|

|

8,492 |

|

|

(5,121 |

) |

|

- |

|

|

3,371 |

|

|

Interest expense, net |

|

143 |

|

|

197 |

|

|

- |

|

340 |

|

|

|

107 |

|

|

126 |

|

|

- |

|

|

233 |

|

|

Income tax expense |

|

369 |

|

|

104 |

|

|

- |

|

473 |

|

|

|

2,755 |

|

|

481 |

|

|

- |

|

|

3,236 |

|

|

Depreciation and amortization |

|

697 |

|

|

700 |

|

|

- |

|

1,397 |

|

|

|

910 |

|

|

401 |

|

|

- |

|

|

1,311 |

|

|

EBITDA |

|

1,307 |

|

|

(6,251 |

) |

|

- |

|

(4,944 |

) |

|

|

12,264 |

|

|

(4,113 |

) |

|

- |

|

|

8,151 |

|

|

Stock-based compensation expense |

|

- |

|

|

652 |

|

|

- |

|

652 |

|

|

|

- |

|

|

892 |

|

|

- |

|

|

892 |

|

|

Equity method holdings (income) loss |

|

- |

|

|

(403 |

) |

|

- |

|

(403 |

) |

|

|

1,150 |

|

|

1,221 |

|

|

- |

|

|

2,371 |

|

|

Employee retention credit |

|

- |

|

|

- |

|

|

- |

|

- |

|

|

|

(1,576 |

) |

|

(336 |

) |

|

- |

|

|

(1,912 |

) |

|

Loss (gain) on equity holdings |

|

2,142 |

|

|

2,326 |

|

|

- |

|

4,468 |

|

|

|

(10,527 |

) |

|

(1,746 |

) |

|

- |

|

|

(12,273 |

) |

|

Loss on disposal of assets and impairment charges |

|

- |

|

|

474 |

|

|

- |

|

474 |

|

|

|

- |

|

|

38 |

|

|

|

38 |

|

|

Foreign currency transaction (income) loss |

|

(265 |

) |

|

1 |

|

|

- |

|

(264 |

) |

|

|

67 |

|

|

- |

|

|

- |

|

|

67 |

|

|

Gain on property and casualty insurance recoveries |

|

- |

|

|

- |

|

|

- |

|

- |

|

|

|

(148 |

) |

|

- |

|

|

- |

|

|

(148 |

) |

|

Severance and other |

|

- |

|

|

222 |

|

|

- |

|

222 |

|

|

|

15 |

|

|

87 |

|

|

- |

|

|

102 |

|

|

Adjusted EBITDA |

$ |

3,184 |

|

$ |

(2,978 |

) |

$ |

- |

$ |

205 |

|

|

$ |

1,245 |

|

$ |

(3,957 |

) |

$ |

- |

|

$ |

(2,712 |

) |

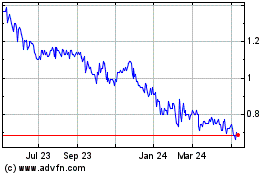

GreenFirst Forest Products (TSX:GFP)

Historical Stock Chart

From Oct 2024 to Nov 2024

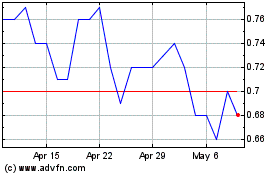

GreenFirst Forest Products (TSX:GFP)

Historical Stock Chart

From Nov 2023 to Nov 2024