Knight Therapeutics Inc. (TSX: GUD) ("Knight" or “the Company”), a

leading pan- American (ex-US) specialty pharmaceutical company,

today reported financial results for its second quarter ended June

30, 2024. All currency amounts are in thousands except for share

and per share amounts. All currencies are Canadian unless otherwise

specified.

Q2 2024

Highlights

Financial Results

- Delivered record revenues of $95,573, an increase of $5,668 or

6% over the same period in prior year driven by growth of our key

promoted products partly offset by our mature products.

- Gross margin of $47,337 or 50% of revenues compared to $37,493

or 42% of revenues in the same period in prior year.

- Adjusted EBITDA1 was $15,744, an increase of $1,475 or 10% over

the same period in prior year.

- Adjusted EBITDA per share1 of $0.16, an increase of $0.03 or

23% over the same period in prior year.

- Net loss was $1,942, compared to net income of $1,840 in the

same period in the prior year.

- Cash outflow from operations was $1,086, compared to $1,486 in

the same period in prior year.

Corporate Developments

- Completed the NCIB launched in July

2023 with a total purchase of 5,999,524 shares at an average price

of $4.87 for aggregate cash consideration of $29,231.

- Shareholders re-elected Jonathan Ross Goodman, Samira Sakhia,

James C. Gale, Robert N. Lande, Michael J. Tremblay, Nicolás Sujoy

and Janice Murray on the Board of Directors.

Products

- Entered into an exclusive supply and

distribution agreement for Jornay PM™ (methylphenidate HCI

extended-release capsules) for Canada and Latin America.

Subsequent to

quarter-end

- Launched a NCIB in July to purchase

up to 5,312,846 common shares of the Company over the next

year.

“I am excited to report that for the six months

ended June 30, 2024, we delivered record revenues of over $180

million and adjusted EBITDA of over $29 million. This strong

performance is the result of the growth of our key promoted

products and of our commercial execution across Canada and Latin

America. In addition, we have expanded and strengthened our

pipeline and will be leveraging our existing neurology

infrastructure with the in-licensing of Jornay PMTM, our third

neurology product added in the last nine months,” said Samira

Sakhia, President and Chief Executive Officer of Knight

Therapeutics Inc.

1 Adjusted EBITDA and Adjusted EBITDA per share are non-GAAP

measures. Refer to section Non-GAAP measures for additional

details.

|

SELECTED FINANCIAL RESULTS REPORTED UNDER IFRS[In

thousands of Canadian dollars] |

|

|

|

|

Change |

|

|

Change |

|

|

Q2-24 |

Q2-23 |

$1 |

|

%2 |

YTD-24 |

YTD-23 |

$1 |

|

%2 |

|

Revenues |

95,573 |

89,905 |

5,668 |

|

6 % |

182,177 |

172,502 |

9,675 |

|

6% |

|

Gross margin |

47,337 |

37,493 |

9,844 |

|

26% |

89,036 |

78,255 |

10,781 |

|

14% |

|

Gross margin % |

50% |

42% |

|

|

|

49% |

45% |

|

|

|

|

Selling and marketing |

13,264 |

12,874 |

(390 |

) |

3% |

25,913 |

23,539 |

(2,374 |

) |

10% |

|

General and administrative |

12,099 |

9,119 |

(2,980 |

) |

33% |

22,637 |

18,225 |

(4,412 |

) |

24% |

|

Research and development |

5,806 |

4,336 |

(1,470 |

) |

34% |

10,786 |

8,523 |

(2,263 |

) |

27% |

|

Amortization of intangible assets |

11,674 |

11,274 |

(400 |

) |

4% |

22,546 |

22,445 |

(101 |

) |

—% |

|

Operating expenses |

42,843 |

37,603 |

(5,240 |

) |

14% |

81,882 |

72,732 |

(9,150 |

) |

13% |

|

Operating income (loss) |

4,494 |

(110) |

4,604 |

|

4185% |

7,154 |

5,523 |

1,631 |

|

30% |

|

Net (loss) income |

(1,942) |

1,840 |

(3,782 |

) |

206% |

(6,488) |

(2,097) |

(4,391 |

) |

209% |

1 A positive variance represents a positive impact to net income

(loss) and a negative variance represents a negative impact to net

income (loss)2 Percentage change is presented in absolute

values

|

SELECTED FINANCIAL RESULTS EXCLUDING IAS 291[In

thousands of Canadian dollars] |

|

|

|

|

Change |

|

|

Change |

|

|

Q2-24 |

Q2-23 |

$ |

|

% |

YTD-24 |

YTD-23 |

$ |

|

% |

|

Revenues |

94,121 |

90,400 |

3,721 |

|

4% |

179,917 |

173,067 |

6,850 |

|

4% |

|

Gross margin |

45,281 |

40,244 |

5,037 |

|

13% |

85,977 |

81,630 |

4,347 |

|

5% |

|

Gross margin % |

48% |

45% |

|

|

|

48% |

47% |

|

|

|

Selling and marketing |

12,968 |

12,985 |

(17 |

) |

—% |

25,461 |

23,698 |

1,763 |

|

7% |

|

General and administrative |

11,578 |

9,188 |

2,390 |

|

26% |

21,790 |

18,075 |

3,715 |

|

21% |

|

Research and development |

5,577 |

4,623 |

954 |

|

21% |

10,417 |

8,725 |

1,692 |

|

19% |

|

Amortization of intangible assets |

11,699 |

11,189 |

510 |

|

5% |

22,545 |

22,314 |

231 |

|

1% |

|

Operating expenses |

41,822 |

37,985 |

3,837 |

|

10% |

80,213 |

72,812 |

7,401 |

|

10% |

|

EBITDA1 |

15,641 |

14,269 |

1,372 |

|

10% |

29,230 |

32,506 |

(3,276 |

) |

10% |

|

Adjusted EBITDA1 |

15,744 |

14,269 |

1,475 |

|

10% |

29,333 |

32,506 |

(3,173 |

) |

10% |

|

Adjusted EBITDA per share1 |

0.16 |

0.13 |

0.03 |

|

23% |

0.29 |

0.30 |

(0.01 |

) |

3% |

1 Financial results excluding the impact of IAS 29, EBITDA,

adjusted EBITDA and adjusted EBITDA per share are non-GAAP

measures. Refer to section “Non- GAAP measures” for additional

details.

RevenuesFor the quarter ended

June 30, 2024, revenues excluding the impact of IAS 29 were $94,121

an increase of $3,721 or 4% mainly driven by a growth of $7,125 or

11% from our key promoted products offset by a decline in our

mature products. The table below provides revenues by therapeutic

area.

|

|

Excluding the impact of IAS 291 |

|

|

|

|

Change |

|

Therapeutic Area |

Q2-24 |

Q2-23 |

$ |

|

% |

|

Oncology/Hematology |

35,625 |

27,935 |

7,690 |

|

28% |

|

Infectious Diseases |

37,824 |

45,567 |

(7,743 |

) |

17% |

|

Other Specialty |

20,672 |

16,898 |

3,774 |

|

22% |

|

Total |

94,121 |

90,400 |

3,721 |

|

4% |

1 Revenues excluding the impact of IAS 29 is a

non-GAAP measure, refer to section “Non-GAAP measures” for

additional details.

The increase in revenues is explained by the

following:

-

Oncology/Hematology: The oncology/hematology

portfolio grew by $7,690 due to the continued growth of key

promoted products including Lenvima®, Akynzeo®, Trelstar® and the

launch of Minjuvi® in Brazil.

-

Infectious Diseases: The infectious diseases

portfolio decreased by $7,743 driven mainly by the timing of orders

for Ambisome® under the MOH contract, a decrease in the demand of

Impavido® partly offset by the growth of our key promoted products

including Cresemba® and timing of orders for certain products.

During Q2-24 the Company delivered $8,900 of Ambisome® to MOH

compared to $18,000 in Q2-23.

- MOH

Contract: The Company signed a contract with the Ministry

of Health of Brazil for Ambisome® in December 2022 ("2022 MOH

Contract"). Knight delivered a total of $34,600 under the 2022 MOH

Contract as follows: $7,000 in 2022, $25,200 in 2023 ($2,400 in

Q1-23, $18,000 in Q2-23 and $4,800 in Q4-23) and $2,400 Q1-24. In

December 2023, Knight signed a new contract with the MOH ("2024 MOH

Contract") and delivered $6,800 in Q1-24 and $8,900 in Q2-24. The

total MOH sales Ambisome® delivered in Q2-24 and YTD-24 was $8,900

and $18,100, respectively.

-

Other Specialty: The other

specialty portfolio increased by $3,774, primarily driven by the

commercial transition of Exelon® from Novartis to Knight. As a

result of advanced purchases by certain customers in Q1-23, the

revenues of Exelon® were negatively impacted in Q2-23.

Gross

marginExcluding the impact of IAS 29, gross margin

as a percentage of revenues was 48% in Q2-24 compared to 45% in

Q2-23. The increase in the Q2-24 gross margin, as a percentage of

revenues, was due to product mix including a lower proportion of

Ambisome® sales to MOH.

Selling and

marketing ("S&M")

expenses: For the quarter ended June 30, 2024

S&M expenses excluding the impact of IAS 29, were $12,968 in

Q2-24 compared to $12,985 in Q2-23, a decrease of $17. There was no

significant variance.

General and

administrative ("G&A")

expenses: For the quarter ended June 30, 2024

G&A expenses excluding the impact of IAS 29, were $11,578 in

Q2-24 compared to $9,188 in Q2-23, an increase of $2,390 or 26%.

The increase was mainly driven by an increase in structure and

compensation expenses.

Research and

development ("R&D")

expenses: For the quarter ended June 30, 2024

R&D expenses excluding the impact of IAS 29, were $5,577 in

Q2-24 compared to 4,623 in Q2-23, an increase of $954 or 21%.

The increase was driven by an increase in product development

activities in connection with our pipeline products and medical

initiatives related to key promoted products. Knight invested $815

in Q2-24, an increase of $795 versus the prior year on its pipeline

development activities. All costs related to development activities

have been expensed which typically include regulatory submissions,

analytical method transfers, stability studies and bio equivalence

studies.

Adjusted

EBITDAFor the quarter ended June 30, 2024,

adjusted EBITDA increased by $1,475 or 10%. The increase was driven

by a higher gross margin partly offset by higher G&A expenses,

mainly related to structure and compensation increase and an

increase in R&D expenses mainly due to an increase in our

product development activities behind our pipeline.

|

SELECT BALANCE SHEET ITEMS[In

thousands of

Canadian dollars] |

|

|

June

30,2024 |

December

31,2023 |

Change |

|

|

$ |

|

% |

|

Cash, cash equivalents and marketable securities |

152,668 |

161,825 |

(9,157 |

) |

6% |

|

Trade and other receivables |

135,203 |

141,684 |

(6,481 |

) |

5% |

|

Inventories |

103,645 |

91,834 |

11,811 |

|

13% |

|

Financial assets |

115,728 |

128,369 |

(12,641 |

) |

10% |

|

Accounts payable and accrued liabilities |

84,821 |

90,617 |

(5,796 |

) |

6% |

|

Bank loans |

50,952 |

61,866 |

(10,914 |

) |

18% |

Cash, cash equivalents and marketable

securities: As at June 30, 2024, Knight had $152,668 in

cash, cash equivalents and marketable securities, a decrease of

$9,157 or 6% as compared to December 31, 2023. The decrease is

mainly due to the settlement of upfront and milestone payments in

connection with product licensing agreements including Qelbree™,

IPX203, Jornay PM™ and Cresemba®, principal and interest

payments on bank loans and repurchase of shares through the NCIB,

partly offset by the cash inflows from operations. The cash inflows

from operating activities were $29,795 driven by the operating

results adjusted for noncash items such as depreciation,

amortization as well as decrease in working capital of $3,576. The

decrease in working capital was mainly due to a decrease in

accounts receivable driven by the timing of collections from

customers and an increase in inventory excluding the impact of IAS

29 driven by the timing of sales and purchases of inventory.

Bank loans: As at June 30,

2024, bank loans were at $50,952, a decrease of $10,914 or 18% as

compared December 31, 2023 due to principal repayments of bank

loans as well as the depreciation of the Brazilian Real and

Colombian Pesos.

Corporate Updates

NCIB

On July 11, 2024, the Company announced that the

Toronto Stock Exchange approved its notice of intention to launch a

NCIB (“2024 NCIB”). Under the terms of the 2024 NCIB, Knight may

purchase for cancellation up to 5,312,846 common shares of the

Company which represented 10% of its public float as at June 30,

2024. The 2024 NCIB commenced on July 15, 2024 and will end on the

earlier of July 14, 2025 or when the Company completes its maximum

purchases under the NCIB. Furthermore, Knight entered into an

agreement with a broker to facilitate purchases of its common

shares under the NCIB.

During the three-month period ended June 30,

2024, the Company purchased 205,661 common shares at an average

price of $6.04 for aggregate cash consideration of $1,242 under the

2023 NCIB. Subsequent to the quarter-end up to July 31, 2024, the

Company purchased an additional 165,000 common shares at an average

purchase price of $5.67 for an aggregate cash consideration of

$936.

The Company has purchased an aggregate of 42.5 million shares at

an average price of $5.70 since the launch of its share buy back

program in 2019.

Financial Outlook

Update

Financial Outlook

Knight provides guidance on revenues on a non-GAAP basis. This

is due to both the difficulty in predicting Argentinian inflation

rates and its IAS 29 impact.

For fiscal 2024, Knight has increased its

financial guidance on revenues and now expects to generate between

$355 million to $365 million in revenues up from $335 to

$350 million. The adjusted EBITDA1 is expected to be approximately

16% of revenues. The change in the financial outlook is primarily

due to an improvement in forecasted LATAM currencies against the

Canadian dollar as well as an acceleration of investments on our

pipeline products. The guidance is based on a number of

assumptions, including but not limited to the following:

- no revenues or expenses for business

development transactions not completed as at August 7, 2024

- no unforeseen termination to our

license, distribution & supply agreements

- no interruptions in supply whether

due to global supply chain disruptions or general manufacturing

issues

- no new generic entrants on our key

pharmaceutical brands

- no unforeseen changes to government

mandated pricing regulations

- successful commercial execution on

product listing arrangements with HMOs, insurers, key accounts, and

public payers

- successful execution and uptake of

newly launched products

- no material increase in provisions

for inventory or trade receivables

- no significant variations of

forecasted foreign currency exchange rates

- inflation remaining within

forecasted ranges

Should any of the assumptions differ, the financial outlook and

the actual results may vary materially. Refer to the risks and

assumptions referred to in the Forward-Looking Statements section

of this news release for further details.

1 Revenues excluding the impact of IAS 29 and adjusted EBITDA

are a non-GAAP measure. Refer to the definitions in section

“Non-GAAP measures” for additional details.

Conference Call

Notice

Knight will host a conference call and audio webcast to discuss

its second quarter ended June 30, 2024, today at 8:30 am ET. Knight

cordially invites all interested parties to participate in this

call.

Date: Thursday, August 8,

2024Time: 8:30 a.m. ETTelephone:

Toll Free: 1-800-836-8184 or International

1-289-819-1350Webcast: www.knighttx.com or

WebcastThis is a listen-only audio webcast. Media Player is

required to listen to the broadcast.

Replay: An archived replay will be available

for 30 days at www.knighttx.com

About Knight

Therapeutics Inc.

Knight Therapeutics Inc., headquartered in

Montreal, Canada, is a specialty pharmaceutical company focused on

acquiring or in-licensing and commercializing pharmaceutical

products for Canada and Latin America. Knight's Latin American

subsidiaries operate under United Medical, Biotoscana Farma and

Laboratorio LKM. Knight Therapeutics Inc.'s shares trade on TSX

under the symbol GUD. For more information about Knight

Therapeutics Inc., please visit the Company's web site at

www.knighttx.com or www.sedarplus.ca.

Forward-Looking Statement

This document contains forward-looking

statements for Knight Therapeutics Inc. and its subsidiaries. These

forward-looking statements, by their nature, necessarily involve

risks and uncertainties that could cause actual results to differ

materially from those contemplated by the forward-looking

statements. Knight Therapeutics Inc. considers the assumptions on

which these forward-looking statements are based to be reasonable

at the time they were prepared but cautions the reader that these

assumptions regarding future events, many of which are beyond the

control of Knight Therapeutics Inc. and its subsidiaries, may

ultimately prove to be incorrect. Factors and risks, which could

cause actual results to differ materially from current expectations

are discussed in Knight Therapeutics Inc.'s Annual Report and in

Knight Therapeutics Inc.'s Annual Information Form for the year

ended December 31, 2023 as filed on www.sedarplus.ca. Knight

Therapeutics Inc. disclaims any intention or obligation to update

or revise any forward-looking statements whether because of new

information or future events, except as required by law.

CONTACT

INFORMATION:

|

Investor Contact: |

|

| Knight Therapeutics Inc. |

|

| Samira Sakhia |

Arvind Utchanah |

| President & Chief Executive Officer |

Chief Financial Officer |

| T: 514.484.4483 |

T. +598.2626.2344 |

| F: 514.481.4116 |

|

| Email: IR@knighttx.com |

Email: IR@knighttx.com |

| Website: www.knighttx.com |

Website: www.knighttx.com |

NON-GAAP

MEASURES[In thousands of Canadian dollars]

The Company discloses non-GAAP measures and

ratios that do not have standardized meanings prescribed by IFRS.

The Company believes that shareholders, investment analysts and

other readers find such measures helpful in understanding the

Company’s financial performance. Non-GAAP financial measures and

adjusted EBITDA per share ratio do not have any standardized

meaning prescribed by IFRS and may not have been calculated in the

same way as similarly named financial measures presented by other

companies.

The Company uses the following non-GAAP

measures.

Revenues and

Financial results

excluding the

impact of

hyperinflation under

IAS 29

The Company applies IAS 29, Financial Reporting

in Hyperinflation Economies, as the Company's Argentine

subsidiaries used the Argentine Peso as their functional currency.

IAS 29 requires that the financial statements of an entity whose

functional currency is the currency of a hyperinflationary economy

be adjusted based on an appropriate general price index to express

the effects of inflation.

Revenues and financial results under IFRS are

adjusted to remove the impact of hyperinflation under IAS 29. The

impact of hyperinflation under IAS 29 is calculated by applying an

appropriate general price index to express the effects of

inflation. After applying the effects of translation, the statement

of income is converted using the closing foreign exchange rate of

the month.

Revenues and financial results excluding the

impact of hyperinflation under IAS 29 allow results to be viewed

without the impact of IAS 29 thereby facilitating the comparison of

results period over period. The presentation of revenues and

financial results excluding the impact of hyperinflation under IAS

29 is considered to be a non-GAAP measure and does not have any

standardized meaning under GAAP. As a result, the information

presented may not be comparable to similar measures presented by

other companies.

The following tables are reconciliations of

financial results under IFRS to financial results excluding the

impact of hyperinflation under IAS 29.

|

|

Q2-24 |

YTD-24 |

|

|

Reported under IFRS |

IAS 29 Adjustment |

|

Excluding the Impact

of IAS

29 |

Reported under IFRS |

IAS 29 Adjustment |

|

Excluding the Impact

of IAS

29 |

|

Revenues |

95,573 |

(1,452 |

) |

94,121 |

182,177 |

(2,260 |

) |

179,917 |

|

Cost of goods sold |

48,236 |

604 |

|

48,840 |

93,141 |

799 |

|

93,940 |

|

Gross margin |

47,337 |

(2,056 |

) |

45,281 |

89,036 |

(3,059 |

) |

85,977 |

|

Gross margin (%) |

50% |

|

|

48% |

49% |

|

|

48% |

|

Expenses |

|

|

|

|

|

|

|

|

|

Selling and marketing |

13,264 |

(296 |

) |

12,968 |

25,913 |

(452 |

) |

25,461 |

|

General and administrative |

12,099 |

(521 |

) |

11,578 |

22,637 |

(847 |

) |

21,790 |

|

Research and development |

5,806 |

(229 |

) |

5,577 |

10,786 |

(369 |

) |

10,417 |

|

Amortization of intangible assets |

11,674 |

25 |

|

11,699 |

22,546 |

(1 |

) |

22,545 |

|

Operating income

(loss) |

4,494 |

(1,035 |

) |

3,459 |

7,154 |

(1,390 |

) |

5,764 |

|

|

Q2-23 |

YTD-23 |

|

|

Reported under IFRS |

IAS 29Adjustment |

Excluding the Impact of IAS 29 |

Reported under IFRS |

IAS 29Adjustment |

Excluding the Impact of IAS 29 |

|

Revenues |

89,905 |

495 |

90,400 |

172,502 |

565 |

173,067 |

|

Cost of goods sold |

52,412 |

(2,256) |

50,156 |

94,247 |

(2,810) |

91,437 |

|

Gross margin |

37,493 |

2,751 |

40,244 |

78,255 |

3,375 |

81,630 |

|

Gross margin (%) |

42% |

|

45% |

45% |

|

47% |

|

Expenses |

|

|

|

|

|

|

|

Selling and marketing |

12,874 |

111 |

12,985 |

23,539 |

159 |

23,698 |

|

General and administrative |

9,119 |

69 |

9,188 |

18,225 |

(150) |

18,075 |

|

Research and development |

4,336 |

287 |

4,623 |

8,523 |

202 |

8,725 |

|

Amortization of intangible assets |

11,274 |

(85) |

11,189 |

22,445 |

(131) |

22,314 |

|

Operating income |

(110) |

2,369 |

2,259 |

5,523 |

3,295 |

8,818 |

Revenues and

Financial results

at constant

currencyRevenues and financial results at constant

currency are obtained by translating the prior period revenues and

financial results from the functional currencies to CAD using the

conversion rates in effect during the current period. Furthermore,

with respect to Argentina, the Company excludes the impact of

hyperinflation and translates the revenues and results at the

average exchange rate in effect for each of the periods.

Revenues and financial results at constant

currency allow results to be viewed without the impact of

fluctuations in foreign currency exchange rates thereby

facilitating the comparison of results period over period. The

presentation of revenues and financial results under constant

currency is considered to be a non-GAAP measure and does not have

any standardized meaning under GAAP. As a result, the information

presented may not be comparable to similar measures presented by

other companies.

The following tables are reconciliations of

financial results under IFRS to financial results and financial

results at constant currency.

|

Q2-23 |

YTD-23 |

|

|

Reported under IFRS |

|

IAS 29Adjustment |

|

Constant Currency Adjustment |

|

Constant Currency |

Reported under IFRS |

IAS 29Adjustment |

|

Constant Currency Adjustment |

Constant Currency |

|

Revenues |

89,905 |

|

495 |

|

112 |

|

90,512 |

172,502 |

565 |

|

3,592 |

176,659 |

|

Cost of goods sold |

52,412 |

|

(2,256 |

) |

(224 |

) |

49,932 |

94,247 |

(2,810 |

) |

1,453 |

92,890 |

|

Gross margin |

37,493 |

|

2,751 |

|

336 |

|

40,580 |

78,255 |

3,375 |

|

2,139 |

83,769 |

|

Expenses |

|

|

|

|

|

|

|

|

|

Selling and marketing |

12,874 |

|

111 |

|

(53 |

) |

12,932 |

23,539 |

159 |

|

205 |

23,903 |

|

General and administrative |

9,119 |

|

69 |

|

301 |

|

9,489 |

18,225 |

(150 |

) |

501 |

18,576 |

|

Research and development |

4,336 |

|

287 |

|

20 |

|

4,643 |

8,523 |

202 |

|

96 |

8,821 |

|

Amortization of intangible assets |

11,274 |

|

(85 |

) |

233 |

|

11,422 |

22,445 |

(131 |

) |

128 |

22,442 |

|

Operating income |

(110 |

) |

2,369 |

|

(165 |

) |

2,094 |

5,523 |

3,295 |

|

1,209 |

10,027 |

EBITDA

EBITDA is defined as operating income or loss

adjusted to exclude amortization and impairment of intangible

assets, depreciation, purchase price allocation accounting

adjustments, and the impact of IAS 29 (accounting under

hyperinflation) but to include costs related to leases.

EBITDA allows results to be viewed without the

impact of amortization and impairment of intangible assets,

depreciation, purchase price allocation accounting adjustments, and

the impact of IAS 29 (accounting under hyperinflation) but to

include costs related to leases fluctuations in foreign currency

exchange rates thereby facilitating the comparison of results

period over period. The presentation of EBITDA is considered to be

a non-GAAP measure and does not have any standardized meaning under

GAAP. As a result, the information presented may not be comparable

to similar measures presented by other companies.

Adjusted EBITDA

Adjusted EBITDA is defined EBITDA adjusted for

acquisition costs and non-recurring expenses.

Adjusted EBITDA allows results to be viewed

without the impact of amortization and impairment of intangible

assets, depreciation, purchase price allocation accounting

adjustments, and the impact of IAS 29 (accounting under

hyperinflation), acquisition costs and non-recurring expenses but

to include costs related to leases fluctuations in foreign currency

exchange rates thereby facilitating the comparison of results

period over period. The presentation of adjusted EBITDA is

considered to be a non-GAAP measure and does not have any

standardized meaning under GAAP. As a result, the information

presented may not be comparable to similar measures presented by

other companies.

The following table is a reconciliation of

operating income (loss) to EBITDA and adjusted EBITDA.

|

|

Q2-24 |

|

Q2-23 |

|

YTD-24 |

|

YTD-23 |

|

|

Operating income

(loss) |

4,494 |

|

(110 |

) |

7,154 |

|

5,523 |

|

|

Adjustments to operating income (loss): |

|

|

|

|

|

|

|

|

|

Amortization of intangible assets |

11,674 |

|

11,274 |

|

22,546 |

|

22,445 |

|

|

Depreciation of property, plant and equipment and ROU assets |

1,495 |

|

884 |

|

3,204 |

|

2,796 |

|

|

Lease costs (IFRS 16 adjustment) |

(982 |

) |

(636 |

) |

(1,864 |

) |

(1,367 |

) |

|

Impact of IAS 29 |

(1,040 |

) |

2,857 |

|

(1,810 |

) |

3,109 |

|

|

EBITDA |

15,641 |

|

14,269 |

|

29,230 |

|

32,506 |

|

|

Acquisition and transition costs |

103 |

|

— |

|

103 |

|

— |

|

|

Adjusted EBITDA |

15,744 |

|

14,269 |

|

29,333 |

|

32,506 |

|

Adjusted EBITDA

per share

Adjusted EBITDA per share is defined as Adjusted

EBITDA over number of common shares outstanding at the end of the

respective period. The presentation of adjusted EBITDA per share is

considered to be a non-GAAP ratio and does not have any

standardized meaning under GAAP. As a result, the information

presented may not be comparable to similar measures presented by

other companies.

The following table calculates adjusted EBITDA

per share as follows:

|

|

Q2-24 |

Q2-23 |

YTD-24 |

YTD-23 |

|

Adjusted EBITDA |

15,744 |

14,269 |

29,333 |

32,506 |

|

Adjusted EBITDA per common share |

0.16 |

0.13 |

0.29 |

0.30 |

|

Number of common shares outstanding at period end (in

thousands) |

101,327 |

107,177 |

101,327 |

107,177 |

|

SELECTED FINANCIAL RESULTS AT CONSTANT CURRENCY[In

thousands of Canadian

dollars] |

|

|

Excluding impact of IAS 29 |

|

|

|

Constant Currency1 |

Change |

|

Constant Currency1 |

Change |

|

|

Q2-24 |

Q2-23 |

$ |

|

% |

YTD-24 |

YTD-23 |

$ |

|

% |

|

Revenues |

94,121 |

90,512 |

3,609 |

|

4% |

179,917 |

176,659 |

3,258 |

|

2% |

|

Gross margin |

45,281 |

40,580 |

4,701 |

|

12% |

85,977 |

83,769 |

2,208 |

|

3% |

|

Gross margin % |

48% |

45% |

|

|

48 % |

47 % |

|

|

|

Operating expenses |

41,822 |

38,486 |

(3,336 |

) |

9% |

80,213 |

73,742 |

(6,471 |

) |

9% |

|

EBITDA |

15,641 |

14,227 |

1,414 |

|

10% |

29,230 |

33,915 |

(4,685 |

) |

14% |

|

Adjusted EBITDA |

15,744 |

14,227 |

1,517 |

|

11% |

29,333 |

33,915 |

(4,582 |

) |

14% |

|

Adjusted EBITDA per share |

0.16 |

0.13 |

0.03 |

|

23% |

0.29 |

0.31 |

(0.02 |

) |

6% |

1 Financial results at constant currency is a non-GAAP measure.

Refer to section “Non-GAAP measures” for additional details.

|

INTERIM CONSOLIDATED BALANCE SHEETS[In

thousands of Canadian dollars][Unaudited] |

|

As at |

June 30,

2024 |

December 31, 2023 |

|

ASSETS |

|

|

|

Current |

|

|

|

Cash and cash equivalents |

60,807 |

58,761 |

|

Marketable securities |

88,028 |

95,657 |

|

Trade receivables |

84,976 |

88,722 |

|

Other receivables |

5,835 |

7,427 |

|

Inventories |

103,645 |

91,834 |

|

Prepaids and deposits |

4,601 |

4,881 |

|

Other current financial assets |

8,631 |

15,753 |

|

Income taxes receivable |

4,087 |

2,080 |

|

Total current

assets |

360,610 |

365,115 |

|

Marketable securities |

3,833 |

7,407 |

|

Prepaids and deposits |

7,283 |

7,767 |

|

Right-of-use assets |

6,673 |

6,190 |

|

Property, plant and equipment |

14,814 |

11,669 |

|

Intangible assets |

295,548 |

289,960 |

|

Goodwill |

84,604 |

79,844 |

|

Other financial assets |

107,097 |

112,616 |

|

Deferred income tax assets |

20,510 |

19,390 |

|

Other long-term receivables |

44,392 |

45,535 |

|

Total non-current

assets |

584,754 |

580,378 |

|

Total assets |

945,364 |

945,493 |

|

INTERIM CONSOLIDATED BALANCE SHEETS (continued)[In

thousands of Canadian dollars][Unaudited] |

|

As at |

June 30,

2024 |

December 31, 2023 |

|

LIABILITIES AND

EQUITY |

|

|

|

Current |

|

|

|

Accounts payable and accrued liabilities |

77,808 |

85,366 |

|

Lease liabilities |

2,569 |

1,728 |

|

Other liabilities |

1,801 |

1,046 |

|

Bank loans |

16,988 |

17,850 |

|

Income taxes payable |

918 |

1,182 |

|

Other balances payable |

5,745 |

6,857 |

|

Total current

liabilities |

105,829 |

114,029 |

|

Accounts payable and accrued liabilities |

7,013 |

5,251 |

|

Lease liabilities |

4,587 |

5,497 |

|

Bank loans |

33,964 |

44,016 |

|

Other balances payable |

26,222 |

27,012 |

|

Deferred income tax liabilities |

4,948 |

2,817 |

|

Total liabilities |

182,563 |

198,622 |

|

Shareholders' equity |

|

|

|

Share capital |

540,945 |

540,046 |

|

Warrants |

117 |

117 |

|

Contributed surplus |

25,662 |

25,991 |

|

Accumulated other comprehensive income |

51,820 |

29,829 |

|

Retained earnings |

144,257 |

150,888 |

|

Total shareholders'

equity |

762,801 |

746,871 |

|

Total liabilities

and shareholders'

equity |

945,364 |

945,493 |

|

INTERIM CONSOLIDATED STATEMENTS OF INCOME

(LOSS) |

|

[In thousands of Canadian dollars, except for share and per share

amounts] |

|

[Unaudited] |

|

|

|

|

|

|

|

|

Three months ended June 30, |

|

Six months ended June 30, |

|

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

95,573 |

|

89,905 |

|

182,177 |

|

172,502 |

|

|

Cost of goods sold |

48,236 |

|

52,412 |

|

93,141 |

|

94,247 |

|

|

Gross margin |

47,337 |

|

37,493 |

|

89,036 |

|

78,255 |

|

|

|

|

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

|

|

|

Selling and marketing |

13,264 |

|

12,874 |

|

25,913 |

|

23,539 |

|

|

General and administrative |

12,099 |

|

9,119 |

|

22,637 |

|

18,225 |

|

|

Research and development |

5,806 |

|

4,336 |

|

10,786 |

|

8,523 |

|

|

Amortization of intangible assets |

11,674 |

|

11,274 |

|

22,546 |

|

22,445 |

|

|

Operating income (loss) |

4,494 |

|

(110 |

) |

7,154 |

|

5,523 |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income on financial instruments measured at amortized

cost |

(1,960 |

) |

(2,015 |

) |

(4,096 |

) |

(4,194 |

) |

|

Other interest income |

(624 |

) |

(1,072 |

) |

(1,129 |

) |

(2,245 |

) |

|

Interest expense |

2,284 |

|

3,004 |

|

4,861 |

|

5,795 |

|

|

Other expense |

(42 |

) |

(310 |

) |

(211 |

) |

(216 |

) |

|

Net loss (gain) on financial instruments measured at fair value

through profit or loss |

665 |

|

(3,939 |

) |

16,932 |

|

7,908 |

|

|

Foreign exchange loss (gain) |

5,542 |

|

4,918 |

|

3,608 |

|

4,845 |

|

|

Gain on hyperinflation |

(2,084 |

) |

(908 |

) |

(6,380 |

) |

(1,636 |

) |

|

(Loss) income before income taxes |

713 |

|

212 |

|

(6,431 |

) |

(4,734 |

) |

|

|

|

|

|

|

|

|

|

|

|

Income tax |

|

|

|

|

|

|

|

|

|

Current |

1,245 |

|

33 |

|

2,914 |

|

2,139 |

|

|

Deferred |

1,410 |

|

(1,661 |

) |

(2,857 |

) |

(4,776 |

) |

|

Income tax expense (recovery) |

2,655 |

|

(1,628 |

) |

57 |

|

(2,637 |

) |

|

Net income (loss) for the period |

(1,942 |

) |

1,840 |

|

(6,488 |

) |

(2,097 |

) |

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net income (loss) per share |

(0.02 |

) |

0.02 |

|

(0.06 |

) |

(0.02 |

) |

|

Weighted average number of common shares

outstanding |

|

|

|

|

|

|

|

|

|

Basic |

101,330,154 |

|

108,475,559 |

|

101,251,374 |

|

109,988,526 |

|

|

Diluted |

101,330,154 |

|

108,678,732 |

|

101,251,374 |

|

109,988,526 |

|

|

INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS[In thousands of

Canadian dollars][Unaudited] |

|

|

Three months ended June 30, |

|

Six months ended June 30, |

|

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

OPERATING ACTIVITIES |

|

|

|

|

|

Net (loss) income for the period |

(1,942 |

) |

1,840 |

|

(6,488 |

) |

(2,097 |

) |

|

Adjustments reconciling net income to operating cash flows: |

|

|

|

|

|

Depreciation and amortization |

13,169 |

|

12,158 |

|

25,750 |

|

25,241 |

|

|

Net loss (gain) on financial instruments |

665 |

|

(3,939 |

) |

16,932 |

|

7,908 |

|

|

Unrealized foreign exchange (gain) loss |

(4,124 |

) |

(809 |

) |

(6,329 |

) |

(2,062 |

) |

|

Other operating activities |

3,078 |

|

407 |

|

(3,646 |

) |

(92 |

) |

|

|

10,846 |

|

9,657 |

|

26,219 |

|

28,898 |

|

|

Changes in non-cash working capital and other items |

(11,932 |

) |

(11,143 |

) |

3,576 |

|

(26,068 |

) |

|

Cash inflow (outflow) from operating activities |

(1,086 |

) |

(1,486 |

) |

29,795 |

|

2,830 |

|

|

INVESTING ACTIVITIES |

|

|

|

|

|

Purchase of marketable securities |

(41,625 |

) |

(76,334 |

) |

(77,922 |

) |

(185,550 |

) |

|

Proceeds on maturity of marketable securities |

69,674 |

|

75,200 |

|

91,990 |

|

181,168 |

|

|

Investment in funds |

(1,072 |

) |

(148 |

) |

(1,203 |

) |

(170 |

) |

|

Purchase of intangible assets |

(16,735 |

) |

— |

|

(26,817 |

) |

(7,667 |

) |

|

Other investing activities |

1,511 |

|

5,482 |

|

1,339 |

|

7,705 |

|

|

Cash inflow (outflow) from investing activities |

11,753 |

|

4,200 |

|

(12,613 |

) |

(4,514 |

) |

|

FINANCING ACTIVITIES |

|

|

|

|

|

Repurchase of common shares through Normal Course Issuer Bid |

(1,242 |

) |

(13,951 |

) |

(1,242 |

) |

(24,465 |

) |

|

Principal repayment of bank loans |

(6,930 |

) |

(5,422 |

) |

(8,659 |

) |

(6,009 |

) |

|

Proceeds from bank loans |

747 |

|

1,443 |

|

1,292 |

|

2,090 |

|

|

Other financing activities |

(3,937 |

) |

(4,165 |

) |

(5,650 |

) |

(5,583 |

) |

|

Cash outflow from financing activities |

(11,362 |

) |

(22,095 |

) |

(14,259 |

) |

(33,967 |

) |

|

Increase (decrease) in cash and cash equivalents during the

period |

(695 |

) |

(19,381 |

) |

2,923 |

|

(35,651 |

) |

|

Cash and cash equivalents, beginning of the period |

62,835 |

|

56,218 |

|

58,761 |

|

71,679 |

|

|

Net foreign exchange difference |

(1,333 |

) |

1,007 |

|

(877 |

) |

1,816 |

|

|

Cash and cash equivalents, end of the period |

60,807 |

|

37,844 |

|

60,807 |

|

37,844 |

|

|

Cash and cash equivalents |

60,807 |

|

37,844 |

|

60,807 |

|

37,844 |

|

|

Marketable securities |

91,861 |

|

103,779 |

|

91,861 |

|

103,779 |

|

|

Total cash, cash equivalents and marketable securities |

152,668 |

|

141,623 |

|

152,668 |

|

141,623 |

|

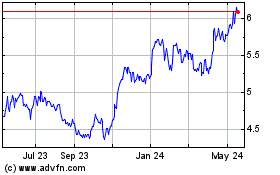

Knight Therapeutics (TSX:GUD)

Historical Stock Chart

From Dec 2024 to Jan 2025

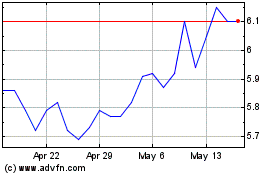

Knight Therapeutics (TSX:GUD)

Historical Stock Chart

From Jan 2024 to Jan 2025