Interfor to Exit Québec Operations

October 16 2024 - 6:55AM

INTERFOR CORPORATION (“Interfor” or the “Company”)

(TSX: IFP) announced today plans to exit its operations in Québec,

Canada, including the sale of its three manufacturing facilities

and the closure of its Montréal corporate office. This strategic

initiative will support a focus on the areas of highest future

potential across the remainder of the Company.

As part of the exit plan, Interfor announced that it has entered

into a definitive agreement to sell its sawmills in Val-d’Or and

Matagami as well as its Sullivan remanufacturing plant in Val-d’Or,

along with all associated forestry and business operations, to

Chantiers Chibougamau Ltée (“CCL”), a long-standing,

privately-held, Québec-based forestry company.

The purchase price is estimated to be approximately $30 million

in cash, based on the value of specific working capital items at

June 30, 2024, which will be subject to normal course adjustments

at closing, plus the assumption of certain liabilities by CCL.

Additionally, Interfor and CCL will enter into a multi-year

contract for the supply of Machine Stress Rated (“MSR”) lumber to

Interfor’s I-Joist engineered wood products (“EWP”) facility in

Sault Ste. Marie, Ontario.

The sale does not include any countervailing (“CV”) or

anti-dumping (“AD”) duty deposits related to the ongoing US/Canada

softwood lumber trade dispute. All historical CV & AD deposits

up to the date of closing will be retained by Interfor. Total CV

& AD deposits related to the facilities up to June 30, 2024

totalled approximately US$56 million, excluding any interest.

As part of the exit plan, Interfor also announced that it

intends to permanently close its corporate office in Montréal in

the coming months, allowing for the full realization of synergies

associated with the Company’s EACOM Timber Corporation acquisition

announced in November 2021.

Interfor will continue to own and operate its five sawmills and

one I-Joist EWP facility in Ontario and its two sawmills and

woodlands management business in New Brunswick.

“After careful review of the potential future options for our

Québec operations, we believe the sale to CCL is the best long-term

outcome for Interfor,” said Ian Fillinger, President & Chief

Executive Officer. “The decision to exit our Québec operations was

influenced by recent developments that have restricted the

availability of economic fibre, including record forest fires in

2023. This divestiture enables us to focus resources on our

remaining Eastern Canadian sawmills situated in Ontario and New

Brunswick, which are well-positioned with competitive log costs and

an increasingly valuable spruce-pine-fir lumber product mix.”

The Val-d’Or and Matagami sawmills have a combined two-shift

rated lumber production capacity of 255 million board feet per

year, representing approximately 5% of Interfor’s total

company-wide capacity. However, the mills only produced 206 million

board feet of lumber in the trailing twelve months ended June 30,

2024, representing a utilization rate of approximately 80%. Since

early August 2024, the mills have been operating at a utilization

rate of approximately 50%.

The completion of the transaction is subject to customary

conditions, including regulatory approvals, and is expected to

close in the fourth quarter of 2024.

Interfor anticipates taking an impairment charge in the third

quarter of 2024 associated with the announcement.

RBC Capital Markets acted as exclusive financial advisor to

Interfor.

FORWARD-LOOKING STATEMENTS

This release contains forward-looking information about the

Company’s business outlook, objectives, plans, strategic priorities

and other information that is not historical fact. A statement

contains forward-looking information when the Company uses what it

knows and expects today, to make a statement about the future.

Statements containing forward-looking information in this release,

include but are not limited to, statements regarding production

capacity, future plans, regulatory approvals and the expected

closing date, and other relevant factors. Readers are cautioned

that actual results may vary from the forward-looking information

in this release, and undue reliance should not be placed on such

forward-looking information. Risk factors that could cause actual

results to differ materially from the forward-looking information

in this release are described in Interfor’s annual Management’s

Discussion & Analysis under the heading “Risks and

Uncertainties,” which is available on www.interfor.com and under

Interfor’s profile on www.sedar.com. Material factors and

assumptions used to develop the forward-looking information in this

report include the fulfilment of the conditions to completing the

transaction described in this release. Unless otherwise indicated,

the forward-looking statements in this release are based on the

Company’s expectations at the date of this release. Interfor

undertakes no obligation to update such forward-looking information

or statements, except as required by law.

ABOUT INTERFOR

Interfor is a growth-oriented forest products company with

operations in Canada and the United States. The Company has annual

lumber production capacity of approximately 5.0 billion board feet

and offers a diverse line of lumber products to customers around

the world. For more information about Interfor, visit our website

at www.interfor.com.

Investor Contacts:

Rick Pozzebon, Executive Vice President & Chief Financial

Officer(604) 689-6804

Mike Mackay, Vice President, Corporate Development &

Treasury (604) 689-6846

Media Contact:

Svetlana Kayumova, Senior Manager, Corporate Affairs &

Communications(604) 422-7329svetlana.kayumova@interfor.com

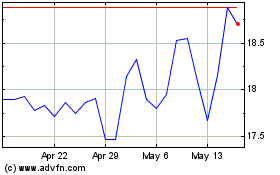

Interfor (TSX:IFP)

Historical Stock Chart

From Nov 2024 to Dec 2024

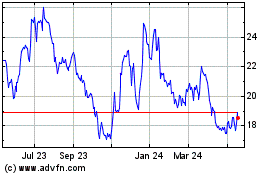

Interfor (TSX:IFP)

Historical Stock Chart

From Dec 2023 to Dec 2024