K92 Mining Inc. (“

K92” or the

“

Company”) (TSX

: KNT;

OTCQX

: KNTNF) is pleased to announce financial

results for the three months ended March 31, 2024.

Production

- Quarterly production of 27,462

ounces gold equivalent (“AuEq”) or 24,389 oz gold,

1,443,300 lbs copper and 35,650 oz silver (1), representing a 39%

increase from Q1 2023.

- Cash costs of US$934/oz gold and

all-in sustaining costs (“AISC”) of US$1,366/oz

gold (2).

- Ore processed of 130,632 tonnes or

1,436 tpd (“tonnes per day”), an 11% increase from

Q1 2023 and 5% greater than the Stage 2A Expansion design rate of

1,370 tpd.

- During the quarter, multiple

throughput records were achieved. Monthly throughput record

achieved in January of 57,144 tonnes processed or 1,843 tpd,

exceeding the Stage 2A Expansion design rate by 34%; weekly

throughput record achieved in January averaging 2,149 tpd,

exceeding the Stage 2A design rate by 57%, and daily throughput

record achieved on January 21st of 2,389 tonnes processed,

exceeding the Stage 2A design rate by 74% (3). In January and

February, 95% of operating days exceeded the Stage 2A Expansion

plant design rate.

- Quarterly ore mined of 111,054

tonnes.

Financials

- Strong cash and treasury bill

position of US$73.4 million as of March 31, 2024 while remaining

debt-free.

- Operating cash flow (before working

capital adjustments) for the three months ended March 31, 2024, of

US$20.0 million or US$0.09 per share, and record earnings before

interest, taxes, depreciation and amortization

(“EBITDA”) (2) of US$17.6 million or US$0.07 per

share.

- Quarterly revenue of US$59.8

million, an increase of 48% from Q1 2023.

- Quarterly net income of US$3.1

million or $0.01 per share.

- Sales of 27,996 oz gold, 1,582,668

lbs copper and 38,812 oz silver. Gold concentrate and doré

inventory of 1,677 oz as of March 31, 2024, a decrease of 3,608 oz

over the prior quarter.

Growth

- On the Stage 3 and 4 Expansions,

52% of growth capital has been either spent or committed as of

April 30, 2024. K92 has completed handover to GR Engineering for

the construction of the 1.2 million tpa (“tonnes per

annum”) Stage 3 Process Plant, with commissioning of the

Stage 3 Process Plant now targeting late-April (previously by end

of March 2025) due to a significantly wetter and longer than

average rainy season. Fortunately, as this occurred early in the

mobilization process, cost variation is minor. Underground, two

raise bore rigs are undergoing electrification and will commence

boring imminently, with the larger raise bore commencing works for

a ventilation raise first followed by the first waste/ore pass. The

first waste/ore pass is scheduled to commence boring in Q3

2024.

- During the quarter, results from

the first two holes from K92’s maiden drill program at the Arakompa

project recorded significant near-surface mineralization, with 4

high-grade lodes intersected in hole KARDD0002. Between the

high-grade lodes, the tonalite to dioritic host rock is overprinted

with porphyry style mineralization increasing the potential for

bulk mining. The target size of Arakompa is very large, with

mineralization demonstrated from drill holes, rock samples and

surface workings for at least 1.7 km of strike, hosted within a

~150-225 m wide mineralized intense phyllic altered package, and

exhibits a vertical extent of +500 m. Arakompa is sparsely drilled,

with K92’s maiden drill results representing the first drilling on

the project completed in 32 years. A total of 18 holes were drilled

historically, with the vast majority shallow. Highlights from the

maiden drill program include:

- KARDD0002 recording 7.20 m at 24.76

g/t AuEq, 5.70 m at 9.94 g/t AuEq, 5.30 m at 6.06 g/t AuEq and 3.60

m at 3.38 g/t AuEq (4).

- KARDD0002 recording a bulk

intersection of 219.8 m at 1.59 g/t AuEq with a higher grade core

of 149.4 m at 2.12 g/t AuEq, starting at 5.2 m from surface.Other

historic highlights reported include:

- 004DA92 recording 4.00 m at 32.03

g/t AuEq

- 013AD92 recording 4.00 m at 20.21

g/t AuEq

- 016AD92 recording 6.30 m at 14.96

g/t AuEq

- 010AD92 recording 9.20 m at 10.67

g/t AuEqSee news release dated February 21, 2024 for additional

details.

- Subsequent to quarter end, strong

results from 140 diamond drill holes were reported from underground

and surface at Kora, Kora South, Judd, and Judd South deposits in

addition to Kora and Judd Northern Deeps. Multiple dilatant zones

intersected at Kora’s K2 Vein, including a new dilatant zone

discovered outside of the Kora resource at Kora South and the

extension of an existing dilatant zone down-dip:

- Kora South new dilatant zone

intercepts:

- KUDD0053: 78.50 m at 27.03 g/t

AuEq

- KUDD0056: 34.00 m at 8.14 g/t

AuEq

- Known Dilatant zone extended

down-dip:

- KUDD0058: 51.00 m at 7.04 g/t

AuEq

High-grade zones extended in multiple directions including up-dip

from the main underground mining area at the K1, K2 and J1 Veins,

to the South outside the Kora resource at the K2 Vein and 300 m to

the North near surface at the J1 Vein. Highlights include:

- KMDD0590: 3.26 m at 86.92 g/t AuEq

from the K1 Vein

- KMDD0634: 12.09 m at 18.90 g/t AuEq

from the K1 Vein

- KMDD0662: 9.00 m at 40.36 g/t AuEq

from the K2 Vein

- KMDD0654A: 17.45 m at 23.79 g/t

AuEq from the K2 Vein

- JDD0235: 4.13 m at 69.10 g/t AuEq

from the J1 Vein

- KODD0055: 9.85 m at 7.58 g/t AuEq

from the J1 VeinSee news release dated May 6, 2024 for additional

details.

The Company’s interim consolidated financial

statements and associated management’s discussion and analysis for

the three months ended March 31, 2024 are available for download on

the Company’s website and under the Company’s profile on SEDAR+

(www.sedarplus.ca). All amounts are in U.S. dollars unless

otherwise indicated.

See Figure 1: Quarterly Production, Cash Cost

and AISC ChartSee Figure 2: Quarterly Total Ore Processed,

Development Metres Advanced and Total Mined Material ChartSee

Figure 3: Process Plant Throughput Performance, Daily Records and

Near-Records

John Lewins, K92 Chief Executive Officer and

Director, stated, “During the first quarter, K92 delivered strong

financial results and above-budget production, even with the

temporary suspension of underground operations for the last 22 days

of March following a non-industrial incident. Since the lifting of

the temporary suspension of underground operations in the first

half of April, we have been pleased with the focus and motivation

of our workforce, with operations having returned to normal.

Financially, we remain in a strong position with $73 million in

cash and treasury bills at quarter end, plus significant liquidity

with the $100 million loan with Trafigura.

On the Stage 3 Expansion, we continue to move

forward on multiple initiatives and as of April 30th, 52% of the

Stage 3 and 4 Expansion growth capital has now been either spent or

committed. The complete handover to GR Engineering for the

construction of the Stage 3 Process Plant was a major milestone, in

addition to the commencement of raise bore works planned for later

this month, which will drive a step-change in productivity

underground over the next few months.

And lastly, as shown this past week with our

exploration drilling results, the Kora-Kora South and Judd-Judd

South system is world class, has significant expansion potential

and with the increase in drilling activity at Arakompa, we expect

exploration to continue to be a driver of value during the Stage 3

Expansion construction period and beyond.”

|

Mine Operating Activities |

|

|

|

|

|

Three months ended March 31, 2024 |

Three months endedMarch 31, 2023 |

|

Operating data |

|

|

|

Gold head grade (Au g/t) |

6.4 |

5.2 |

|

Copper grade (%) |

0.55% |

0.70% |

|

Gold equivalent head grade (AuEq g/t) |

7.2 |

6.4 |

|

Gold recovery (%) |

90.7% |

89.1% |

|

Copper recovery (%) |

91.9% |

91.3% |

|

Gold ounces produced |

24,389 |

17,593 |

|

Gold ounces equivalent produced (1) (2) |

27,462 |

21,488 |

|

Tonnes of copper produced |

655 |

749 |

|

Silver ounces produced |

35,650 |

29,891 |

|

|

|

|

|

|

Financial data (in thousands of dollars) |

|

|

|

Gold ounces sold |

27,996 |

17,602 |

|

Revenues from concentrate and doré sales |

US$59,798 |

US$40,366 |

|

Mine operating expenses |

US$12,465 |

US$8,753 |

|

Other mine expenses |

US$20,942 |

US$8,241 |

|

Depreciation and depletion |

US$7,482 |

US$6,744 |

|

|

|

|

|

|

Statistics (in dollars) |

|

|

|

Average realized selling price per ounce, net |

US$2,016 |

US$1,807 |

|

Cash cost per ounce (2) |

US$934 |

US$758 |

|

All-in sustaining cost per ounce (2) |

US$1,366 |

US$1,506 |

|

|

|

|

|

|

Notes: |

|

|

|

|

|

(1) |

Gold equivalent in Q1 2024 is calculated based on: gold $2,070 per

ounce; silver $23.34 per ounce; and copper $3.83 per pound. Gold

equivalent in Q1 2023 is calculated based on: gold $1,890 per

ounce; silver $22.55 per ounce; and copper $4.05 per pound. |

|

|

|

|

|

|

(2) |

The Company provides some non-international financial reporting

standard measures as supplementary information that management

believes may be useful to investors to explain the Company’s

financial results. Please refer to non-IFRS financial performance

measures in the Company’s management’s discussion and analysis

dated May 10, 2024, available on SEDAR+ or the Company’s website,

for reconciliation of these measures. |

|

|

|

|

|

|

(3) |

Daily tonnes processed record achieved on day with 23.5 hours of

plant operation. 7-day tonnes processed recorded achieved with

98.1% plant availability. 95.4% plant availability in January. 2024

budget annual average plant availability is 94.0%. |

|

|

|

|

|

|

(4) |

Gold equivalent exploration results are calculated using

longer-term commodity prices with a copper price of US$4.00/lb, a

silver price of US$22.50/oz and a gold price of US$1,750/oz. |

|

|

|

Mineral resources that are not mineral reserves

do not have demonstrated economic viability.

Conference Call and Webcast to Present

Results

K92 will host a conference call and webcast to

present the 2024 first quarter financial results at 8:30 am (EDT)

on Monday, May 13, 2024.

- Listeners may access the conference

call by dialing toll-free to 1-844-763-8274 within North America or

+1-647-484-8814 from international locations.

The conference call will also be broadcast live (webcast) and

may be accessed via the following link:

https://services.choruscall.ca/links/k92mining2024q1.html

Qualified Person

K92 Mine Geology Manager and Mine Exploration

Manager, Mr. Andrew Kohler, PGeo, a qualified person under the

meaning of Canadian National Instrument 43-101 – Standards of

Disclosure for Mineral Projects, has reviewed and is responsible

for the technical content of this news release.

Technical Report

The Integrated Development Plan (“IDP”),

including the Definitive Feasibility Study and Preliminary Economic

Assessment for the Kainantu Gold Mine Project in Papua New Guinea

is included in the Technical Report, titled, “Independent Technical

Report, Kainantu Gold Mine Integrated Development Plan, Kainantu

Project, Papua New Guinea” dated October 26, 2022, with an

effective date of January 1, 2022.

About K92

K92 Mining Inc. is engaged in the production of

gold, copper and silver at the Kainantu Gold Mine in the Eastern

Highlands province of Papua New Guinea, as well as exploration and

development of mineral deposits in the immediate vicinity of the

mine. The Company declared commercial production from Kainantu in

February 2018 and is in a strong financial position. A maiden

resource estimate on the Blue Lake copper-gold porphyry project was

completed in August 2022. K92 is operated by a team of mining

company professionals with extensive international mine-building

and operational experience.

On Behalf of the Company,

John Lewins, Chief Executive Officer and

Director

For further information, please contact David

Medilek, P.Eng., CFA, President and Chief Operating Officer at

+1-604-416-4445

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

INFORMATION: This news release includes certain “forward-looking

statements” under applicable Canadian securities legislation. Such

forward-looking statements include, without limitation: (i) the

results of the Kainantu Mine Definitive Feasibility Study, and the

Kainantu 2022 Preliminary Economic Assessment, including the Stage

3 Expansion, a new standalone 1.2 mtpa process plant and supporting

infrastructure; (ii) statements regarding the expansion of the mine

and development of any of the deposits; (iii) the Kainantu Stage 4

Expansion, operating two standalone process plants, larger surface

infrastructure and mining throughputs; and (iv) the potential

extended life of the Kainantu Mine.

All statements in this news release that address

events or developments that we expect to occur in the future are

forward-looking statements. Forward-looking statements are

statements that are not historical facts and are generally,

although not always, identified by words such as “expect”, “plan”,

“anticipate”, “project”, “target”, “potential”, “schedule”,

“forecast”, “budget”, “estimate”, “intend” or “believe” and similar

expressions or their negative connotations, or that events or

conditions “will”, “would”, “may”, “could”, “should” or “might”

occur. All such forward-looking statements are based on the

opinions and estimates of management as of the date such statements

are made. Forward-looking statements are necessarily based on

estimates and assumptions that are inherently subject to known and

unknown risks, uncertainties and other factors, many of which are

beyond our ability to control, that may cause our actual results,

level of activity, performance or achievements to be materially

different from those expressed or implied by such forward-looking

information. Such factors include, without limitation, Public

Health Crises, including the COVID-19 virus; changes in the price

of gold, silver, copper and other metals in the world markets;

fluctuations in the price and availability of infrastructure and

energy and other commodities; fluctuations in foreign currency

exchange rates; volatility in price of our common shares; inherent

risks associated with the mining industry, including problems

related to weather and climate in remote areas in which certain of

the Company’s operations are located; failure to achieve

production, cost and other estimates; risks and uncertainties

associated with exploration and development; uncertainties relating

to estimates of mineral resources including uncertainty that

mineral resources may never be converted into mineral reserves; the

Company’s ability to carry on current and future operations,

including development and exploration activities at the Arakompa,

Kora, Judd and other projects; the timing, extent, duration and

economic viability of such operations, including any mineral

resources or reserves identified thereby; the accuracy and

reliability of estimates, projections, forecasts, studies and

assessments; the Company’s ability to meet or achieve estimates,

projections and forecasts; the availability and cost of inputs; the

availability and costs of achieving the Stage 3 Expansion or the

Stage 4 Expansion; the ability of the Company to achieve the inputs

the price and market for outputs, including gold, silver and

copper; failures of information systems or information security

threats; political, economic and other risks associated with the

Company’s foreign operations; geopolitical events and other

uncertainties, such as the conflicts in Ukraine, Israel and

Palestine; compliance with various laws and regulatory requirements

to which the Company is subject to, including taxation; the ability

to obtain timely financing on reasonable terms when required; the

current and future social, economic and political conditions,

including relationship with the communities in Papua New Guinea and

other jurisdictions it operates; other assumptions and factors

generally associated with the mining industry; and the risks,

uncertainties and other factors referred to in the Company’s Annual

Information Form under the heading “Risk Factors”.

Estimates of mineral resources are also

forward-looking statements because they constitute projections,

based on certain estimates and assumptions, regarding the amount of

minerals that may be encountered in the future and/or the

anticipated economics of production. The estimation of mineral

resources and mineral reserves is inherently uncertain and involves

subjective judgments about many relevant factors. Mineral resources

that are not mineral reserves do not have demonstrated economic

viability. The accuracy of any such estimates is a function of the

quantity and quality of available data, and of the assumptions made

and judgments used in engineering and geological interpretation,

Forward-looking statements are not a guarantee of future

performance, and actual results and future events could materially

differ from those anticipated in such statements. Although we have

attempted to identify important factors that could cause actual

results to differ materially from those contained in the

forward-looking statements, there may be other factors that cause

actual results to differ materially from those that are

anticipated, estimated, or intended. There can be no assurance that

such statements will prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking statements. The Company disclaims any

intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by law.

Figure 1: Quarterly Production, Cash Cost and

AISC Chart

Figure 2: Quarterly Total Ore Processed,

Development Metres Advanced and Total Mined Material Chart

Figure 3: Process Plant Throughput Performance,

Daily Records and Near-Records

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/f749af78-cfed-4e46-b08e-08c7a4d227e5https://www.globenewswire.com/NewsRoom/AttachmentNg/b7d771c7-e3b6-4899-8b04-0a2905674b3ahttps://www.globenewswire.com/NewsRoom/AttachmentNg/51ae0141-35ad-42c8-b31a-7a68d67b7830

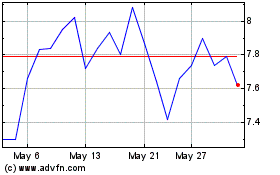

K92 Mining (TSX:KNT)

Historical Stock Chart

From Dec 2024 to Jan 2025

K92 Mining (TSX:KNT)

Historical Stock Chart

From Jan 2024 to Jan 2025