K92 Mining Inc. (“

K92” or the

“

Company”) (TSX

: KNT;

OTCQX

: KNTNF) is pleased to announce record

quarterly production results for the fourth quarter

(“

Q4”) of 2024 at its Kainantu Gold Mine in Papua

New Guinea, of 53,401 oz AuEq or 51,371 oz gold, 958,312 lbs copper

and 41,992 oz silver, which represents a 37% increase from Q4 2023

and a 21% increase from the previous quarterly record set in Q3

2024. Sales during the quarter were 48,350 oz gold, 946,704 lbs

copper and 41,720 oz silver. Annual production achieved 149,515 oz

AuEq or 139,123 oz gold, 4,926,738 lbs copper and 142,063 oz

silver, significantly exceeding the production guidance range of

120,000 to 140,000 oz AuEq and representing a 27% increase from

2023. Annual sales were 140,659 oz gold, 5,043,134 lbs copper and

145,060 oz silver.

During Q4, the process plant processed 96,614

tonnes, with a head grade averaging 18.0 g/t AuEq or 17.3 g/t gold,

0.47% copper and 15.2 g/t silver. Gold equivalent head grade was

the highest since Q2 2020. Gold grades were above budget, driven by

higher grade stopes from Judd and Kora combined with a notable

positive gold grade reconciliation and moderate positive copper

grade reconciliation when compared with the independent mineral

resource model. Throughput was deliberately reduced to maximize

recoveries at the higher feed grade.

Strong metallurgical recoveries were also

achieved, with record recoveries in the quarter for gold, averaging

96.4%, and near-record recoveries of 94.7% for copper, and record

monthly gold recovery of 97.1% and copper recovery of 96.1% in

December. Annual gold recoveries of 94.6% and copper recoveries of

94.1% compare favorably to the recovery parameters stated in the

Updated IDP, of 92.6% and 94.2% for gold and copper, respectively

(January 1, 2024 effective date).

In Q4, the mine delivered 97,016 tonnes of ore

mined, with 12 levels mined, including the 1090, 1285, 1305, 1345,

and 1365 levels at Kora, and the 1170, 1185, 1205, 1265, 1305, 1325

and 1365 levels at Judd. Total material movements (ore plus waste)

were the second highest on record, totalling 306,430 tonnes. Long

hole open stoping performed to design. Overall mine development

achieved a total of 2,571 metres, increasing by 381 metres, or 17%

from the prior quarter. Development rates are well positioned to

continue to increase near-term to 1,000 metres per month required

for the Stage 3 Expansion and later this year to the 1,200 metres

per month required to ramp-up to the Stage 4 Expansion run-rate,

driven by: the interim ventilation upgrade recently completed and

online in early January 2025; stage 2 interim clean water supply

upgrade planned for completion in second half of January 2025; the

sequential completion of multiple infrastructure projects over the

next 2 quarters (Puma ventilation drive for life of mine

ventilation upgrade with two x 2 MW fans operational – Q2 2025,

first ore pass/waste pass – raise bore completion early Q1 2025,

fully operational late Q2 2025); significant increase to available

headings and advance productivities as two mining fronts are opened

up (twin incline and front below the main mine); progressive

introduction of multiple jumbos and equipment that are already on

site as available headings increase, and; the execution of various

identified productivity initiatives.

See Figure 1: Quarterly Production, Cash Cost

and AISC ChartSee Figure 2: Quarterly Ore Processed, Development,

and Mined Material Chart See Figure 3: Gold and Copper Recoveries

Chart

Table 1 – 2024 & 2023 Annual Production

Data

|

|

|

2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

Q4 2024 |

2024 |

|

Tonnes Processed |

T |

503,484 |

130,632 |

95,582 |

104,992 |

96,614 |

427,821 |

|

Feed Grade Au |

g/t |

6.8 |

6.4 |

7.5 |

13.0 |

17.3 |

10.7 |

|

Feed Grade Cu |

% |

0.75% |

0.55% |

0.62% |

0.58% |

0.47% |

0.55% |

|

Recovery (%) Au |

% |

91.5% |

90.7% |

93.7% |

95.3% |

96.4% |

94.6% |

|

Recovery (%) Cu |

% |

92.8% |

91.9% |

95.3% |

95.1% |

94.7% |

94.1% |

|

Metal in Conc & Doré Prod Au |

oz |

100,533 |

24,389 |

21,661 |

41,702 |

51,371 |

139,123 |

|

Metal in Conc Prod Cu |

T |

3,488 |

655 |

565 |

580 |

435 |

2,235 |

|

Metal in Conc & Doré Prod Ag |

oz |

160,628 |

35,650 |

26,754 |

37,613 |

41,992 |

142,063 |

|

Gold Equivalent Production |

oz |

117,607 |

27,462 |

24,347 |

44,304 |

53,401 |

149,515 |

Notes – Gold equivalent for Q4 2024 is

calculated based on: gold

$2,658 per ounce; silver $31.52 per ounce; and copper $4.25 per

pound.

Gold equivalent for

Q3 2024 is calculated based on: gold $2,474 per ounce; silver

$29.43 per ounce; and copper $4.17 per pound.

Gold equivalent for

Q2 2024 is calculated based on: gold $2,338 per ounce; silver

$28.84 per ounce; and copper $4.42 per pound.

Gold equivalent for

Q1 2024 is calculated based on: gold $2,070 per ounce; silver

$23.34 per ounce; and copper $3.83 per pound.

Gold equivalent for

2023 is calculated based on: Q4 2023: gold $1,974 per ounce; silver

$23.20 per ounce; and copper $3.71 per pound. Q3 2023: gold $1,928

per ounce; silver $23.57 per ounce; and copper $3.79 per pound. Q2

2023: gold $1,976 per ounce; silver $24.13 per ounce; and copper

$3.85 per pound. Q1 2023: gold $1,890 per ounce; silver $22.55 per

ounce; and copper $4.05 per pound.

Qualified Person

K92 Mine Geology Manager and Mine Exploration

Manager, Andrew Kohler, PGeo, a qualified person under the meaning

of Canadian National Instrument 43-101 – Standards of Disclosure

for Mineral Projects, has reviewed and is responsible for the

technical content of this news release. Data verification by Mr.

Kohler includes significant time onsite reviewing drill core, face

sampling, underground workings, and discussing work programs and

results with geology and mining personnel.

Technical Report

The Updated Integrated Development Plan

(“Updated IDP”) for the Kainantu Gold Mine Project in Papua New

Guinea that contains information on the Mineral Resource Estimate,

Definitive Feasibility Study and Preliminary Economic Assessment is

included in a technical report, titled, “Independent Technical

Report, Kainantu Gold Mine Updated Integrated Development Plan,

Kainantu Project, Papua New Guinea” dated November 28, 2024, with

an effective date of January 1, 2024.

About K92

K92 Mining Inc. is engaged in the production of

gold, copper and silver at the Kainantu Gold Mine in the Eastern

Highlands province of Papua New Guinea, as well as exploration and

development of mineral deposits in the immediate vicinity of the

mine. The Company declared commercial production from Kainantu in

February 2018, is in a strong financial position, and is working to

become a Tier 1 mid-tier producer through ongoing plant expansions.

A maiden resource estimate on the Blue Lake copper-gold porphyry

project was completed in August 2022. K92 is operated by a team of

mining company professionals with extensive international

mine-building and operational experience.

On Behalf of the Company,

John Lewins, Chief Executive Officer and

Director

For further information, please contact David

Medilek, P.Eng., CFA, President and Chief Operating Officer at

+1-604-416-4445

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

INFORMATION: This news release includes certain “forward-looking

statements” under applicable Canadian securities legislation. Such

forward-looking statements include, without limitation: (i) the

results of the Kainantu Mine Definitive Feasibility Study, and the

Kainantu Preliminary Economic Assessment, including the Stage 3

Expansion, a new standalone 1.2 mtpa process plant and supporting

infrastructure; (ii) statements regarding the expansion of the mine

and development of any of the deposits; (iii) the Kainantu Stage 4

Expansion, operating two standalone process plants, larger surface

infrastructure and mining throughputs; and (iv) the potential

extended life of the Kainantu Mine.

All statements in this news release that address

events or developments that we expect to occur in the future are

forward-looking statements. Forward-looking statements are

statements that are not historical facts and are generally,

although not always, identified by words such as “expect”, “plan”,

“anticipate”, “project”, “target”, “potential”, “schedule”,

“forecast”, “budget”, “estimate”, “intend” or “believe” and similar

expressions or their negative connotations, or that events or

conditions “will”, “would”, “may”, “could”, “should” or “might”

occur. All such forward-looking statements are based on the

opinions and estimates of management as of the date such statements

are made. Forward-looking statements are necessarily based on

estimates and assumptions that are inherently subject to known and

unknown risks, uncertainties and other factors, many of which are

beyond our ability to control, that may cause our actual results,

level of activity, performance or achievements to be materially

different from those expressed or implied by such forward-looking

information. Such factors include, without limitation, Public

Health Crises, including the COVID-19 virus; changes in the price

of gold, silver, copper and other metals in the world markets;

fluctuations in the price and availability of infrastructure and

energy and other commodities; fluctuations in foreign currency

exchange rates; volatility in price of our common shares; inherent

risks associated with the mining industry, including problems

related to weather and climate in remote areas in which certain of

the Company’s operations are located; failure to achieve

production, cost and other estimates; risks and uncertainties

associated with exploration and development; uncertainties relating

to estimates of mineral resources including uncertainty that

mineral resources may never be converted into mineral reserves; the

Company’s ability to carry on current and future operations,

including development and exploration activities at the Arakompa,

Kora, Judd and other projects; the timing, extent, duration and

economic viability of such operations, including any mineral

resources or reserves identified thereby; the accuracy and

reliability of estimates, projections, forecasts, studies and

assessments; the Company’s ability to meet or achieve estimates,

projections and forecasts; the availability and cost of inputs; the

availability and costs of achieving the Stage 3 Expansion or the

Stage 4 Expansion; the ability of the Company to achieve the inputs

the price and market for outputs, including gold, silver and

copper; failures of information systems or information security

threats; political, economic and other risks associated with the

Company’s foreign operations; geopolitical events and other

uncertainties, such as the conflicts in Ukraine, Israel and

Palestine; compliance with various laws and regulatory requirements

to which the Company is subject to, including taxation; the ability

to obtain timely financing on reasonable terms when required; the

current and future social, economic and political conditions,

including relationship with the communities in Papua New Guinea and

other jurisdictions it operates; other assumptions and factors

generally associated with the mining industry; and the risks,

uncertainties and other factors referred to in the Company’s Annual

Information Form under the heading “Risk Factors”.

Estimates of mineral resources are also

forward-looking statements because they constitute projections,

based on certain estimates and assumptions, regarding the amount of

minerals that may be encountered in the future and/or the

anticipated economics of production. The estimation of mineral

resources and mineral reserves is inherently uncertain and involves

subjective judgments about many relevant factors. Mineral resources

that are not mineral reserves do not have demonstrated economic

viability. The accuracy of any such estimates is a function of the

quantity and quality of available data, and of the assumptions made

and judgments used in engineering and geological interpretation,

Forward-looking statements are not a guarantee of future

performance, and actual results and future events could materially

differ from those anticipated in such statements. Although we have

attempted to identify important factors that could cause actual

results to differ materially from those contained in the

forward-looking statements, there may be other factors that cause

actual results to differ materially from those that are

anticipated, estimated, or intended. There can be no assurance that

such statements will prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking statements. The Company disclaims any

intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by law.

Figure 1: Quarterly Production, Cash Cost and

AISC Chart

Figure 2: Quarterly Ore Processed, Development, and Mined

Material Chart

Figure 3: Gold and Copper Recoveries Chart

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/5dd2c7ef-78ed-448f-b689-9d4e2236255f

https://www.globenewswire.com/NewsRoom/AttachmentNg/52a19ea4-3f4f-4962-8cc8-ad8d340509e2

https://www.globenewswire.com/NewsRoom/AttachmentNg/bd9182f0-c766-4c1f-89ad-68b55dd56f7a

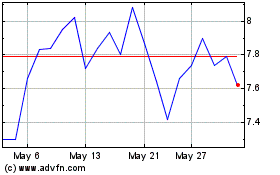

K92 Mining (TSX:KNT)

Historical Stock Chart

From Dec 2024 to Jan 2025

K92 Mining (TSX:KNT)

Historical Stock Chart

From Jan 2024 to Jan 2025