Medexus Pharmaceuticals Inc. (“

Medexus” or the

“

Company”) (TSX: MDP) (OTCQX: MEDXF) today

announced its financial results and provided a business update for

the three-month period ended June 30, 2021. All dollar amounts

below are in United States dollars unless specified otherwise.

First Quarter Fiscal 2022 Financial

Highlights*:

- Revenue of $17.3 million compared

to $20 million for Q1 of fiscal 2021. The decrease in net sales was

due to a temporary decline in ex-factory sales of IXINITY®, as

pharmacy and wholesale customers continued to work through

inventory on hand. Despite the decreased sales, patient unit demand

for IXINITY® increased 25.3% compared to the corresponding period

in the prior year, to 7.6 million IUs, which reflects the Company’s

successful commercial efforts. These efforts are expected to be

realized in strong ex-factory sales and improved gross margin, once

the inventory on hand is reduced to normal levels, in the coming

quarters.

- Adjusted EBITDA* decreased to

$(4.9) million compared to $3.6 million for the same period last

year, due primarily to the decrease in Net Sales, the impact of a

manufacturing expense related to IXINITY®, an increase in Research

& Development Costs over the comparative period due to the ramp

up of the IXINITY® pediatric trial, and the investments the Company

made related to plans for the commercialization of treosulfan.

- Cash used by operating activities

was $6.8 million, compared to cash provided by operating activities

of $3.0 million for the same period last year. $5 million of the

cash used was a milestone payment to medac for the treosulfan

license. There are no additional milestone payments for that

license until approval.

- Net loss was $6.6 million compared

to $3.4 million for the same period last year.

- Adjusted Net Loss* (which adjusts

for such unrealized losses (or gains) on the fair value of

derivatives) was $9.8 million compared to $0.8 million for the same

period last year.

Ken d’Entremont, Chief Executive Officer of

Medexus, commented, “We continued to see pressure on IXINITY®

ex-factory sales this past quarter, due to the high level of

product in the distribution channel. We believe that we are making

progress in normalizing the distribution channel and are highly

encouraged by growing demand. Specifically, unit demand for

IXINITY® increased 25% over the corresponding quarter in the prior

year, which follows a 15% increase in demand for the twelve months

ended March 31, 2021. We are confident that we will be able

capitalize on this growth to both increase revenue and improve our

margins as we implement supply chain improvements.”

“Looking towards the balance of the year, the US

approval for treosulfan will remain a major priority. The recent

Complete Response Letter was not expected, however, we remain

confident in the data that supports the use in patients with Acute

Myeloid Leukemia and Myelodysplastic Syndrome. To our knowledge, no

other agency has refused approval of treosulfan, with Health Canada

most recently providing our Company with a Notice of Compliance,

and approving its commercialization. Beyond treosulfan, we see

tremendous opportunity across the rest of our product portfolio. We

have historically generated very strong organic growth and we

anticipate this will continue. We are also looking at a number of

exciting new opportunities and are determined to continue our

growth trajectory.”

“Finally, we were pleased to announce the

appointment of Marcel Konrad last month as our new CFO, who is a

vital addition to our team as our focus increasingly turns to the

US market. Moreover, we continue to maintain strict financial

discipline and believe we have built a highly scalable business

model that will generate significant value for our shareholders in

the months and years ahead.”

Operational Highlights:

Operational highlights for the three-month

period ended June 30, 2021, or subsequent to the period end,

include:

- Treosulfan US Licensing

Agreement: During the year ended March 31, 2021, the

Company entered into an exclusive license to commercialize

treosulfan in the United States. Treosulfan is an innovative,

orphan-designated agent developed for use as part of a conditioning

treatment, in combination with fludarabine as a preparative

regimen, for patients undergoing allogeneic hematopoietic stem cell

transplantation (“allo-HSCT”). On August 2, 2021 the Company

received notice from medac, Medexus’s licensor for treosulfan, that

is had received a Complete Response Letter (CRL) from the U.S. Food

and Drug Administration (“FDA”) with respect to the New Drug

Application (“NDA”) for use of treosulfan in the United States. Via

the CRL, the FDA has determined that it cannot approve the NDA in

its present form. The FDA has however provided recommendations for

how to address what they see as the outstanding issues, primarily

around the provision of additional clinical and statistical data

and analyses pertaining to the primary endpoint of the completed

pivotal Phase III study. The steps associated with addressing these

recommendations are already covered by medac’s existing development

plan for treosulfan, which medac is contractually responsible to

execute and fund. The Company, together with medac, plans to move

forward with the FDA, to meet the agency’s requests. It is the

Company’s belief that the CRL provides a path to review and

approval that does not require additional clinical studies,

provided medac can satisfy the FDA’s data requirements and post

marketing commitments, which the Company is hopeful can be done

with already available data from the existing completed Phase III

study and the current development plan.

- Treosulfan

Canada: On June 28, 2021, the Company received a

Notice of Compliance from Health Canada to commercialize treosulfan

in Canada under the tradename Trecondyv® and on July 12, 2021, the

Company entered into an exclusive license with medac to

commercialize treosulfan in Canada. Previously, the Company had

been distributing treosulfan in Canada only under the Special

Access Program pursuant to the authorization received in March of

2019.

- Rupall™: Unit

demand growth reached 44.4% for the trailing twelve-months ended

June 30, 2021, which reflects further acceleration compared to the

unit demand growth of 35.7% seen for trailing twelve-months ended

March 31, 2021.1 This due to a strong allergy season across Canada,

and further market share gain by the brand. Rupall™ is one of the

fastest growing anti-histamines in the Canadian prescription

market2.

- IXINITY®: On

August 12, 2021, the Company announced the completion of enrollment

for the Phase 4 clinical trial to evaluate the safety and efficacy

of IXINITY® in previously treated patients under 12 years of age

with hemophilia B. Medexus expects the trial to be completed in

June of 2022. Once completed, this study may support a significant

expansion of the indicated patient population for IXINITY® as

approximately 1 in 3 patients treated for hemophilia B in the

United States are 12 years of age or younger.

- Graduation to Toronto Stock

Exchange: On June 17, 2021, the Company’s common shares,

which had previously been listed for trading on the TSX Venture

exchange, began trading on the TSX.

- Appointment of New

CFO: On July 19, 2021, the Company introduced Marcel

Konrad as the new CFO replacing Roland Boivin. Marcel brings broad

understanding of the healthcare market, having worked in companies

large and small, ranging from Novartis to most recently, CareDx.

The company believes that his experience will be instrumental to

its continued growth in the future. Roland Boivin will continue in

the company for a period of 3 months to help ensure a smooth

transition.

Operating and Financial Results Summary

for the Three Months Ended June 30, 2021:

Total revenue reached $17.3 million for the

three-month period ended June 30, 2021, compared to revenue of $20

million for the three-month period ended June 30, 2020, mainly due

to a drop in IXINITY® net sales. While patient

unit demand for IXINITY® continued to grow, net

sales were lower as pharmacy and wholesale customers worked through

inventory on hand.

Gross profit reached $6.9 million for the

three-month period ended June 30, 2021, compared to gross profit of

$10.9 million for the three-month period ended June 30, 2020. Gross

profit for the three-month period ended June 30, 2021, has been

impacted by a $2.5 million increase in cost of goods sold, related

to a manufacturing expense for IXINITY®.

The gross margin was 40.1% for the three-month

period ended June 30, 2021, compared to 54.5% for the three-month

period ended June 30, 2020. The lower gross margins for the current

period were a direct result of the manufacturing expense for

IXINITY®. Normalized for this $2.5 million impact, the gross margin

for the three-month period ended June 30, 2021, would have been

54.6%.

Operating loss for the three-month period ended

June 30, 2021, was $7.2 million compared to an operating income of

$1.2 million for the three-month period ended June 30, 2020.

Adjusted EBITDA was $(4.9) million for the

three-month period ended June 30, 2021, compared to Adjusted EBITDA

of $3.6 million for the three-months period ended June 30,

2020.

Net loss was $6.6 million compared to $3.4

million for the same period last year. This included a non-cash

unrealized gain of $3.2 million in the current period on the fair

value of the embedded derivatives in the Company’s convertible

debentures, which was driven by a decrease in the Company’s share

price at the end of the applicable periods.

The Company’s financial statements and

management discussion and analysis (“MD&A”) for the period

ended June 30, 2021 are available on our corporate website at

www.medexus.com and in our corporate filings on SEDAR

at www.sedar.com.

* Refer to “Non-IFRS Financial Measures” at the

end of this press release.

Conference Call Details

Medexus will host a conference call at 8:00 AM

Eastern Time on Tuesday, August 17, 2021 to discuss the Company’s

financial results for the fiscal 2022 first quarter ended June 30,

2021, as well as the Company’s corporate progress and other

developments.

The conference call will be available via

telephone by dialing toll free 844-602-0380 for Canadian and U.S.

callers or +1 862-298-0970 for international callers. A webcast of

the call may be accessed

at https://www.webcaster4.com/Webcast/Page/2010/42339 or

on the Company’s Investor Events section of the

website: https://www.medexus.com/en_US/investors/news-events.

A webcast replay will be available on the

Company’s Investor Events section of the website

(https://www.medexus.com/en_US/investors/news-events) through

Wednesday, August 17, 2022. A telephone replay of the call will be

available approximately one hour following the call, through

Tuesday, August 24, 2021 and can be accessed by dialing

877-481-4010 for Canadian and U.S. callers or +1 919-882-2331 for

international callers and entering conference ID: 42339.

1Source: IQVIA CDH units – Drugstores and

hospitals purchases 2Source: IQVIA CDH units – Drugstores and

hospitals purchases, MAT June 2021

About Medexus

Medexus is a leader in innovative rare disease

treatment solutions with a strong North American commercial

platform. From a foundation of proven best in class products

we are building a highly differentiated company with a portfolio of

innovative and high value orphan and rare disease products that

will underpin our growth for the next decade. The Company’s vision

is to provide the best healthcare products to healthcare

professionals and patients, through our core values of Quality,

Innovation, Customer Service and Teamwork. Medexus Pharmaceuticals

is focused on the therapeutic areas of hematology, auto-immune

disease, and allergy. The Company’s leading products are: Rasuvo™

and Metoject®, a unique formulation of methotrexate (auto-pen and

pre-filled syringe) designed to treat rheumatoid arthritis and

other auto-immune diseases; IXINITY®, an intravenous recombinant

factor IX therapeutic for use in patients 12 years of age or older

with Hemophilia B – a hereditary bleeding disorder characterized by

a deficiency of clotting factor IX in the blood, which is necessary

to control bleeding; and Rupall®, an innovative prescription

allergy medication with a unique mode of action. The Company has

also licensed treosulfan, a preparative regimen for allogeneic

hematopoietic stem cell transplantation to be used in combination

with fludarabine, from medac GmbH for Canada and the United

States.

For more information, please contact:

Ken d’Entremont, Chief Executive OfficerMedexus Pharmaceuticals

Inc.Tel.: 905-676-0003E-mail: ken.dentremont@medexus.com

Marcel Konrad, Chief Financial OfficerMedexus Pharmaceuticals

Inc.Tel.: 312-548-3139E-mail: marcel.konrad@medexus.com

Investor Relations (U.S.):Crescendo Communications, LLCTel:

+1-212-671-1020Email: mdp@crescendo-ir.com

Investor Relations (Canada):Tina ByersAdelaide CapitalTel:

905-330-3275E-mail: tina@adcap.ca

Forward-Looking Statements

Certain statements made in this press release

contain forward-looking information within the meaning of

applicable securities laws (“forward-looking statements”). The

words “anticipates”, “believes”, “expects”, “will”, “plans” and

similar expressions are often intended to identify forward-looking

statements, although not all forward-looking statements contain

these identifying words. Specific forward-looking statements

contained in this news release include, but are not limited to,

statements with respect to the implementation of supply chain

improvements and the Company’s ability to benefit from the same;

future expectations regarding the Company’s growth trajectory and

future revenues; expectations regarding approval by the FDA for

treosulfan and the ability to satisfy the FDA’s requirements

without the need additional clinical studies. These statements are

based on factors or assumptions that were applied in drawing a

conclusion or making a forecast or projection, including

assumptions based on historical trends, current conditions and

expected future developments. Since forward-looking statements

relate to future events and conditions, by their very nature they

require making assumptions and involve inherent risks and

uncertainties. The Company cautions that although it is believed

that the assumptions are reasonable in the circumstances, these

risks and uncertainties give rise to the possibility that actual

results may differ materially from the expectations set out in the

forward-looking statements. Material risk factors include those set

out in the Company’s materials filed with the Canadian securities

regulatory authorities from time to time, including the Company’s

most recent annual information form and management’s discussion and

analysis; future capital requirements and dilution; intellectual

property protection and infringement risks; competition (including

potential for generic competition); reliance on key management

personnel; the Company’s ability to implement its business plan;

the Company’s ability to leverage its United States and Canadian

infrastructure to promote additional growth; regulatory approval by

the health authorities; product reimbursement by third party

payers; patent litigation or patent expiry; litigation risk; stock

price volatility; government regulation; and potential third party

claims. Given these risks, undue reliance should not be placed on

these forward-looking statements, which apply only as of the date

hereof. Other than as specifically required by law, the Company

undertakes no obligation to update any forward-looking statements

to reflect new information, subsequent or otherwise.

Non-IFRS Financial Measures

This press release uses the terms “Adjusted Net

Income (Loss)” and “Adjusted EBITDA” which are non-IFRS financial

measures, which do not have any standardized meaning prescribed by

IFRS and are therefore unlikely to be comparable to similar

measures presented by other companies. Rather, these measures are

provided as additional information to complement those IFRS

measures by providing further understanding of the Company’s

results of operations from management’s perspective. Accordingly,

they should not be considered in isolation nor as a substitute for

analysis of the Company’s financial information reported under

IFRS. In particular, management uses Adjusted Net Income (Loss) and

Adjusted EBITDA as measures of the Company’s performance. The

Company defines Adjusted Net Income (Loss) as net income (loss)

before unrealized loss (gain) on fair value of derivatives. The

Company defines Adjusted EBITDA as earnings before financing and

special transaction costs (including, for greater certainty, fees

related to the acquisitions and related financings), interest

expenses, income taxes, interest income, depreciation of property

and equipment, amortization of intangible assets, non-cash

share-based compensation, income from sale of assets, gain or loss

on the convertible debenture embedded derivative, foreign exchange

gains or losses, termination benefits, and impairment of intangible

assets. The Company considers Adjusted Net Income (Loss) and

Adjusted EBITDA as key metrics in assessing business performance

and considers Adjusted EBITDA to be an important measure of

operating performance and cash flow, providing useful information

to investors and analysts. These non-IFRS measures are not intended

to represent cash provided by operating activities, net earnings or

other measures of financial performance calculated in accordance

with IFRS. Additional information relating to the use of these

non-IFRS measures, including the reconciliation of each of Adjusted

Net Income (Loss) and Adjusted EBITDA to Net Income (Loss), can be

found in our MD&A, which is available through the SEDAR website

(www.sedar.com).

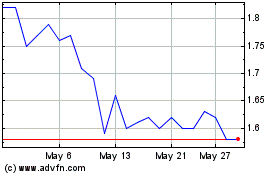

Medexus Pharmaceuticals (TSX:MDP)

Historical Stock Chart

From Dec 2024 to Jan 2025

Medexus Pharmaceuticals (TSX:MDP)

Historical Stock Chart

From Jan 2024 to Jan 2025