Madison Pacific Properties Inc. announces the results for the six months ended February 29, 2024

April 12 2024 - 7:19PM

Madison Pacific Properties Inc. (the Company) (TSX: MPC and MPC.C),

a Vancouver-based real estate company announces the results of

operations for the six months ended February 29, 2024.

The results reported are pursuant to

International Financial Reporting Standards (IFRS) for public

companies.

For the six months ended February 29, 2024, the

Company is reporting net loss of $43.4 million (2023: net

income of $23.0 million); cash flows generated from operating

activities before changes in non-cash operating balances of $4.3

million (2023: $4.6 million); and loss per share of $0.73 (2023:

income per share of $0.38). Included in net loss is a provision of

$50.2 million (2023: $nil) for uncertain tax positions recognizing

a tax liability for unpaid taxes, estimated interest and awarded

legal costs and provisions against the carrying value of the

Company’s tax deposits and deferred tax assets related to unused

carryforward amounts. Also included in net loss is a net gain on

the fair value adjustment on investment properties of approximately

$4.3 million (2023: $14.0 million).

As previously reported in the Company’s

Consolidated Financial Statements, the Company and certain

subsidiaries had received from the Canada Revenue Agency (“CRA”)

and Alberta Tax and Revenue Administration (“ATRA”) tax notices of

reassessment for various taxation years. The reassessments deny the

application and usage of certain non-capital losses, capital

losses, deductions and investment tax credits arising from prior

years. The Company and its subsidiaries had filed notices of

objection and notices of appeal to the reassessments with the CRA

and ATRA.

The appeal with the Tax Court of Canada (“TCC”)

for one of the reassessed companies, Madison Pacific Properties

Inc., was heard in 2020, 2022 and in 2023 (the “MPP Appeal”). The

TCC released its judgement on the MPP Appeal on December 27, 2023

in favour of the CRA’s position, confirming the CRA’s

reassessments. The decision denied Madison Pacific Properties

Inc.’s ability to use certain carryforward losses for certain

taxation years within its 2009 to 2017 taxation years. On January

26, 2024, the Company filed a notice of objection to the Federal

Court of Appeal to appeal the decision issued by the TCC.

Based on the decision of the TCC in respect of

the MPP Appeal and other related factors, including the accounting

criteria under IFRS regarding tax contingencies, the Company has

recorded a full provision against the carrying value of the tax

deposits and deferred tax assets related to unused carryforward

amounts and a liability for uncertain tax positions for unpaid

taxes and estimated interest for all three tax reassessments

totalling $50.2 million. The total amount of $50.2 million was

recognized to income tax expense of $36.7 million and interest

expense and other costs on uncertain tax positions of $13.5 million

in the Interim Consolidated Statement of (Loss) Income and

Comprehensive (Loss) Income for the six months ended February 29,

2024. As at the date of this Press Release, the Company and its

subsidiaries have paid a total of $49.3 million to the CRA and ATRA

for the taxes and estimated interest the CRA and the ATRA claimed

are owed.

The Company will continue to evaluate its

defense positions in respect of the two other reassessed

subsidiaries.

As at February 29, 2024, the Company owns

approximately $709 million in investment properties, including the

Company’s proportionate share of investment properties held through

joint operations.

As at the date of this Press Release, the

Company’s investment portfolio comprises 56 properties with

approximately 1.9 million rentable sq. ft. of industrial and

commercial space and a 50% interest in four multi-family rental

properties with a total of 151 units. Approximately 98.57% of

available space within the industrial and commercial investment

properties is currently leased. The Company’s development

properties include a 50% interest in the Silverdale Hills Limited

Partnership which currently owns approximately 1,400 acres of

primarily residential designated development lands in Mission,

British Columbia.

For a review of the risks and uncertainties to

which the Company is subject, see its most recently filed annual

and interim MD&A.

|

Contact: |

|

Mr. John Delucchi |

|

Ms. Bernice Yip |

| |

|

President & CEO |

|

Chief Financial Officer |

| Telephone: |

|

(604) 732-6540 |

|

(604) 732-6540 |

| |

|

|

|

|

| Address: |

|

389 West 6th Avenue |

|

|

| |

|

Vancouver, B.C. V5Y 1L1 |

|

|

| |

|

|

|

|

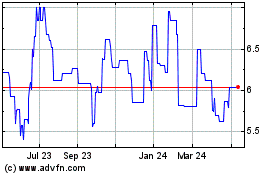

Madison Pacific Properties (TSX:MPC)

Historical Stock Chart

From Dec 2024 to Jan 2025

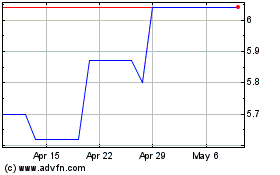

Madison Pacific Properties (TSX:MPC)

Historical Stock Chart

From Jan 2024 to Jan 2025