MELCOR DEVELOPMENTS LTD. ANNOUNCES NORMAL COURSE ISSUER BID

March 30 2020 - 10:03AM

Melcor Developments Ltd. (TSX:MRD), an Alberta-based real estate

development and asset management company, announced today that the

Toronto Stock Exchange has accepted its notice of intention to make

a normal course issuer bid through the facilities of the TSX and on

alternative trading systems.

The notice provides that Melcor may, during the

twelve-month period commencing April 1, 2020 and ending March 31,

2021, purchase for cancellation up to 1,661,033 common shares in

total, being approximately 5% of its issued and outstanding common

shares. The daily repurchase restriction for the common shares is

1,000.

In accordance with temporary relief

announced by the TSX on March 23, 2020, the number of Shares

that can be purchased pursuant to the NCIB is subject to a current

daily maximum of 1,616 Shares (which is equal to 50% of 3,233,

being the average daily trading volume from September 1,

2019 through to February 29, 2020). Following

the expiry of such temporary relief on June 30, 2020 (or

such later date as may be announced by the TSX), the number of

Shares that can be purchased pursuant to the NCIB will be subject

to a daily maximum of 1,000 Shares (which is the greater of 25% of

3,233 or 1,000).

The price which Melcor will pay for any such

common shares will be the market price at the time of acquisition.

The actual number of common shares which may be purchased and the

timing of any such purchases will be subject to compliance with the

TSX guidelines.

Under the current normal course issuer bid due

to expire March 31, 2020, 74,100 common shares were purchased for

cancellation through the facilities of the TSX during the last

twelve months (as of March 18, 2020) at a weighted average price

per common share of $12.14 (1,665,080 had been approved for

repurchase). As of March 18, 2020 there were 33,220,677 common

shares of Melcor outstanding with an average daily trading volume

for the prior six months of 3,233.

Melcor believes that, at times, its common

shares trade in a price range which does not adequately reflect the

value of such common shares in relation to the business of Melcor

and its future business prospects. As a result, depending upon

future price movements and other factors, Melcor believes that its

outstanding common shares may represent an attractive investment

for itself. Furthermore, the purchases may benefit all persons who

continue to hold common shares by increasing their equity interest

in Melcor. All common shares purchased by Melcor under the normal

course issuer bid will be cancelled.

In connection with commencement of the NCIB the

Corporation also announced that it has entered into an automatic

share purchase plan agreement (“ASPP”) with a broker to allow for

the purchase of common shares under the NCIB at times when the

Corporation ordinarily would not be active in the market due to

regulatory restrictions or self-imposed trading blackout periods.

Before entering into such restricted or blackout period, the

Corporation may, but is not required to, instruct the designated

broker to make purchases under the NCIB in accordance with the

terms of the ASPP. Such purchases will be determined by the broker

in its sole discretion based on parameters established by the

Corporation prior to the restricted or blackout period in

accordance with TSX rules, applicable securities laws and the terms

of the ASPP. Outside of these pre-determined restricted or blackout

periods, common shares will be purchased based on management's

discretion, in compliance with TSX rules and applicable securities

laws.

About Melcor Developments

Ltd.

Melcor is a diversified real estate development

and asset management company that transforms real estate from raw

land through to high-quality finished product in both residential

and commercial built form. Melcor develops and manages mixed-use

residential communities, business and industrial parks, office

buildings, retail commercial centres and golf courses. Melcor owns

a well diversified portfolio of assets in Alberta, Saskatchewan,

British Columbia, Arizona and Colorado.

Melcor has been focused on real estate since

1923. The company has built over 140 communities across Western

Canada and today manages 4.6 million sf in commercial real estate

assets and 608 residential rental units. Melcor is committed to

building communities that enrich quality of life - communities

where people live, work, shop and play.

Melcor’s headquarters are located in Edmonton,

Alberta, with regional offices throughout Alberta and in British

Columbia and Arizona. Melcor has been a public company since 1968

and trades on the Toronto Stock Exchange (TSX:MRD).

Forward Looking

Statements

Certain information set forth in this news

release, may contain forward-looking statements, and necessarily

involve risks and uncertainties, certain of which are beyond

Melcor's control. Actual results, performance or achievements could

differ materially from those expressed in, or implied by, these

forward-looking statements and, accordingly, no assurance can be

given that any events anticipated by the forward-looking statements

will transpire or occur, or if any of them do so, what benefits

that Melcor will derive therefrom. Additional information on these

and other factors that could affect Melcor are included in reports

on file with Canadian securities regulatory authorities and may be

accessed through the SEDAR website (www.sedar.com). Furthermore,

the forward-looking statements contained in this news release are

made as of the date of this news release, and Melcor does not

undertake any obligation to update publicly or to revise any of the

included forward looking statements, whether as a result of new

information, future events or otherwise, except as may be expressly

required by applicable securities law.

Contact

Information:

Media ContactNicole

Forsythe780.945.47071.855.673.6931 (x4707)ir@melcor.ca

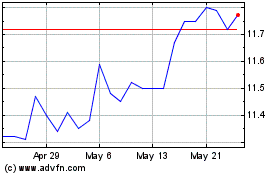

Melcor Developments (TSX:MRD)

Historical Stock Chart

From Nov 2024 to Dec 2024

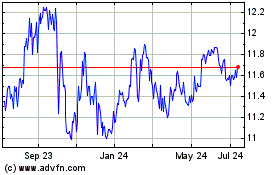

Melcor Developments (TSX:MRD)

Historical Stock Chart

From Dec 2023 to Dec 2024