Martinrea International Inc. (TSX : MRE), a diversified and global

automotive supplier engaged in the design, development and

manufacturing of highly engineered, value-added Lightweight

Structures and Propulsion Systems, today announced the release of

its financial results for the first quarter ended March 31, 2024,

and declared a quarterly cash dividend of $0.05 per share.

FIRST-QUARTER HIGHLIGHTS

- Total sales of $1,323.9 million, up

1.5% year-over-year.

- Diluted net earnings per share of

$0.56 and Adjusted Net Earnings per Share(1) of $0.62.

- Adjusted Operating Income Margin(1)

of 6.0%.

- Adjusted EBITDA(1) of $162.8

million.

- First-quarter results improved

significantly quarter over quarter.

- Free Cash Flow(1) (excluding

principal payments of IFRS-16 lease liabilities) was ($1.4)

million, inclusive of a normal seasonal build in non-cash working

capital, a significant improvement over ($31.5) million generated

in the first quarter of 2023.

- Net debt-to-Adjusted EBITDA(1)

ratio, excluding the impact of IFRS 16, ended the quarter at

1.51x.

- New business awards of

approximately $30 million in annualized sales at mature volumes;

the Company was also awarded replacement business worth $150

million in annualized sales at mature volumes with various

customers.

- Quarterly cash dividend of $0.05

per share declared.

1 The Company prepares its financial statements in accordance

with IFRS Accounting Standards. However, the Company considers

certain non-IFRS financial measures as useful additional

information in measuring the financial performance and condition of

the Company. These measures, which the Company believes are widely

used by investors, securities analysts and other interested parties

in evaluating the Company’s performance, do not have a standardized

meaning prescribed by IFRS and therefore may not be comparable to

similarly titled measures presented by other publicly traded

companies, nor should they be construed as an alternative to

financial measures determined in accordance with IFRS. Non-IFRS

measures, included anywhere in this press release, include

“Adjusted Net Income”, “Adjusted Net Earnings per Share (on a basic

and diluted basis)”, “Adjusted Operating Income”, “Adjusted

EBITDA”, “Free Cash Flow”, “Free Cash-Flow (after IFRS 16 lease

payments)” and “Net Debt”. The relevant IFRS financial measure, as

applicable, and a reconciliation of certain non-IFRS financial

measures to measures determined in accordance with IFRS are

contained in the Company’s Management Discussion and Analysis for

the three months ended March 31, 2024 and in this press

release.

OVERVIEW

Pat D’Eramo, Chief Executive Officer, stated:

“Our first quarter financial results were solid, and a notable

improvement over the prior quarter as we bounced back from the

disruptions caused by the UAW strike and Tier 2 supplier issue we

faced in the fourth quarter. We continue to perform at a high level

operationally. Industry headwinds from supply shortages,

inflationary cost pressures, and tight labour market conditions

continue to improve, vehicle production volumes had a good start to

the year despite the slower-than-expected ramp-up in electric

vehicle platforms across the industry, and a number of our core

platforms experienced growth in production volumes quarter over

quarter. Commercial negotiations aimed at offsetting inflationary

cost pressures and volume shortfalls on certain programs continue,

and I am happy with the progress our team is making on this

front.”

He added: “I am pleased to announce that we have

been awarded new business representing $30 million in annualized

sales at mature volumes, consisting of $20 million in Lightweight

Structures and $10 million in Propulsion Systems. In addition, we

were awarded replacement business in both Lightweight Structures

and Propulsion Systems worth approximately $150 million in

annualized sales at mature volumes with a variety of

customers.”

Fred Di Tosto, President and Chief Financial

Officer, stated: “We are pleased with our operational and financial

performance in the first quarter. Adjusted EBITDA(1) of $162.8

million was near record levels, and Adjusted Operating Income

Margin(1) of 6.0% returned to a level consistent with where we were

prior to the disruptions from the UAW strike and Tier 2 supplier

issue that impacted the fourth quarter. Sales for the first

quarter, excluding tooling sales of $66.4 million, were $1,257.5

million, and diluted net earnings per share and Adjusted Net

Earnings per Share(1) were $0.56 and $0.62 respectively. Free Cash

Flow(1) (excluding principal payments of IFRS-16 lease liabilities)

of ($1.4) million improved significantly year over year. We expect

another solid year of Free Cash Flow(1) in 2024, with the bulk of

it being generated in the back half of the year, similar to

2023.”

He continued: “Net Debt(1) (excluding IFRS-16

lease liabilities) increased by approximately $74 million quarter

over quarter, to $856.5 million, reflecting our Free Cash Flow(1)

profile for the quarter, as well as funding an investment in

Equispheres Inc., cash restructuring costs, our regular dividend

payment, and significant share buyback activity during the quarter.

Our Net Debt to Adjusted EBITDA(1) ratio (excluding the impact of

IFRS 16) ended the quarter at 1.51x, inline with our long-term

target range of 1.5x or better.”

Rob Wildeboer, Executive Chairman, stated: “As

Pat and Fred outlined, we continue to perform well operationally,

our balance sheet is in great shape, and we are executing on our

capital allocation priorities. We repurchased 1,353,500 shares for

cancellation under our normal course issuer bid (NCIB) during the

quarter at a cost of $15.9 million. We have renewed our NCIB for

another year, and our intention is to continue to buy back stock at

these price levels. We also funded an investment in Equispheres

Inc. for $8.0 million. Equispheres is a leading-edge company

developing innovative technologies for the production of advanced

materials, including high-performance aluminum powder for additive

manufacturing applications. Our relationship with Equispheres is

expected to enable us to introduce increasingly complex and

sophisticated products to our customers, thereby advancing our

Project BreakThrough strategy. On behalf of the executive

management team, we would like to thank our people for their hard

work in delivering a solid quarterly performance, as well as our

shareholders and other stakeholders for their continued

support.”

RESULTS OF OPERATIONS

All amounts in this press release are in

Canadian dollars, unless otherwise stated; and all tabular amounts

are in thousands of Canadian dollars, except earnings per share and

number of shares.

Additional information about the Company,

including the Company’s Management Discussion and Analysis of

Operating Results and Financial Position for the three months ended

March 31, 2024 (“MD&A”), the Company’s interim condensed

consolidated financial statements for the three months ended March

31, 2024 (the “interim financial statements”) and the Company’s

Annual Information Form for the year ended December 31, 2023 can be

found at www.sedarplus.ca.

OVERALL RESULTS

Results of operations may include certain items

which have been separately disclosed, where appropriate, in order

to provide a clear assessment of the underlying Company results. In

addition to IFRS measures, management uses non-IFRS measures in the

Company’s disclosures that it believes provide the most appropriate

basis on which to evaluate the Company’s results.

The following table sets out certain highlights

of the Company’s performance for the three months ended March 31,

2024 and 2023. Refer to the Company’s interim financial statements

for the three months ended March 31, 2024 for a detailed account of

the Company’s performance for the periods presented in the table

below.

|

|

Three months ended March 31, 2024 |

|

Three months ended March 31, 2023 |

|

$ Change |

|

% Change |

|

Sales |

$ |

1,323,913 |

|

|

$ |

1,303,889 |

|

|

20,024 |

|

|

1.5 |

% |

| Gross Margin |

|

172,537 |

|

|

|

167,386 |

|

|

5,151 |

|

|

3.1 |

% |

| Operating Income |

|

72,932 |

|

|

|

75,177 |

|

|

(2,245 |

) |

|

(3.0 |

%) |

| Net

Income for the period |

|

43,650 |

|

|

|

48,171 |

|

|

(4,521 |

) |

|

(9.4 |

%) |

|

Net Earnings per Share - Basic and Diluted |

$ |

0.56 |

|

|

$ |

0.60 |

|

|

(0.04 |

) |

|

(6.7 |

%) |

|

Non-IFRS Measures* |

|

|

|

|

|

|

|

| Adjusted Operating Income |

$ |

79,187 |

|

|

$ |

75,177 |

|

|

4,010 |

|

|

5.3 |

% |

| % of Sales |

|

6.0 |

% |

|

|

5.8 |

% |

|

|

|

|

| Adjusted EBITDA |

|

162,830 |

|

|

|

152,504 |

|

|

10,326 |

|

|

6.8 |

% |

| % of Sales |

|

12.3 |

% |

|

|

11.7 |

% |

|

|

|

|

| Adjusted Net Income |

|

48,097 |

|

|

|

43,597 |

|

|

4,500 |

|

|

10.3 |

% |

|

Adjusted Net Earnings per Share - Basic and Diluted |

$ |

0.62 |

|

|

$ |

0.54 |

|

|

0.08 |

|

|

14.8 |

% |

*Non-IFRS Measures

The Company prepares its interim financial

statements in accordance with IFRS Accounting Standards. However,

the Company considers certain non-IFRS financial measures as useful

additional information in measuring the financial performance and

condition of the Company. These measures, which the Company

believes are widely used by investors, securities analysts and

other interested parties in evaluating the Company’s performance,

do not have a standardized meaning prescribed by IFRS and therefore

may not be comparable to similarly titled measures presented by

other publicly traded companies, nor should they be construed as an

alternative to financial measures determined in accordance with

IFRS. Non-IFRS measures include “Adjusted Net Income”, “Adjusted

Net Earnings per Share (on a basic and diluted basis)”, “Adjusted

Operating Income”, "Adjusted EBITDA”, “Free Cash Flow”, "Free Cash

Flow (after IFRS 16 lease payments)", and “Net Debt”.

The following tables provide a reconciliation of

IFRS “Net Income” to Non-IFRS “Adjusted Net Income”, “Adjusted

Operating Income” and “Adjusted EBITDA”:

|

|

Three months ended March 31, 2024 |

|

Three months ended March 31, 2023 |

|

Net Income |

$ |

43,650 |

|

$ |

48,171 |

|

|

Adjustments, after tax* |

|

4,447 |

|

|

(4,574 |

) |

|

Adjusted Net Income |

$ |

48,097 |

|

$ |

43,597 |

|

*Adjustments are explained in the “Adjustments

to Net Income” section of this Press Release

|

|

Three months ended March 31, 2024 |

|

Three months ended March 31, 2023 |

|

Net Income |

$ |

43,650 |

|

|

$ |

48,171 |

|

| Income tax expense |

|

13,918 |

|

|

|

12,079 |

|

| Other finance income |

|

(5,443 |

) |

|

|

(224 |

) |

| Share of loss of equity

investments |

|

634 |

|

|

|

1,378 |

|

| Finance expense |

|

20,173 |

|

|

|

19,046 |

|

|

Adjustments, before tax* |

|

6,255 |

|

|

|

(5,273 |

) |

|

Adjusted Operating Income |

$ |

79,187 |

|

|

$ |

75,177 |

|

|

Depreciation of property, plant and equipment and right-of-use

assets |

|

81,037 |

|

|

|

74,672 |

|

| Amortization of development

costs |

|

2,494 |

|

|

|

2,613 |

|

| Loss on

disposal of property, plant and equipment |

|

112 |

|

|

|

42 |

|

|

Adjusted EBITDA |

$ |

162,830 |

|

|

$ |

152,504 |

|

*Adjustments are explained in the “Adjustments

to Net Income” section of this Press Release

SALES

Three months ended March 31, 2024 to

three months ended March 31, 2023 comparison

|

|

Three months ended March 31, 2024 |

|

Three months ended March 31, 2023 |

|

$ Change |

|

% Change |

|

North America |

$ |

963,943 |

|

|

$ |

973,992 |

|

|

(10,049 |

) |

|

(1.0 |

%) |

| Europe |

|

334,010 |

|

|

|

303,470 |

|

|

30,540 |

|

|

10.1 |

% |

| Rest of the World |

|

31,762 |

|

|

|

33,882 |

|

|

(2,120 |

) |

|

(6.3 |

%) |

|

Eliminations |

|

(5,802 |

) |

|

|

(7,455 |

) |

|

1,653 |

|

|

22.2 |

% |

|

Total Sales |

$ |

1,323,913 |

|

|

$ |

1,303,889 |

|

|

20,024 |

|

|

1.5 |

% |

The Company’s consolidated sales for the first

quarter of 2024 increased by $20.0 million or 1.5% to $1,323.9

million as compared to $1,303.9 million for the first quarter of

2023. The total increase in sales was driven by a year-over-year

increase in the Europe operating segment, partially offset by

year-over-year decreases in North America and the Rest of the

World.

Sales for the first quarter of 2024 in the

Company’s North America operating segment decreased by $10.0

million or 1.0% to $963.9 million from $974.0 million for the first

quarter of 2023. The decrease was due to lower year-over-year OEM

production volumes on certain light vehicle platforms, including

the Ford Mustang Mach E, General Motors' Equinox/Terrain, and

Mercedes' new electric vehicle platform (EVA2); programs that ended

production during or subsequent to the first quarter of 2023,

specifically the Dodge Charger/Challenger and Chevrolet Bolt; and a

decrease in tooling sales of $33.0 million, which are typically

dependent of the timing of tooling construction and final

acceptance by the customer. These negative factors were partially

offset by the launch and ramp up of new programs during or

subsequent to the first quarter of 2023, including General Motors'

new electric vehicle platform (BEV3), a Toyota/Lexus SUV, and a

transmission for the ZF Group; and higher year-over-year OEM

production volumes on certain other light vehicle platforms,

including the Ford Escape and General Motors' large pick-up truck

and SUV platform. Overall first quarter industry-wide OEM light

vehicle production volumes in North America increased by

approximately 1% year-over-year.

Sales for the first quarter of 2024 in the

Company’s Europe operating segment increased by $30.5 million or

10.1% to $334.0 million from $303.5 million for the first quarter

of 2023. The increase was due to an increase in tooling sales of

$30.8 million, which are typically dependent of the timing of

tooling construction and final acceptance by the customer; higher

year-over-year OEM production volumes on certain platforms,

including aluminum engine blocks for Jaguar Land Rover, Mercedes

and Ford; and the impact of foreign exchange on the translation of

Euro denominated production sales, which had a positive impact on

overall sales for the first quarter of 2024 of $5.0 million. These

positive factors were partially offset by lower year-over-year

production volumes of certain other light vehicle platforms,

including the Mercedes' new electric vehicle platform (EVA2) and

Lucid Air. Overall industry-wide first quarter OEM light vehicle

production volumes in Europe decreased by approximately 3%

year-over-year.

Sales for the first quarter of 2024 in the

Company’s Rest of the World operating segment decreased by $2.1

million or 6.3% to $31.8 million from $33.9 million for the first

quarter of 2023. The decrease was largely driven by programs that

came with the operations acquired from Metalsa in China that ended

production during or subsequent to the first quarter of 2023;

partially offset by the launch and ramp up of new programs during

or subsequent to the first quarter of 2023, specifically the BMW

5-series in China, and an increase in tooling sales of $4.2

million.

Overall tooling sales increased by $2.1 million

(including outside segment sales eliminations) to $66.4 million for

the first quarter of 2024 from $64.3 million for the first quarter

of 2023.

GROSS MARGIN

Three months ended March 31, 2024 to

three months ended March 31, 2023 comparison

|

|

Three months ended March 31, 2024 |

|

Three months ended March 31, 2023 |

|

$ Change |

|

% Change |

|

Gross margin |

$ |

172,537 |

|

|

$ |

167,386 |

|

|

5,151 |

|

3.1 |

% |

| % of

Sales |

|

13.0 |

% |

|

|

12.8 |

% |

|

|

|

|

The gross margin percentage for the first

quarter of 2024 of 13.0% increased as a percentage of sales by 0.2%

as compared to the gross margin percentage for the first quarter of

2023 of 12.8%. The increase in gross margin as a percentage of

sales was generally due to:

- productivity and efficiency

improvements at certain operating facilities and other

improvements; and

- contribution

from overall higher production sales volume.

These factors were partially offset by:

- a negative sales mix, including

additional depreciation expense from recent new program

investments;

- an unfavourable impact from a

year-over-year change in foreign exchange rates in Mexico; and

- operational

inefficiencies at certain operating facilities.

Overall market related inflationary pressures on

labour, material and energy costs, along with offsetting commercial

settlements, were generally stable for the quarter on a

year-over-year basis.

ADJUSTMENTS TO NET INCOME

Adjusted Net Income excludes certain items as

set out in the following table and described in the notes thereto.

Management uses Adjusted Net Income as a measurement of operating

performance of the Company and believes that, in conjunction with

IFRS measures, it provides useful information about the financial

performance and condition of the Company.

TABLE A

Three months ended March 31, 2024 to

three months ended March 31, 2023 comparison

|

|

Three months ended March 31, 2024 |

|

Three months ended March 31, 2023 |

|

$ Change |

|

NET INCOME |

$ |

43,650 |

|

|

$ |

48,171 |

|

|

$ |

(4,521 |

) |

| |

|

|

|

|

|

| Adjustments: |

|

|

|

|

|

| Restructuring costs (1) |

|

6,255 |

|

|

|

- |

|

|

|

6,255 |

|

| Net gain on disposal of equity

investments (2) |

|

- |

|

|

|

(5,273 |

) |

|

|

5,273 |

|

|

ADJUSTMENTS, BEFORE TAX |

$ |

6,255 |

|

|

$ |

(5,273 |

) |

|

$ |

11,528 |

|

| |

|

|

|

|

|

| Tax impact of adjustments |

|

(1,808 |

) |

|

|

699 |

|

|

|

(2,507 |

) |

|

ADJUSTMENTS, AFTER TAX |

$ |

4,447 |

|

|

$ |

(4,574 |

) |

|

$ |

9,021 |

|

|

|

|

|

|

|

|

|

ADJUSTED NET INCOME |

$ |

48,097 |

|

|

$ |

43,597 |

|

|

$ |

4,500 |

|

|

|

|

|

|

|

|

| Number of Shares Outstanding –

Basic (‘000) |

|

77,900 |

|

|

|

80,387 |

|

|

|

| Adjusted Basic Net Earnings

Per Share |

$ |

0.62 |

|

|

$ |

0.54 |

|

|

|

| Number of Shares Outstanding –

Diluted (‘000) |

|

77,960 |

|

|

|

80,445 |

|

|

|

|

Adjusted Diluted Net Earnings Per Share |

$ |

0.62 |

|

|

$ |

0.54 |

|

|

|

(1) Restructuring

costs

Additions to the restructuring provision during

the first quarter of 2024 totaled $6.3 million, and represent

employee-related severance resulting from the rightsizing of

certain operations in Mexico ($2.8 million), Germany ($1.7

million), Canada ($1.2 million), and the United States ($0.6

million).

(2) Net

gain on disposal of equity investments

On March 24, 2023, Martinrea sold its equity

interest in VoltaXplore Inc. ("VoltaXplore) to NanoXplore Inc.

("NanoXplore") for 3,420,406 common shares of NanoXplore at $2.92

per share representing an aggregate consideration of $10.0 million.

The sale transaction resulted in a gain on disposal of equity

investments during the first quarter of 2023 as follows:

|

Gross gain (Total consideration of $10.0 million less book value of

investment) |

$ |

6,821 |

|

| Less:

gain attributable to indirect retained interest |

|

(1,548 |

) |

|

Net gain on disposal of equity investments |

$ |

5,273 |

|

Subsequent to this transaction, the Company no

longer holds a direct equity interest in VoltaXplore while its

equity ownership interest in NanoXplore increased from 21.1% to

22.7%.

NET INCOME

Three months ended March 31, 2024 to

three months ended March 31, 2023 comparison

|

|

Three months ended March 31, 2024 |

|

Three months ended March 31, 2023 |

|

$ Change |

|

% Change |

|

Net Income |

$ |

43,650 |

|

$ |

48,171 |

|

(4,521 |

) |

|

(9.4 |

%) |

| Adjusted Net Income |

|

48,097 |

|

|

43,597 |

|

4,500 |

|

|

10.3 |

% |

| Net Earnings per Share |

|

|

|

|

|

|

|

|

Basic and Diluted |

$ |

0.56 |

|

$ |

0.60 |

|

|

|

|

| Adjusted Net Earnings per

Share |

|

|

|

|

|

|

|

|

Basic and Diluted |

$ |

0.62 |

|

$ |

0.54 |

|

|

|

|

Net Income, before adjustments, for the first

quarter of 2024 decreased by $4.5 million to $43.7 million or $0.56

per share, on a basic and diluted basis, from Net Income of $48.2

million or $0.60 per share, on a basic and diluted basis, for the

first quarter of 2023. Excluding the adjustments explained in Table

A under “Adjustments to Net Income”, Adjusted Net Income for the

first quarter of 2024 increased by $4.5 million to $48.1 million or

$0.62 per share on a basic and diluted basis, from $43.6 million or

$0.54 per share, on a basic and diluted basis, for the first

quarter of 2023.

Adjusted Net Income for the first quarter of

2024, as compared to the first quarter of 2023, was positively

impacted by the following:

- higher gross margin as previously

explained; and

- a net foreign

exchange gain of $4.9 million for the first quarter of 2024

compared to a gain of $0.1 million for the first quarter of

2023.

These factors were partially offset by the

following:

- a $1.7 million year-over-year

increase in research and development costs driven generally by

increased new product and process development activity;

- a $1.1 million year-over-year

increase in finance expense as a result of increased borrowing

rates on the Company's revolving bank debt; and

- a higher effective tax rate (24.6%

for the first quarter of 2024 compared to 20.7% for the first

quarter of 2023).

DIVIDEND

A cash dividend of $0.05 per share has been

declared by the Board of Directors payable to shareholders of

record on June 30, 2024, on or about July 15, 2024.

ABOUT MARTINREA

Martinrea International Inc. is a leader in the

development and production of quality metal parts, assemblies and

modules, fluid management systems, and complex aluminum products

focused primarily on the automotive sector. Martinrea currently

operates in 56 locations in Canada, the United States, Mexico,

Brazil, Germany, Slovakia, Spain, China, South Africa, and Japan.

Martinrea’s vision is making lives better by being the best

supplier we can be in the products we make and the services we

provide. For more information on Martinrea, please visit

www.martinrea.com. Follow Martinrea on X and Facebook.

CONFERENCE CALL DETAILS

A conference call to discuss the financial

results will be held on Thursday, May 2, 2024 at 5:30 p.m. Eastern

Time. To participate, please dial 416-641-6104 (Toronto area) or

800-952-5114 (toll free Canada and US) and enter participant code

1012992#. Please call 10 minutes prior to the start of the

conference call.

The conference call will also be webcast live in

listen-only mode and archived for twelve months. The webcast and

accompanying presentation can be accessed at:

https://www.martinrea.com/investor-relations/events-presentations/.

There will also be a rebroadcast of the call

available by dialing 905-694-9451 or toll free 800-408-3053

(Conference ID – 3168089#). The rebroadcast will be available until

June 3, 2024 at 5:00 p.m.

If you have any teleconferencing questions,

please call Ganesh Iyer at 416-749-0314.

FORWARD-LOOKING INFORMATION

Special Note Regarding Forward-Looking

Statements

This Press Release and the documents

incorporated by reference therein contains forward-looking

statements within the meaning of applicable Canadian securities

laws including those related to the Company’s expectations as to,

or its views or beliefs in or on, the impact of, or duration of, or

factors affecting, or expected response to or growth of,

improvements in, expansion of and/or guidance or outlook (including

for 2024) as to future results, revenue, sales, margin, gross

margin, earnings, and earnings per share, adjusted earnings per

share, free cash flow, volumes, adjusted net earnings per share,

operating income margins, operating margins, adjusted operating

income margins, leverage ratios, net debt to adjusted EBITDA(1),

debt repayment, Adjusted EBITDA(1), capex levels, working capital

levels, cash tax levels, progress on commercial negotiations, the

growth of the Company and pursuit of, and belief in, its

strategies, the strength, recovery and growth of the automotive

industry and continuing challenges, contemplated purchases under

the NCIB, expectation of the benefit of the Equispheres investment,

as well as other forward-looking statements. The words “continue”,

“expect”, “anticipate”, “estimate”, “may”, “will”, “should”,

“views”, “intend”, “believe”, “plan” and similar expressions are

intended to identify forward-looking statements. Forward-looking

statements are based on estimates and assumptions made by the

Company in light of its experience and its perception of historical

trends, current conditions and expected future developments, as

well as other factors that the Company believes are appropriate in

the circumstances, such as expected sales and industry production

estimates, current foreign exchange rates, timing of product

launches and operational improvement during the period, and current

Board approved budgets. Many factors could cause the Company’s

actual results, performance or achievements to differ materially

from those expressed or implied by the forward-looking statements,

including, without limitation, the following factors, some of which

are discussed in detail in the Company’s AIF and MD&A for the

year ended December 31, 2023, and other public filings which can be

found at www.sedarplus.ca:

- North American and Global Economic

and Political Conditions (including war) and Consumer

Confidence

- Automotive Industry Risks

- Pandemics and Epidemics, Force

Majeure Events, Natural Disasters, Terrorist Activities, Political

and Civil Unrest or War, and Other Outbreaks

- Russia and Ukraine War and

Hamas-Israel War

- Semiconductor Chip Shortages and

Price Increases

- Inflationary Pressures

- Regional Energy Shortages

- Dependence Upon Key Customers

- Customer Consolidation and

Cooperation

- Emergence of Potentially Disruptive

EV OEMs

- Outsourcing and Insourcing

Trends

- Financial Viability of Suppliers

and Key Suppliers and Supply Disruptions

- Competition

- Customer Pricing Pressures,

Contractual Arrangements, Cost and Risk Absorption and Purchase

Orders

- Material and Commodity Prices and

Volatility

- Scrap Steel/Aluminum Price

Volatility

- Quote/Pricing Assumptions

- Launch and Operational Costs and

Cost Structure

- Fluctuations in Operating

Results

- Product Warranty,

Repair/Replacement Costs, Recall, Product Liability and Liability

Risk

- Product Development and

Technological Change

- A Shift Away from Technologies in

Which the Company is Investing

- Dependence Upon Key Personnel

- Limited Financial

Resources/Uncertainty of Future Financing/Banking

- Cybersecurity Threats

- Acquisitions

- Joint Ventures

- Private or Public Equity

Investments in Technology Companies

- Potential Tax Exposures

- Potential Rationalization Costs,

Turnaround Costs and Impairment Charges

- Labour Relations Matters

- Trade Restrictions or Disputes

- Changes in Laws and Governmental

Regulations

- Environmental Regulation and

Climate Change

- Litigation and Regulatory

Compliance and Investigations

- Risks of Conducting Business in

Foreign Countries, Including China, Brazil and Other Growing

Markets

- Currency Risk

- Internal Controls Over Financial

Reporting and Disclosure Controls and Procedures

- Loss of Use of Key Manufacturing

Facilities

- Intellectual Property

- Availability of Consumer Credit or

Cost of Borrowing

- Evolving Business Risk Profile

- Competition with Low Cost

Countries

- The Company’s Ability to Shift its

Manufacturing Footprint to Take Advantage of Opportunities in

Growing Markets

- Change in the Company’s Mix of

Earnings Between Jurisdictions with Lower Tax Rates and Those with

Higher Tax Rates

- Pension Plans and Other

Post-Employment Benefits

- Potential Volatility of Share

Prices

- Dividends

- Lease Obligations

These factors should be considered carefully,

and readers should not place undue reliance on the Company’s

forward-looking statements. The Company has no intention and

undertakes no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by law.

The common shares of Martinrea trade on The

Toronto Stock Exchange under the symbol “MRE”.

For further information, please contact:

Fred Di TostoPresident and Chief Financial

OfficerMartinrea International Inc.3210 Langstaff RoadVaughan,

Ontario L4K 5B2Tel: 416-749-0314Fax:

289-982-3001

Martinrea International Inc.Interim Condensed

Consolidated Balance Sheets(in thousands of Canadian dollars)

(unaudited)

|

|

Note |

March 31, 2024 |

December 31, 2023 |

|

ASSETS |

|

|

|

|

Cash and cash equivalents |

|

$ |

173,694 |

$ |

186,804 |

| Trade and other

receivables |

2 |

|

826,880 |

|

695,819 |

| Inventories |

3 |

|

558,119 |

|

568,274 |

| Prepaid expenses and

deposits |

|

|

32,310 |

|

33,904 |

| Income

taxes recoverable |

|

|

20,080 |

|

11,089 |

|

TOTAL CURRENT ASSETS |

|

|

1,611,083 |

|

1,495,890 |

|

Property, plant and equipment |

4 |

|

1,947,889 |

|

1,943,771 |

| Right-of-use assets |

5 |

|

231,103 |

|

238,552 |

| Deferred tax assets |

|

|

199,925 |

|

192,301 |

| Intangible assets |

|

|

42,119 |

|

42,743 |

| Investments |

6 |

|

67,654 |

|

60,170 |

| Pension

assets |

|

|

15,943 |

|

16,303 |

|

TOTAL NON-CURRENT ASSETS |

|

|

2,504,633 |

|

2,493,840 |

|

TOTAL ASSETS |

|

$ |

4,115,716 |

$ |

3,989,730 |

|

|

|

|

|

|

LIABILITIES |

|

|

|

| Trade and other payables |

|

$ |

1,211,451 |

$ |

1,176,579 |

| Provisions |

7 |

|

13,749 |

|

29,892 |

| Income taxes payable |

|

|

22,096 |

|

25,017 |

| Current portion of long-term

debt |

8 |

|

11,178 |

|

12,778 |

| Current

portion of lease liabilities |

9 |

|

49,385 |

|

48,507 |

|

TOTAL CURRENT LIABILITIES |

|

|

1,307,859 |

|

1,292,773 |

|

Long-term debt |

8 |

|

1,019,016 |

|

956,458 |

| Lease liabilities |

9 |

|

203,100 |

|

210,469 |

| Pension and other

post-retirement benefits |

|

|

38,774 |

|

37,261 |

|

Deferred tax liabilities |

|

|

27,492 |

|

27,588 |

|

TOTAL NON-CURRENT LIABILITIES |

|

|

1,288,382 |

|

1,231,776 |

|

TOTAL LIABILITIES |

|

|

2,596,241 |

|

2,524,549 |

|

|

|

|

|

| EQUITY |

|

|

|

| Capital stock |

11 |

|

634,079 |

|

645,256 |

| Contributed surplus |

|

|

45,945 |

|

45,903 |

| Accumulated other

comprehensive income |

|

|

127,132 |

|

95,753 |

|

Retained earnings |

|

|

712,319 |

|

678,269 |

|

TOTAL EQUITY |

|

|

1,519,475 |

|

1,465,181 |

|

TOTAL LIABILITIES AND EQUITY |

|

$ |

4,115,716 |

$ |

3,989,730 |

Contingencies (note

16)Subsequent event

(note 11)

See accompanying notes to the interim condensed consolidated

financial statements.

On behalf of the Board:

| “Robert

Wildeboer” |

Director |

|

“Terry Lyons” |

Director |

Martinrea International Inc.Interim Condensed

Consolidated Statements of Operations(in thousands of Canadian

dollars, except per share amounts) (unaudited)

|

|

Note |

|

Three months endedMarch 31,

2024 |

|

|

Three months endedMarch 31,

2023 |

|

|

|

|

|

|

|

SALES |

|

$ |

1,323,913 |

|

$ |

1,303,889 |

|

|

|

|

|

|

|

Cost of sales (excluding depreciation of property, plant and

equipment and right-of-use assets) |

|

|

(1,074,409 |

) |

|

(1,066,197 |

) |

|

Depreciation of property, plant and equipment and right-of-use

assets (production) |

|

|

(76,967 |

) |

|

(70,306 |

) |

|

Total cost of sales |

|

|

(1,151,376 |

) |

|

(1,136,503 |

) |

|

GROSS MARGIN |

|

|

172,537 |

|

|

167,386 |

|

|

|

|

|

|

|

Research and development costs |

|

|

(10,977 |

) |

|

(9,278 |

) |

|

Selling, general and administrative |

|

|

(78,191 |

) |

|

(78,523 |

) |

|

Depreciation of property, plant and equipment and right-of-use

assets (non-production) |

|

|

(4,070 |

) |

|

(4,366 |

) |

|

Loss on disposal of property, plant and equipment |

|

|

(112 |

) |

|

(42 |

) |

|

Restructuring costs |

7 |

|

(6,255 |

) |

|

- |

|

|

OPERATING INCOME |

|

|

72,932 |

|

|

75,177 |

|

|

|

|

|

|

|

Share of loss of equity investments |

6 |

|

(634 |

) |

|

(1,378 |

) |

|

Net gain on disposal of equity investments |

|

|

- |

|

|

5,273 |

|

|

Finance expense |

13 |

|

(20,173 |

) |

|

(19,046 |

) |

|

Other finance income |

13 |

|

5,443 |

|

|

224 |

|

|

INCOME BEFORE INCOME TAXES |

|

|

57,568 |

|

|

60,250 |

|

|

|

|

|

|

|

Income tax expense |

10 |

|

(13,918 |

) |

|

(12,079 |

) |

|

NET INCOME FOR THE

PERIOD |

|

$ |

43,650 |

|

$ |

48,171 |

|

|

|

|

|

|

|

Basic earnings per share |

12 |

$ |

0.56 |

|

$ |

0.60 |

|

|

Diluted earnings per share |

12 |

$ |

0.56 |

|

$ |

0.60 |

|

See accompanying notes to the interim condensed consolidated

financial statements.

Martinrea International Inc.Interim Condensed

Consolidated Statements of Comprehensive Income(in thousands of

Canadian dollars) (unaudited)

|

|

|

Three months endedMarch 31,

2024 |

|

|

Three months endedMarch 31,

2023 |

|

|

|

|

|

| NET

INCOME FOR THE PERIOD |

$ |

43,650 |

|

$ |

48,171 |

|

| Other

comprehensive income (loss), net

of tax: |

|

|

|

Items that may be reclassified to net

income |

|

|

|

Foreign currency translation differences for foreign

operations |

|

31,391 |

|

|

2,621 |

|

|

Items that will not be reclassified to net

income |

|

|

|

Share of other comprehensive loss of equity investments (note

6) |

|

(12 |

) |

|

(11 |

) |

|

Remeasurement of defined benefit plans |

|

(1,028 |

) |

|

375 |

|

|

Other comprehensive

income, net of tax |

|

30,351 |

|

|

2,985 |

|

|

TOTAL COMPREHENSIVE INCOME

FOR THE PERIOD |

$ |

74,001 |

|

$ |

51,156 |

|

See accompanying notes to the interim condensed consolidated

financial statements.

Martinrea International Inc.Interim Condensed

Consolidated Statements of Changes in Equity(in thousands of

Canadian dollars) (unaudited)

|

|

|

Capital stock |

|

|

Contributedsurplus |

|

|

Accumulated other comprehensive

income |

|

|

Retained earnings |

|

|

Total equity |

|

|

BALANCE AT DECEMBER 31,

2022 |

$ |

663,646 |

|

$ |

45,558 |

|

$ |

124,065 |

|

$ |

543,636 |

|

$ |

1,376,905 |

|

|

Net income for the period |

|

- |

|

|

- |

|

|

- |

|

|

48,171 |

|

|

48,171 |

|

|

Compensation expense related to stock options |

|

- |

|

|

110 |

|

|

- |

|

|

- |

|

|

110 |

|

|

Dividends ($0.05 per share) |

|

- |

|

|

- |

|

|

- |

|

|

(4,019 |

) |

|

(4,019 |

) |

|

Other comprehensive income (loss) net of tax |

|

|

|

|

|

|

Remeasurement of defined benefit plans |

|

- |

|

|

- |

|

|

- |

|

|

375 |

|

|

375 |

|

|

Foreign currency translation differences |

|

- |

|

|

- |

|

|

2,621 |

|

|

- |

|

|

2,621 |

|

|

Share of other comprehensive loss of equity investments |

|

- |

|

|

- |

|

|

(11 |

) |

|

- |

|

|

(11 |

) |

|

BALANCE AT MARCH 31,

2023 |

|

663,646 |

|

|

45,668 |

|

|

126,675 |

|

|

588,163 |

|

|

1,424,152 |

|

|

Net income for the period |

|

- |

|

|

- |

|

|

- |

|

|

105,494 |

|

|

105,494 |

|

|

Compensation expense related to stock options |

|

- |

|

|

332 |

|

|

- |

|

|

- |

|

|

332 |

|

|

Dividends ($0.15 per share) |

|

- |

|

|

- |

|

|

- |

|

|

(11,827 |

) |

|

(11,827 |

) |

|

Exercise of employee stock options |

|

358 |

|

|

(97 |

) |

|

- |

|

|

- |

|

|

261 |

|

|

Repurchase of common shares (note 11) |

|

(18,748 |

) |

|

- |

|

|

- |

|

|

(10,321 |

) |

|

(29,069 |

) |

|

Other comprehensive income (loss) net of tax |

|

|

|

|

|

|

Remeasurement of defined benefit plans |

|

- |

|

|

- |

|

|

- |

|

|

6,760 |

|

|

6,760 |

|

|

Foreign currency translation differences |

|

- |

|

|

- |

|

|

(30,915 |

) |

|

- |

|

|

(30,915 |

) |

|

Share of other comprehensive loss of equity investments |

|

- |

|

|

- |

|

|

(7 |

) |

|

- |

|

|

(7 |

) |

|

BALANCE AT DECEMBER 31,

2023 |

|

645,256 |

|

|

45,903 |

|

|

95,753 |

|

|

678,269 |

|

|

1,465,181 |

|

|

Net income for the period |

|

- |

|

|

- |

|

|

- |

|

|

43,650 |

|

|

43,650 |

|

|

Compensation expense related to stock options |

|

- |

|

|

42 |

|

|

- |

|

|

- |

|

|

42 |

|

|

Dividends ($0.05 per share) |

|

- |

|

|

- |

|

|

- |

|

|

(3,839 |

) |

|

(3,839 |

) |

|

Repurchase of common shares (note 11) |

|

(11,177 |

) |

|

- |

|

|

- |

|

|

(4,733 |

) |

|

(15,910 |

) |

|

Other comprehensive income (loss) net of tax |

|

|

|

|

|

|

Remeasurement of defined benefit plans |

|

- |

|

|

- |

|

|

- |

|

|

(1,028 |

) |

|

(1,028 |

) |

|

Foreign currency translation differences |

|

- |

|

|

- |

|

|

31,391 |

|

|

- |

|

|

31,391 |

|

|

Share of other comprehensive loss of equity investments |

|

- |

|

|

- |

|

|

(12 |

) |

|

- |

|

|

(12 |

) |

|

BALANCE AT MARCH 31,

2024 |

$ |

634,079 |

|

$ |

45,945 |

|

$ |

127,132 |

|

$ |

712,319 |

|

$ |

1,519,475 |

|

See accompanying notes to the interim condensed consolidated

financial statements.

Martinrea International Inc.Interim Condensed

Consolidated Statements of Cash Flows(in thousands of Canadian

dollars) (unaudited)

|

|

|

Three months endedMarch 31,

2024 |

|

|

Three months endedMarch 31,

2023 |

|

|

CASH PROVIDED BY (USED IN): |

|

|

| OPERATING

ACTIVITIES: |

|

|

|

Net income for the period |

$ |

43,650 |

|

$ |

48,171 |

|

| Adjustments for: |

|

|

|

Depreciation of property, plant and equipment and right-of-use

assets |

|

81,037 |

|

|

74,672 |

|

|

Amortization of development costs |

|

2,494 |

|

|

2,613 |

|

|

Unrealized gain on foreign exchange forward contracts |

|

(796 |

) |

|

(4,784 |

) |

|

Finance expense |

|

20,173 |

|

|

19,046 |

|

|

Income tax expense |

|

13,918 |

|

|

12,079 |

|

|

Loss on disposal of property, plant and equipment |

|

112 |

|

|

42 |

|

|

Deferred and restricted share units expense (benefit) |

|

(184 |

) |

|

5,436 |

|

|

Stock options expense |

|

42 |

|

|

110 |

|

|

Share of loss of equity investments |

|

634 |

|

|

1,378 |

|

|

Net gain on disposal of equity investments |

|

- |

|

|

(5,273 |

) |

|

Pension and other post-retirement benefits expense |

|

564 |

|

|

694 |

|

|

Contributions made to pension and other post-retirement

benefits |

|

(568 |

) |

|

(623 |

) |

|

|

|

161,076 |

|

|

153,561 |

|

| Changes in non-cash working

capital items: |

|

|

|

Trade and other receivables |

|

(118,212 |

) |

|

(131,868 |

) |

|

Inventories |

|

18,607 |

|

|

(21,975 |

) |

|

Prepaid expenses and deposits |

|

1,983 |

|

|

3,259 |

|

|

Trade, other payables and provisions |

|

21,396 |

|

|

107,426 |

|

|

|

|

84,850 |

|

|

110,403 |

|

|

Interest paid |

|

(20,678 |

) |

|

(23,299 |

) |

|

Income taxes paid |

|

(25,118 |

) |

|

(32,577 |

) |

|

NET CASH PROVIDED BY

OPERATING ACTIVITIES |

$ |

39,054 |

|

$ |

54,527 |

|

|

|

|

|

| FINANCING

ACTIVITIES: |

|

|

|

Increase in long-term debt (net of deferred financing fees) |

|

49,464 |

|

|

47,094 |

|

|

Equipment loan repayments |

|

(2,710 |

) |

|

(4,240 |

) |

|

Principal payments of lease liabilities |

|

(12,324 |

) |

|

(10,954 |

) |

|

Dividends paid |

|

(3,907 |

) |

|

(4,019 |

) |

|

Repurchase of common shares |

|

(15,910 |

) |

|

- |

|

|

NET CASH PROVIDED BY

FINANCING ACTIVITIES |

$ |

14,613 |

|

$ |

27,881 |

|

|

|

|

|

| INVESTING

ACTIVITIES: |

|

|

|

Purchase of property, plant and equipment (excluding capitalized

interest)* |

|

(58,273 |

) |

|

(83,416 |

) |

|

Capitalized development costs |

|

(1,045 |

) |

|

(1,765 |

) |

|

Increase in investments (note 6) |

|

(8,130 |

) |

|

- |

|

|

Proceeds on disposal of property, plant and equipment |

|

978 |

|

|

131 |

|

|

NET CASH USED IN

INVESTING ACTIVITIES |

$ |

(66,470 |

) |

$ |

(85,050 |

) |

|

|

|

|

| Effect

of foreign exchange rate changes on cash and cash equivalents |

|

(307 |

) |

|

(2,428 |

) |

|

|

|

|

| DECREASE

IN CASH AND CASH EQUIVALENTS |

|

(13,110 |

) |

|

(5,070 |

) |

|

CASH AND CASH EQUIVALENTS, BEGINNING OF

PERIOD |

|

186,804 |

|

|

161,655 |

|

|

CASH AND CASH EQUIVALENTS, END OF PERIOD |

$ |

173,694 |

|

$ |

156,585 |

|

*As at March 31, 2024, $53,063

(December 31, 2023 - $75,800) of purchases of property, plant

and equipment remain unpaid and are recorded in trade and other

payables.

See accompanying notes to the interim condensed

consolidated financial statements.

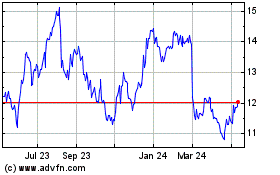

Martinrea (TSX:MRE)

Historical Stock Chart

From Nov 2024 to Dec 2024

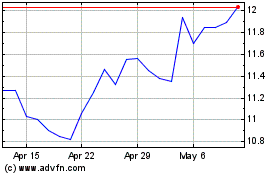

Martinrea (TSX:MRE)

Historical Stock Chart

From Dec 2023 to Dec 2024