All amounts are in US dollars except as otherwise noted

Nutrien Ltd. (TSX and NYSE: NTR) announced today its 2020 third

quarter results, with a net loss of $587 million ($1.03 diluted

loss per share), which includes a non-cash impairment of $823

million, primarily related to our Phosphate operations.

Third-quarter adjusted net earnings were $0.23 per share (adjusted

EBITDA was $670 million), excluding the impairment. Adjusted net

earnings includes a net tax benefit of $48 million ($0.08 per

diluted share) related primarily to recoveries of prior year taxes

due to US legislative changes. Adjusted net earnings per share and

adjusted EBITDA (consolidated), together with the related guidance

and potash cash cost of product manufactured are non-IFRS financial

measures. See the “Non-IFRS Financial Measures” section for further

information.

“Nutrien delivered another quarter of solid operating results

with strong fertilizer sales volumes and exceptional growth of

orders through our digital agriculture platform, surpassing $1

billion of sales. Market conditions are improving around the world

with higher crop and fertilizer prices, lower expected inventories

and strong demand for crop inputs as we finish the year and enter

2021,” commented Chuck Magro, Nutrien’s President and CEO.

Highlights:

- In the third quarter of 2020, we recognized a non-cash

impairment of $823 million associated primarily with our Phosphate

assets related to a less favorable long-term outlook for phosphate

prices and expected global supply imbalance.

- Retail delivered 13 percent higher adjusted EBITDA in the first

nine months of 2020, over the same period in 2019 as a result of

double-digit growth in sales and gross margin. Adjusted EBITDA in

the third quarter of 2020 was 15 percent lower due to elevated

applications in the same period last year caused by the timing of

the growing season, and was further impacted by lower insecticide

and fungicide applications this quarter as a result of lower than

expected US acreage and dry conditions. Total sales through our

leading digital retail platform exceeded $1.0 billion in the first

nine months of 2020, more than double our annual goal of $500

million. Digital sales in the first nine months of 2020 accounted

for 43 percent of North American sales of products that were

available for purchase online.

- Potash sales volumes in the third quarter and first nine months

of 2020 were higher compared to the same periods in 2019, and

Nutrien is fully committed on offshore potash sales volumes and

well subscribed domestically for the remainder of the year. Potash

adjusted EBITDA was down 19 percent and 33 percent in the third

quarter and first nine months of 2020 respectively, compared to the

same periods last year as strong sales volumes and lower cost of

goods sold per tonne were more than offset by lower net realized

selling prices. Potash cash cost of product manufactured was $53

per tonne in the third quarter, the second lowest on record and $9

per tonne lower than in the third quarter of 2019.

- Nitrogen adjusted EBITDA was 21 percent lower in the third

quarter and 17 percent lower in the first nine months of 2020

compared to the same periods last year due to lower net realized

selling prices and lower industrial sales volumes. We delivered

higher sales volumes, lower cost of goods sold and higher ammonia

utilization rates (93 percent versus 90 percent) in the first nine

months of 2020 compared to the same period last year. In the third

quarter, we also made the decision to indefinitely close the

smallest of our four ammonia plants in Trinidad. The closure is

expected to enhance the competitiveness at that site, and we are

now running three plants at normal production levels.

- Nutrien’s full-year 2020 adjusted net earnings per share and

adjusted EBITDA guidance range is narrowed to $1.60 to $1.85 per

share and $3.5 billion to $3.7 billion, respectively due to

increased visibility in each of our business units to the end of

the year.

Management’s Discussion and Analysis

The following management’s discussion and analysis (“MD&A”)

is the responsibility of management and is dated as of November 2,

2020. The Board of Directors (“Board”) of Nutrien carries out its

responsibility for review of this disclosure principally through

its audit committee, comprised exclusively of independent

directors. The audit committee reviews and, prior to its

publication approves this disclosure pursuant to the authority

delegated to it by the Board. The term “Nutrien” refers to Nutrien

Ltd. and the terms “we”, “us”, “our”, “Nutrien” and “the Company”

refer to Nutrien and, as applicable, Nutrien and its direct and

indirect subsidiaries on a consolidated basis. Additional

information relating to Nutrien (which, except as otherwise noted,

is not incorporated by reference herein), including our 2019 Annual

Report dated February 19, 2020, which includes our annual audited

consolidated financial statements and MD&A and our Annual

Information Form, each for the year ended December 31, 2019, can be

found on SEDAR at www.sedar.com and on EDGAR at www.sec.gov. No

update is provided to the disclosure in our annual MD&A except

for material information since the date of our annual MD&A. The

Company is a foreign private issuer under the rules and regulations

of the US Securities and Exchange Commission (“SEC”).

This MD&A is based on the Company’s unaudited interim

condensed consolidated financial statements as at and for the three

and nine months ended September 30, 2020 (“interim financial

statements”) based on International Financial Reporting Standards

as issued by the International Accounting Standards Board (“IFRS”)

and prepared in accordance with International Accounting Standard

34 “Interim Financial Reporting” unless otherwise noted. This

MD&A contains certain non-IFRS financial measures and

forward-looking statements which are described in the “Non-IFRS

Financial Measures” and the “Forward-Looking Statements” sections,

respectively.

Market Outlook

Agriculture and Retail

- Key crop prices have increased, driven by significant

improvements in supply and demand fundamentals. Higher crop prices

have boosted North American grower sentiment.

- The North American harvest progressed at a pace well ahead of

the past two years when timing was impacted by late maturing crops

and weather delays. This is expected to provide a wider window for

growers to plan and apply fall fertilizer compared to the past few

fall seasons.

- Strong Brazilian crop prices and margins provided an incentive

to boost summer soybean and Safrinha corn planting. We expect the

planted area of these crops to increase by approximately 4 percent

and 6 percent respectively. Planting has started slower than normal

as a result of dry weather, but we expect a long planting window

and high crop prices will motivate farmers to plant.

Crop Nutrient Markets

- Global potash demand has been strong in 2020 and we continue to

expect global potash shipments and consumption to increase by

approximately 2 million tonnes from 2019 levels. As a result, we

maintain our 2020 shipment forecast between 65 and 67 million

tonnes.

- The prospect of a robust fall application season in North

America has supported strong retail-level demand. We expect that

potash delivered in North America in the fall of 2020 will largely

be applied to ground and that channel inventories will be lower at

the end of 2020 compared to recent years. We also expect that

strong fall applications in China, driven by historically high crop

prices in combination with seasonal increases in compound NPK

production, will support strong potash consumption in the remainder

of 2020. Meanwhile, demand in India will continue to be supported

by the favorable growing conditions and increased minimum support

prices for crops.

- Global urea prices have been relatively stable as Indian import

tenders have pulled significant volumes out of the trade market.

The pace of Chinese urea exports has recently increased, along with

Indian demand, but remains down around 10 percent in the first nine

months of the year. North American urea prices are currently

discounted relative to the rest of the world, which is seasonally

normal, but offshore imports are down more than 25 percent from

July to September and prices need to increase significantly to

reach import parity. Global ammonia prices have increased driven by

improved industrial demand, higher global gas prices and production

curtailments in East Asia and Trinidad.

- Global phosphate prices have trended higher due to strong

demand in India and Brazil and trade flow changes related to

countervailing duty investigations in the US. We continue to

believe the phosphate market is fundamentally oversupplied which

could limit a long-term price recovery.

Financial Outlook and Guidance

Based on market factors detailed above, we are narrowing our

2020 adjusted net earnings guidance to $1.60 to $1.85 per share

(from $1.50 to $1.90 per share previously) and adjusted EBITDA

guidance to $3.5 to $3.7 billion (from $3.5 to $3.8 billion

previously). In the third quarter of 2020, we revised the measure

with which we evaluate our segments from EBITDA to adjusted EBITDA.

This has not had an impact on our segment guidance numbers

below.

All guidance numbers, including those noted above are outlined

in the tables below. Refer to page 46 of Nutrien’s 2019 Annual

Report for related sensitivities.

2020 Guidance Ranges 1

Low

High

Adjusted net earnings per share 2

$

1.60

$

1.85

Adjusted EBITDA (billions) 2

$

3.5

$

3.7

Adjusted Retail EBITDA (billions)

$

1.37

$

1.42

Adjusted Potash EBITDA (billions)

$

1.1

$

1.2

Adjusted Nitrogen EBITDA (billions)

$

1.05

$

1.10

Adjusted Phosphate EBITDA (millions)

$

200

$

250

Potash sales tonnes (millions) 3

12.2

12.5

Nitrogen sales tonnes (millions) 3

10.9

11.1

Depreciation and amortization

(billions)

$

1.85

$

1.95

Effective tax rate

11

%

13

%

Sustaining capital expenditures

(billions)

$

0.9

$

1.0

1 See the “Forward-Looking Statements”

section.

2 See the “Non-IFRS Financial Measures”

section.

3 Manufactured products only. Nitrogen

excludes ESN® and Rainbow products.

Consolidated Results

Three Months Ended September

30

Nine Months Ended September

30

(millions of US dollars)

2020

2019

% Change

2020

2019

% Change

Sales

4,205

4,169

1

16,807

16,581

1

Freight, transportation and

distribution

204

210

(3)

653

596

10

Cost of goods sold

3,004

2,819

7

12,129

11,558

5

Gross margin

997

1,140

(13)

4,025

4,427

(9)

Expenses

1,719

812

112

3,526

2,628

34

Net (loss) earnings

(587)

141

n/m

143

1,040

(86)

Adjusted EBITDA 1

670

787

(15)

2,899

3,361

(14)

Free cash flow ("FCF") 1

280

329

(15)

1,634

2,019

(19)

FCF including changes in non-cash

operating working capital 1

(888)

333

n/m

34

579

(94)

1 See the "Non-IFRS Financial Measures"

section.

Our third-quarter and first-nine months net (loss) earnings for

2020 were negatively impacted primarily by a non-cash impairment of

assets related primarily to our Phosphate operations. Adjusted

EBITDA decreased in the same periods due to significantly lower

crop nutrient prices that more than offset strong Retail earnings

growth and greater operational efficiencies. The COVID-19 pandemic

had limited impact on our business during the periods.

Segment Results

Our discussion of segment results set out on the following pages

is a comparison of the results for the three and nine months ended

September 30, 2020 to the results for the three and nine months

ended September 30, 2019, respectively, unless otherwise noted. In

the third quarter of 2020, we revised the measure with which we

evaluate our segments from EBITDA to Adjusted EBITDA. Adjusted

EBITDA provides a better indication of the segments performance as

it excludes the impact of impairments and other costs that are

centrally managed by our corporate function. We have presented

adjusted EBITDA for the comparative periods.

Retail

Three Months Ended September

30

(millions of US dollars, except

Dollars

Gross Margin

Gross Margin (%)

as otherwise noted)

2020

2019

% Change

2020

2019

% Change

2020

2019

Sales

Crop nutrients

780

769

1

179

175

2

23

23

Crop protection products

1,328

1,318

1

256

303

(16)

19

23

Seed

103

60

72

27

17

59

26

28

Merchandise

234

135

73

37

22

68

16

16

Services and other

275

217

27

162

138

17

59

64

2,720

2,499

9

661

655

1

24

26

Cost of goods sold

2,059

1,844

12

Gross margin

661

655

1

Expenses 1

669

617

8

Earnings (loss) before finance costs and

taxes ("EBIT")

(8)

38

n/m

Depreciation and amortization

170

152

12

EBITDA / Adjusted EBITDA

162

190

(15)

1 Includes selling expenses of $669

million (2019 – $601 million).

Nine Months Ended September

30

(millions of US dollars, except

Dollars

Gross Margin

Gross Margin (%)

as otherwise noted)

2020

2019

% Change

2020

2019

% Change

2020

2019

Sales

Crop nutrients

4,092

4,082

-

894

846

6

22

21

Crop protection products

4,774

4,348

10

960

892

8

20

21

Seed

1,638

1,613

2

305

276

11

19

17

Merchandise

703

387

82

116

65

78

17

17

Services and other

911

620

47

527

425

24

58

69

12,118

11,050

10

2,802

2,504

12

23

23

Cost of goods sold

9,316

8,546

9

Gross margin

2,802

2,504

12

Expenses 1

2,157

1,937

11

EBIT

645

567

14

Depreciation and amortization

488

433

13

EBITDA / Adjusted EBITDA

1,133

1,000

13

1 Includes selling expenses of $2,068

million (2019 – $1,816 million).

- Adjusted EBITDA was lower in the third quarter of 2020

due primarily to the sales mix and use of crop protection products

compared to the delayed season last year which pushed sales into

the third quarter in North America. US applications this year were

also negatively impacted by lower than expected planted acreage and

weather-related events. Adjusted EBITDA in the first nine months of

2020 increased significantly from the same period in 2019 due to

strong growth in revenue and gross margins across most product

lines. The increase was primarily due to organic growth, aided by

more normal weather conditions in the US, as well as from the

benefit of acquisitions made over the past year. Total selling

expenses increased in the periods due primarily to acquisitions,

including the acquisition of Ruralco Holdings Limited (“Ruralco”).

Selling expenses as a percentage of sales were also impacted by

lower crop nutrient and seed prices in 2020, which resulted in

lower associated sales. Total US selling expenses, excluding

depreciation and amortization, were down this quarter relative to

the third quarter of last year.

- Crop nutrients sales were higher in the third quarter

and the first nine months of 2020, compared to the same periods in

2019 as higher sales volumes more than offset the impact of lower

selling prices. Third quarter sales volumes were 10 percent higher

than last year, due to strong applications in Australia which

offset lower sales volumes in the US. For the first nine months of

2020, total sales volumes were up 12 percent, with increases across

all geographies. Gross margin percentage was stable in the third

quarter but higher in the nine-month period due to a larger

proportion of higher-margin proprietary product sales.

- Crop protection products sales in the third quarter and

first nine months of 2020 were higher compared to the same periods

in 2019, due to acquisitions and continued market share growth.

Gross margin percentage decreased in the periods due to the impact

of recent acquisitions, including that of Ruralco, which impacted

the mix of product sold. There was also a slight reduction in use

of higher margin discretionary products such as fungicides and

insecticides in the US market due to a combination of weather and

market factors.

- Seed sales in the third quarter and first nine months of

2020 increased from the same period last year due to strong growth

in all key markets, including contributions from the Tec Agro Group

acquisition in Brazil and Ruralco in Australia. Gross margin

percentage decreased in the third quarter of 2020 primarily due to

the Ruralco acquisition, while US seed margins in the third quarter

strengthened year over year. Gross margin percentage increased in

the first nine months of 2020 due to higher margins achieved on

soybean and corn sales and fewer replanting discounts compared to

the same periods in 2019.

- Merchandise sales increased in third quarter and first

nine months of 2020 due to benefits from the acquisition of the

Ruralco business in Australia. Gross margin percentage was stable

in the periods.

- Services and other sales were higher in the third

quarter and first nine months of 2020 due to increased

contributions from our Australian business. Sales and gross profit

in the US declined in the third quarter but margins were slightly

stronger. Gross margin percentage decreased in the periods due to

product mix changes resulting primarily from the acquisition of

Ruralco.

Potash

Three Months Ended September

30

(millions of US dollars, except

Dollars

Tonnes (thousands)

Average per Tonne

as otherwise noted)

2020

2019

% Change

2020

2019

% Change

2020

2019

% Change

Manufactured product

Net sales

North America

252

330

(24)

1,426

1,438

(1)

176

229

(23)

Offshore

339

379

(11)

2,252

1,823

24

151

208

(27)

591

709

(17)

3,678

3,261

13

161

218

(26)

Cost of goods sold

303

303

-

83

94

(12)

Gross margin - manufactured

288

406

(29)

78

124

(37)

Gross margin - other 1

-

-

-

Depreciation and amortization

34

34

-

Gross margin - total

288

406

(29)

Gross margin excluding depreciation

Expenses 2

84

86

(2)

and amortization - manufactured 3

112

158

(29)

EBIT

204

320

(36)

Potash cash cost of product

Depreciation and amortization

124

110

13

manufactured 3

53

62

(15)

EBITDA

328

430

(24)

Impairment of assets

22

-

n/m

Adjusted EBITDA

350

430

(19)

1 Includes other potash and purchased

products and is comprised of net sales of $Nil (2019 – $Nil) less

cost of goods sold of $Nil (2019 – $Nil).

2 Includes provincial mining and other

taxes of $58 million (2019 – $83 million).

3 See the "Non-IFRS Financial Measures"

section.

Nine Months Ended September

30

(millions of US dollars, except

Dollars

Tonnes (thousands)

Average per Tonne

as otherwise noted)

2020

2019

% Change

2020

2019

% Change

2020

2019

% Change

Manufactured product

Net sales

North America

709

832

(15)

3,774

3,389

11

188

245

(23)

Offshore

987

1,421

(31)

6,396

6,247

2

154

228

(32)

1,696

2,253

(25)

10,170

9,636

6

167

234

(29)

Cost of goods sold

878

892

(2)

87

93

(6)

Gross margin - manufactured

818

1,361

(40)

80

141

(43)

Gross margin - other 1

-

1

(100)

Depreciation and amortization

32

34

(6)

Gross margin - total

818

1,362

(40)

Gross margin excluding depreciation

Expenses 2

199

242

(18)

and amortization - manufactured

112

175

(36)

EBIT

619

1,120

(45)

Potash cash cost of product

Depreciation and amortization

329

324

2

manufactured

55

60

(8)

EBITDA

948

1,444

(34)

Impairment of assets

22

-

n/m

Adjusted EBITDA

970

1,444

(33)

1 Includes other potash and purchased

products and is comprised of net sales of $Nil million (2019 – $1

million) less cost of goods sold of $Nil (2019 – $Nil).

2 Includes provincial mining and other

taxes of $161 million (2019 – $237 million).

- Adjusted EBITDA decreased in the third quarter and first

nine months of 2020 due to lower global potash prices. This was

partially offset by higher sales volumes and lower cost of goods

sold per tonne.

- Sales volumes in the third quarter of 2020 were the

second highest of any quarter on record while sales volumes in the

first nine months of 2020 were the highest on record. Higher sales

volumes relative to the same periods last year were supported by

strong offshore demand, higher US planted acreage and improved crop

fundamentals.

- Net realized selling price decreased in the third

quarter and first nine months of 2020, due to pressure in global

benchmark prices.

- Cost of goods sold per tonne decreased in both periods

due to production efficiency gains and the deferral of maintenance

projects related to COVID-19 precautions. These factors also

lowered the potash cash cost of product manufactured in the third

quarter and the first nine months of 2020.

Canpotex Sales by Market

(percentage of sales volumes, except

as

Three Months Ended September

30

Nine Months Ended September

30

otherwise noted)

2020

2019

% Change

2020

2019

% Change

Latin America

36

44

(18)

33

31

6

Other Asian markets 1

20

21

(5)

25

27

(7)

China

23

16

44

22

23

(4)

India

14

12

17

13

11

18

Other markets

7

7

-

7

8

(13)

100

100

100

100

1 All Asian markets except China and

India.

Nitrogen

Three Months Ended September

30

(millions of US dollars, except

Dollars

Tonnes (thousands)

Average per Tonne

as otherwise noted)

2020

2019

% Change

2020

2019

% Change

2020

2019

% Change

Manufactured product

Net sales

Ammonia

105

144

(27)

546

715

(24)

193

203

(5)

Urea

193

221

(13)

766

726

6

251

304

(17)

Solutions, nitrates and sulfates

143

168

(15)

1,091

1,081

1

131

155

(15)

441

533

(17)

2,403

2,522

(5)

184

211

(13)

Cost of goods sold

392

416

(6)

164

165

(1)

Gross margin - manufactured

49

117

(58)

20

46

(57)

Gross margin - other 1

9

16

(44)

Depreciation and amortization

55

50

10

Gross margin - total

58

133

(56)

Gross margin excluding depreciation

Expenses

21

13

62

and amortization - manufactured

75

96

(22)

EBIT

37

120

(69)

Ammonia controllable cash cost of

Depreciation and amortization

131

127

3

product manufactured 2

47

45

4

EBITDA

168

247

(32)

Impairment of assets

27

-

n/m

Adjusted EBITDA

195

247

(21)

1 Includes other nitrogen (including ESN®

and Rainbow) and purchased products and is comprised of net sales

of $99 million (2019 – $69 million) less cost of goods sold of $90

million (2019 – $53 million).

2 See the "Non-IFRS Financial Measures"

section.

Nine Months Ended September

30

(millions of US dollars, except

Dollars

Tonnes (thousands)

Average per Tonne

as otherwise noted)

2020

2019

% Change

2020

2019

% Change

2020

2019

% Change

Manufactured product

Net sales

Ammonia

464

602

(23)

2,048

2,400

(15)

227

251

(10)

Urea

703

739

(5)

2,622

2,342

12

268

315

(15)

Solutions, nitrates and sulfates

500

540

(7)

3,451

3,166

9

145

170

(15)

1,667

1,881

(11)

8,121

7,908

3

205

238

(14)

Cost of goods sold

1,344

1,345

-

165

170

(3)

Gross margin - manufactured

323

536

(40)

40

68

(41)

Gross margin - other 1

40

57

(30)

Depreciation and amortization

56

50

12

Gross margin - total

363

593

(39)

Gross margin excluding depreciation

Expenses

29

7

314

and amortization - manufactured

96

118

(19)

EBIT

334

586

(43)

Ammonia controllable cash cost of

Depreciation and amortization

453

394

15

product manufactured

44

44

-

EBITDA

787

980

(20)

Impairment of assets

27

-

n/m

Adjusted EBITDA

814

980

(17)

1 Includes other nitrogen (including ESN®

and Rainbow) and purchased products and is comprised of net sales

of $404 million (2019 – $364 million) less cost of goods sold of

$364 million (2019 – $307 million).

- Adjusted EBITDA decreased in the third quarter and first

nine months of 2020 as lower net realized selling prices more than

offset the benefit of higher sales volumes into North American

agricultural markets and lower cost of goods sold per tonne.

- Sales volumes decreased in the third quarter of 2020

compared to the same period in 2019 due to lower industrial

nitrogen demand, particularly for ammonia, and associated

operational changes in Trinidad. This was partially offset by

higher agriculture-related nitrogen sales. Sales volumes in the

first nine months of 2020 were higher compared to the same period

in 2019 due to recent expansion projects and strong operating rates

at our North American facilities.

- Net realized selling price of nitrogen was lower in the

third quarter and first nine months of 2020 than the same periods

last year due to lower global and North American benchmark prices.

Third quarter sales commitments in 2020 were weighted towards the

beginning of the quarter prior to benchmark price increases.

- Cost of goods sold per tonne decreased in the third

quarter and first nine months of 2020 compared to the same periods

in 2019 due to lower natural gas prices and fixed costs. This more

than offset higher depreciation and amortization per tonne related

to expansion and turnaround work completed in late 2019. Ammonia

controllable cash cost of product manufactured per tonne increased

in the third quarter due to lower production associated with

curtailments in Trinidad. Ammonia controllable cash costs for the

first nine months of 2020 were consistent with the same period last

year due to lower fixed costs that offset lower production.

Natural Gas Prices in Cost of Production

Three Months Ended September

30

Nine Months Ended September

30

(US dollars per MMBtu, except as otherwise

noted)

2020

2019

% Change

2020

2019

% Change

Overall gas cost excluding realized

derivative impact

2.18

2.06

6

2.17

2.47

(12)

Realized derivative impact

0.06

0.22

(73)

0.06

0.14

(57)

Overall gas cost

2.24

2.28

(2)

2.23

2.61

(15)

Average NYMEX

1.98

2.23

(11)

1.88

2.67

(30)

Average AECO

1.62

0.78

108

1.54

1.05

47

- Gas prices in our cost of production decreased in

the third quarter and first nine months of 2020 as lower US gas

prices and a lower realized derivative impact more than offset

higher Canadian gas prices compared to the same period last

year.

Phosphate

Three Months Ended September

30

(millions of US dollars, except

Dollars

Tonnes (thousands)

Average per Tonne

as otherwise noted)

2020

2019

% Change

2020

2019

% Change

2020

2019

% Change

Manufactured product

Net sales

Fertilizer

172

164

5

542

492

10

317

335

(5)

Industrial and feed

94

106

(11)

166

192

(14)

563

549

3

266

270

(1)

708

684

4

375

396

(5)

Cost of goods sold

268

284

(6)

379

416

(9)

Gross margin - manufactured

(2)

(14)

86

(4)

(20)

80

Gross margin - other 1

1

(1)

n/m

Depreciation and amortization

85

85

-

Gross margin - total

(1)

(15)

93

Gross margin excluding depreciation

Expenses

782

9

n/m

and amortization - manufactured

81

65

25

EBIT

(783)

(24)

n/m

Depreciation and amortization

60

58

3

EBITDA

(723)

34

n/m

Impairment of assets

769

-

n/m

Adjusted EBITDA

46

34

35

1 Includes other phosphate and purchased

products and is comprised of net sales of $26 million (2019 - $44

million) less cost of goods sold of $25 million (2019 - $45

million).

Nine Months Ended September

30

(millions of US dollars, except

Dollars

Tonnes (thousands)

Average per Tonne

as otherwise noted)

2020

2019

% Change

2020

2019

% Change

2020

2019

% Change

Manufactured product

Net sales

Fertilizer

491

635

(23)

1,582

1,664

(5)

310

382

(19)

Industrial and feed

304

321

(5)

551

578

(5)

552

555

(1)

795

956

(17)

2,133

2,242

(5)

373

426

(12)

Cost of goods sold

779

963

(19)

366

429

(15)

Gross margin - manufactured

16

(7)

n/m

7

(3)

n/m

Gross margin - other 1

4

(4)

n/m

Depreciation and amortization

84

80

5

Gross margin - total

20

(11)

n/m

Gross margin excluding depreciation

Expenses

799

29

n/m

and amortization - manufactured

91

77

18

EBIT

(779)

(40)

n/m

Depreciation and amortization

179

180

(1)

EBITDA

(600)

140

n/m

Impairment of assets

769

-

n/m

Adjusted EBITDA

169

140

21

1 Includes other phosphate and purchased

products and is comprised of net sales of $87 million (2019 - $125

million) less cost of goods sold of $83 million (2019 - $129

million).

- Adjusted EBITDA increased in the third quarter and first

nine months of 2020 primarily due to lower cost of goods sold per

tonne. As part of our expenses, we recognized a $769 million

non-cash impairment of assets which is added back to adjusted

EBITDA. This impairment relates to a less favorable long-term

outlook of phosphate selling prices and an expected global supply

imbalance.

- Sales volumes increased in the third quarter of 2020

compared to the third quarter last year due to higher fertilizer

sales that more than offset lower industrial and feed sales. Sales

volumes in the first nine months of 2020 decreased compared to the

same period last year primarily due to the conversion of the

Redwater phosphate facility to ammonium sulfate in 2019 and lower

phosphoric acid exports in 2020.

- Net realized selling price of phosphate fertilizer sales

was lower than in the third quarter of last year due to the lag

effect in realized prices, which was partially offset by higher

industrial and feed prices. Net realized selling prices in the

first nine months of 2020 were lower than the same period last year

consistent with declines in global benchmark prices.

- Cost of goods sold per tonne decreased in the third

quarter of 2020 due to lower raw material costs and a favorable

non-cash inventory adjustment. Cost of goods sold per tonne

decreased significantly in the first nine months of 2020 compared

to the same period last year primarily due to both lower raw

material costs and a change in estimate related to an asset

retirement obligation recorded in the second quarter of 2020.

Corporate and Others

(millions of US dollars, except as otherwise

Three Months Ended September

30

Nine Months Ended September

30

noted)

2020

2019

% Change

2020

2019

% Change

Sales 1

23

35

(34)

70

99

(29)

Cost of goods sold

20

35

(43)

63

99

(36)

Gross margin

3

-

n/m

7

-

n/m

Selling expenses

(4)

(5)

(20)

(17)

(14)

21

General and administrative expenses

66

65

2

191

191

-

Provincial mining and other taxes

-

8

(100)

1

13

(92)

Share-based compensation expense

(recovery)

29

(21)

n/m

9

95

(91)

Impairment of assets

5

-

n/m

5

33

(85)

Other expenses

67

40

68

153

95

61

EBIT

(160)

(87)

84

(335)

(413)

(19)

Depreciation and amortization

15

10

50

41

32

28

EBITDA

(145)

(77)

88

(294)

(381)

(23)

Merger and related costs

-

21

(100)

-

57

(100)

Acquisition and integration related

costs

10

-

n/m

38

-

n/m

Share-based compensation expense

(recovery)

29

(21)

n/m

9

95

(91)

Impairment of assets

5

-

n/m

5

33

(85)

COVID-19 related expenses

11

-

n/m

30

-

n/m

Foreign exchange loss, net of related

derivatives

13

2

550

4

14

(71)

Loss on disposal of business

6

-

n/m

6

-

n/m

Adjusted EBITDA

(71)

(75)

(5)

(202)

(182)

11

Finance costs

129

147

(12)

401

413

(3)

Income tax (recovery) expense

(264)

40

n/m

(45)

346

n/m

Other comprehensive income (loss)

71

(75)

n/m

(86)

(57)

51

1 Primarily relates to our non-core

Canadian business which was sold in the third quarter of 2020.

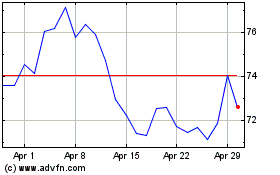

- Share-based compensation expense (recovery) - We

had an expense for the third quarter of 2020 due to an increase in

share price and a recovery for the comparative period in 2019 due

to a decrease in share price. We had a lower expense for the first

nine months of 2020 as our share price was negatively impacted from

market volatility due to the COVID-19 pandemic in the first nine

months of 2020.

- Impairment of assets was lower for the first nine months

of 2020 due to a $33 million impairment of our intangible assets as

a result of Fertilizantes Heringer S.A. filing for bankruptcy

protection in 2019.

- Other expenses in the third quarter and first nine

months of 2020 were higher due to project costs related to our

Retail enterprise resource planning system as part of our digital

transformation and COVID-19 related expenses. COVID-19 expenses

primarily consist of increased cleaning and sanitization costs, the

purchase of personal protective equipment, discretionary

supplemental employee costs and costs related to construction

delays from access limitations and other government

restrictions.

- Finance costs in the third quarter and first nine months

of 2020 were slightly lower than the same periods last year. Lower

interest rates more than offset higher finance costs incurred as we

managed our immediate liquidity position during the initial months

of the COVID-19 pandemic.

- Income tax (recovery) expense – Income tax recoveries

were recorded for the third quarter and first nine months of 2020

due to an impairment of assets, discrete tax recoveries primarily

related to US legislative changes and a change in jurisdictional

earnings composition. The discrete tax recoveries were $48 million

and $59 million for the third quarter and first nine months of

2020, respectively.

- Other comprehensive income (loss) – For the third

quarter of 2020, we had higher other comprehensive income from a

gain on translation of our Retail operations in Canada and

Australia as the Canadian and Australian dollars appreciated

relative to the US dollar as global markets rebounded following the

COVID-19 pandemic in the early part of 2020. For the first nine

months of 2020, we had a higher other comprehensive loss due

primarily to a loss on translation of our Retail operations in

Brazil as the Brazilian Real declined relative to the US dollar.

There were also offsetting impacts from translation of our Canadian

and Australian Retail operations.

Financial Condition Review

The following balance sheet categories contained variances that

were considered significant:

As at

(millions of US dollars, except as

otherwise noted)

September 30, 2020

December 31, 2019

$ Change

% Change

Assets

Cash and cash equivalents

465

671

(206)

(31)

Receivables

5,056

3,542

1,514

43

Inventories

3,829

4,975

(1,146)

(23)

Prepaid expenses and other current

assets

531

1,477

(946)

(64)

Property, plant and equipment

19,308

20,335

(1,027)

(5)

Liabilities and Equity

Short-term debt

1,644

976

668

68

Current portion of long-term debt

-

502

(502)

(100)

Payables and accrued charges

5,239

7,437

(2,198)

(30)

Long-term debt

10,041

8,553

1,488

17

Retained earnings

6,477

7,101

(624)

(9)

- Explanations for changes in Cash and cash equivalents

are in the “Sources and Uses of Cash” section.

- Receivables increased due to seasonal Retail sales

resulting in higher receivables from customers and vendor rebates

receivables.

- Inventories decreased due to seasonal Retail sales

activity.

- Prepaid expenses and other current assets decreased due

to the drawdown of prepaid inventory where Retail typically prepays

for products at year-end and takes possession of inventory

throughout the year.

- Property, plant and equipment decreased primarily due to

a non-cash impairment of our Phosphate production facilities as

described in Note 3 to the interim financial statements.

- Short-term debt increased from commercial paper

issuances as part of our seasonal working capital management.

- Payables and accrued charges decreased due to lower

customer prepayments as Retail customers took delivery of prepaid

products. This was partially offset by an increase related to a

shift in timing of vendor payments.

- Long-term debt (including current portion) increased due

to the addition of $1.5 billion in notes issued in May 2020

exceeding the repayment of $500 million in notes that matured in

the first quarter of 2020.

- Retained earnings decreased due to dividends declared

exceeding net earnings.

Liquidity and Capital Resources

Sources and Uses of Liquidity

We managed our capital in

accordance with our capital allocation strategy. We believe that

our internally generated cash flow, supplemented by available

borrowings under our existing financing sources, if necessary, will

be sufficient to meet our anticipated capital expenditures and

other cash requirements for at least the next 12 months. As further

developments and impacts of COVID-19 are highly uncertain and

cannot be predicted, we continue to monitor our liquidity position.

Refer to the “Capital Structure and Management” section for details

on our existing long-term debt and credit facilities.

Key uses and sources of cash and cash equivalents in the

third quarter and/or nine months ended September 30, 2020

included:

- Investments in capital assets to sustain and grow our safe,

reliable and cost-efficient operations. Sustaining capital

expenditures were $203 million in the third quarter of 2020 and

were $511 million in the first nine months of 2020. Investing

capital expenditures were $96 million in the third quarter of 2020

and were $360 million for the first nine months of 2020.

- Returns to our shareholders through dividends and share

repurchases (See Note 9 to the interim financial statements).

Dividends paid were $257 million in the third quarter of 2020 and

were $771 million for the first nine months of 2020. Share

repurchases were $nil in the third quarter of 2020 and were $160

million in the first nine months of 2020.

- Other financing activities including the following:

- Issued $1.5 billion of notes on May 13, 2020. See Note 8 to the

interim financial statements.

- Drew down $446 million and $801 million from our commercial

paper during the three and nine months ended September 30, 2020,

respectively.

- Repaid at maturity $500 million of 4.875 percent notes during

the nine months ended September 30, 2020. See Note 8 to the interim

financial statements.

- Established new committed revolving credit facilities totaling

approximately $1.5 billion in March and April 2020, in response to

the market uncertainty caused by the COVID-19 pandemic. We closed

these credit facilities after the issuance of the new notes, as

described above. During the first nine months of 2020, we drew down

from and later repaid $3.5 billion of our revolving credit

facilities to provide additional liquidity in the volatile market

caused by the COVID-19 pandemic.

Sources and Uses of Cash

(millions of US dollars, except as

otherwise

Three Months Ended September

30

Nine Months Ended September

30

noted)

2020

2019

% Change

2020

2019

% Change

Cash (used in) provided by operating

activities

(685)

589

n/m

545

1,246

(56)

Cash used in investing activities

(356)

(904)

(61)

(1,209)

(2,133)

(43)

Cash provided by (used in) financing

activities

85

272

(69)

465

(837)

n/m

Effect of exchange rate changes on cash

and cash equivalents

6

(5)

n/m

(7)

(22)

(68)

Decrease in cash and cash equivalents

(950)

(48)

n/m

(206)

(1,746)

(88)

Cash and cash equivalents decreased by $950 million in

the third quarter of 2020 compared to a decrease of $48 million in

2019 as a result of lower cash from our operating activities mainly

due to lower crop nutrient prices and comparatively strong results

in the third quarter of 2019. We also settled more trade payables

due to the shift in timing of vendor payments from the second to

third quarter of 2020.

As cash from operations decreased, we lowered our spend in

investing activities through:

- A $305 million decrease in cash used for acquisitions compared

to the same period in 2019. We acquired Ruralco in the third

quarter of 2019 with no similar acquisition in the third quarter of

2020.

- A $276 million decrease in capital expenditures compared to the

same period in 2019 as we deferred or reduced capital projects

mainly due to lower crop nutrient prices, as well as COVID-19

precautions.

Cash and cash equivalents decreased by $206 million in the nine

months ended September 30, 2020 compared to a decrease of $1.7

billion in the nine months ended September 30, 2019.

Cash from our operating activities decreased as a result of

lower crop nutrient prices. Despite this decrease, we had a $933

million decrease in short-term debt net proceeds compared to the

same period in 2019, due to improved working capital

management.

The decrease in our cash from operating activities was partially

offset by:

- An approximately $900 million decrease in cash used for Retail

acquisitions and capital expenditures compared to the same period

in 2019.

- A decrease of $1.8 billion in cash payments to shareholders in

the form of share repurchases compared to the same period in

2019.

- A $503 million decrease in long-term debt repayments compared

to the same period in 2019.

Capital Structure and Management

Principal Debt Instruments

In response to the COVID-19 pandemic, we continue to monitor our

liquidity position. We added new credit facilities of $1.5 billion

in March and April 2020, which we subsequently closed in May 2020

after the issuance of the new notes described below. We use a

combination of cash generated from operations and short-term and

long-term debt to finance our operations. We are in compliance with

our debt covenants and did not have any changes to our credit

ratings in the nine months ended September 30, 2020.

Short-term Debt

As at September 30,

2020

(millions of US dollars)

Rate of Interest (%)

Total Facility Limit

Outstanding and

Committed

Remaining Available

Credit facilities

Unsecured revolving term credit

facility

NIL

4,500

-

4,500

Uncommitted revolving demand facility

NIL

500

-

500

Other credit facilities 1

0.8 - 9.5

600

193

407

Commercial paper

0.2 - 0.6

1,451

Total

1,644

1 Other credit facilities are unsecured

and consist of South American facilities with debt of $143

(December 31, 2019 – $149) and interest rates ranging from 2.0

percent to 9.5 percent, Australian facilities with debt of $24

(December 31, 2019 – $157) and an interest rate of 1.3 percent, and

other facilities with debt of $26 (December 31, 2019 – $20) and

interest rates ranging from 0.8 percent to 4.0 percent.

The amount available under the commercial paper program is

limited to the availability of backup funds under the $4,500

million unsecured revolving term credit facility and excess cash

invested in highly liquid securities.

Long-term Debt

Our long-term debt consists primarily of notes. See the “Capital

Structure and Management” section of our 2019 Annual Report for

information on balances, rates and maturities for our notes. On May

13, 2020, we issued $1.5 billion in notes. See Note 8 to the

interim financial statements. During the first quarter of 2020, we

repaid the $500 million 4.875 percent notes that matured March 30,

2020.

Outstanding Share Data

As at October 30, 2020

Common shares

569,145,935

Options to purchase common shares

11,123,020

For more information on our capital structure and management,

see Note 26 to our 2019 financial statements.

Quarterly Results

(millions of US dollars, except as

otherwise noted)

Q3 2020

Q2 2020

Q1 2020

Q4 2019

Q3 2019

Q2 2019

Q1 2019

Q4 2018

Sales

4,205

8,416

4,186

3,442

4,169

8,693

3,719

3,762

Net earnings (loss) from continuing

operations

(587)

765

(35)

(48)

141

858

41

296

Net earnings from discontinued

operations

-

-

-

-

-

-

-

2,906

Net earnings (loss)

(587)

765

(35)

(48)

141

858

41

3,202

Adjusted EBITDA

670

1,721

508

664

787

1,870

704

924

Earnings (loss) per share ("EPS") from

continuing operations

Basic

(1.03)

1.34

(0.06)

(0.08)

0.25

1.48

0.07

0.48

Diluted

(1.03)

1.34

(0.06)

(0.08)

0.24

1.47

0.07

0.48

EPS

Basic

(1.03)

1.34

(0.06)

(0.08)

0.25

1.48

0.07

5.23

Diluted

(1.03)

1.34

(0.06)

(0.08)

0.24

1.47

0.07

5.22

Seasonality in our business results from increased demand for

products during the planting season. Crop input sales are generally

higher in the spring and fall application seasons. Crop nutrient

inventories are normally accumulated leading up to each application

season. Our cash collections generally occur after the application

season is complete, while customer prepayments made to us are

concentrated in December and January and inventory prepayments paid

to our vendors are typically concentrated in the period from

November to January. Feed and industrial sales are more evenly

distributed throughout the year.

Since the fourth quarter of 2019, Potash earnings have been

impacted by lower net realized selling prices caused by a temporary

slowdown in global demand. In the fourth quarter of 2018, earnings

were impacted by $2.9 billion in after-tax gains on the sales of

our investments in Sociedad Quimica y Minera de Chile S.A. and Arab

Potash Company, which were categorized as discontinued operations.

In the third quarter of 2020, earnings were impacted by non-cash

impairments of property, plant and equipment primarily in the

Phosphate segment as a result of lower forecasted global phosphate

prices.

Risk Factors

Coronavirus Disease (COVID-19) Pandemic

Epidemics, pandemics or other such crises or public health

concerns in regions of the world where we have operations or source

material or sell products could impact or disrupt our business.

Specifically, the ongoing COVID-19 outbreak has resulted in travel

restrictions and extended shutdowns of certain businesses around

the world, as well as a deterioration of general economic

conditions. These or any governmental or other regulatory responses

or developments or health concerns in countries in which we operate

could result in operational restrictions or social and economic

instability, or labor shortages. More specifically, there remains

uncertainty relating to the potential impact that COVID-19 could

ultimately have on our business. It is still possible that COVID-19

could impact our operations, create supply chain disruptions and/or

limit our ability to timely sell or distribute our products in the

future, which would negatively impact our business, financial

condition and operating results. It is also possible that COVID-19

could negatively impact our customers, even though the agriculture

sector is classified as an essential service. Any significant

long-term downturn in the global economy or agricultural markets

could impact the Company’s access to capital or credit ratings, or

our customers’ access to liquidity, which could increase our

counterparty credit exposure.

Critical Accounting Estimates

Our critical accounting policies are disclosed in our 2019

Annual Report. We have discussed the development, selection and

application of our key accounting policies, and the critical

accounting estimates and assumptions they involve, with the audit

committee of the Board. Our critical accounting estimates are

discussed on page 54 of our 2019 Annual Report. Other than the

critical accounting estimates discussed below, there were no

significant changes in the first nine months of 2020.

Long-lived Asset Impairment

During the three and nine months ended September 30, 2020, we

identified an impairment indicator in our Phosphate cash generating

units (“CGUs”) due to lower long-term forecasted global phosphate

prices and recorded impairments of assets in the statement of

(loss) earnings relating to our property plant and equipment at

Aurora and White Springs of $545 million and $215 million,

respectively. See Note 3 to the interim financial statements.

The recoverable values of Aurora and White Springs are most

sensitive to the following key assumptions: our internal sales

price forecasts which consider projections from an independent

third-party data source, discount rates, long-term growth rates,

and expected mine life. We used key assumptions that were based on

historical data and estimates of future results from internal

sources, external price benchmarks, mineral reserve technical

reports, as well as industry and market trends.

The following table highlights sensitivities to the recoverable

value which could result in additional impairment losses or

reversals of previously recorded losses. The sensitivities have

been calculated independently of changes in other key

variables.

Aurora

Increase (Decrease)

Key Assumptions

Change in Assumption

to Recoverable Value ($

millions)

Net selling price

±

10 per tonne

±

150

Discount rate

±

1.0 percentage point

±

120

For our White Springs CGU, there were no reasonably possible

changes in the key assumptions that would result in a substantial

change in the recoverable value.

At September 30, 2020, we performed impairment testing on the

Trinidad CGU, part of our Nitrogen segment, due to the indefinite

closure of an ammonia plant in response to market conditions and

lower long-term forecasted global ammonia prices. No impairment

resulted from comparing the carrying value of the Trinidad CGU to

its recoverable value determined on a fair value less costs of

disposal (“FVLCD”) methodology. FVLCD was based on after-tax

discounted cash flows (using a five-year projection and a 2.0%

terminal growth rate) discounted at a post-tax rate of 12.6%.

The following table indicates the percentages by which key

assumptions would need to change individually for the estimated

Trinidad CGU recoverable value to be equal to the carrying

value:

Change Required for

Carrying

Key Assumptions

Value to Equal Recoverable

Value

Net selling price (5-year

average)

4 percent decrease

Production volumes (5-year

average)

5 percent decrease

Discount rate (post-tax)

0.9 percentage point increase

Controls and Procedures

Management is responsible for establishing and maintaining

adequate internal control over financial reporting, as defined in

Rules 13a-15(f) and 15d-15(f) under the Securities Exchange Act of

1934, as amended, and National Instrument 52-109 Certification of

Disclosure in Issuers’ Annual and Interim Filings. Internal control

over financial reporting is designed to provide reasonable

assurance regarding the reliability of financial reporting and

preparation of financial statements for external purposes in

accordance with IFRS. Any system of internal control over financial

reporting, no matter how well designed, has inherent limitations.

Therefore, even those systems determined to be effective can

provide only reasonable assurance with respect to financial

statement preparation and presentation.

There have been changes to our internal control over financial

reporting during the quarter ended June 30, 2020. As part of our

digital transformation, we have implemented a new enterprise

resource planning system in the Retail segment resulting in a more

automated control environment for our Canadian and Loveland

Products operations. This change continues to materially affect our

internal control over financial reporting.

As a result of the acquisition of Ruralco and the integration of

the Australian Retail operations, the internal control over the

Australian Retail operations will come into scope of the Company’s

internal control over financial reporting for the fourth quarter of

2020. The acquisition of Ruralco was previously excluded from

management’s evaluation of the effectiveness of the Company’s

internal control over financial reporting as of December 31, 2019

due to the proximity of the acquisition to year-end. The

integration of the Australian Retail operations is expected to

materially affect our internal control over financial

reporting.

COVID-19 has also affected our business. During the quarter,

corporate office staff and many site administrative staff have

worked from home. This change has required certain processes and

controls that were previously done or documented manually to be

completed and retained in electronic form. This change has not

materially affected our internal control over financial

reporting.

Except as discussed herein, there have been no changes during

the quarter ended September 30, 2020, that have materially

affected, or are reasonably likely to materially affect, our

internal control over financial reporting.

Forward-Looking Statements

Certain statements and other information included and

incorporated by reference in this document constitute

“forward-looking information” or “forward-looking statements”

(collectively, “forward-looking statements”) under applicable

securities laws (such statements are often accompanied by words

such as “anticipate”, “forecast”, “expect”, “believe”, “may”,

“will”, “should”, “estimate”, “intend” or other similar words). All

statements in this document, other than those relating to

historical information or current conditions, are forward-looking

statements, including, but not limited to: Nutrien's 2020 annual

guidance, including expectations regarding our adjusted net

earnings per share, adjusted EBITDA (consolidated and by segment);

capital spending expectations for 2020; expectations regarding our

liquidity; expectations regarding performance of our operating

segments in 2020, including the impact of our ammonia plant closure

on our Nitrogen segment; our operating segment market outlooks and

market conditions for 2020, including the impact of COVID-19

thereon, and the anticipated supply and demand for our products and

services, expected market and industry conditions with respect to

crop nutrient application rates, planted acres, crop mix, prices

and the impact of import and export volumes; and acquisitions and

divestitures, and the expected synergies associated with various

acquisitions, including timing thereof. These forward-looking

statements are subject to a number of assumptions, risks and

uncertainties, many of which are beyond our control, which could

cause actual results to differ materially from such forward-looking

statements. As such, undue reliance should not be placed on these

forward-looking statements.

All of the forward-looking statements are qualified by the

assumptions that are stated or inherent in such forward-looking

statements, including the assumptions referred to below and

elsewhere in this document. Although we believe that these

assumptions are reasonable, having regard to our experience and our

perception of historical trends, this list is not exhaustive of the

factors that may affect any of the forward-looking statements and

the reader should not place an undue reliance on these assumptions

and such forward-looking statements. Current conditions, economic

and otherwise, render assumptions, although reasonable when made,

subject to greater uncertainty. The additional key assumptions that

have been made include, among other things, assumptions with

respect to our ability to successfully complete, integrate and

realize the anticipated benefits of our already completed and

future acquisitions and divestitures, and that we will be able to

implement our standards, controls, procedures and policies at any

acquired businesses to realize the expected synergies; that future

business, regulatory and industry conditions will be within the

parameters expected by us, including with respect to prices,

margins, demand, supply, product availability, supplier agreements,

availability and cost of labor and interest, exchange and effective

tax rates; the completion of our expansion projects on schedule, as

planned and on budget; assumptions with respect to global economic

conditions and the accuracy of our market outlook expectations for

2020 and in the future; our expectations regarding the impacts,

direct and indirect, of COVID-19 on our business, customers,

business partners, employees, supply chain, other stakeholders and

the overall economy; the adequacy of our cash generated from

operations and our ability to access our credit facilities or

capital markets for additional sources of financing; our ability to

identify suitable candidates for acquisitions and divestitures and

negotiate acceptable terms; our ability to maintain investment

grade ratings and achieve our performance targets; and the receipt,

on time, of all necessary permits, utilities and project approvals

with respect to our expansion projects and that we will have the

resources necessary to meet the projects’ approach.

Events or circumstances that could cause actual results to

differ materially from those in the forward-looking statements

include, but are not limited to: general global economic, market

and business conditions; failure to complete announced and future

acquisitions or divestitures at all or on the expected terms and

within the expected timeline; climate change and weather

conditions, including impacts from regional flooding and/or drought

conditions; crop planted acreage, yield and prices; the supply and

demand and price levels for our products; governmental and

regulatory requirements and actions by governmental authorities,

including changes in government policy (including tariffs, trade

restrictions and climate change initiatives), government ownership

requirements, changes in environmental, tax and other laws or

regulations and the interpretation thereof; political risks,

including civil unrest, actions by armed groups or conflict and

malicious acts including terrorism; the occurrence of a major

environmental or safety incident; innovation and cybersecurity

risks related to our systems, including our costs of addressing or

mitigating such risks; regional natural gas supply restrictions;

counterparty and sovereign risk; delays in completion of

turnarounds at our major facilities; gas supply interruptions; any

significant impairment of the carrying value of certain assets;

risks related to reputational loss; certain complications that may

arise in our mining processes; the ability to attract, engage and

retain skilled employees and strikes or other forms of work

stoppages; the COVID-19 pandemic and its resulting effects on

economic conditions, restrictions imposed by public health

authorities or governments, fiscal and monetary responses by

governments and financial institutions and disruptions to global

supply chains; and other risk factors detailed from time to time in

Nutrien reports filed with the Canadian securities regulators and

the SEC in the United States.

The purpose of our expected adjusted net earnings per share and

adjusted EBITDA (consolidated and by segment) guidance ranges are

to assist readers in understanding our expected financial results,

and this information may not be appropriate for other purposes.

The forward-looking statements in this document are made as of

the date hereof and Nutrien disclaims any intention or obligation

to update or revise any forward-looking statements in this document

as a result of new information or future events, except as may be

required under applicable Canadian securities legislation or

applicable US federal securities laws.

Terms and Definitions

For the definitions of certain financial and non-financial terms

used in this document, as well as a list of abbreviated company

names and sources, see the “Terms and Definitions” section of our

2019 Annual Report dated February 19, 2020. All references to per

share amounts pertain to diluted net earnings (loss) per share,

“n/m” indicates information that is not meaningful and all

financial amounts are stated in millions of US dollars, unless

otherwise noted.

About Nutrien

Nutrien is the world's largest provider of crop inputs and

services, playing a critical role in helping growers increase food

production in a sustainable manner. We produce and distribute 25

million tonnes of potash, nitrogen and phosphate products

world-wide. With this capability and our leading agriculture retail

network, we are well positioned to supply the needs of our

customers. We operate with a long-term view and are committed to

working with our stakeholders as we address our economic,

environmental and social priorities. The scale and diversity of our

integrated portfolio provides a stable earnings base, multiple

avenues for growth and the opportunity to return capital to

shareholders.

Selected financial data for download can be found in our data

tool at www.nutrien.com/investors/interactive-datatool.

Such data is not incorporated by reference herein.

Nutrien will host a Conference Call on Tuesday, November 3,

2020 at 10:00 am Eastern Time.

- In order to expedite access to our conference call, each

participant will be required to pre-register for the event:

- Online:

http://www.directeventreg.com/registration/event/9668938.

- Via Phone: 1-888-869-1189 Conference ID 9668938.

- Once the registration is complete, a confirmation will be sent

providing the dial in number and both the Direct Event Passcode and

your unique Registrant ID to join this call. For security reasons,

please do not share your information with anyone else.

- Live Audio Webcast: Visit

http://www.nutrien.com/investors/events/2020-q3-earnings-conference-call

Appendix A - Selected Additional Financial Data

Selected Retail measures

Three Months Ended September

30

Nine Months Ended September

30

2020

2019

2020

2019

Proprietary products margin as a

percentage of product line margin (%)

Crop

nutrients

33

31

27

24

Crop

protection products

43

39

40

42

Seed

n/m

20

43

44

All

products

25

27

27

28

Crop nutrients sales volumes (tonnes -

thousands)

North

America

1,159

1,202

7,683

7,254

International

741

533

2,364

1,677

Total

1,900

1,735

10,047

8,931

Crop nutrients selling price per

tonne

North

America

413

467

423

471

International

407

389

356

395

Total

411

443

407

457

Crop nutrients gross margin per

tonne

North

America

116

114

102

103

International

61

70

47

57

Total

94

101

89

95

Financial performance measures

2020 Target

2020 Actuals

Retail

Adjusted EBITDA to sales (%) 1, 2

10

10

Retail

adjusted average working capital to sales (%) 1, 2

21

17

Retail

cash operating coverage ratio (%) 1, 2

61

62

Retail

Adjusted EBITDA per US selling location (thousands of US dollars)

1, 2

1,000

1,031

1

Rolling four quarters ended September 30, 2020.

2 See

the "Non-IFRS Financial Measures" section.

Nutrien Financial

As at September 30,

2020

(millions of US dollars)

Current

31-90 days past due

>90 days past due

Allowance 2

Total

Nutrien

Financial receivables 1

1,661

37

35

(22)

1,711

1 See

the "Non-IFRS Financial Measures" section.

2

Allowance for expected credit losses of receivables from

customers.

Selected Nitrogen measures

Three Months Ended September

30

Nine Months Ended September

30

2020

2019

2020

2019

Sales volumes (tonnes -

thousands)

Fertilizer

1,426

1,304

5,010

4,204

Industrial and feed

977

1,218

3,111

3,704

Net sales (millions of US

dollars)

Fertilizer

280

316

1,108

1,155

Industrial and feed

161

217

559

726

Net selling price per tonne

Fertilizer

196

243

221

275

Industrial and feed

166

178

180

196

Production measures

Three Months Ended September

30

Nine Months Ended September

30

2020

2019

2020

2019

Potash

production (Product tonnes - thousands)

3,430

2,977

9,811

9,761

Potash

shutdown weeks 1

4

11

38

27

Nitrogen

production (Ammonia tonnes - thousands) 2

1,413

1,529

4,479

4,763

Ammonia

operating rate (%) 3

91

85

93

90

Phosphate production (P2O5 tonnes -

thousands) 4

354

374

1,083

1,124

Phosphate P2O5 operating rate (%)

4

83

87

85

88

1

Represents weeks of full production shutdown, excluding the impact

of any periods of reduced operating rates and planned routine

annual maintenance shutdowns and announced workforce

reductions.

2 All

figures are provided on a gross production basis.

3

Excludes Trinidad and Joffre.

4

Excludes Redwater.

Appendix B - Non-IFRS Financial Measures

We use both IFRS and certain non-IFRS financial measures to

assess performance. Non-IFRS financial measures are numerical

measures of a company’s performance, that either exclude or include

amounts that are not normally excluded or included in the most

directly comparable measures calculated and presented in accordance

with IFRS. In evaluating these measures, investors should consider

that the methodology applied in calculating such measures may

differ among companies and analysts.

Management believes the non-IFRS financial measures provide

transparent and useful supplemental information to help investors

evaluate our financial performance, financial condition and

liquidity using the same measures as management. These non-IFRS

financial measures should not be considered as a substitute for, or

superior to, measures of financial performance prepared in

accordance with IFRS.

The following section outlines our non-IFRS financial measures,