Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (OTCQX:

ORAAF) (“

Aura” or the

“

Company”) announces that it has filed its

unaudited consolidated financial statements and management

discussion and analysis (together, “

Financial and

Operational Results”) for the period ended June 30, 2024

(“

Q2 2024”). The full version of the Financial and

Operational Results can be viewed on the Company’s website at

www.auraminerals.com or on SEDAR+ at www.sedarplus.ca. All amounts

are in thousands of U.S. dollars unless stated otherwise.

Rodrigo Barbosa, President, and CEO of Aura,

commented, “In Q2, Aura's EBITDA increased 6% from Q1, even with

reduced production due to mine sequencing. With stable operations

and rising gold and copper prices, our EBITDA hit US$109 million in

H1 2024, a 111% increase from H1 2023 with an average gold price of

only US$2,173/Oz. Our robust cash flows enabled us to distribute

US$25 million in dividends and invest US$4 million in share

buybacks, resulting in an 8.8% yield on LTM. Looking ahead to H2,

we anticipate another robust production, and we are set to meet our

yearly guidance. Moreover, the construction of project Borborema is

on track and within budget, with a ramp-up planned for Q1 next

year, promising further growth in production and results in 2025.

All of this is achieved while maintaining the highest standards of

management and safety.”

Q2 2024 Financial and Operational

Highlights:

|

(US$ thousand): |

|

|

|

|

|

|

|

|

|

|

For the three months ended June 30, 2024 |

|

For the three months ended June 30, 2023 |

|

For the six months ended June 30, 2024 |

|

For the six months ended June 30, 2023 |

|

|

Total Production1 (GEO) |

64,327 |

|

48,522 |

|

132,514 |

|

102,890 |

|

|

Sales2 (GEO) |

63,258 |

|

47,950 |

|

132,344 |

|

101,836 |

|

|

Net Revenue |

134,411 |

|

84,950 |

|

266,489 |

|

181,937 |

|

|

Adjusted EBITDA |

56,172 |

|

26,596 |

|

109,376 |

|

63,194 |

|

|

AISC per GEO sold |

1,328 |

|

1,385 |

|

1,307 |

|

1,264 |

|

|

Ending Cash balance |

191,963 |

|

217,938 |

|

191,963 |

|

217,938 |

|

|

Net Debt |

142,409 |

|

(10,318) |

|

142,409 |

|

(10,318) |

|

|

(1) Considers capitalized production |

|

(2) Does not consider capitalized production |

| |

- In Q2 2024,

production reached 64,327 GEO, a notable increase of 33% in

comparison to Q2 2023 at current prices. The increase was a result

of improved performance in Minosa, which achieved stable production

at approximately 19k GEO per quarter after 5 consecutive quarterly

production increases as result of operational improvements in 2023.

In the first semester of 2024, Aura`s total production was 132,513

GEO, 30% above H1 2023.

- Aranzazu:

Production was 24,692 GEO, 4% lower than Q1 2024 and 1% below Q2

2023 at constant metal prices, and slightly below at current prices

due to mine sequencing, reflecting stable performance. H1 2024

production was 50,295 GEO at constant prices, up 2% from H1 2023,

but 49,693 GEO at current prices, down 4% from H1 2023.

- Apoena (EPP):

Production was 9,912 GEO, a decrease of 18% compared to 1Q24, due

to an increase in strip ratio (+35%) and a lower grade (-14%), but

up 43% from Q2 2023 due to increased ore mining and higher grades,

aligning with expectations for Q3 and Q4 2024. H1 2024 production

was 22,017 GEO, up 12% from H1 2023.

- Minosa (San

Andres): Production was 19,142 GEO, stable compared to the previous

quarter and 17% higher than Q2 2023, driven by a higher volume of

stacked ore from 2023 investments. H1 2024 production was 38,328

GEO, up 26% from H1 2023.

- Almas:

Production reached 10,580 GEO, 11% lower than the previous quarter

due to a change in the mine contractor during the period. The new

contractor is already operating at the expected level, achieving

4,850 GEO in June, versus 2,220 GEO in May and 3,510 GEO in April,

reinforcing the Company's confidence in meeting the 2024 production

guidance. In H1 2024, production was 22,475 GEO, 26% above H2 2023,

when the mine began operations.

- Sales volumes

decreased by 8% from Q1 2024, mainly driven by the change in the

contractor at Almas during Q2 2024, and mine sequencing at Apoena.

Compared to the same period in 2023, sales volumes increased by

32%, mainly due to an increase in production at Minosa, commercial

production at Almas in 2023 and increase in sales volumes at

Apoena, partially offset by lower sales volumes at Aranzazu. In H1

2024, sales volume increased by 30%, mainly due to increase in

production at Minosa and Apoena, and commercial production in

Almas.

- Revenues reached

$134,411 in Q2 2024, representing an increase of 2% compared to Q1

2024 and 58% compared to the same period in 2023. In H1 2024,

revenues reached $266,489, a 46% increase in comparison to H1 2023.

- Average

realized gold sale prices increased 11% compared to Q1 2024, with

an average of $2,291/oz in the quarter. Compared to the same period

in 2023, average gold sale prices increased 17% in Q2 2024. In H1

2024, average gold sale prices reached $2,173, a 13% increase when

compared to H1 2023.

- Average

realized copper sales prices increased 16% when compared to Q1

2024, with an average of $4.48/lb in the quarter. Compared to the

same period in 2023, average copper prices increased by 17% in Q2

2024. In H1 2024, average copper prices reached $4.17/lb, a 5%

increase when compared to H1 2023.

- Adjusted EBITDA1

reached $56,172 in Q2 2024, an improvement of 6% compared to

$53,208 in Q1 2024, as a result of increases in gold and copper

prices during the quarter when compared to Q1 2024. This is the

result of Aura’s sustained commitment to enhancing efficiency and

reducing expenses throughout its operations. Compared to Q2 2023,

Adjusted EBITDA showed an improvement of 111%, mainly due to higher

gold and copper prices and higher sales volumes. In H1 2024,

Adjusted EBITDA reached $109,376, a 73% increase when compared to

H1 2023.

- AISC2 during Q2

2024 were $1,328/GEO, representing an increase of $41/GEO when

compared to Q1 2024 ($1,287/GEO) mainly due to higher strip ratio

and a quarterly decrease in ore grade in Apoena (EPP), impacting

costs and productivity. These impacts were partially offset by a

quarterly decrease in AISC at Aranzazu and Minosa. In H1 2024,

AISCs were $1,307/GEO, a $44/GEO increase when compared to H1 2023

($1,263/GEO).

- By the end of Q2

2024, the Company’s Net Debt3 position was $142,409, an increase

compared to $105,361 reported in the previous quarter, mainly due

to a decrease in cash and cash equivalents, most of it related to

the Borborema project construction which consumed US$ 14,641 in

cash in the quarter and $25,400 payment in dividends in June.

Guidance:

The Company is on track to meet its guidance for the current

fiscal year, including production, cash cost, All-In Sustaining

Cost (AISC), and capital expenditures, as demonstrated by the

results of the first semester.

|

Gold equivalent thousand ounces ('000 GEO) production -

2024 |

|

|

|

|

|

Low - 2024 |

High - 2024 |

H1 2024 A |

% |

|

|

|

Minosa (San Andrés) |

60 |

75 |

38 |

51% - 64% |

|

|

|

Apoena (EPP) |

46 |

56 |

22 |

39% - 48% |

|

|

|

Aranzazu |

94 |

108 |

50 |

46% - 53% |

|

|

|

Almas |

45 |

53 |

22 |

43% - 50% |

|

|

|

Total |

244 |

292 |

133 |

45% - 54% |

|

| |

|

|

|

|

|

|

|

Cash Cost per equivalent ounce of gold produced -

2024 |

|

|

|

|

|

Low - 2024 |

High - 2024 |

H1 2024 A |

% |

|

|

|

Minosa (San Andrés) |

1120 |

1288 |

1140 |

88% - 102% |

|

|

|

Apoena (EPP) |

1182 |

1300 |

941 |

72% - 80% |

|

|

|

Aranzazu |

826 |

1009 |

942 |

93% - 114% |

|

|

|

Almas |

932 |

1025 |

1176 |

115% - 126% |

|

|

|

Total |

984 |

1140 |

1040 |

91% - 106% |

|

| |

|

|

|

|

|

|

|

AISC per equivalent ounce of gold produced -

2024 |

|

|

|

|

|

Low - 2024 |

High - 2024 |

H1 2024 A |

% |

|

|

|

Minosa (San Andrés) |

1216 |

1398 |

1223 |

87% - 101% |

|

|

|

Apoena (EPP) |

1588 |

1747 |

1500 |

86% - 94% |

|

|

|

Aranzazu |

1089 |

1331 |

1235 |

93% - 113% |

|

|

|

Almas |

1179 |

1297 |

1428 |

110% - 121% |

|

|

|

Total |

1290 |

1459 |

1307 |

90% - 101% |

|

| |

|

|

|

|

|

|

|

Capex (US$ million) - 2024 |

|

|

|

|

|

Low - 2024 |

High - 2024 |

H1 2024 A |

% |

|

|

|

Sustaining |

37 |

43 |

17 |

39% - 46% |

|

|

|

Exploration |

7 |

8 |

4 |

51% - 60% |

|

|

|

New projects + Expansion |

144 |

169 |

35 |

20% - 24% |

|

|

|

Total |

188 |

219 |

55 |

25% - 29% |

|

| |

|

|

|

|

|

|

Q2 2024 Earnings Call

The Company will hold an earnings conference

call on Tuesday, August 6, 2024, at 9:00 AM (Eastern Time). To

register and participate, please click the link below.

Date: August 6, 2024

Time: 9 AM (New York and

Toronto) | 10 AM (Brasília)

Access Link: Click here

Key Factors

The Company’s future profitability, operating

cash flows, and financial position will be closely related to the

prevailing prices of gold and copper. Key factors influencing the

price of gold and copper include, but are not limited to, the

supply of and demand for gold and copper, the relative strength of

currencies (particularly the United States dollar), and

macroeconomic factors such as current and future expectations for

inflation and interest rates. Management believes that the

short-to-medium term economic environment is likely to remain

relatively supportive for commodity prices but with continued

volatility.

To decrease risks associated with commodity

prices and currency volatility, the Company will continue to

evaluate and implement available protection programs. For

additional information on this, please refer to the AIF.

Other key factors influencing profitability and

operating cash flows are production levels (impacted by grades, ore

quantities, process recoveries, labor, country stability, plant,

and equipment availabilities), production and processing costs

(impacted by production levels, prices, and usage of key

consumables, labor, inflation, and exchange rates), among other

factors.

Non-GAAP Measures

In this press release, the Company has included

Adjusted EBITDA, cash operating costs per gold equivalent ounce

sold, AISC and net debt which are non-GAAP measures. These non-GAAP

measures do not have any standardized meaning within IFRS and

therefore may not be comparable to similar measures presented by

other companies. The Company believes that these measures provide

investors with additional information which is useful in evaluating

the Company’s performance and should not be considered in isolation

or as a substitute for measures of performance prepared in

accordance with IFRS. The below tables provide a reconciliation of

the non-GAAP measures presented:

|

Reconciliation from Income for the Quarter for EBITDA and

Adjusted EBITDA (US$

thousand): |

|

|

|

|

|

|

|

|

For the three months ended June 30, 2024 |

|

For the three months ended June 30, 2023 |

|

For the six months ended June 30, 2024 |

|

For the six months ended June 30, 2023 |

|

|

Profit (loss) from continued and discontinued operation |

(25,775 |

) |

11,369 |

|

(34,992 |

) |

30,029 |

|

|

Income tax (expense) recovery |

14,612 |

|

4,833 |

|

24,755 |

|

10,442 |

|

|

Deferred income tax (expense) recovery |

6,888 |

|

(2,579 |

) |

7,733 |

|

(7,418 |

) |

|

Finance costs |

45,102 |

|

4,549 |

|

79,197 |

|

8,453 |

|

|

Other gains (losses) |

(1 |

) |

(3,167 |

) |

593 |

|

(2,644 |

) |

|

Depreciation |

15,346 |

|

11,591 |

|

32,090 |

|

24,332 |

|

|

EBITDA |

56,172 |

|

26,596 |

|

109,376 |

|

63,194 |

|

|

Impairment |

- |

|

- |

|

- |

|

- |

|

|

ARO Change |

- |

|

- |

|

- |

|

- |

|

|

Adjusted EBITDA |

56,172 |

|

26,596 |

|

109,376 |

|

63,194 |

|

| |

|

|

|

|

| |

|

|

|

|

|

Reconciliation from the consolidated financial statements

to cash operating costs per gold equivalent ounce sold

(US$ thousand): |

| |

|

|

For the three months ended June 30, 2024 |

|

For the three months ended June 30, 2023 |

|

For the six months ended June 30, 2024 |

|

For the six months ended June 30, 2023 |

|

|

Cost of goods sold |

(83,103 |

) |

(59,706 |

) |

(168,500 |

) |

(122,594 |

) |

|

Depreciation |

14,782 |

|

11,320 |

|

30,891 |

|

23,654 |

|

|

COGS w/o Depreciation |

(68,321 |

) |

(48,386 |

) |

(137,609 |

) |

(98,940 |

) |

|

Gold Equivalent Ounces sold |

63,258 |

|

47,950 |

|

132,345 |

|

101,836 |

|

|

Cash costs per gold equivalent ounce sold |

1,080 |

|

1,009 |

|

1,040 |

|

972 |

|

| |

|

|

|

|

| |

|

|

|

|

|

Reconciliation from the consolidated financial statements

to all in sustaining costs per gold equivalent ounce sold

(US$ thousand): |

| |

|

|

|

|

|

|

For the three months ended June 30, 2024 |

For the three months ended June 30, 2023 |

For the six months ended June 30, 2024 |

For the six months ended June 30, 2023 |

|

Cost of goods sold |

(83,103 |

) |

(59,706 |

) |

(168,500 |

) |

(122,594 |

) |

|

Depreciation |

14,782 |

|

11,320 |

|

30,891 |

|

23,654 |

|

|

COGS w/o Depreciation |

(68,321 |

) |

(48,386 |

) |

(137,609 |

) |

(98,940 |

) |

|

Capex w/o Expansion |

8,774 |

|

11,668 |

|

21,189 |

|

20,349 |

|

|

Site G&A |

2,631 |

|

1,754 |

|

5,456 |

|

3,770 |

|

|

Lease Payments |

4,273 |

|

4,587 |

|

8,680 |

|

5,650 |

|

|

Sub-Total |

|

|

|

|

|

Gold Equivalent Ounces sold |

63,258 |

|

47,950 |

|

132,345 |

|

101,836 |

|

|

All In Sustaining costs per ounce sold |

1,328 |

|

1,385 |

|

1,307 |

|

1,264 |

|

| |

|

|

|

|

| |

|

|

|

|

|

Reconciliation Net Debt (US$

thousand): |

| |

|

|

|

|

|

|

For the three months ended June 30, 2024 |

|

For the three months endedJune 30, 2023 |

|

For the six months ended June 30, 2024 |

|

For the six months ended June 30, 2023 |

|

|

Short Term Loans |

98,004 |

|

113,434 |

|

98,004 |

|

113,434 |

|

|

Long-Term Loans |

236,413 |

|

126,758 |

|

236,413 |

|

126,758 |

|

|

Plus / (Less): Derivative Financial Instrument for Debentures |

(45 |

) |

(16,586 |

) |

(45 |

) |

(16,586 |

) |

|

Less: Cash and Cash Equivalents |

(191,963 |

) |

(110,074 |

) |

(191,963 |

) |

(110,074 |

) |

|

Less: Restricted cash |

- |

|

- |

|

- |

|

- |

|

|

Less: Short term investments |

- |

|

- |

|

- |

|

- |

|

|

Net Debt |

142,409 |

|

113,532 |

|

142,409 |

|

113,532 |

|

|

|

About Aura 360° Mining

Aura is focused on mining in complete terms –

thinking holistically about how its business impacts and benefits

every one of our stakeholders: our company, our shareholders, our

employees, and the countries and communities we serve. We call this

360° Mining.

Aura is a mid-tier gold and copper production

company focused on operating and developing gold and base metal

projects in the Americas. The Company has 4 operating mines

including the Aranzazu copper-gold-silver mine in Mexico, the

Apoena (EPP) and Almas gold mines in Brazil, and the Minosa (San

Andres) gold mine in Honduras. The Company’s development projects

include Borborema and Matupá both in Brazil. Aura has unmatched

exploration potential owning over 630,000 hectares of mineral

rights and is currently advancing multiple near-mine and regional

targets along with the Aura Carajas copper project in the prolific

Carajás region of Brazil.

For more information, please contact: Investor

Relations ri@auraminerals.comwww.auraminerals.com

Forward-Looking Information

This press release contains “forward-looking

information” and “forward-looking statements”, as defined in

applicable securities laws (collectively, “forward-looking

statements”) which may include, but is not limited to, statements

with respect to the activities, events or developments that the

Company expects or anticipates will or may occur in the future.

Often, but not always, forward-looking statements can be identified

by the use of words and phrases such as “plans,” “expects,” “is

expected,” “budget,” “scheduled,” “estimates,” “forecasts,”

“intends,” “anticipates,” or “believes” or variations (including

negative variations) of such words and phrases, or state that

certain actions, events or results “may,” “could,” “would,” “might”

or “will” be taken, occur or be achieved.

Known and unknown risks, uncertainties and other

factors, many of which are beyond the Company’s ability to predict

or control, could cause actual results to differ materially from

those contained in the forward-looking statements. Specific

reference is made to the most recent Annual Information Form on

file with certain Canadian provincial securities regulatory

authorities for a discussion of some of the factors underlying

forward-looking statements, which include, without limitation,

volatility in the prices of gold, copper and certain other

commodities, changes in debt and equity markets, the uncertainties

involved in interpreting geological data, increases in costs,

environmental compliance and changes in environmental legislation

and regulation, interest rate and exchange rate fluctuations,

general economic conditions and other risks involved in the mineral

exploration and development industry. Readers are cautioned that

the foregoing list of factors is not exhaustive of the factors that

may affect the forward-looking statements.

All forward-looking statements herein are

qualified by this cautionary statement. Accordingly, readers should

not place undue reliance on forward-looking statements. The Company

undertakes no obligation to update publicly or otherwise revise any

forward-looking statements whether as a result of new information

or future events or otherwise, except as may be required by law. If

the Company does update one or more forward-looking statements, no

inference should be drawn that it will make additional updates with

respect to those or other forward-looking statements.

Financial Outlook and Future-Oriented Financial

Information

To the extent any forward-looking statements in

this press release constitute “financial outlooks” within the

meaning of applicable Canadian securities legislation, such

information is being provided as certain estimated financial

metrics and the reader is cautioned that this information may not

be appropriate for any other purpose and the reader should not

place undue reliance on such financial outlooks. Such information

was approved by the company’s Board of Directors on August 5, 2024.

Financial outlooks, as with forward-looking statements generally,

are, without limitation, based on the assumptions and subject to

various risks as set out herein. The Company’s actual financial

position and results of operations may differ materially from

management’s current expectations and, as a result, may differ

materially from values provided in this press release.

1 Adjusted EBITDA is a non-GAAP financial

measure with no standardized meaning under IFRS, and therefore may

not be comparable to similar measures presented by other issuers.

For further information and detailed reconciliations to the most

directly comparable IFRS measures, see Section 18 in the MD&A:

Non-GAAP Performance Measures in this MD&A2 AISC is a non-GAAP

financial measure with no standardized meaning under IFRS, and

therefore may not be comparable to similar measures presented by

other issuers. For further information and detailed reconciliations

to the most directly comparable IFRS measures, see Section 18 in

the MD&A: Non-GAAP Performance Measures in this MD&A.3 Net

Debt is a non-GAAP financial measure with no standardized meaning

under IFRS, and therefore may not be comparable to similar measures

presented by other issuers. For further information and detailed

reconciliations to the most directly comparable IFRS measures, see

Section 18 in the MD&A: Non-GAAP Performance Measures in this

MD&A.

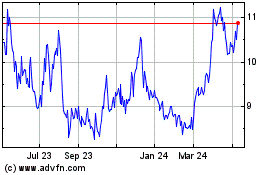

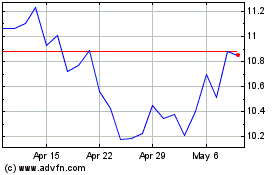

Aura Minerals (TSX:ORA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Aura Minerals (TSX:ORA)

Historical Stock Chart

From Dec 2023 to Dec 2024