Almas’ 2nd Issuance of Simple Debentures

September 25 2024 - 8:30PM

Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (OTCQX: ORAAF)

(“Company” or

“Aura”) hereby informs

its shareholders and the market in general that its subsidiary,

Aura Almas Mineração S.A. (“Almas”), approved at the Extraordinary

General Meeting of Almas, held on this date, the rectification of

certain terms and conditions of the 2nd (second) issue of simple

debentures, not convertible into shares, of the type with real

guarantee, with additional fiduciary guarantee, in a single series,

for public distribution under the automatic registration rite, of

Almas, which had been approved at the Extraordinary General Meeting

of Almas held on September 8, 2024 (“Debentures” and “Issue”,

respectively), in a total amount equivalent to 1,000,000 (one

million) debentures, totaling BRL 1,000,000,000.00 (one

billion reais).

Pursuant to the new terms and conditions of the

Issue approved in the present date by the Almas’ Extraordinary

General Meeting, among other changes (i) the total amount of the

Issue increased from BRL five hundred million reais (BRL

500,000,000.00) to R$ 1,000,000. 000.00 (one billion reais); (ii)

with a nominal unit value or the balance of the nominal unit value

of the Debentures, as the case may be, remunerative interest shall

accrue to be defined in the Bookbuilding Procedure and, in any

event, limited to the accumulated variation of 100% (one hundred

percent) of the average daily rates of the one-day Interbank

Deposit (DI), “over extra-group”, expressed as a percentage per

year, based on 252 (two hundred and fifty-two) Business Days,

calculated and disclosed daily by B3, in the daily information

available on its website (http: //www. b3.com.br) (“DI Rate”), plus

a spread to be defined in accordance with the Bookbuilding

Procedure and, in any case, of at least 1.60% (one whole and sixty

hundredths percent) and at most 1.75% (one whole and seventy-five

hundredths percent) per year, based on 252 (two hundred and

fifty-two) Business Days (“Interest Rate”); and (iii) The net funds

raised by the Company through the Issue will be used for (a) cash

reinforcement and ordinary management of the Company's business;

(b) early redemption of all debentures issued by the Company within

the scope of the of the 1st (first) issue of simple debentures, not

convertible into shares of the type with real guarantee, with

additional personal guarantee, under the terms set forth in the

“Instrumento Particular de Escritura de Emissão Pública de

Debêntures Simples, Não Conversíveis em Ações, da Espécie com

Garantia Real, com Garantia Fidejussória Adicional, em Série Única,

da 1ª (Primeira) Emissão da Aura Almas Mineração S.A”, within

thirty (30) days of the date of the financial settlement of the

Debentures; and (c) payment and full settlement of other debts of

the Company.

The other terms and conditions of the Issue have

not been altered, so that the Debentures will continue to mature in

six (6) years, counting from the effective date of issue.

The Debentures, with the rectified terms and

conditions described above, will be the object of a public

distribution offering, to be registered by the CVM under the

automatic rite and destined exclusively at professional investors,

pursuant to CVM Resolution No. 160, of July 13, 2022, as amended

(“Offering”).

Details of the conditions and terms of the Issue

are disclosed in the minutes of the Company's Extraordinary

Shareholders’ General Meeting, which are available at the Company's

head office and on the CVM's (www.cvm.gov.br) and the Company's

(https://www.auraminerals.com/investidores/) websites.

This material fact does not constitute an offer,

invitation or request for an offer to acquire the Debentures.

São Paulo, September 25th, 2024.

Natasha Utescher

Investor Relations Officer

For more information, please contact:

Investor Relations

www.auraminerals.com

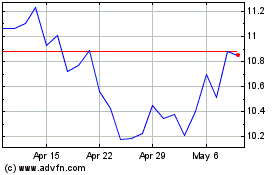

Aura Minerals (TSX:ORA)

Historical Stock Chart

From Nov 2024 to Dec 2024

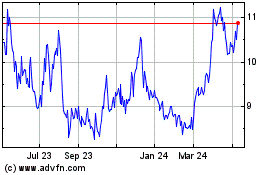

Aura Minerals (TSX:ORA)

Historical Stock Chart

From Dec 2023 to Dec 2024