Profound Medical Corp. (TSX:PRN; NASDAQ:PROF)

(“

Profound” or the “

Company”) is

pleased to announce the commencement of an underwritten public

offering in the United States of common shares (the “

Common

Shares”) in the capital of the Company (the

“

Offering”). The Company intends to file a

preliminary prospectus supplement (the “

Preliminary

Supplement”) to its short form base shelf prospectus dated

March 23, 2022 (the “

Base Shelf Prospectus”) in

the United States and Canada relating to the proposed Offering. The

Company intends that the Offering will be priced in the context of

the market, with such price and the total size of the Offering to

be determined at the time of entering into an underwriting

agreement with respect thereto. The Company expects to grant the

underwriter for the Offering an over-allotment option to purchase

up to an additional 15% of the Common Shares to be sold pursuant to

the Offering on the same terms and conditions, and that the

over-allotment option will be exercisable for a period of 30 days

after closing. All of the securities in the offering will be sold

by the Company.

Titan Partners Group, a division of American

Capital Partners, is acting as the sole bookrunner for the

Offering.

Closing of the Offering will be subject to a

number of customary conditions including, but not limited to, the

listing of the Common Shares on the Toronto Stock Exchange and any

required approvals of that exchange, as well as notice of the

listing of the Common Shares on Nasdaq in accordance with the rules

of that exchange, and there can be no assurance as to whether or

when the Offering may be completed.

The net proceeds of the Offering are expected to

be used: (i) to fund the continued commercialization of the

TULSA-PRO® system in the United States, (ii) to fund the continued

development and commercialization of the TULSA-PRO® system and the

Sonalleve® system globally, and (iii) for working capital and

general corporate purposes.

The Preliminary Supplement will be filed with

the securities commissions or similar securities regulatory

authorities in each of the provinces and territories of Canada. The

Preliminary Supplement will also be filed with the U.S. Securities

and Exchange Commission (the “SEC”) as part of the

Company’s effective registration statement on Form F-10 (file no.

333-263248), as amended (the “Registration

Statement”), previously filed under the

multijurisdictional disclosure system adopted by the securities

regulatory authorities in Canada and in the United States. The

Preliminary Supplement, together with the Base Shelf Prospectus and

the Registration Statement, as applicable, contains certain

important detailed information about the Offering but remains

subject to completion. Copies of the Preliminary Supplement and the

Base Shelf Prospectus will be available on SEDAR+ at

www.sedarplus.ca and on EDGAR at www.sec.gov, and a copy of the

Registration Statement is available on EDGAR at www.sec.gov. Copies

of the Preliminary Supplement, the Base Shelf Prospectus and the

Registration Statement may also be obtained in the United States by

contacting Titan Partners Group at 4 World Trade Center, 29th

Floor, New York, NY 10007, by telephone at (929) 833-1246 or by

email to info@titanpartnersgrp.com. Before investing in

the Offering, potential investors should read the Preliminary

Supplement, the Base Shelf Prospectus and the Registration

Statement and the other documents that Profound has filed in Canada

and with the SEC for more complete information about Profound and

the Offering.

The Company is offering the Common Shares in the

United States only. The Common Shares will not be qualified for

sale under the securities laws of Canada or any province or

territory of Canada and are not being offered for sale in Canada or

to any resident of Canada.

No securities regulatory authority has either

approved or disapproved of the contents of this press release. This

press release is for information purposes only and shall not

constitute an offer to sell or the solicitation of an offer to buy,

nor shall there be any sale of these securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior

to registration or qualification under the securities laws of any

such jurisdiction.

About Profound Medical

Corp.

Profound is a commercial-stage medical device

company that develops and markets customizable, incision-free

therapies for the ablation of diseased tissue.

Profound is commercializing TULSA-PRO®, a

technology that combines real-time MRI, robotically-driven

transurethral ultrasound and closed-loop temperature feedback

control. TULSA-PRO® is designed to provide customizable and

predictable radiation-free ablation of a surgeon-defined prostate

volume while actively protecting the urethra and rectum to help

preserve the patient’s natural functional abilities.

TULSA-PRO® has the potential to be a flexible technology in

customizable prostate ablation, including intermediate stage

cancer, localized radio-recurrent cancer, retention and hematuria

palliation in locally advanced prostate cancer, and the transition

zone in large volume benign prostatic hyperplasia (“BPH”).

TULSA-PRO® is CE marked, Health Canada approved, and 510(k)

cleared by the U.S. Food and Drug Administration (“FDA”).

Profound is also commercializing Sonalleve®, an

innovative therapeutic platform that is CE marked for the treatment

of uterine fibroids and palliative pain treatment of bone

metastases. Sonalleve® has also been approved by the China

National Medical Products Administration for the non-invasive

treatment of uterine fibroids and has FDA approval under a

Humanitarian Device Exemption for the treatment of osteoid osteoma.

The Company is in the early stages of exploring additional

potential treatment markets for Sonalleve® where the

technology has been shown to have clinical application, such as

non-invasive ablation of abdominal cancers and hyperthermia for

cancer therapy.

Forward-Looking Statements

This release includes forward-looking statements

regarding Profound and its business which may include, but are not

limited to, statements with respect to the proposed Offering and

the expectations regarding the efficacy of Profound’s technology in

the treatment of prostate cancer, BPH, uterine fibroids, palliative

pain treatment and osteoid osteoma, statements regarding the

expected use of proceeds from the Offering and the jurisdictions in

which the Offering is being made. Often, but not always,

forward-looking statements can be identified by the use of words

such as "plans", "is expected", "expects", "scheduled", "intends",

"contemplates", "anticipates", "believes", "proposes" or variations

(including negative variations) of such words and phrases, or state

that certain actions, events or results "may", "could", "would",

"might" or "will" be taken, occur or be achieved. Such statements

are based on the current expectations of the management of

Profound. The forward-looking events and circumstances discussed in

this release, may not occur by certain specified dates or at all

and could differ materially as a result of known and unknown risk

factors and uncertainties affecting the Company, including risks

regarding the potential Offering (including that the Offering may

not be completed on the terms indicated or at all, the Company may

be unsuccessful in satisfying conditions to closing of the Offering

or that the Company’s use of proceeds of the Offering may differ

from those indicated), the medical device industry, regulatory

approvals, reimbursement, economic factors, the equity markets

generally and risks associated with growth and competition, and the

other risks described in the Preliminary Supplement, the Base Shelf

Prospectus and the Registration Statement, and the documents

incorporated by reference therein. Although Profound has attempted

to identify important factors that could cause actual actions,

events or results to differ materially from those described in

forward-looking statements, there may be other factors that cause

actions, events or results to differ from those anticipated,

estimated or intended. No forward-looking statement can be

guaranteed. In addition, there is uncertainty about the spread of

the COVID-19 virus and the impact it will have on Profound’s

operations, the demand for its products, global supply chains and

economic activity in general. Except as required by applicable

securities laws, forward-looking statements speak only as of the

date on which they are made and Profound undertakes no obligation

to publicly update or revise any forward-looking statement, whether

as a result of new information, future events, or otherwise, other

than as required by law.

For further information, please contact:

Stephen KilmerInvestor Relationsskilmer@profoundmedical.com T:

647.872.4849

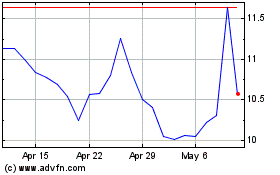

Profound Medical (TSX:PRN)

Historical Stock Chart

From Oct 2024 to Nov 2024

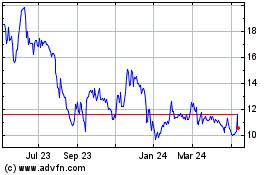

Profound Medical (TSX:PRN)

Historical Stock Chart

From Nov 2023 to Nov 2024