Petrus Resources Ltd. (“Petrus” or the “Company”) (TSX: PRQ) is

pleased to report financial and operating results as at and for the

three and twelve months ended December 31, 2023 and to provide 2023

year end reserves information as evaluated by Insite Petroleum

Consultants Ltd. ("Insite"). The Company's Management's Discussion

and Analysis ("MD&A") and audited consolidated financial

statements are available on SEDAR+ (the System for Electronic

Document Analysis and Retrieval) at www.sedarplus.ca.

An updated corporate presentation as well as the

monthly activity update can be found on the Company's website at

www.petrusresources.com.

Q4 2023 HIGHLIGHTS

- Dividends – The Company declared a regular

monthly dividend of $0.01 per share, starting January 2024,

following its inaugural special dividend of $0.03 per share which

was paid on November 9, 2023. These dividends serve as a tangible

reward allowing Petrus' shareholders to realize the value created

by the Company's continued success.

- Increased production – Total production

increased by 4% to 9,474 boe/d(1) in the fourth quarter of 2023,

compared to 9,113 boe/d in the fourth quarter of 2022.

- Lower operating expense – Operating expense in

the fourth quarter of 2023 was $5.07/boe, a 26% decrease from

$6.86/boe in the fourth quarter of 2022. The decrease is

primarily due to the realization of the cost recovery on Petrus'

North Ferrier gas plant interest.

- Infrastructure investment – Construction of

the North Ferrier pipeline was completed in the fourth quarter of

2023 and production started flowing to our Ferrier gas plant near

the end of the quarter. This strategic infrastructure allows

Petrus to expedite the development of its North Ferrier assets

while providing the same low cost structure as its core Ferrier

area.

- Commodity price decline – Total realized price

of $30.60/boe decreased by 47% in the fourth quarter of 2023

compared to the fourth quarter of 2022 ($57.81/boe) as a result of

lower commodity prices across all products.

- Funds flow(2) – The Company generated

funds flow(2) of $16.5 million in the fourth quarter of 2023, a 52%

decline from the fourth quarter of 2022 due to lower commodity

prices.

2023 ANNUAL HIGHLIGHTS

- Increased production – Total average annual

production increased by 35% to 10,301 boe/d in 2023, compared to

7,604 boe/d in 2022, in line with Petrus' 2023 production

guidance.

- Commodity price decline – Total realized price

of $33.31/boe decreased by 39% in 2023 compared to 2022

($54.63/boe) as a result of lower commodity prices across all

products.

- Funds flow(2) – Petrus generated funds

flow of $78.0 million, only 11% lower than the prior year despite a

39% lower total realized price per boe in 2023 and also within

Petrus' 2023 guidance. The decrease in 2023 funds flow was

due to lower commodity prices, which was partially offset by higher

production volumes and the realized gain on financial

derivatives.

- Net debt(2) – Net debt was $62.6 million at

December 31, 2023 or 0.8x funds flow for 2023. The Company

targets a net debt to funds flow ratio of less than 1.0x.

2024 OUTLOOK(3)

Petrus' 2024 budget was announced in February

and prioritizes its commitment to generating sustainable returns

and maintaining a healthy balance sheet. To date, Petrus has

successfully completed its planned first quarter 2024 drilling

program, and the wells are scheduled to be completed and put on

production over the next few months.

The 2024 capital budget targets(4):

- Capital spending of $40 million to $50 million - 90% allocated

toward drilling new wells in Ferrier and North Ferrier areas

- Annual average production of 9,000 to 10,000 boe per

day(1)

- Annual funds flow(2) of $55 million to $65 million

- Free funds flow(2) of $15 million to $20 million

- Monthly dividend of $0.01/share - annually this represents

approximately 9% of the current share price

- Net debt(1) in the range of $55 million to $60 million

The Company remains optimistic on the long-term

outlook for commodity prices and is strategically positioned to

take full advantage of the next constructive pricing cycle. As

always, Petrus will closely monitor changing market conditions and

is ready to adjust its capital program accordingly, guided by its

commitment to delivering sustainable returns to shareholders, which

remains the foundation of the Company’s long-term strategy.

(1)Disclosure of production on a per boe basis

consists of the constituent product types and their respective

quantities. Refer to "BOE Presentation" and "Production and

Product Type Information" for further details.(2)Non-GAAP measure

or non-GAAP ratio. Refer to "Non-GAAP and Other Financial

Measures".(3)Refer to "Advisories - Forward-Looking Statements".

(4)The budget was established using an average price forecast of

US$75/bbl WTI for oil, an AECO gas price of CAD$2.50/GJ and a

foreign exchange rate of US$0.74.

SELECTED FINANCIAL INFORMATION

| |

Twelve months ended |

Twelve months ended |

Three months ended |

Three months ended |

Three months ended |

Three months ended |

| OPERATIONS |

|

|

|

|

|

|

| |

Dec. 31, 2023 |

Dec. 31, 2022 |

Dec. 31, 2023 |

Sept. 30, 2023 |

Jun. 30, 2023 |

Mar. 31, 2023 |

| Average production |

|

|

|

|

|

|

| Natural gas

(mcf/d) |

42,779 |

|

30,441 |

|

39,891 |

|

42,045 |

|

44,010 |

|

45,237 |

|

| Oil (bbl/d) |

1,595 |

|

1,436 |

|

1,218 |

|

1,316 |

|

1,670 |

|

2,192 |

|

| NGLs (bbl/d) |

1,575 |

|

1,094 |

|

1,607 |

|

1,556 |

|

1,486 |

|

1,654 |

|

| Total (boe/d) |

10,301 |

|

7,604 |

|

9,474 |

|

9,880 |

|

10,492 |

|

11,385 |

|

| Total

(boe) |

3,760,004 |

|

2,775,561 |

|

871,567 |

|

908,985 |

|

954,738 |

|

1,024,645 |

|

| Total liquids

weighting |

31 |

% |

33 |

% |

30 |

% |

29 |

% |

30 |

% |

34 |

% |

| Realized Prices |

|

|

|

|

|

|

| Natural gas ($/mcf) |

3.01 |

|

6.03 |

|

2.76 |

|

2.81 |

|

2.64 |

|

3.78 |

|

| Oil ($/bbl) |

95.61 |

|

113.19 |

|

98.63 |

|

99.33 |

|

91.69 |

|

94.63 |

|

| NGLs ($/bbl) |

39.31 |

|

63.26 |

|

37.26 |

|

37.09 |

|

34.82 |

|

47.55 |

|

| Total realized

price ($/boe) |

33.31 |

|

54.63 |

|

30.60 |

|

31.05 |

|

30.59 |

|

40.16 |

|

| Royalty income |

0.09 |

|

0.26 |

|

0.09 |

|

0.06 |

|

0.06 |

|

0.16 |

|

| Royalty expense |

(4.59 |

) |

(8.70 |

) |

(4.78 |

) |

(3.37 |

) |

(3.66 |

) |

(6.38 |

) |

| Gain (loss) on risk

management activities |

0.40 |

|

(2.17 |

) |

— |

|

— |

|

0.03 |

|

1.45 |

|

| Net oil and

natural gas sales ($/boe) |

29.21 |

|

44.02 |

|

25.91 |

|

27.74 |

|

27.02 |

|

35.39 |

|

| Operating expense |

(6.25 |

) |

(7.45 |

) |

(5.07 |

) |

(6.70 |

) |

(5.83 |

) |

(7.26 |

) |

| Transportation

expense |

(1.63 |

) |

(2.08 |

) |

(1.46 |

) |

(1.54 |

) |

(1.40 |

) |

(2.05 |

) |

|

Operating netback(1) ($/boe) |

21.33 |

|

34.49 |

|

19.38 |

|

19.50 |

|

19.79 |

|

26.08 |

|

| Realized gain (loss) on financial derivatives ($/boe) |

2.14 |

|

(0.58 |

) |

1.99 |

|

1.21 |

|

3.56 |

|

1.77 |

|

| Cash other income |

0.02 |

|

0.10 |

|

(0.18 |

) |

0.04 |

|

0.04 |

|

0.16 |

|

| General & administrative expense |

(1.11 |

) |

(1.22 |

) |

(0.37 |

) |

(1.27 |

) |

(1.55 |

) |

(1.20 |

) |

| Cash finance expense |

(1.28 |

) |

(1.14 |

) |

(1.43 |

) |

(1.26 |

) |

(1.33 |

) |

(1.11 |

) |

|

Decommissioning expenditures |

(0.37 |

) |

(0.05 |

) |

(0.43 |

) |

(0.34 |

) |

(0.58 |

) |

(0.13 |

) |

|

Funds flow & corporate netback(1)

($/boe) |

20.73 |

|

31.60 |

|

18.96 |

|

17.88 |

|

19.93 |

|

25.57 |

|

|

|

|

|

|

|

|

|

| |

Twelve

months ended |

Twelve

months ended |

Three months ended |

Three months

ended |

Three months

ended |

Three months

ended |

| FINANCIAL (000s except $ per share) |

|

|

|

|

|

|

| |

Dec. 31, 2023 |

Dec. 31, 2022 |

Dec. 31, 2023 |

Sept. 30, 2023 |

Jun. 30, 2023 |

Mar. 31, 2023 |

| Oil and natural gas revenue |

125,605 |

|

152,350 |

|

26,747 |

|

28,273 |

|

29,266 |

|

41,319 |

|

| Net income |

50,731 |

|

60,868 |

|

39,708 |

|

(11,293 |

) |

5,043 |

|

17,273 |

|

| Net income per share |

|

|

|

|

|

|

| Basic |

0.41 |

|

0.53 |

|

0.32 |

|

(0.09 |

) |

0.04 |

|

0.14 |

|

| Fully diluted |

0.40 |

|

0.51 |

|

0.32 |

|

(0.09 |

) |

0.04 |

|

0.14 |

|

| Funds flow(1) |

78,024 |

|

87,716 |

|

16,525 |

|

16,243 |

|

19,040 |

|

26,216 |

|

| Funds flow per share (1) |

|

|

|

|

|

|

| Basic |

0.63 |

|

0.76 |

|

0.13 |

|

0.13 |

|

0.15 |

|

0.21 |

|

| Fully diluted |

0.62 |

|

0.73 |

|

0.13 |

|

0.13 |

|

0.15 |

|

0.21 |

|

| Capital expenditures |

86,843 |

|

96,744 |

|

32,029 |

|

21,617 |

|

3,380 |

|

29,820 |

|

| Weighted average shares outstanding |

|

|

|

|

|

|

| Basic |

123,469 |

|

115,189 |

|

123,812 |

|

123,743 |

|

123,752 |

|

123,416 |

|

| Fully diluted |

126,436 |

|

119,525 |

|

124,840 |

|

123,743 |

|

127,040 |

|

127,358 |

|

| As at period end |

|

|

|

|

|

|

| Common shares outstanding |

|

|

|

|

|

|

| Basic |

124,266 |

|

123,239 |

|

124,266 |

|

123,867 |

|

123,849 |

|

123,239 |

|

| Fully diluted |

134,542 |

|

133,377 |

|

134,542 |

|

134,436 |

|

134,423 |

|

133,377 |

|

| Total assets |

437,842 |

|

381,057 |

|

437,842 |

|

380,100 |

|

383,231 |

|

403,276 |

|

| Non-current liabilities |

60,926 |

|

63,021 |

|

60,926 |

|

59,687 |

|

62,630 |

|

68,056 |

|

| Net debt(1) |

62,596 |

|

50,808 |

|

62,596 |

|

42,610 |

|

36,857 |

|

53,111 |

|

| (1) Non-GAAP financial measure or non-GAAP

ratio. Refer to "Non-GAAP and Other Financial Measures". |

| |

|

|

|

|

|

|

|

|

|

|

|

|

OPERATIONS UPDATE

Fourth quarter average production by area was as

follows:

|

For the three months ended December 31, 2023 |

Ferrier |

North Ferrier |

Foothills |

Central Alberta |

Kakwa |

Total |

| Natural gas (mcf/d) |

30,836 |

2,558 |

1,735 |

4,634 |

129 |

39,892 |

| Oil (bbl/d) |

808 |

85 |

83 |

233 |

10 |

1,219 |

| NGLs

(bbl/d) |

1,393 |

61 |

6 |

138 |

9 |

1,607 |

|

Total (boe/d) |

7,340 |

572 |

378 |

1,144 |

40 |

9,474 |

| |

|

|

|

|

|

|

Fourth quarter 2023 production averaged 9,474

boe/d compared to 9,113 boe/d in the fourth quarter of 2022.

Production has increased as a result of the Company's capital

program that was executed in 2023. Two gross (2.0 net) wells

were drilled during the fourth quarter of 2023. Completion

activities of these wells is set to commence in late spring of

2024.

RESERVES

Petrus’ 2023 year end reserves were evaluated by

the independent reserves evaluator InSite Petroleum Consultants

Ltd. ("Insite") in accordance with the definitions, standards and

procedures contained in the Canadian Oil and Gas Evaluation

Handbook (“COGE Handbook”) and National instrument 51-101 -

Standards of Disclosure for Oil and Gas Activities (“NI 51-101”) as

of December 31, 2023 ("2023 Insite Report"). Additional

reserve information as required under NI 51-101 will be included in

our Annual Information Form for the year ended December 31,

2023, which will be available under the Company's profile on SEDAR+

(the System for Electronic Document Analysis and Retrieval) at

www.sedarplus.ca.

Petrus has a reserves committee, comprised of a

majority of independent board members, that reviews the

qualifications and appointment of the independent reserves

evaluator. The committee also reviews the procedures for providing

information to the evaluators. All booked reserves are based upon

annual evaluations by the independent qualified reserve evaluator

conducted in accordance with the COGE Handbook and NI 51-101. The

evaluations are conducted using all available geological and

engineering data. The reserves committee has reviewed the

reserves information and approved the 2023 Insite Report.

The following table provides a summary of the

Company’s before tax reserves as evaluated by Insite:

|

As at December 31, 2023 |

Total Company Interest (1)(3) |

|

Reserve Category |

Conventional Natural

Gas(mmcf) |

Light and Medium Crude

Oil(mbbl) |

Condensate NGL(mmbl) |

OtherNGL(mbbl) |

Total(mboe) |

NPV 0%(2)($000s) |

NPV 5%(2)($000s) |

NPV 10%(2)($000s) |

| Proved Developed

Producing |

76,176 |

786 |

2,687 |

2,199 |

18,368 |

350,754 |

273,749 |

226,577 |

| Proved Developed

Non-Producing |

1,516 |

7 |

37 |

38 |

334 |

4,244 |

3,162 |

2,433 |

| Proved

Undeveloped |

121,139 |

3,027 |

2,966 |

3,396 |

29,579 |

426,193 |

273,193 |

179,434 |

| Total

Proved |

198,831 |

3,820 |

5,690 |

5,632 |

48,281 |

781,190 |

550,105 |

408,445 |

| Proved

+ Probable Producing |

92,978 |

931 |

3,332 |

2,710 |

22,469 |

457,213 |

333,717 |

266,914 |

|

Total Probable |

109,300 |

3,062 |

2,500 |

3,308 |

27,086 |

510,098 |

291,076 |

185,544 |

|

Total Proved Plus Probable |

308,131 |

6,882 |

8,190 |

8,940 |

75,367 |

1,291,289 |

841,181 |

593,989 |

| (1)Tables may not

add due to rounding. |

| (2)NPV 0%, NPV 5%

and NPV 10% refer to the risked net present value of the future net

revenue of the Company's reserves, discounted by 0%, 5% and 10%,

respectively and is presented before tax and based on Insite's

pricing assumptions. |

| (3)Total company

interest reserve volumes presented above and in the remainder of

this press release are presented as the Company's total working

interest before the deduction of royalties (but after including any

royalty interests of Petrus). |

| |

In 2023, Petrus’ development program generated

proved developed producing ("PDP") reserve volume additions of 4.4

mmboe. The Company produced 3.8 mmboe and divested of 0.1 mmboe of

PDP reserves resulting in a net increase of 0.6 mmboe to end the

year with 18.4 mmboe of PDP reserves (31% crude oil and

liquids).

At December 31, 2023, Petrus’ PDP, Total Proved

("TP"), and Proved plus Probable (“P+P”) reserves were valued at

$226.6 million, $408.4 million and $594.0 million, respectively,

before-tax, discounted at 10%, based on the 2023 Insite Report. In

2023, the Company realized Finding, Development and Acquisition

(“FD&A”) costs of $19.67/boe for PDP reserves.

Based on the 2023 Insite Report, the Company’s

PDP reserve value before-tax, discounted at 10% is $1.68 per share

(134,501,972 fully-diluted common shares outstanding at December

31, 2023). On the same basis, the P+P reserve value before-tax,

discounted at 10%, is $4.42 per share.

FUTURE DEVELOPMENT COSTFuture

Development Cost ("FDC") reflects Insite's best estimate of what it

will cost to bring the P+P undeveloped reserves on production. The

following table provides a summary of the Company's FDC as set

forth in the 2023 Insite Report:

|

|

|

|

|

Future Development Cost ($000s) |

|

|

|

|

Total Proved |

Total Proved + Probable |

| 2024 |

90,209 |

96,328 |

| 2025 |

111,299 |

132,962 |

| 2026 |

129,859 |

154,841 |

| 2027 |

59,691 |

120,446 |

|

2028 |

— |

113,860 |

|

Total FDC, Undiscounted |

391,058 |

618,437 |

|

Total FDC, Discounted at 10% |

328,247 |

490,116 |

| |

|

|

PERFORMANCE RATIOS

The following table highlights annual

performance ratios for the Company from 2019 to 2023(3):

|

|

December 31, 2023 |

|

December 31, 2022 |

|

December 31, 2021 |

|

December 31, 2020 |

December 31, 2019 |

| Proved

Producing |

|

|

|

|

|

|

|

|

|

FD&A ($/boe) (1)(2) |

19.67 |

|

12.58 |

|

15.64 |

|

4.83 |

|

13.31 |

|

| F&D ($/boe) (1)(2) |

19.67 |

|

12.70 |

|

8.90 |

|

4.83 |

|

12.81 |

|

| Reserve Life Index (yr)

(1) |

5.27 |

|

5.31 |

|

5.41 |

|

5.20 |

|

3.80 |

|

| Reserve Replacement Ratio

(1) |

1.15 |

|

3.20 |

|

0.78 |

|

1.20 |

|

0.40 |

|

|

FD&A Recycle Ratio (1) |

1.06 |

|

2.91 |

|

1.58 |

|

2.60 |

|

1.20 |

|

| Proved

Developed |

|

|

|

|

|

|

|

|

| FD&A ($/boe) (1)(2) |

19.34 |

|

12.50 |

|

14.54 |

|

4.71 |

|

12.49 |

|

| F&D ($/boe) (1)(2) |

19.34 |

|

12.61 |

|

8.53 |

|

4.71 |

|

12.03 |

|

| Reserve Life Index (yr)

(1) |

5.36 |

|

5.39 |

|

5.50 |

|

5.20 |

|

4.80 |

|

| Reserve Replacement Ratio

(1) |

1.17 |

|

3.22 |

|

0.84 |

|

1.20 |

|

0.50 |

|

|

FD&A Recycle Ratio (1) |

1.08 |

|

2.93 |

|

1.70 |

|

2.70 |

|

1.30 |

|

| Total

Proved |

|

|

|

|

|

|

|

|

| FD&A ($/boe) (1)(2) |

14.50 |

|

18.24 |

|

10.51 |

|

1.29 |

|

1.09 |

|

| F&D ($/boe) (1)(2) |

14.50 |

|

33.99 |

|

9.24 |

|

1.29 |

|

(6.83 |

) |

| Reserve Life Index (yr)

(1) |

13.85 |

|

12.18 |

|

15.30 |

|

10.90 |

|

9.90 |

|

| Reserve Replacement Ratio

(1) |

2.98 |

|

3.79 |

|

4.50 |

|

(1.00 |

) |

0.30 |

|

| FD&A Recycle Ratio

(1) |

1.44 |

|

2.01 |

|

2.35 |

|

9.80 |

|

14.40 |

|

| Future

Development Cost (undiscounted) ($000s) |

391,058 |

|

313,786 |

|

233,684 |

|

156,815 |

|

174,027 |

|

| Total Proved +

Probable |

|

|

|

|

|

|

|

|

| FD&A ($/boe) (1)(2) |

14.00 |

|

15.66 |

|

10.57 |

|

0.37 |

|

(7.32 |

) |

| F&D ($/boe) (1)(2) |

14.00 |

|

36.12 |

|

8.36 |

|

0.37 |

|

190.21 |

|

| Reserve Life Index (yr)

(1) |

21.62 |

|

19.68 |

|

23.29 |

|

17.70 |

|

15.40 |

|

| Reserve Replacement Ratio

(1) |

3.49 |

|

6.63 |

|

5.10 |

|

(1.30 |

) |

— |

|

| FD&A Recycle Ratio

(1) |

1.50 |

|

2.34 |

|

2.33 |

|

33.70 |

|

(2.10 |

) |

| Future

Development Cost (undiscounted) ($000s) |

618,437 |

|

519,823 |

|

343,489 |

|

252,335 |

|

267,652 |

|

| (1)Refer to "Oil

and Gas Disclosures". |

| (2)Certain

changes in FD&A costs and F&D costs produce non-meaningful

figures as discussed in "Oil and Gas Disclosures". |

| (3)While FD&A

costs and F&D costs, reserve life index, reserve replacement

ratio and FD&A recycle ratio are commonly used in the oil and

nature gas industry and have been prepared by management, these

terms do not have a standardized meaning and may not be comparable

to similar measures presented by other companies and, therefore,

should not be used to make such comparisons. |

| |

NET ASSET VALUEThe Company

estimates its net asset value to be $562.0 million or $4.18 per

fully diluted common share as at December 31, 2023 based on the

present value of its P+P reserves before tax, discounted at

10%. The components of the Company's net asset value are set

forth in the table below. The reader is cautioned that these

amounts may not be directly comparable to other companies, as the

term "Net Asset Value" does not have a standardized meaning under

GAAP or NI 51-101. Management believes that net asset value

provides a useful measure to analyze the comparative change in the

Company's estimated value on a normalized basis.

The following table shows the Company's Net Asset Value ("NAV"),

calculated using the 2023 Insite Report and Insite's

December 31, 2023 price forecast:

| As at December

31, 2023 ($000s except per share) |

Proved Developed Producing |

Total Proved |

Proved + Probable |

|

Present Value Reserves, before tax (discounted at 10%) (1) |

|

226,577 |

|

|

408,445 |

|

|

593,989 |

|

| Undeveloped Land Value

(2) |

|

30,628 |

|

|

30,628 |

|

|

30,628 |

|

| Net

Debt (3) |

|

(62,596 |

) |

|

(62,596 |

) |

|

(62,596 |

) |

| Net Asset

Value |

|

194,609 |

|

|

376,477 |

|

|

562,021 |

|

| Fully

Diluted Shares Outstanding |

|

134,542 |

|

|

134,542 |

|

|

134,542 |

|

|

Estimated Net Asset Value per Fully Diluted

Share |

$ |

1.45 |

|

$ |

2.80 |

|

$ |

4.18 |

|

| (1)Based on the

2023 Insite Report, using the forecast future prices and

costs. |

| (2)Based on the

exploration and evaluation assets as per the Company's December 31,

2023 audited consolidated financial statements. |

| (3)Non-GAAP

financial measure. See "Non-GAAP and Other Financial

Measures". |

| |

FOURTH QUARTER AND YEAR-END 2023

CONFERENCE CALL

Date: March 27, 2024Time: 9:00am (mountain

time)

Webcast View

Link: https://edge.media-server.com/mmc/p/3nn4uzdx

1. Click the link and you will be able to view

the webcast playback of the conference call

Live Call Link:

https://register.vevent.com/register/BIfc58f5e315534b0eb701d1f69879f7e7

1. Click on the call link and complete the

online registration form.2. Upon registering you will receive the

dial-in info and a unique PIN to join the call as well as an email

confirmation with the details.3. Select a method for joining the

call:

- Dial-In: A dial in number and unique PIN are displayed to

connect directly from your phone.

- Call Me: Enter your phone number and click “Call Me” for an

immediate callback from the system. The call will come from a US

number.

ANNUAL GENERAL MEETING

The Company's Annual General Meeting will be

held at 240FOURTH (previously BP Centre) Conference Room A, 240,

4th Ave SW Calgary, Alberta, on Wednesday May 29, 2024 at 1:00 p.m.

(mountain time).

For further information, please

contact:Ken Gray, P.Eng.President and Chief Executive

OfficerT: (403) 930-0889E: kgray@petrusresources.com

NON-GAAP AND OTHER FINANCIAL

MEASURESThis press release makes reference to the terms

"operating netback" (on an absolute and $/boe basis), "corporate

netback" (on an absolute and $/boe basis), "funds flow" (on an

absolute, per share (basic and fully diluted) and $/boe basis),

"free funds flow", "net debt" and "net debt to funds flow ratio".

These non-GAAP and other financial measures are not recognized

measures under GAAP (IFRS) and do not have a standardized meaning

prescribed by GAAP (IFRS). Accordingly, the Company's use of these

terms may not be comparable to similarly defined measures presented

by other companies. These non-GAAP and other financial measures

should not be considered to be more meaningful than GAAP measures

which are determined in accordance with IFRS as indicators of our

performance. Management uses these non-GAAP and other financial

measures for the reasons set forth below.

Operating Netback

Operating netback is a common non-GAAP financial

measure used in the oil and natural gas industry which is a useful

supplemental measure to evaluate the specific operating performance

by product type at the oil and natural gas lease level. The most

directly comparable GAAP measure to operating netback is oil and

natural gas revenue. Operating netback is calculated as oil and

natural gas revenue less royalty expenses, operating expenses and

transportation expenses, plus or minus the gain (loss) on risk

management activities. See below for a reconciliation of operating

netback to oil and natural gas revenue.

Operating netback ($/boe) is a non-GAAP ratio

used in the oil and natural gas industry which is a useful

supplemental measure to evaluate the specific operating performance

by product type at the oil and natural gas lease level . It is

calculated as operating netbacks divided by weighted average daily

production on a per boe basis. See below.

Corporate Netback and Funds

FlowCorporate netback or funds flow is a common non-GAAP

financial measure used in the oil and natural gas industry which

evaluates the Company’s profitability at the corporate level.

Corporate netback and funds flow are used interchangeably. Petrus

analyzes these measures on an absolute value and on a per unit

(boe) and per share (basic and fully diluted) basis as non-GAAP

ratios. Management believes that funds flow and corporate netback

provide information to assist a reader in understanding the

Company's profitability relative to current commodity prices. They

are calculated as the operating netback less general and

administrative expense, cash finance expense, decommissioning

expenditures, plus other income and the net realized gain (loss) on

financial derivatives and risk management activities. See below for

a reconciliation of funds flow and corporate netback to oil and

natural gas revenue.

Corporate netback ($/boe) or funds flow ($/boe)

is a non-GAAP ratio used in the oil and natural gas industry which

evaluates the Company’s profitability at the corporate level.

Management believes that funds flow ($/boe) or corporate netback

($/boe) provide information to assist a reader in understanding the

Company's profitability relative to current commodity prices. It is

calculated as corporate netbacks or funds flow divided by weighted

average daily production on a per boe basis. See below.

Funds flow per share (basic and fully diluted)

is comprised of funds flow divided by basic or fully diluted

weighted average common shares outstanding.

Free Funds FlowFree funds flow

is a common non-GAAP financial measure used in the oil and natural

gas industry that evaluates the Company’s efficiency and liquidity.

Free funds flow represents the funds after capital expenditures

available to manage debt levels and pay dividends. Petrus

calculates free funds flow as funds flow generated during the

period less capital expenditures. The most directly comparable

financial measure that is disclosed in the Company's primary

financial statements is oil and natural gas revenue. See below for

a reconciliation of free funds flow to oil and natural gas

revenue.

| |

Three months ended |

Three months ended |

Twelve months ended |

Twelve months ended |

|

|

December 31, 2023 |

December 31, 2022 |

December 31, 2023 |

December 31, 2022 |

|

|

$000s |

$/boe |

$000s |

$/boe |

$000s |

$/boe |

$000s |

$/boe |

|

Oil and natural gas revenue |

26,747 |

|

30.70 |

|

48,590 |

|

57.96 |

|

125,605 |

|

33.41 |

|

152,350 |

|

54.89 |

|

| Royalty expense |

(4,167 |

) |

(4.78 |

) |

(6,636 |

) |

(7.92 |

) |

(17,255 |

) |

(4.59 |

) |

(24,161 |

) |

(8.70 |

) |

| Gain

(loss) on risk management activities |

— |

|

— |

|

(1,056 |

) |

(1.26 |

) |

1,522 |

|

0.40 |

|

(6,029 |

) |

(2.17 |

) |

|

Net oil and natural gas revenue |

22,580 |

|

25.92 |

|

40,898 |

|

48.78 |

|

109,872 |

|

29.22 |

|

122,160 |

|

44.02 |

|

| Transportation expense |

(1,271 |

) |

(1.46 |

) |

(1,743 |

) |

(2.08 |

) |

(6,115 |

) |

(1.63 |

) |

(5,772 |

) |

(2.08 |

) |

|

Operating expense |

(4,419 |

) |

(5.07 |

) |

(5,753 |

) |

(6.86 |

) |

(23,505 |

) |

(6.25 |

) |

(20,665 |

) |

(7.45 |

) |

|

Operating netback |

16,890 |

|

19.39 |

|

33,402 |

|

39.84 |

|

80,252 |

|

21.34 |

|

95,723 |

|

34.49 |

|

| Realized gain (loss) on

financial derivatives |

1,737 |

|

1.99 |

|

2,421 |

|

2.89 |

|

8,051 |

|

2.14 |

|

(1,601 |

) |

(0.58 |

) |

| Other income(1) |

(161 |

) |

(0.18 |

) |

186 |

|

0.22 |

|

79 |

|

0.02 |

|

291 |

|

0.10 |

|

| General & administrative

expense |

(319 |

) |

(0.37 |

) |

(926 |

) |

(1.10 |

) |

(4,183 |

) |

(1.11 |

) |

(3,389 |

) |

(1.22 |

) |

| Cash finance expense |

(1,246 |

) |

(1.43 |

) |

(987 |

) |

(1.18 |

) |

(4,801 |

) |

(1.28 |

) |

(3,171 |

) |

(1.14 |

) |

|

Decommissioning expenditures |

(376 |

) |

(0.43 |

) |

21 |

|

0.03 |

|

(1,374 |

) |

(0.37 |

) |

(137 |

) |

(0.05 |

) |

|

Funds flow and corporate netback |

16,525 |

|

18.97 |

|

34,117 |

|

40.70 |

|

78,024 |

|

20.74 |

|

87,716 |

|

31.60 |

|

| Capital

expenditures |

(32,029 |

) |

(36.73 |

) |

(37,792 |

) |

(45.10 |

) |

(86,843 |

) |

(23.10 |

) |

(96,744 |

) |

(34.85 |

) |

|

Free funds flow |

(15,504 |

) |

(17.76 |

) |

(3,675 |

) |

(4.40 |

) |

(8,819 |

) |

(2.36 |

) |

(9,028 |

) |

(3.25 |

) |

| (1)Excludes

non-cash government grant related to decommissioning

expenditures. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Debt

Net debt is a non-GAAP financial measure and is

calculated as the sum of long term debt and working capital

(current assets and current liabilities), excluding the current

financial derivative contracts and current portion of the lease

obligation and decommissioning obligation. Petrus uses net

debt as a key indicator of its leverage and strength of its balance

sheet. Net debt is reconciled, in the table below, to long-term

debt which is the most directly comparable GAAP measure.

|

($000s) |

|

|

|

|

|

| |

As at Dec. 31, 2023 |

As at Sept. 30, 2023 |

As at Jun. 30, 2023 |

As at Mar. 31, 2023 |

As at Dec. 31, 2022 |

|

Long-term debt |

25,000 |

|

25,000 |

|

25,000 |

|

25,000 |

|

25,000 |

|

| Current assets |

(30,805 |

) |

(19,375 |

) |

(28,150 |

) |

(31,309 |

) |

(29,849 |

) |

| Current liabilities |

61,755 |

|

40,636 |

|

30,032 |

|

50,336 |

|

51,395 |

|

| Current financial

derivatives |

8,374 |

|

(3,397 |

) |

10,224 |

|

9,328 |

|

4,502 |

|

| Current portion of lease

obligation |

(258 |

) |

(254 |

) |

(249 |

) |

(244 |

) |

(240 |

) |

| Current

portion of decommissioning obligation |

(1,470 |

) |

(359 |

) |

(671 |

) |

(1,357 |

) |

(1,357 |

) |

|

Net debt |

62,596 |

|

42,251 |

|

36,186 |

|

51,754 |

|

49,451 |

|

| |

|

|

|

|

|

|

|

|

|

|

Net debt to funds flow ratio is a non-GAAP ratio used as a key

indicator of our leverage and strength of our balance sheet.

It is calculated as net debt divided by funds flow for the relevant

period.

OIL AND GAS DISCLOSURES

Our oil and gas reserves statement for the year

ended December 31, 2023, which includes disclosure of our oil

and natural gas reserves and other oil and natural gas information

in accordance with NI 51-101, is contained in the Company's Annual

Information Form (the "AIF"), which will be filed on SEDAR+ at

www.sedarplus.ca.

It should not be assumed that the present worth

of estimated future amounts presented in the tables above

represents the fair market value of the reserves. There is no

assurance that the forecast prices and costs assumptions will be

attained, and variances could be material. The recovery and

reserve estimates contained herein are estimates only and there is

no guarantee that the estimated reserves will be recovered.

Actual reserves may be greater than or less than the estimates

provided herein.

This press release contains metrics commonly

used in the oil and natural gas industry which have been prepared

by management. These terms do not have a standardized meaning

and may not be comparable to similar measures presented by other

companies, and therefore should not be used to make such

comparisons.

Management uses oil and gas metrics for its own

performance measurements and to provide shareholders with measures

to compare Petrus' operations over time. Readers are

cautioned that the information provided by these metrics, or that

can be derived from the metrics presented in this press release,

should not be relied upon for investment or other purposes.

F&D Costs and FD&A

CostsFD&A cost is defined as capital costs for the

time period including change in FDC divided by change in reserves

including revisions and production for that same time period.

F&D cost is defined as capital costs for the time period

including change in FDC divided by change in reserves including

revisions and production for that same time period, excluding

acquisitions and dispositions. Both F&D costs and

FD&A costs take into account reserves revisions during the year

on a per boe basis. The methodology used to calculate F&D

costs includes disclosure required to bring the proved undeveloped

and probable reserves to production. Annually, changes in

forecast FDC occur as a result of Petrus' development, acquisition

and disposition activities, undeveloped reserve revision and

capital cost estimates. These values reflect the independent

evaluator's best estimate of the cost to bring the proved and

probable undeveloped reserves to production.

Reserve Life IndexReserve life

index is defined as total reserves by category divided by the

annualized fourth quarter production.

Reserve Replacement RatioThe

reserve replacement ratio is calculated by dividing the yearly

change in reserves net of production by the actual annual

production for the year.

FD&A Recycle RatioThe

FD&A recycle ratio is calculated by dividing operating netback

by FD&A costs.

BOE PresentationThe oil and

natural gas industry commonly expresses production volumes and

reserves on a barrel of oil equivalent (“boe”) basis whereby

natural gas volumes are converted at the ratio of six thousand

cubic feet to one barrel of oil. The intention is to sum oil and

natural gas measurement units into one basis for improved

measurement of results and comparisons with other industry

participants. Petrus uses the 6:1 boe measure which is the

approximate energy equivalence of the two commodities at the burner

tip. Boe’s do not represent an economic value equivalence at the

wellhead and therefore may be a misleading measure if used in

isolation.

Production and Product Type

InformationThe Company's average daily production for the

fourth quarter of 2022 disclosed in this press release consists of

the following product types, as defined in National Instrument

51-101 and using the conversion ratio described above, where

applicable: 9,113 boe/d – 27% light oil and condensate, 12% natural

gas liquids and 61% conventional natural gas.

The Company's forecast average daily production

for 2024 of 9,000 to 10,000 boe per day disclosed in this press

release consists of the following product types, as defined in

National Instrument 51-101 and using the conversion ratio described

above, where applicable: 9,500 boe/d (midpoint) – 18% light oil and

condensate, 16% natural gas liquids and 66% conventional natural

gas.

ADVISORIES

Basis of PresentationFinancial

data presented above has largely been derived from the Company’s

financial statements, prepared in accordance with Canadian

Generally Accepted Accounting Principles ("GAAP") which require

publicly accountable enterprises to prepare their financial

statements using International Financial Reporting Standards

("IFRS"). Accounting policies adopted by the Company are set out in

the notes to the audited consolidated financial statements as at

and for the twelve months ended December 31, 2023. The

reporting and the measurement currency is the Canadian dollar. All

financial information is expressed in Canadian dollars, unless

otherwise stated. Forward-Looking

StatementsCertain information regarding Petrus set forth

in this press release contains forward-looking statements within

the meaning of applicable securities law, that involve substantial

known and unknown risks and uncertainties. The use of any of the

words “anticipate”, “continue”, “estimate”, “expect”, “may”,

“will”, “project”, “should”, “believe” and similar expressions are

intended to identify forward-looking statements. Such statements

represent Petrus’ internal projections, estimates, beliefs, plans,

objectives, assumptions, intentions or statements about future

events or performance. These statements are only predictions and

actual events or results may differ materially. Although Petrus

believes that the expectations reflected in the forward-looking

statements are reasonable, it cannot guarantee future results,

levels of activity, performance or achievement since such

expectations are inherently subject to significant business,

economic, competitive, political and social uncertainties and

contingencies. Many factors could cause Petrus’ actual results to

differ materially from those expressed or implied in any

forward-looking statements made by, or on behalf of, Petrus.

In particular, forward-looking statements

included in this press release include, but are not limited to,

statements with respect to: the Company's intention to pay a

regular monthly dividend of $0.01 per share going forward; that the

completion of the North Ferrier pipeline will allow Petrus to

expedite the development of its North Ferrier assets while

providing the same low cost structure as its core Ferrier area; our

target of a debt to funds flow ratio of less than 1.0x; our

commitment to generating sustainable returns and maintaining a

healthy balance sheet; that the wells drilled in Q1 2024 are

scheduled to be completed and put on production over the next few

months; all elements of our 2024 capital budget, including our

targets for capital spending and the portion thereof allocated to

drilling new wells in Ferrier and North Ferrier, annual average

production, annual funds flow, free funds flow, monthly dividends

and net debt; our expectations for the long-term outlook for

commodity prices; that we are strategically positioned to take full

advantage of the next constructive pricing cycle; that we will

closely monitor changing market conditions and are ready to adjust

our capital program accordingly; that we are guided by our

commitment to deliver sustainable returns to shareholders, which

remains the foundation of our long-term strategy; our forecast for

commodity prices and the US/CDN exchange rate in 2024; the timing

for completion activities for wells drilling during Q4 2023; and

the estimated future development costs to bring our P+P undeveloped

reserves on production. In addition, statements relating to

“reserves” are deemed to be forward-looking statements, as they

involve the implied assessment, based on certain estimates and

assumptions, that the reserves described can be profitably produced

in the future.

These forward-looking statements are subject to

numerous risks and uncertainties, most of which are beyond the

Company’s control, including: the impact of general economic

conditions; volatility in market prices for crude oil, NGL and

natural gas; industry conditions; currency fluctuation; changes in

interest rates and inflation rates; imprecision of reserve

estimates; liabilities inherent in crude oil and natural gas

operations; environmental risks; incorrect assessments of the value

of acquisitions and exploration and development programs;

competition; the lack of availability of qualified personnel or

management; changes in income tax laws or changes in tax laws and

incentive programs relating to the oil and gas industry; hazards

such as fire, explosion, blowouts, cratering, and spills, each of

which could result in substantial damage to wells, production

facilities, other property and the environment or in personal

injury; stock market volatility; ability to access sufficient

capital from internal and external sources; and the other risks and

uncertainties described in the AIF. With respect to forward-looking

statements contained in this press release, Petrus has made

assumptions regarding: future commodity prices and royalty regimes;

availability of skilled labour; timing and amount of capital

expenditures; future exchange rates; the impact of increasing

competition; conditions in general economic and financial markets;

availability of drilling and related equipment and services;

effects of regulation by governmental agencies; the effects of

inflation on our costs and profitability; future interest rates;

and future operating costs. Management has included the above

summary of assumptions and risks related to forward-looking

information provided in this press release in order to provide

investors with a more complete perspective on Petrus’ future

operations and such information may not be appropriate for other

purposes. Petrus’ actual results, performance or achievement could

differ materially from those expressed in, or implied by, these

forward-looking statements and, accordingly, no assurance can be

given that any of the events anticipated by the forward-looking

statements will transpire or occur, or if any of them do so, what

benefits that the Company will derive therefrom. Readers are

cautioned that the foregoing lists of factors are not

exhaustive.

This press release contains future-oriented

financial information and financial outlook information

(collectively, "FOFI") about Petrus' prospective results of

operations including, without limitation, its forecasts for: net

debt to funds flow ratio; 2024 capital spending range; 2024 average

daily production rate range; 2024 annual funds flow, free funds

flow and net debt ranges; and 2024 monthly dividend payments; which

are subject to the same assumptions, risk factors, limitations, and

qualifications as set forth above. Readers are cautioned that the

assumptions used in the preparation of such information, although

considered reasonable at the time of preparation, may prove to be

imprecise and, as such, undue reliance should not be placed on

FOFI. Petrus' actual results, performance or achievement could

differ materially from those expressed in, or implied by, these

FOFI, or if any of them do so, what benefits Petrus will derive

therefrom. Petrus has included the FOFI in order to provide readers

with a more complete perspective on Petrus' future operations and

such information may not be appropriate for other purposes.

These forward-looking statements and FOFI are

made as of the date of this press release and the Company disclaims

any intent or obligation to update any forward-looking statements

and FOFI, whether as a result of new information, future events or

results or otherwise, other than as required by applicable

securities laws.

|

Abbreviations |

|

| $000’s |

thousand dollars |

| $/bbl |

dollars per barrel |

| $/boe |

dollars per barrel of oil equivalent |

| $/GJ |

dollars per gigajoule |

| $/mcf |

dollars per thousand cubic feet |

| bbl |

barrel |

| mbbl |

thousand barrel |

| bbl/d |

barrels per day |

| boe |

barrel of oil equivalent |

| mboe |

thousand barrel of oil equivalent |

| mmboe |

million barrel of oil equivalent |

| boe/d |

barrel of oil equivalent per day |

| GJ |

gigajoules |

| GJ/d |

gigajoules per day |

| mcf |

thousand cubic feet |

| mcf/d |

thousand cubic feet per day |

| mmcf/d |

million cubic feet per day |

| bcf |

billion cubic feet |

| NGLs |

natural gas liquids |

| WTI |

West Texas Intermediate |

| |

|

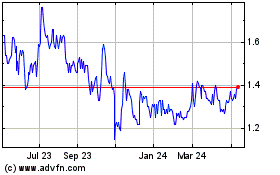

Petrus Resources (TSX:PRQ)

Historical Stock Chart

From Dec 2024 to Jan 2025

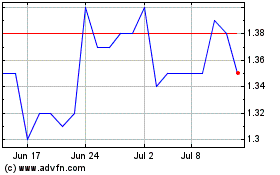

Petrus Resources (TSX:PRQ)

Historical Stock Chart

From Jan 2024 to Jan 2025