Petrus Resources Announces Renewal of Normal Course Issuer Bid

June 25 2024 - 4:05PM

Petrus Resources Ltd. ("

Petrus") (TSX: PRQ) is

pleased to announce that the Toronto Stock Exchange (the

"

TSX") has accepted Petrus' notice of intention to

renew its normal course issuer bid (the "

NCIB").

The NCIB allows Petrus to purchase up to 6,218,596 common shares

(representing 5% of Petrus' outstanding common shares as of June

14, 2024) over a period of twelve months commencing on June 28,

2024. On June 14, 2024, Petrus had 124,371,925 common shares

outstanding. The NCIB will expire no later than June 27, 2025.

Under the NCIB, common shares may be repurchased

on the open market through the facilities of the TSX and/or

alternative Canadian trading systems and in accordance with the

rules of the TSX governing normal course issuer bids. The total

number of common shares Petrus is permitted to purchase through the

facilities of the TSX is subject to a daily purchase limit of

12,509 common shares, representing 25% of the average daily trading

volume of 50,039 common shares on the TSX calculated for the

six-month period ended May 31, 2024. However, Petrus may make one

block purchase per calendar week which exceeds such daily

repurchase restrictions. Any common shares that are purchased under

the NCIB will be cancelled.

Petrus believes that, at times, the prevailing

share price does not reflect the underlying value of the common

shares and the repurchase of its common shares for cancellation

represents an attractive opportunity to enhance Petrus' per share

metrics and thereby increase the underlying value of Petrus' common

shares to its shareholders.

In connection with the NCIB, Petrus has

established an automatic share purchase plan (“ASPP”) with a

designated broker. The ASPP is designed to aid in the repurchasing

of common shares during periods under the NCIB when Petrus would

typically be restricted from making purchases due to regulatory

constraints or customary self-imposed blackout periods. Prior to

the onset of any specific trading blackout period, Petrus may, at

its discretion, instruct its designated broker to acquire common

shares under the NCIB during the subsequent blackout period in line

with the terms of the ASPP. Such acquisitions will be determined by

the designated broker independently, based on purchasing criteria

set by Petrus in compliance with TSX regulations, relevant

securities laws, and the terms of the ASPP. The ASPP has been

pre-cleared by the TSX. Outside of predefined blackout periods,

common shares may be bought under the NCIB at the discretion of

management, in accordance with TSX regulations and applicable

securities laws.

As of June 14, 2024, under Petrus' current NCIB

that runs from June 28, 2023 to June 27, 2024 and pursuant to which

Petrus may repurchase up to 6,192,425 common shares, Petrus has

repurchased 594,800 common shares at a weighted average price per

share of $1.33. All common shares repurchased under the current

NCIB have been canceled.

ABOUT PETRUS

Petrus is a public Canadian oil and gas company

focused on property exploitation, strategic acquisitions and

risk-managed exploration in Alberta.

For further information, please

contact:

Ken GrayPresident and Chief Executive OfficerT:

403-930-0889E: kgray@petrusresources.com

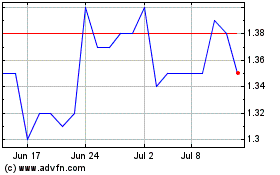

Petrus Resources (TSX:PRQ)

Historical Stock Chart

From Feb 2025 to Mar 2025

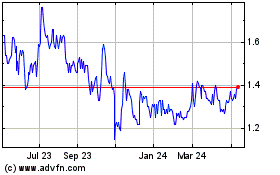

Petrus Resources (TSX:PRQ)

Historical Stock Chart

From Mar 2024 to Mar 2025