Parex Resources Inc. (“Parex” or the “Company”) (TSX:PXT) is

pleased to announce its financial and operating results for the

year and the three months ended (“Fourth Quarter” or “Q4”)

December 31, 2019.

All amounts herein are in United States dollars

(“USD”) unless otherwise stated. Please note that Parex will

hold a conference call on Wednesday, March 11, 2020 beginning

at 9:30 AM Mountain Time to discuss the 2019 year-end and fourth

quarter results.

2019 Financial and Operational Highlights

- Annual oil and natural gas

production in 2019 averaged 52,687 barrels of oil equivalent per

day ("boe/d") (98% crude oil), representing a production per share

increase of 26% over the prior year comparative period;

- Earned net income of $328.0 million

($2.24 (CAD $2.97)(1) per share basic) for the year ended

December 31, 2019 compared to net income of $402.9 million

($2.59 (CAD $3.36)(1) per share basic) for the year ended

December 31, 2018;

- Generated an operating netback of

$37.51/boe and a funds flow provided by operations ("FFO") netback

of $29.61/boe from an average Brent price of $64.21/bbl;

- FFO of $570.5 million ($3.90 (CAD

$5.17)1 per share basic), a 42% increase from the year ended

December 31, 2018 of $400.6 million ($2.58 (CAD $3.34)1 per

share basic) with a 10% decrease in Brent reference pricing year

over year;

- For the year ended

December 31, 2019 the Company recognized $362.3 million in

free funds flow, compared to the previous year of $98.3

million;

- Utilized a portion of free funds

flow, $223.9 million, to purchase 14,679,474 of the Company's

common shares at an average price of CAD$20.41 pursuant to the

Company's normal course issuer bid ("NCIB") referred to as share

buy back;

- Capital expenditures ("Capex") were

$208.2 million compared to $302.3 million for the year ended

December 31, 2018. Capital expenditures were funded from

FFO;

- Increased net working capital to

$344.0 million at December 31, 2019 compared to a net working

capital position of $218.5 million at December 31, 2018, and

exited 2019 with no bank or term debt; and

- Participated in drilling 43 gross

wells in Colombia resulting in 38 oil wells, 1 abandoned well, 2

suspended wells and 2 wells under test, for a success rate of

97%.

Fourth Quarter Financial and Operational

Highlights

- Achieved a record quarterly oil and

natural gas production of 54,221 boe/d (98% oil), representing a

production per share increase of 3% over the previous quarter ended

September 30, 2019 and an increase of 20% on a per basic share

basis over the fourth quarter of 2018;

- Earned net income of $87.2

million($0.61 (CAD $0.81)(1) per share basic) compared to net

income of $54.1 million ($0.35 (CAD $0.46)(1) per share basic) in

Q4 2018;

- Fourth quarter sales volumes,

excluding purchased oil, averaged 55,831 boe/d (98% oil);

- Realized an operating netback of

$36.43/boe and an FFO netback of $27.89/boe from an average Brent

price of $62.49/bbl;

- Generated FFO of $143.3 million, a

7% decrease compared to $154.2 million in Q4 2018. On a per share

basic basis FFO was $1.00 (CAD $1.32)1 compared to $0.99 (CAD

$1.31)1 per share basic compared to Q4 2018. The increase in FFO on

a per share basis is a result of the Company's share buyback

program;

- Capex was $58.3 million in the

period compared to $76.8 million in the comparative period of 2018

and $208.2 million for the full year in 2019. The fourth quarter

capital expenditure program included $52.7 million for drilling and

completion;

- For the three months ended

December 31, 2019, the Company recognized free funds flow of

$84.9 million; and

- Participated in drilling 15 gross

(9.25 net)(2) wells in Colombia resulting in 11 oil wells, 1

abandoned well, 1 suspended well and 2 wells under test, for a

success rate of 92% in Q4 2019 compared to 28 gross wells in the

preceding nine months of 2019 and 8 gross wells in the fourth

quarter of 2018.

In 2019, Parex strengthened its balance sheet

and exited the year with a larger net working capital surplus and

no long-term debt.

(1) Using USD-CAD Bank of Canada 2019 Q4 average

rate of 1.3200 and 2019 annual average of 1.3269 and 2018 Q4

average rate of 1.3204 and 2018 annual average of 1.2957.

(2) Oil wells: Block LLA-32: Azogue-1; Block

LLA-34: Tigana Norte-13, 15 & 18, Jacana-32, 34 & 35 and

Tigui-18 &21; Block VIM-1: La Belleza-1; and Block Cabrestero:

Akira-17. Abandoned: Block LLA-10: Tautaco-1.

Suspended: Block Cabrestero: Bacano Oeste-5. Under test:

Block LLA-34: Jacana-33 and Tigui-12.

|

|

|

Three Months Ended |

Year Ended |

|

|

|

Dec. 31, |

|

Dec. 31, |

|

Sep. 30, |

|

December 31, |

|

|

|

2019 |

|

2018 |

|

2019 |

|

2019 |

|

2018 |

|

2017 |

|

|

Operational |

|

|

|

|

|

|

|

|

Average daily production(1) |

|

|

|

|

|

|

| Oil &

Gas (boe/d) |

|

54,221 |

|

49,300 |

|

53,045 |

|

52,687 |

|

44,408 |

|

35,541 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average daily sales of produced oil and natural

gas(1) |

|

|

|

|

|

|

|

|

|

|

|

|

| Oil

(bbl/d) |

|

54,696 |

|

51,420 |

|

51,353 |

|

51,799 |

|

43,903 |

|

35,183 |

|

|

Gas (Mcf/d) |

|

6,810 |

|

4,446 |

|

6,288 |

|

5,874 |

|

3,720 |

|

1,974 |

|

| Oil &

Gas (boe/d) |

|

55,831 |

|

52,161 |

|

52,401 |

|

52,778 |

|

44,523 |

|

35,512 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Oil

inventory - end of period (bbls) |

27,653 |

|

60,977 |

|

175,813 |

|

27,653 |

|

60,977 |

|

103,018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating netback ($/boe)(2) |

|

|

|

|

|

|

|

|

|

|

|

|

| Reference

price - Brent ($/bbl) |

62.49 |

|

68.32 |

|

62.03 |

|

64.21 |

|

71.59 |

|

54.75 |

|

| Oil and gas

revenue (excluding hedging) |

53.00 |

|

55.42 |

|

53.59 |

|

54.70 |

|

58.64 |

|

43.73 |

|

|

Royalties |

|

(7.15 |

) |

(7.93 |

) |

(6.72 |

) |

(7.06 |

) |

(8.17 |

) |

(4.52 |

) |

| Net

revenue |

|

45.85 |

|

47.49 |

|

46.87 |

|

47.64 |

|

50.47 |

|

39.21 |

|

| Production

expense |

|

(5.68 |

) |

(5.62 |

) |

(6.15 |

) |

(5.76 |

) |

(5.54 |

) |

(5.34 |

) |

|

Transportation expense |

(3.74 |

) |

(3.98 |

) |

(4.51 |

) |

(4.37 |

) |

(3.49 |

) |

(4.18 |

) |

|

Operating netback ($/boe)(2) |

36.43 |

|

37.89 |

|

36.21 |

|

37.51 |

|

41.44 |

|

29.69 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Funds flow provided by operations

($/boe)(2)(5) |

27.89 |

|

32.14 |

|

29.61 |

|

29.61 |

|

24.65 |

|

22.29 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial ($000s except per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

| Oil

and natural gas revenue |

289,585 |

|

270,599 |

|

275,693 |

|

1,113,622 |

|

965,723 |

|

572,768 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

income |

|

87,218 |

|

54,060 |

|

57,257 |

|

327,994 |

|

402,904 |

|

155,078 |

|

| Per share -

basic |

|

0.61 |

|

0.35 |

|

0.40 |

|

2.24 |

|

2.59 |

|

1.01 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Funds flow provided by operations(2)(5) |

143,269 |

|

154,211 |

|

142,733 |

|

570,480 |

|

400,627 |

|

288,884 |

|

| Per share -

basic |

|

1.00 |

|

0.99 |

|

0.99 |

|

3.90 |

|

2.58 |

|

1.87 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures and property

acquisitions |

58,321 |

|

76,758 |

|

48,600 |

|

208,196 |

|

302,343 |

|

212,346 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Free funds flow(2) |

|

84,948 |

|

77,453 |

|

94,133 |

|

362,284 |

|

98,284 |

|

76,538 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

1,684,581 |

|

1,642,120 |

|

1,593,802 |

|

1,684,581 |

|

1,642,120 |

|

1,085,065 |

|

|

Working capital surplus |

344,031 |

|

218,526 |

|

279,949 |

|

344,031 |

|

218,526 |

|

163,401 |

|

|

Bank debt(3) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

Cash |

|

396,839 |

|

462,891 |

|

350,210 |

|

396,839 |

|

462,891 |

|

235,042 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Outstanding shares (end of period) (000s) |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

143,295 |

|

155,014 |

|

143,304 |

|

143,295 |

|

155,014 |

|

154,742 |

|

| Weighted

average basic |

142,967 |

|

155,403 |

|

144,081 |

|

146,380 |

|

155,417 |

|

154,209 |

|

|

Diluted(4) |

147,848 |

|

161,991 |

|

148,453 |

|

147,848 |

|

161,991 |

|

164,055 |

|

(1) Disclosure of production and sales volumes

by product type, are included in the Company’s Annual Information

Form dated March 10, 2020 and may be accessed through the

SEDAR website at www.sedar.com.(2) The table above contains

Non-GAAP measures. See “Non-GAAP Terms” for further

discussion.(3) Borrowing limit of $200.0 million as of

December 31, 2019.(4) Diluted shares include the effects of

common shares and in-the-money stock options outstanding at the

period-end. The December 31, 2019 closing stock price on the

Toronto Stock Exchange was CAD $24.15 per share.(5) In the second

quarter of 2019, Parex changed the way it calculates and presents

funds flow from operations. For further details refer to the

"Non-GAAP Terms" in the Company's Q4 2019 MD&A. Comparative

periods have also been adjusted for this change.

Guidance

The table below is a summary of Parex’ original annual guidance

for 2019 and 2020, and a review of 2019 actual results:

|

|

2020 Guidance(as releasedNovember 2019) |

|

2019 Guidance(as releasedDec 2018) |

|

2019Actuals |

|

% Variancefrom2019 Guidance |

|

| Brent

crude average ($/bbl) |

60.00 |

|

60.00 |

|

64.21 |

|

7 |

|

|

Production (average for period) (boe/d) |

54,500-56,250 |

|

52,000-54,000 |

|

52,687 |

|

— |

|

|

|

|

|

|

|

|

|

|

|

| Operating

netback ($/boe)(1) |

33.50 |

|

— |

|

37.51 |

|

— |

|

| Funds

Flow provided by Operations (FFO) netback(1) ($/boe) |

26.50 |

|

— |

|

29.61 |

|

— |

|

|

|

|

|

|

|

|

|

|

|

| Total

Capital Expenditures ($ millions) |

210-240 |

|

200-230 |

|

208 |

|

— |

|

| Funds

Flow provided by Operations (FFO)(1)(2) ($ millions) |

520-550 |

|

450-500 |

|

570 |

|

14 |

|

| Free

Funds Flow (FFO less Total Capex mid-points)(1) ($ millions) |

310 |

|

260 |

|

362 |

|

40 |

|

|

Outstanding shares (end of period)(3) (millions) |

130 |

|

— |

|

143 |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

Production per share growth % |

14% |

|

— |

|

26% |

|

— |

|

|

Current tax effective rate on FFO (%) |

17% |

|

14-17% |

|

17% |

|

— |

|

(1) The table above contains Non-GAAP

measures. See “Non-GAAP Terms” for further discussion.(2)

2020 Guidance assumes Brent/Vasconia crude differential less than

$3/bbl.(3) It is expected FFO will be used to fund the 2020 share

buy-back program. Outstanding shares at Dec 31, 2020 assumes 1

million shares of equity settled long term compensation exercised

in the period.

Parex' 2019 financial and operational results

were within guidance. Actual 2019 funds flow provided by

operations and free funds flow exceeded guidance mainly related to

higher Brent benchmark pricing and stronger Vasconia pricing.

Balance Sheet Strength and Resiliency

provides Optionality

With the recent decrease in world crude oil

prices, the table below summarizes the operational sensitivities to

Parex' 2020 guidance:

|

Brent crude average ($/bbl) (March - December

2020) |

30.00 |

|

40.00 |

|

50.00 |

|

|

Production (average for period) (boe/d) |

54,500 |

|

54,500 |

|

54,500 |

|

|

|

|

|

|

|

|

|

| Operating

netback ($/boe)(1) |

12.00 |

|

19.00 |

|

26.00 |

|

| Funds

Flow provided by Operations (FFO) netback(1) ($/boe) |

10.00 |

|

15.00 |

|

20.00 |

|

|

|

|

|

|

|

|

|

| 2020

Total Capital Expenditures ($ millions) (4) |

160 |

|

175 |

|

230 |

|

| 2020

Funds Flow provided by Operations (FFO)(1)(2)(4) ($ millions) |

190 |

|

295 |

|

410 |

|

| 2020 Free

Funds Flow (FFO less Total Capex)(1)(4) ($ millions) |

30 |

|

120 |

|

180 |

|

|

Outstanding shares (end of period)(3) (millions) |

130 |

|

130 |

|

130 |

|

|

|

|

|

|

|

|

|

|

2020 Current tax effective rate on FFO (%) |

4% |

|

12% |

|

14% |

|

(1) The table above contains Non-GAAP

measures. See “Non-GAAP Terms” for further discussion.(2)

Assumes Brent/Vasconia crude differential of $5/bbl.(3) It is

expected FFO will be used to fund the 2020 share buy-back program.

Outstanding shares at Dec 31, 2020 assumes 1 million shares of

equity settled long term compensation exercised in the period.(4)

2020 total capital, funds flow from operations, and free funds

flow include January and February actuals at an average Brent crude

price of $60/bbl for the first 2 months of 2020. At low oil

prices, capital will be focused on maintenance and development

(LLA-34 & Cabrestero) and growth in Capachos and VIM-1.

At current oil prices and Parex' current common

share price, for 2020 the Company expects to maintain production at

current levels and plans to reallocate capital from growth projects

to accelerating its automatic share buy back program up to 100,000

common shares per day from the current program of 55,000 common

shares per day. At the current valuation, Parex has the opportunity

to repurchase its proven plus probable reserves (as per the press

release dated February 6, 2020) at less than $6/boe and at a

recycle ratio greater than 2 times.

Operational Update

Q1 2020 Production: Parex

expects Q1 2020 average production to be approximately 54,500

boe/d.

Cabrestero (Operated,

100% WI): Parex is currently drilling a 7 well

program, using 2 drilling rigs. We expect to complete

drilling in April 2020.

CPO-11 (WI

50%): The Montuno-1 exploration well was

drilled and abandoned. Parex expects to analyze and calibrate

the well results to the existing 2D seismic data prior to future

exploration activity.

Shareholder Return: 2020 Share Buy Back of 10% of

Outstanding shares

As of March 9, 2020, Parex has purchased for

cancellation 2,800,000 common shares of the Company at an average

cost of CAD$21.91 per share, pursuant to the NCIB that commenced on

December 23, 2019. Pursuant to the NCIB, Parex may purchase

for cancellation up to 13,986,994 common shares prior to December

22, 2020.

Environmental, Social & Governance

Update

Providing Stakeholders with greater ESG

disclosure - Parex continued on its ESG journey by

responding to the annual CDP (formerly Carbon Disclosure Project)

climate change questionnaire and included disclosure on water

security in 2019. Parex is committed to progressively

improving its disclosure and environmental performance efficiency

metrics, which have been reported annually in our sustainability

report since 2014. The Company disclosed over 140 indicators

in the 2018 annual sustainability report, prepared in 2019 in

accordance with the Global Reporting Initiative (GRI) Standards;

which represents a 86% disclosure increase year-over-year and

greater transparency of corporate practices.

Sharing benefits of our success with the

community - Parex marked its 10-year anniversary with

gifts to the Faculty of Sciences at the University of Calgary and

the Simón Bolívar Hospital in Bogota, Colombia. A $2.0 million gift

to the University of Calgary launched six Parex Innovations

Scholarships to support innovators and encourage research.

During the first half of 2020, the Company plans to spend $1.6

million to renovate infrastructure and provide specialized medical

equipment to the Simón Bolívar Hospital, which serves the

population within Bogota’s radius. These gifts support two

United Nations Sustainable Development Goals (SDG 4: Quality

Education and SDG3: Good Health and Well-being). Additionally,

these community gifts provide an opportunity for Parex to show

appreciation to the communities where the Company's employees

live.

Inclusion in Bloomberg Gender-Equality

Index - On January 21, 2020, Parex was included in the

Bloomberg Gender-Equality Index (“GEI”), which tracks the financial

performance of public companies committed to supporting gender

equality through policy development, representation, and

transparency (Sourced at Bloomberg.com). Inclusion in the GEI

highlights our commitments to internal policies and practices that

promote work-place diversity, inclusiveness, and equal

opportunity.

Appointment of VP New Ventures, Jeff

Meunier

Parex is pleased to announce that Jeff Meunier

has joined the Company in the role of Vice President, New Ventures

and as a member of the Executive team. Jeff will be primarily

responsible for reviewing business development opportunities where

Parex can apply its conventional oil expertise and balance sheet

strength. Jeff joins us most recently from RBC Capital

Markets where he was a Managing Director. Jeff earned his

Bachelor of Science in Mechanical Engineering from the University

of Calgary and has over 22 years of experience working in the

Investment Banking and oil & gas industry, including roles with

a number of international companies including Marathon Oil

Corporation, Woodside Petroleum Ltd., McDaniel & Associates

Consultants Ltd. and Enerplus Corporation.

Annual General Meeting

Parex anticipates holding its Annual General and Special Meeting

of Shareholders on Tuesday, May 5, 2020 at 9:30 am (Mountain Time)

at the Residence Inn by Marriott Downtown/Beltline District,

Beltline Room, 610 10 Ave SW, Calgary, AB T2R 1M3.

Q4 2019 Conference Call &

Webcast

Parex will host a conference call to discuss the 2019 fourth

quarter and year-end results on Wednesday, March 11, 2020

beginning at 9:30 am Mountain Time. To participate in the call,

from Canada and the United States, dial 1-800-806-5484 then enter

the passcode 8822777#.

The live audio webcast will be carried at:

https://edge.media-server.com/mmc/p/etxrjg2h

Individuals located outside of Canada and the USA are invited to

access this event via webcast or by calling their respective

location dial-in number available

at:https://www.confsolutions.ca/ILT?oss=7P1R8666965910

This news release does not constitute an

offer to sell securities, nor is it a solicitation of an offer to

buy securities, in any jurisdiction.

For more information, please

contact:Mike KruchtenSenior Vice

President, Capital Markets & Corporate PlanningParex Resources

Inc.Phone: (403) 517-1733Investor.relations@parexresources.com

NOT FOR DISTRIBUTION FOR DISSEMINATION

IN THE UNITED STATES

Non-GAAP Terms

The Company discloses several financial measures

("non-GAAP Measures") herein that do not have any standardized

meaning prescribed under International Financial Reporting

Standards ("IFRS"). These financial measures include operating

netback per boe, funds flow provided by operations ("FFO") netback,

FFO per boe, FFO per share and free funds flow. Management uses

these non-GAAP measures for its own performance measurement and to

provide shareholders and investors with additional measurements of

the Company’s efficiency and its ability to fund a portion of its

future capital expenditures.

The Company considers operating netback per boe to be a key

measure as it demonstrates Parex' profitability relative to current

commodity prices. The following is a description of each component

of the Company's operating netback per boe and how it is

determined:

- Oil and natural gas sales per boe

is determined by sales revenue excluding risk management contracts

divided by total equivalent sales volume including purchased oil

volume;

- Royalties per boe is determined by

dividing royalty expense by the total equivalent sales volume and

excludes purchased oil volumes;

- Production expense per boe is

determined by dividing production expense by total equivalent sales

volume and excludes purchased oil volumes; and

- Transportation expense per boe is

determined by dividing transportation expense by the total

equivalent sales volumes including purchased oil volumes.

Funds flow provided by operations is a non-GAAP

measure that includes all cash generated from operating activities

and is calculated before changes in non-cash working capital. In Q2

2019, the Company changed how it presents funds flow provided by

operations to present a more comparable basis to industry

presentation.

FFO netback or FFO per boe, is a non-GAAP

measure that includes all cash generated from operating activities

and is calculated before changes in non-cash working capital,

divided by produced oil and natural gas sales volumes.

FFO per share is determined by FFO divided by

basic shares outstanding.

Free funds flow is determined by funds flow

provided by operations less capital expenditures.

Shareholders and investors should be cautioned

that these measures should not be construed as an alternative to

net income or other measures of financial performance as determined

in accordance with IFRS. Parex' method of calculating these

measures may differ from other companies, and accordingly, they may

not be comparable to similar measures used by other companies.

Please see the Company's most recent Management’s Discussion and

Analysis, which is available at www.sedar.com for additional

information about these financial measures.

Oil & Gas Matters

Advisory

The term "Boe" means a barrel of oil equivalent

on the basis of 6 Mcf of natural gas to 1 barrel of oil ("bbl").

Boe’s may be misleading, particularly if used in isolation. A boe

conversation ratio of 6 Mcf: 1 Bbl is based on an energy

equivalency conversion method primarily applicable at the burner

tip and does not represent a value equivalency at the wellhead.

Given the value ratio based on the current price of crude oil as

compared to natural gas is significantly different from the energy

equivalency of 6 Mcf: 1Bbl, utilizing a conversion ratio at 6 Mcf:

1 Bbl may be misleading as an indication of value.

This press release contains a number of oil and

gas metrics, including finding, operating netbacks and FFO

netbacks. These oil and gas metrics have been prepared by

management and do not have standardized meanings or standard

methods of calculation and therefore such measures may not be

comparable to similar measures used by other companies and should

not be used to make comparisons. Such metrics have been included

herein to provide readers with additional measures to evaluate the

Company's performance; however, such measures are not reliable

indicators of the future performance of the Company and future

performance may not compare to the performance in previous periods

and therefore such metrics should not be unduly relied upon.

Management uses these oil and gas metrics for its own performance

measurements and to provide security holders with measures to

compare the Company's operations over time. Readers are cautioned

that the information provided by these metrics, or that can be

derived from the metrics presented in this news release, should not

be relied upon for investment or other purposes.

Advisory on Forward Looking

StatementsCertain information regarding Parex set forth in

this document contains forward-looking statements that involve

substantial known and unknown risks and uncertainties. The use of

any of the words "plan", "expect", “prospective”, "project",

"intend", "believe", "should", "anticipate", "estimate",

“forecast”, "guidance", “budget” or other similar words, or

statements that certain events or conditions "may" or "will" occur

are intended to identify forward-looking statements. Such

statements represent Parex' internal projections, estimates or

beliefs concerning, among other things, future growth, results of

operations, production, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, plans for and results of drilling activity,

environmental matters, business prospects and opportunities. These

statements are only predictions and actual events or results may

differ materially. Although the Company’s management believes that

the expectations reflected in the forward-looking statements are

reasonable, it cannot guarantee future results, levels of activity,

performance or achievement since such expectations are inherently

subject to significant business, economic, competitive, political

and social uncertainties and contingencies. Many factors could

cause Parex' actual results to differ materially from those

expressed or implied in any forward-looking statements made by, or

on behalf of, Parex.

In particular, forward-looking statements

contained in this document include, but are not limited to,

statements with respect to the performance characteristics of the

Company's oil properties; the Company's expected 2020 capital

expenditures, including the allocation of capital expenditures, the

anticipated effect of the recent decrease in world oil prices on

such capital expenditures and the Company's expectation that even

in a lower oil price environment, it can fund its 2020 capital

program (including its NCIB) from funds flow provided by operations

or use its existing cash reserves, or adjust its capital

expenditures as required based on certain oil prices; anticipated

shares outstanding at the end of the applicable period, forecasted

2020 full year average production rate based on certain oil prices

and anticipated year-over-year production growth; the Company's

ability to generate free cash flow and its allocation; estimated

tax effective rate on FFO for 2020; expected average production for

Q1 2020; the Company's anticipated drilling program at Cabrestero

and CPO-11; and the Company's plans in respect of the Simon Bolivar

Hospital. In addition, statements relating to "reserves" are by

their nature forward-looking statements, as they involve the

implied assessment, based on certain estimates and assumptions that

the resources described can be profitably produced in the future.

The recovery and reserve estimates of Parex' reserves provided

herein are estimates only and there is no guarantee that the

estimated reserves will be recovered.

These forward-looking statements are subject to

numerous risks and uncertainties, including but not limited to, the

impact of general economic conditions in Canada and Colombia;

volatility in commodity prices; industry conditions including

changes in laws and regulations including adoption of new

environmental laws and regulations, and changes in how they are

interpreted and enforced, in Canada and Colombia; competition; lack

of availability of qualified personnel; the results of exploration

and development drilling and related activities; obtaining required

approvals of regulatory authorities, in Canada and Colombia; risks

associated with negotiating with foreign governments as well as

country risk associated with conducting international activities;

volatility in market prices for oil; fluctuations in foreign

exchange or interest rates; environmental risks; changes in income

tax laws or changes in tax laws and incentive programs relating to

the oil industry; changes to pipeline capacity; ability to access

sufficient capital from internal and external sources; risk that

Parex' evaluation of its existing portfolio of development and

exploration opportunities is not consistent with its expectations;

that production test results may not necessarily be indicative of

long term performance or of ultimate recovery; failure to reach

production targets; and other factors, many of which are beyond the

control of the Company. Readers are cautioned that the foregoing

list of factors is not exhaustive. Additional information on these

and other factors that could affect Parex' operations and financial

results are included in reports on file with Canadian securities

regulatory authorities and may be accessed through the SEDAR

website (www.sedar.com).

Although the forward-looking statements

contained in this document are based upon assumptions which

Management believes to be reasonable, the Company cannot assure

investors that actual results will be consistent with these

forward-looking statements. With respect to forward-looking

statements contained in this document, Parex has made assumptions

regarding, among other things: current and anticipated commodity

prices and royalty regimes; availability of skilled labour; timing

and amount of capital expenditures; future exchange rates; the

price of oil, including anticipated Brent oil prices; the impact of

increasing competition; conditions in general economic and

financial markets; availability of drilling and related equipment;

receipt of partner, regulatory and community approvals; royalty

rates; effective tax rates on FFO; future operating costs; effects

of regulation by governmental agencies; uninterrupted access to

areas of Parex’ operations and infrastructure; recoverability of

reserves and future production rates; timing of drilling and

completion of wells; on-stream timing of production from successful

exploration wells; operational performance of non-operated

producing fields; pipeline capacity; that Parex will have

sufficient cash flow, debt or equity sources or other financial

resources required to fund its capital and operating expenditures

and requirements as needed; that Parex' conduct and results of

operations will be consistent with its expectations; that Parex

will have the ability to develop its oil and gas properties in the

manner currently contemplated; current or, where applicable,

proposed industry conditions, laws and regulations will continue in

effect or as anticipated as described herein; that the estimates of

Parex' reserves and production volumes and the assumptions related

thereto (including commodity prices and development costs) are

accurate in all material respects; that Parex will be able to

obtain contract extensions or fulfill the contractual obligations

required to retain its rights to explore, develop and exploit any

of its undeveloped properties; and other matters.

Management has included the above summary of

assumptions and risks related to forward-looking information

provided in this document in order to provide shareholders with a

more complete perspective on Parex' current and future operations

and such information may not be appropriate for other purposes.

Parex' actual results, performance or achievement could differ

materially from those expressed in, or implied by, these

forward-looking statements and, accordingly, no assurance can be

given that any of the events anticipated by the forward-looking

statements will transpire or occur, or if any of them do, what

benefits Parex will derive. These forward-looking statements are

made as of the date of this document and Parex disclaims any intent

or obligation to update publicly any forward-looking statements,

whether as a result of new information, future events or results or

otherwise, other than as required by applicable securities

laws.

This press release and, in particular the

information in respect of the Company's expected capital

expenditures, FFO and free funds flow for 2020, may contain future

oriented financial information ("FOFI") within the meaning of

applicable securities laws. The FOFI has been prepared by

management to provide an outlook of the Company's financial results

and activities and may not be appropriate for other purposes. The

FOFI has been prepared based on a number of assumptions including

the assumptions discussed in this press release. The actual results

of operations of the Company and the resulting financial results

may vary from the amounts set forth herein, and such variations may

be material. The Company and management believe that the FOFI has

been prepared on a reasonable basis, reflecting management’s best

estimates and judgments. FOFI contained in this press release was

made as of the date of this press release and Parex disclaims any

intent or obligation to update publicly the press release, whether

as a result of new information, future events or otherwise, unless

required pursuant to applicable law.

PDF

available: http://ml.globenewswire.com/Resource/Download/8241cf98-8944-426a-90f8-05770902b341

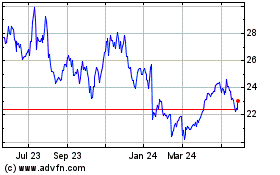

Parex Resources (TSX:PXT)

Historical Stock Chart

From Dec 2024 to Jan 2025

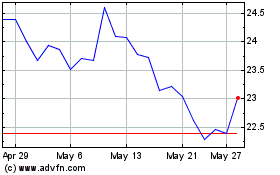

Parex Resources (TSX:PXT)

Historical Stock Chart

From Jan 2024 to Jan 2025