Questerre Energy Corporation (“Questerre” or the “Company”)

(TSX,OSE:QEC) reported today on its financial and operating results

for the second quarter ended June 30, 2020.

Michael Binnion, President and Chief Executive

Officer, commented, “We responded quickly to the impacts of the

COVID-19 pandemic and the ensuing global shutdown during the second

quarter. To weather the collapse in oil prices, we cut spending and

reduced overheads and operating costs wherever possible. The

capital savings and the imminent credit facility renewal have

strengthened our financial liquidity. With cost reductions of

approximately $3/bbl, we can now operate at a lower breakeven

price.”

He added, “The crisis has also created an

unexpected opportunity to move our Clean Tech Energy project

forward. As securing local supply chains and developing projects to

restart the economic recovery and create jobs have become top

priorities in Quebec, interest in our project is growing. Late in

the quarter, we resumed discussions with stakeholders including

farmers, local municipalities and First Nations on their

participation and support. We have been very pleased with the

recent progress and hope to conclude several participation

agreements later this year.”

Highlights

- Reengaging with stakeholders to

build social acceptability for Clean Tech Energy in Quebec

- Credit facilities will be renewed

at $20 million

- Collapse in oil prices responsible

for adjusted funds flow from operations of $0.2 million with

average daily production of 2,058 boe/d

Consistent with prior periods, Kakwa continued

to account for over three quarters of corporate production. During

the second quarter, daily production averaged 2,058 boe/d (2019:

2,035 boe/d). While production remained largely flat over the last

year, depressed oil prices severely impacted financial results.

Petroleum and natural gas sales declined to $3.4 million in the

quarter from $8 million last year and $7 million last quarter with

realized prices averaging just over $21/bbl compared to $66/bbl

last year and $49/bbl in the first quarter. Despite cost

reductions, the lower prices contributed to adjusted funds flow

from operations of $0.2 million for the quarter (2019: $2.7

million). The Company anticipates this should improve over the

second half of the year assuming oil prices continue to

stabilize.

The lower prices also contributed to a net loss

of $2.7 million for the quarter (2019: $2.1 million) and $116.6

million (2019: $3.0 million) for the first half of the year. The

year to date loss reflects the impairment expense of $113 million

incurred in the first quarter largely because of the lower future

oil prices. Capital expenditures in the quarter were $0.5 million

(2019: $7.5 million) and $3.4 million year to date (2019: $10.4

million).

The Company also reported on the pending renewal

of its credit facility with a Canadian chartered bank. Following

the review conducted in the second quarter, the facilities will be

renewed at $20 million. The renewal will become effective upon the

execution of an amending agreement which the Company anticipates

will be completed in late August 2020. The renewed facilities will

consist of a revolving operating demand loan of $17 million and an

uncommitted demand non-conforming revolving facility for $3

million. Any borrowing under the facilities, except letters of

credit are subject to the Bank’s prime rate and applicable basis

point margin. The effective interest rate on the facility for the

first half of 2020 was 3.58% (2019: 4.45%). As at June 30, 2020,

$19.3 million was drawn on the facility and the Company held

unrestricted cash and term deposits of $12.8 million. Including

amounts drawn under the facility, the Company had a net working

capital deficit of $9.3 million (2019: $0.8 million).

The term "adjusted funds flow from operations"

and “working capital deficit” are non-IFRS measures. Please see the

reconciliation elsewhere in this press release.

Questerre is an energy technology and innovation

company. It is leveraging its expertise gained through early

exposure to low permeability reservoirs to acquire significant

high-quality resources. We believe we can successfully transition

our energy portfolio. With new clean technologies and innovation to

responsibly produce and use energy, we can sustain both human

progress and our natural environment.

Questerre is a believer that the future success

of the oil and gas industry depends on a balance of economics,

environment, and society. We are committed to being transparent and

are respectful that the public must be part of making the important

choices for our energy future.For further information, please

contact:

Questerre Energy CorporationJason D’Silva, Chief

Financial Officer(403) 777-1185 | (403) 777-1578 (FAX) |Email:

info@questerre.com

Advisory Regarding Forward-Looking

Statements

This news release contains certain statements

which constitute forward-looking statements or information

(“forward-looking statements”) including the Company’s reduction in

capital spending, overheads and operating costs where possible, the

improvement in its financial liquidity, the Company’s view that it

can operate at lower breakeven prices, the Company’s view that the

pandemic has created an opportunity for its Clean Tech Energy

project in Quebec, the Company’s view that interest in this project

is growing, its hope to conclude several participation agreements

later this year, its anticipation that adjusted funds flow from

operations will improve over the second half of the year and its

expectation that it will execute an amending agreement for its

credit facility in late August.

Forward-looking statements are based on a number

of material factors, expectations or assumptions of Questerre which

have been used to develop such statements and information, but

which may prove to be incorrect. Although Questerre believes that

the expectations reflected in these forward-looking statements are

reasonable, undue reliance should not be placed on them because

Questerre can give no assurance that they will prove to be correct.

Since forward-looking statements address future events and

conditions, by their very nature they involve inherent risks and

uncertainties. Further, events or circumstances may cause actual

results to differ materially from those predicted as a result of

numerous known and unknown risks, uncertainties, and other factors,

many of which are beyond the control of the Company, including,

without limitation: the effect of COVID-19 on the markets and the

demand for oil and natural gas; commitments to cut oil production

by OPEC and others; whether the Company's exploration and

development activities respecting its prospects will be successful

or that material volumes of petroleum and natural gas reserves will

be encountered, or if encountered can be produced on a commercial

basis; the ultimate size and scope of any hydrocarbon bearing

formations on its lands; that drilling operations on its lands will

be successful such that further development activities in these

areas are warranted; that Questerre will continue to conduct its

operations in a manner consistent with past operations; results

from drilling and development activities will be consistent with

past operations; the general stability of the economic and

political environment in which Questerre operates; drilling

results; field production rates and decline rates; the general

continuance of current industry conditions; the timing and cost of

pipeline, storage and facility construction and expansion and the

ability of Questerre to secure adequate product transportation;

future commodity prices; currency, exchange and interest rates;

regulatory framework regarding royalties, taxes and environmental

matters in the jurisdictions in which Questerre operates; and the

ability of Questerre to successfully market its oil and natural gas

products; changes in commodity prices; changes in the demand for or

supply of the Company's products; unanticipated operating results

or production declines; changes in tax or environmental laws,

changes in development plans of Questerre or by third party

operators of Questerre's properties, increased debt levels or debt

service requirements; inaccurate estimation of Questerre's oil and

gas reserve and resource volumes; limited, unfavourable or a lack

of access to capital markets; increased costs; a lack of adequate

insurance coverage; the impact of competitors; and certain other

risks detailed from time-to-time in Questerre's public disclosure

documents. Additional information regarding some of these risks,

expectations or assumptions and other factors may be found under in

the Company's Annual Information Form for the year ended December

31, 2019 and other documents available on the Company’s profile at

www.sedar.com. The reader is cautioned not to place undue reliance

on these forward-looking statements. The forward-looking statements

contained in this news release are made as of the date hereof and

Questerre undertakes no obligations to update publicly or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise, unless so required by

applicable securities laws.

Certain information set out herein may be

considered as “financial outlook” within the meaning of applicable

securities laws. The purpose of this financial outlook is to

provide readers with disclosure regarding Questerre’s reasonable

expectations as to the anticipated results of its proposed business

activities for the periods indicated. Readers are cautioned that

the financial outlook may not be appropriate for other

purposes.

Barrel of oil equivalent (“boe”) amounts may be

misleading, particularly if used in isolation. A boe conversion

ratio has been calculated using a conversion rate of six thousand

cubic feet of natural gas to one barrel of oil and the conversion

ratio of one barrel to six thousand cubic feet is based on an

energy equivalent conversion method application at the burner tip

and does not necessarily represent an economic value equivalent at

the wellhead. Given that the value ratio based on the current price

of crude oil as compared to natural gas is significantly different

from the energy equivalent of 6:1, utilizing a conversion on a 6:1

basis may be misleading as an indication of value.

This press release contains the terms “adjusted

funds flow from operations” and “working capital deficit” which are

non-GAAP terms. Questerre uses these measures to help evaluate its

performance.

As an indicator of Questerre’s performance,

adjusted funds flow from operations should not be considered as an

alternative to, or more meaningful than, cash flows from operating

activities as determined in accordance with GAAP. Questerre’s

determination of adjusted funds flow from operations may not be

comparable to that reported by other companies. Questerre considers

adjusted funds flow from operations to be a key measure as it

demonstrates the Company’s ability to generate the cash necessary

to fund operations and support activities related to its major

assets.

|

|

Three months ended June 30, |

|

Six months ended June 30, |

|

|

($ thousands) |

2020 |

|

2019 |

|

2020 |

|

2019 |

|

| Net cash from (used in)

operating activities |

(792 |

) |

3,098 |

|

3,770 |

|

2,599 |

|

| Interest received |

(33 |

) |

(34 |

) |

(172 |

) |

(35 |

) |

| Interest paid |

144 |

|

181 |

|

331 |

|

355 |

|

| Change

in non-cash operating working capital |

887 |

|

(583 |

) |

(1,263 |

) |

2,290 |

|

|

Adjusted Funds Flow from Operations |

206 |

|

2,662 |

|

2,666 |

|

5,209 |

|

Working capital surplus is a non-GAAP measure

calculated as current assets less current liabilities excluding

risk management contracts and lease liabilities.

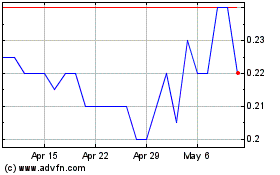

Questerre Energy (TSX:QEC)

Historical Stock Chart

From Nov 2024 to Dec 2024

Questerre Energy (TSX:QEC)

Historical Stock Chart

From Dec 2023 to Dec 2024