Questerre Energy Corporation (“Questerre” or the “Company”)

(TSX,OSE: QEC) reported today on the upcoming drilling program at

Kakwa North.

The Company plans to participate in three (1.5

net) wells proposed by the operator at an estimated cost of $21

million net to Questerre. Subject to equipment availability, the

wells are scheduled to spud early in the fourth quarter. Completion

operations are planned for the first quarter of next year.

Questerre holds a 50% interest in these wells.

Questerre also reported that the three (0.75

net) new wells on its Kakwa Central acreage were tied in earlier

last month. Gross production from these wells over the last month

is approximately 2,755 boe/d consisting of 6.8 MMcf/d of natural

gas and 1,625 bbl/d of condensate and natural gas liquids. The

Company holds a 25% interest in these wells. While the initial

rates are encouraging, they are not indicative of the long-term

performance or ultimate recovery.

Michael Binnion, President and Chief Executive

Officer of Questerre, commented, “As we continue to develop the

Kakwa area, we are looking forward to the new wells at Kakwa North.

With success, we could see our production grow in the second half

of next year. Additionally, one of these wells will test a deeper

interval in the Montney formation for future development

opportunities. As oil prices remain volatile, we are focused on

ensuring our drilling program is well funded by our existing cash

and cash flow.”

Questerre also reported that it has filed with

the Québec Superior Court (Civil Division) (the “Court”) an

independent expert report (the “Report”) that quantifies the

economic losses that may be incurred by the Company should its

licenses to explore for oil and gas be successfully revoked by the

Government of Québec (“GoQ”).

The independent expert was retained by the

Company’s litigation counsel on behalf of the Company to prepare

the Report. The Report was prepared in connection with the legal

action to assist the Court. It is solely for use by Questerre in

the legal action. The Report was prepared in accordance with the

Canadian Institute of Chartered Business Valuators (“CICBV”)

requirements for both a Comprehensive Valuation Report and an

Expert Report as defined in the CICBV Practice Standards. Based on

the scope, and subject to the restrictions, qualifications, and

major assumptions, under various scenarios, all of which are set

forth in the Report, potential economic losses range from

approximately $700 million to $4,800 million. The Report must be

considered as a whole to avoid creating a misleading view. The

Report has been filed on SEDAR+ and the NewsPoint service of Oslo

Børs. The Report, nor any part thereof, does not form part of nor

is deemed to be incorporated by reference in this news release.

Questerre notes that there is no guarantee that

it will be successful in respect of its legal action against the

Attorney General of Québec, the Minister of Economy, Innovation and

Energy and the GoQ which is currently before the Court or that,

even if successful, there is no guarantee as to the amount of

damages that Questerre may recover, if any. There are no guarantees

that the amounts set out in any of the scenarios of the Report will

be accepted by the Court, and such amounts may be materially

different than the amounts ultimately awarded to and actually

recovered by Questerre, if any. Please see “Advisory Regarding

Forward-Looking Statements” below.

Questerre is an energy technology and innovation

company. It is leveraging its expertise gained through early

exposure to low permeability reservoirs to acquire significant

high-quality resources. We believe we can successfully transition

our energy portfolio. With new clean technologies and innovation to

responsibly produce and use energy, we can sustain both human

progress and our natural environment.

Questerre is a believer that the future success

of the oil and gas industry depends on a balance of economics,

environment, and society. We are committed to being transparent and

are respectful that the public must be part of making the important

choices for our energy future.

Advisory Regarding Forward-Looking

Statements

This news release contains certain statements

which constitute forward-looking statements or information

(“forward-looking statements”) including, without limitation,

forward-looking statements pertaining to the Company’s plans to

participate in the drilling and completion of three wells at Kakwa

North, the funding of the Company’s drilling program, statements

related to the revocation of the Company’s licenses to explore for

oil and gas in Québec and the quantification of the Company’s

economic losses as a result of the same, the ability to recover

such economic losses in any amount or not at all and the Company’s

plans to continue to move forward with litigation against the GoQ

and related parties in respect of such litigation. Although

management believes that the expectations reflected in the

forward-looking statements are reasonable, it cannot guarantee

future results, the drilling and completion of future wells, the

eventual outcome of the litigation, whether the Company’s licenses

to explore for oil and gas will be successfully revoked, amounts or

damages or costs incurred by the Company related to the litigation,

what weight, if any, the Court will give to the Report, if any, the

amounts, if any, of any damage awards to the Company in the event

that such license to explore are successfully revoked, or that the

Company will be able to recover any amounts if so awarded.

Forward-looking statements are based on several

material factors, expectations, or assumptions of Questerre which

have been used to develop such statements and information, but

which may prove to be incorrect. Although Questerre believes that

the expectations reflected in these forward-looking statements are

reasonable, undue reliance should not be placed on them because

Questerre can give no assurance that they will prove to be correct.

Since forward-looking statements address future events and

conditions, by their very nature they involve inherent risks and

uncertainties. Further, events or circumstances may cause actual

results to differ materially from those predicted as a result of

numerous known and unknown risks, uncertainties, and other factors,

many of which are beyond the control of the Company, including,

without limitation: the timing and availability of funding, permits

and equipment to complete the Company’s drilling program,

production from existing wells, whether the Company's exploration

and development activities respecting its prospects will be

successful or that material volumes of petroleum and natural gas

reserves will be encountered, or if encountered can be produced on

a commercial basis; the ultimate size and scope of any hydrocarbon

bearing formations on its lands; that drilling operations on its

lands will be successful such that further development activities

in these areas are warranted; that the Company will continue to

conduct its operations in a manner consistent with past operations;

results from drilling and development activities will be consistent

with past operations; the general stability of the economic and

political environment in which the Company operates; drilling

results; field production rates and decline rates; the general

continuance of current industry conditions; the timing and cost of

pipeline, storage and facility construction and expansion and the

ability of the Company to secure adequate product transportation;

future commodity prices; currency, exchange and interest rates;

regulatory framework regarding royalties, taxes and environmental

matters in the jurisdictions in which the Company operates; and the

ability of the Company to successfully market its oil and natural

gas products; changes in commodity prices; changes in the demand

for or supply of the Company's products; unanticipated operating

results or production declines; changes in tax or environmental

laws, changes in development plans of the Company or by third party

operators of the Company's properties, increased debt levels or

debt service requirements; inaccurate estimation of the Company's

oil and gas reserve and resource volumes; limited, unfavourable or

a lack of access to capital markets; increased costs; a lack of

adequate insurance coverage; the impact of competitors,

uncertainties involving whether its licenses to explore for oil and

gas in Québec will be successfully revoked, risks that the Company

will not be fully or partially compensated for its economic losses

if such licenses are revoked, or that it will not be compensated at

all, risks related to material amount of legal and other costs,

including costs incurred to prepare the Report, that the Company

has and will continue to incur in order to pursue litigation

against the GoQ, risks relating to potential costs or other awards

that may be made against Questerre in connection with its

litigation, risks related to the eventual ruling of the Court which

may not be in favour of Questerre, risks related to the quantum of

any damages which may be payable to the Company, if any, and that

such damages may or may not reflect the estimated economic losses

suffered by the Company, as set out in the Report, risks related to

the Company’s ability to recover any damage amount if so awarded,

and risks related to further legislative changes in the Province of

Québec, changes in the administration of laws, policies, and

practices or ither political or economic developments in Québec and

certain other risks detailed from time-to-time in Questerre's

public disclosure documents. Additional information regarding some

of these risks, expectations or assumptions and other factors may

be found under in the Company's Annual Information Form for the

year ended December 31, 2023, and other documents available on the

Company’s profile at www.sedarplus.ca. Therefore, the Company’s

actual results, performance or achievement could differ materially

for those expressed in, or implied by, these forward-looking

statements and, accordingly, no assurances can be given that any of

the events anticipated by these forward-looking statements will

transpire or occur, or if any of them do so, what benefits the

Corporation will derive therefrom. Readers are cautioned that the

foregoing list of factors is not exhaustive. The reader is

cautioned not to place undue reliance on these forward-looking

statements.

The reader is cautioned not to place undue

reliance on these forward-looking statements. The forward-looking

statements contained in this news release are made as of the date

hereof and Questerre undertakes no obligations to update publicly

or revise any forward-looking statements, whether as a result of

new information, future events or otherwise, unless so required by

applicable securities laws.

For further information, please contact:

Questerre Energy Corporation

Jason D’Silva, Chief Financial Officer

(403) 777-1185 | (403) 777-1578 (FAX) | Email: info@questerre.com

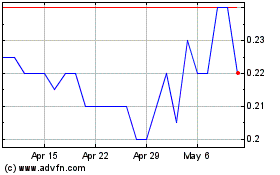

Questerre Energy (TSX:QEC)

Historical Stock Chart

From Dec 2024 to Jan 2025

Questerre Energy (TSX:QEC)

Historical Stock Chart

From Jan 2024 to Jan 2025