Quipt Home Medical Corp. (the “

Company” or

“

Quipt”) (NASDAQ: QIPT; TSX: QIPT), a U.S. based

home medical equipment provider, focused on end-to-end respiratory

care, today announced that it has entered into a cooperation

agreement (the “

Agreement”) with David Kanen,

Philotimo Fund, LP and Kanen Wealth Management, LLC (collectively

with their affiliates, “

Kanen”), under which Kanen

has agreed to withdraw its notice of its intent to solicit proxies

in support of four director candidates at the Company’s upcoming

2025 annual general meeting of shareholders in opposition to the

director candidates recommended by the Company. As part of the

Agreement, the Company’s Board of Directors (the

“

Board”) has granted Kanen certain Board access

rights for as long as Kanen maintains aggregate beneficial

ownership of at least 3.5% of the Company’s outstanding shares.

These access rights include the right to request and conduct

quarterly discussions with either the Chairman of the Board or

another non-executive director designee of the Board.

Under the Agreement, the Company agreed to

establish a new committee of the Board to review and provide

analysis and non-binding recommendations to the Board pertaining to

Kanen’s previously communicated recommendations related to

corporate governance and other areas related to the Company’s

operations.

“We want to thank Kanen for their constructive

discussions and valuable insights,” stated Mark Greenberg, Lead

Independent Director of the Board. “We appreciate the perspectives

of all shareholders and welcome ongoing engagement as management

executes on our strategic growth plans to drive long-term

growth.”

David Kanen, President and CEO of Kanen

commented: “We appreciate the Company’s willingness to engage with

us and its commitment to maximizing value for Quipt shareholders.

The formation of this Committee is an important step, and we look

forward to working constructively with the Company to help unlock

long-term value.”

Pursuant to the Agreement, Kanen has also agreed

to a customary standstill, a voting commitment and other

provisions. The full text of the Agreement will be filed as an

exhibit to a Current Report on Form 8-K with the U.S. Securities

and Exchange Commission (the “SEC”) and with the

Canadian securities regulators.

Advisors

DLA Piper serves as the Company’s legal advisors

in Canada and the United States. In addition, Vinson & Elkins

L.L.P. and Goodmans LLP assisted as legal advisors to the Company,

along with Longacre Square Partners as strategic advisor.

ABOUT QUIPT HOME MEDICAL

The Company provides in-home monitoring and

disease management services including end-to-end respiratory

solutions for patients in the United States healthcare market. It

seeks to continue to expand its offerings to include the management

of several chronic disease states focusing on patients with heart

or pulmonary disease, sleep disorders, reduced mobility, and other

chronic health conditions. The primary business objective of the

Company is to create shareholder value by offering a broader range

of services to patients in need of in-home monitoring and chronic

disease management. The Company’s organic growth strategy is to

increase annual revenue per patient by offering multiple services

to the same patient, consolidating the patient’s services, and

making life easier for the patient.

For further information please visit our website at

www.quipthomemedical.com, or contact:

Cole StevensVP of Corporate DevelopmentQuipt Home Medical

Corp.859-300-6455cole.stevens@myquipt.com

Gregory CrawfordChief Executive OfficerQuipt Home Medical

Corp.859-300-6455

investorinfo@myquipt.com

Forward-Looking Statements

Certain statements contained in this press

release constitute “forward-looking statements” within the meaning

of the U.S. Private Securities Litigation Reform Act of 1995 or

“forward-looking information” as such term is defined in

applicable Canadian securities legislation (collectively,

“forward-looking statements”). The words “may”, “would”, “could”,

“should”, “potential”, “will”, “seek”, “intend”, “plan”,

“anticipate”, “believe”, “estimate”, “expect”, “outlook”, or the

negatives thereof or variations of such words, and similar

expressions as they relate to the Company, are intended to

identify forward-looking information. All statements other than

statements of historical fact, including those that express, or

involve discussions as to, expectations, beliefs, plans,

objectives, assumptions or future events or performance are not

historical facts and may be forward-looking statements and may

involve estimates, assumptions and uncertainties that could cause

actual results or outcomes to differ materially from those

expressed in the forward-looking statements. Such statements

reflect the Company’s current views and intentions with respect to

future events, and current information available to the Company,

and are subject to certain risks, uncertainties and assumptions.

Many factors could cause the actual results, performance or

achievements that may be expressed or implied by such

forward-looking statements to vary from those described herein

should one or more of these risks or uncertainties materialize.

Examples of such risk factors include, without limitation, those

risk factors discussed or referred to in the Company’s disclosure

documents, including the Company’s most recent Annual Report on

Form 10-K, filed with the SEC and available at www.sec.gov, and

with the securities regulatory authorities in certain provinces of

Canada and available at www.sedarplus.com. Should any factor affect

the Company in an unexpected manner, or should assumptions

underlying the forward-looking statement prove incorrect, the

actual results or events may differ materially from the results or

events predicted. Any such forward-looking statements are

expressly qualified in their entirety by this cautionary statement.

Moreover, the Company does not assume responsibility for the

accuracy or completeness of such forward-looking statements. The

forward-looking statements included in this press release is made

as of the date of this press release and the Company undertakes no

obligation to publicly update or revise any forward-looking

statements, other than as required by applicable law.

Important Additional Information

On January 24, 2025, the Company filed a

Management Information and Proxy Circular (as may be amended or

supplemented from time to time, the “Circular”) and WHITE Proxy

Card with the SEC and on the System for Electronic Document

Analysis and Retrieval (“SEDAR+”) in connection with its

solicitation of proxies in support of four director candidates to

the Board at the 2025 annual general meeting of shareholders of the

Company to be held on March 17, 2025 (including any adjournments,

reschedulings, continuations or postponements thereof, the

“Meeting”).

On January 25, 2025, the Company received a

letter pursuant to Rule 14a-19(b) under the Securities Exchange Act

of 1934, as amended (the “Exchange Act”), from Kanen purporting to

provide notice of Kanen’s intent to solicit proxies in support of

four director candidates in opposition to the Company’s four

director candidates. As part of the Cooperation Agreement, Kanen

has agreed to withdraw its notice of intent to solicit proxies in

support of any opposition candidates.

SHAREHOLDERS OF THE COMPANY ARE STRONGLY

ENCOURAGED TO READ THE CIRCULAR, ACCOMPANYING WHITE PROXY CARD AND

ALL OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH, OR FURNISHED

TO, THE SEC AND SEDAR+ CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN

THEY BECOME AVAILABLE, AS THEY WILL CONTAIN IMPORTANT INFORMATION

ABOUT THE MEETING.

Participant Information

The Company, its directors (Gregory Crawford,

Chairman of the Board and Chief Executive Officer, Mark Greenberg,

Dr. Kevin A. Carter and Brian J. Wessel) and certain of its

executive officers (Hardik Mehta, Chief Financial Officer) are

“participants” (as defined in Section 14(a) of the Exchange Act) in

the solicitation of proxies from the Company’s shareholders in

connection with matters to be considered at the Meeting.

Information about the compensation of our non-employee directors

and our named executive officers is set forth in the section of the

Circular titled “Executive Compensation,” which commences on page

15. Information regarding the participants’ holdings of the

Company’s securities can be found in the section if the Circular

titled “Voting Securities and Principal Holders,” which commences

on page 3 and is available here.

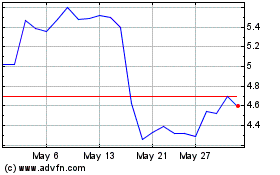

Quipt Home Medical (TSX:QIPT)

Historical Stock Chart

From Feb 2025 to Mar 2025

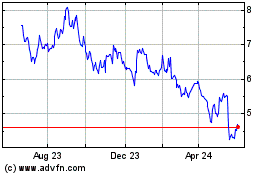

Quipt Home Medical (TSX:QIPT)

Historical Stock Chart

From Mar 2024 to Mar 2025