RioCan Real Estate Investment Trust Announces Renewal of Normal Course Issuer Bid

November 08 2024 - 7:30AM

Business Wire

RioCan Real Estate Investment Trust (“RioCan”) (TSX:REI.UN)

today announced that the Toronto Stock Exchange (“TSX) has approved

its notice of intention to make a normal course issuer bid for a

portion of its trust units (“Units”) as appropriate opportunities

arise from time to time. RioCan's normal course issuer bid will be

made in accordance with the requirements of the TSX.

Pursuant to the notice, RioCan is authorized to acquire up to a

maximum of 29,878,867 of its 299,967,991 outstanding Units, or

approximately 10% of the public float of 298,788,675 as of October

31, 2024, over the next 12 months. Purchases under the normal

course issuer bid will be made through the facilities of the TSX or

through a Canadian alternative trading system and in accordance

with applicable regulatory requirements at a price per Unit equal

to the market at the time of acquisition. The number of Units that

can be purchased pursuant to the bid is subject to a current daily

maximum of 209,391 Units (which is equal to 25% of 837,564, being

the average daily trading volume on the TSX during the last six

months), subject to RioCan’s ability to make one block purchase of

Units per calendar week that exceeds such limits.

Units purchased under the normal course issuer bid will be

cancelled upon their purchase or may be used to satisfy RioCan’s

obligation to deliver Units under RioCan’s Restricted Equity Unit

Plan and/or Performance Equity Unit Plan. RioCan intends to fund

the purchases out of its available cash and undrawn credit

facilities. Under its previous normal course issuer bid, which

expired on November 8, 2024, RioCan was authorized to acquire a

total of 29,895,017 Units. RioCan did not purchase any Units under

its previous normal course issuer bid.

RioCan may begin to purchase Units on November 12, 2024 and the

bid will terminate on November 11, 2025 or such earlier time as

RioCan completes its purchases pursuant to the bid or provides

notice of termination. RioCan believes that the purchase of its

Units may represent an investment opportunity for the Trust and an

appropriate and desirable use of its funds based on market

conditions, Unit price and other factors.

RioCan has adopted an automatic securities purchase plan

(“ASPP”) in connection with its normal course issuer bid that

contains strict parameters regarding how its Units may be

repurchased during times when it would ordinarily not be permitted

to purchase Units due to regulatory restrictions or self-imposed

blackout periods. Pursuant to the ASPP, purchases will be made by

RioCan’s designated broker based on pre-established purchasing

parameters, in accordance with the rules of the TSX, applicable

securities laws and the terms of the ASPP. The ASPP has been

pre-cleared by the TSX and will be implemented effective

immediately. All purchases made under the ASPP will be included in

computing the number of Units purchased under RioCan’s normal

course issuer bid. Outside of pre-determined blackout periods,

Units may be purchased under the normal course issuer bid at such

times as RioCan may determine in compliance with TSX rules and

applicable securities laws.

About RioCan

RioCan is one of Canada’s largest real estate investment trusts.

RioCan owns, manages and develops retail-focused, mixed-use

properties located in prime, high-density transit-oriented areas

where Canadians want to shop, live and work. As at June 30, 2024,

our portfolio is comprised of 187 properties with an aggregate net

leasable area of approximately 33 million square feet (at RioCan's

interest). To learn more about us, please visit www.riocan.com.

Forward-Looking Information

This News Release contains forward-looking information within

the meaning of applicable Canadian securities laws. This

information reflects RioCan’s objectives, our strategies to achieve

those objectives, as well as statements with respect to

management’s beliefs, estimates and intentions concerning

anticipated future events, results, circumstances, performance or

expectations that are not historical facts. Forward-looking

information generally can be identified by the use of

forward-looking terminology such as “outlook”, “objective”, “may”,

“will”, “would”, “expect”, “intend”, “estimate”, “anticipate”,

“believe”, “should”, “plan”, “continue”, or similar expressions

suggesting future outcomes or events. Such forward-looking

information reflects management’s current beliefs and is based on

information currently available to management. All forward-looking

information in this News Release is qualified by these cautionary

statements.

Forward-looking information is not a guarantee of future events

or performance and, by its nature, is based on RioCan’s current

estimates and assumptions, which are subject to numerous risks and

uncertainties, including those described in the “Risks and

Uncertainties” section in RioCan's MD&A for three and six

months ended June 30, 2024 and in our most recent Annual

Information Form, which could cause actual events or results to

differ materially from the forward-looking information contained in

this News Release. General economic conditions, including interest

rate fluctuations, may also have an effect on RioCan’s results of

operations.

The forward-looking statements contained in this News Release

are made as of the date hereof, and should not be relied upon as

representing RioCan’s views as of any date subsequent to the date

of this News Release. Management undertakes no obligation, except

as required by applicable law, to publicly update or revise any

forward-looking information, whether as a result of new

information, future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241108195061/en/

RioCan: Kim Lee Vice President, Investor Relations (416)

646-8326

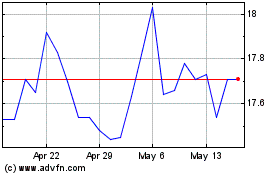

RioCan Real Estate Inves... (TSX:REI.UN)

Historical Stock Chart

From Jan 2025 to Feb 2025

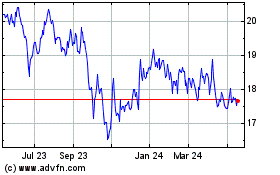

RioCan Real Estate Inves... (TSX:REI.UN)

Historical Stock Chart

From Feb 2024 to Feb 2025