For immediate release

30 May 2022

Serabi Gold plc

(“Serabi” or the “Company”)

Notice of Annual General Meeting and

Directorate Change

The Company announces that its Annual General

Meeting will be held on Tuesday 28 June 2022, at the offices of

Travers Smith LLP, 10 Snow Hill, London EC1A 2AL, England at 2.00

pm (BST). The Company has published the formal notice of the

meeting (the “Notice”) on its website which can be accessed using

the following link https://bit.ly/3GrWEQ1. Proxy voting forms are

being posted to all shareholders providing details of how to access

the Notice and instructions for voting. A copy of the Notice

together with proxy voting forms is being posted to all

shareholders who are required to receive or have formally requested

to receive these documents.

The Notice contains a letter from the Chairman

of the Company, Mr Nicolas Bañados, which is set out below in

Appendix 1.

Directorate Change

Mr Sean Harvey, who has served as a Director of

Serabi since 2011 and was Chairman of the Company for the period

from March 2011 to June 2017, has advised his intention to step

down from the Board at the AGM. Sean’s knowledge and experience has

been a significant asset to the Company over the last eleven years

and has always ensured lively and insightful debate at Board

meetings. The Company extends its gratitude for the time and effort

he has contributed to Serabi, and the assistance and guidance he

has provided to management.

Enquiries:

|

Serabi Gold plc |

|

|

Michael Hodgson |

Tel: +44 (0)20 7246 6830 |

|

Chief Executive |

Mobile: +44 (0)7799 473621 |

|

|

|

|

Clive Line |

Tel: +44 (0)20 7246 6830 |

|

Finance Director |

Mobile: +44 (0)7710 151692 |

|

|

|

|

Email:

contact@serabigold.com |

|

|

Website: www.serabigold.com |

|

|

|

|

|

Beaumont Cornish Limited Nominated

Adviser |

|

|

Roland Cornish |

Tel: +44 (0)20 7628 3396 |

|

Michael Cornish |

Tel: +44 (0)20 7628 3396 |

|

|

|

|

Peel Hunt LLP Joint UK

Broker |

|

|

Ross Allister |

Tel: +44 (0)20 7418 9000 |

|

|

|

|

Tamesis Partners LLP Joint UK

Broker |

|

|

Charlie Bendon |

Tel: +44 (0)20 3882 2868 |

|

Richard Greenfield |

Tel: +44 (0)20 3882 2868 |

|

|

|

|

Camarco

Financial PR Gordon Poole / Emily

Hall |

Tel: +44(0) 20 3757 4980 |

Copies of this announcement are available from

the Company's website at www.serabigold.com.

Neither the Toronto Stock Exchange, nor any

other securities regulatory authority, has approved or disapproved

of the contents of this announcement.

Appendix 1

The letter from the Chairman of the Company

included in the Notice is reproduced below (without material

adjustment or amendment):

“Dear Shareholder

This document provides the formal notice (the

"Notice") of the 2022 Annual General Meeting of the Company to be

held at Travers Smith LLP, 10 Snow Hill, London EC1A 2AL England on

28 June 2022 at 2.00 p.m. (London time) (the "AGM"). The purpose of

the AGM is to seek Shareholders' approval of the resolutions.

Canadian Designated Foreign Issuer

Status

The Company is a "designated foreign issuer" for

the purposes of Canadian Securities Administrators’ National

Instrument 71-102 – Continuous Disclosure and Other Exemptions

Relating to Foreign Issuer ("NI 71-102") and, as such, the Company

is not subject to the same ongoing reporting requirements as most

other reporting issuers in Canada. Generally, the Company complies

with Canadian ongoing reporting requirements by complying with the

regulatory requirements of AIM, which is a "foreign regulatory

authority" (as defined in NI 71-102), and filing any documents

required to be filed with or furnished to AIM with the securities

regulatory authorities in Canada.

Action to be taken by

Shareholders

A Form of Proxy for use by Shareholders

accompanies this document. To be valid, Forms of Proxy must be

completed and returned so as to be received at either the offices

of the Company's UK Registrar, Computershare Investor Services Plc,

The Pavilions, Bridgwater Road, Bristol, BS99 6ZZ or the offices of

the Company's Canadian Registrar, Computershare Investor Services

Inc., 100 University Avenue, 8th Floor, Toronto, Ontario M5J 2Y1 by

not later than 2.00 p.m. (London time) (9.00 a.m. Eastern time) on

26 June 2022. Alternatively, Shareholders can appoint a proxy

electronically by going to either www.investorcentre.co.uk/eproxy

(for UK appointments) or www.investorvote.com (for Canadian

appointments) or, if they hold their shares in CREST, Shareholders

can appoint a proxy using the CREST electronic proxy appointment

service, in each case by not later than not later than 2.00 p.m.

(London time) (9.00 a.m. Eastern time) on 26 June 2022 in

accordance with the instructions set out in the "Proxy

Instructions" section below and the Form of Proxy.

Completion and return of a Form of Proxy will

not prevent Shareholders from attending and voting in person at the

AGM should they so wish.

Beneficial Shareholders (as defined in the

"Voting by Beneficial Shareholders" section below on page 14)

should note that only registered Shareholders or their duly

authorised proxy holders are entitled to vote at the AGM. Each

Beneficial Shareholder should ensure that their voting instructions

are communicated to the appropriate person well in advance of the

AGM.

Further details of the restrictions and steps to

be taken with respect to voting are set out in the Notice and

Information Circular contained in this document.

The Company will continue to monitor the impact

of Covid-19 and reserves the ability to revise arrangements in

relation to the AGM should circumstances change. Any relevant

updates regarding the AGM will be available on the Company's

website and announced through a Regulatory Information Service.

Background

The matters being considered at the 2022 Annual

General Meeting, as set out in the Notice are, for the most part,

items that are routinely considered at such meetings.

“In common with many other businesses, we have

continued to face challenges and through 2021 we have sought to

re-establish our activities as quickly as possible in an

environment that is still resetting itself following what we all

hope are the worst effects of the COVID-19 pandemic. As we return

to normality, protecting the health of our employees, suppliers and

communities continues to be a priority, and the Company will

maintain its full commitment to be a safe place in this difficult

environment.

The development of our Coringa project remains

our immediate growth priority and it is very pleasing to see the

continued progress that we are making. As we reported in the first

quarter of 2022, the ramp development of the Serra orebody has

intersected the three known veins of the Serra orebody with grades

significantly higher than we were expecting. All three veins have

been intersected on the 320m and 340m levels, with excellent

results to date. Our plan is now to develop the two principal

veins, V1 and V3 to the north. We have also introduced ‘resue’

development mining, where the ore and waste can be blasted

separately. The advantage of this technique is that dilution of the

ore coming out of the mine will be minimised and allow us to build

a high-grade stockpile over the coming months, in preparation for

plant feed in 2023.

The current development operations at Coringa

are being carried out under a trial mining licence (“GUIA”) that

allows us to undertake mining activities and perform some initial

processing of the ore and further test work at the Palito Complex.

We remain optimistic regarding the award of the Installation

Licence which is required before we can start construction of the

plant and the rest of the site infrastructure. Ongoing dialogue

with the relevant agencies involved with issuing this licence,

continues to be very positive and has not highlighted any concerns

with the project design itself. The agencies continue to follow the

steps and processes set down by the law to help expedite the issue

of the licence. Both the National Mining Agency (the “ANM”) and the

State environmental agency (“SEMAS”) have together with Serabi,

filed documents of protest with the relevant court authorities and

the court judge who, is currently reviewing the need for any

ongoing intervention given that all proper processes are being

followed. The key issue has been confirmation that the needs of the

indigenous populations have been properly considered. In all steps

of the process Serabi, SEMAS and the ANM have observed their legal

and moral obligations consulting with and obtaining approval from

FUNAI, the national agency that protects the rights of indigenous

populations. A specific indigenous study that goes beyond the

requirements of the law is now expected to be completed during the

second quarter of 2022 and is intended to allay any further

concerns regarding the impact of mining activity at Coringa. In the

meantime, SEMAS have received letters from the indigenous tribes

confirming their support for the project. Discussions regarding the

additional funding that will be required for the longer term

development of Coringa, including the construction of the plant and

the necessary site infrastructure, remain on-going with a variety

of providers.

Brownfield exploration during 2021 brought some

excellent mine-site discoveries, especially around the current

Palito deposit, which will allow us to expand the operation during

the latter half of 2022. This growth is particularly important

after the lower than expected production in the fourth quarter of

2021 and the first quarter of 2022.

The last 12 months have been challenging and I

believe that the post pandemic effects on Serabi have been more

wide ranging than we originally anticipated. Whilst in 2020, it was

the pandemic itself that hampered operations, 2021 was a year when

supply chain delays became prevalent, as businesses in Brazil

accelerated output, but struggled to meet targets due to lack of

critical items. Since travel restrictions for non-nationals

travelling to Brazil were eased in the latter part 2021, Serabi’s

executive management have spent a lot of time in country, making a

number of management changes and implementing numerous operational

actions.

At the Palito operation, whilst 2021 was a

better year than 2020, we still faced a number of challenges, and

the final quarter of 2021 as well as the first quarter of 2022 saw

lower than anticipated levels of production. The reasons for this

are twofold. In the Palito orebody, ongoing delays in the delivery

of critical new mining fleet have hampered mine development and

therefore the speed at which new areas at Palito can be prepared

for mining. The brownfield exploration has brought some excellent

results over the past six months but accessing these resources and

translating them into reserves and production has not been possible

due to fleet shortage, which we have been waiting for since mid

2021. In the meantime, we have been reliant upon an aging fleet

that, with increasing maintenance downtime, is unable to provide

the required capacity. As a consequence of this delay, we have been

somewhat restricted in our production options and have, in the

short-term, needed to mine and process the ore that is in

immediately accessible blocks, including those with lower grades.

This has resulted in lower than anticipated production in the

fourth quarter of 2021 and the first quarter of 2022. Nevertheless,

we are confident the already identified new vein structures will

allow us to increase production from the deposit during the

remainder of 2022 and in 2023. All new items of fleet have been or

are expected to be delivered during the second quarter of 2022.

Secondly, we have also experienced lower than

expected production from the São Chico orebody. During the second

half of 2021, we commenced production on the Julia Vein. Up until

then, most São Chico production has come from the Main Vein, where

mechanised long hole open stoping has proved to be an efficient and

effective mining method. During the second and third quarters of

2021, the Julia Vein was developed with the intention to again use

mechanised long hole open stoping. However, as we progressed

through the fourth quarter, it became clear that the levels of

dilution from stoping were far higher than forecast as a

consequence of the presence of multiple cross cutting faults and

intrusive dykes, which post-date the ore. These faults were not

easily identified in the initial drilling into the vein Through the

latter part of the fourth quarter of 2021 and the first quarter of

this year we installed significant amounts of ground support such

as cable bolts and leaving ground pillars to help minimise

dilution. This made some marginal improvements, but production

rates were nevertheless greatly reduced, with the drilling

equipment and manpower being utilised just as much for ground

support activity as they have been for production. During February

2022, the decision was made to stop the long hole method on the

Julia Vein, and introduce selective open stoping, with air-legs, as

used in most areas of the Palito orebody. This will bring improved

grades by minimising dilution through greater selectivity. However,

this is not an overnight change. It is slower, and therefore needs

preparation time, but continuing with long hole mining is not a

viable option. A consequence is that 1,000 ounces of production

scheduled from São Chico in February by long hole, was delayed and

will now be mined selectively during both the second quarter and

over the rest of the year.

This decision to move away from long hole to

selective mining methods means the reliance on production ounces

will, in the near term, move away from the São Chico orebody to the

Palito orebody, with operations at São Chico focusing far more on

mine development with a view to a return to normal production in

2023. In parallel to this, during the second half of 2022, we will

be increasing production from the Palito orebody. As a result, it

is unlikely that we will be able to maintain quarterly production

at a level of around 9,000 ounces, and we will focus on producing

profitable ounces and maximising operational cashflow rather than

production growth for the rest of the year. This has required us to

lower our production guidance for 2022 to be in the region of

30,000 ounces but expect a return to previous levels once access

has been gained to the new working areas.

I am pleased to say that these decisions are

beginning to bear fruit with some much-improved grades and daily

production in March and April. We will make every effort to exceed

the revised guidance and have already taken and implemented the

decision to bring in 34 specialised selective miners to help

accelerate the transition back to selective mining at São Chico and

increase production from Palito. There are multiple smaller,

higher-grade areas in upper levels, that require minimal

development and access, but lend themselves to selective mining and

these can provide additional ounces. This transition to the more

selective mining method going forward to emphasise quality over

quantity, means an increased focus on reducing costs, moving less

volume and optimising the operation rather than just chasing scale.

The real scale change will be driven by the successful start-up of

Coringa.

Exploration results from the Palito Mine have

been very encouraging. The Ipe and Mogno veins in the Chica da

Santa sector, which was a key part of the Palito production during

2021, have demonstrated the depth potential and continued high

grades of the sector. Lateral extensions of the deposit comprising

the Piaui sector to the southwest and Pele sector to the northeast

also bode well with both sectors expected to support resource

replenishment, growth and future production at the Palito Mine

while ensuring a successful future for this long-life asset. The

drilling into Piaui has really opened up the deposit to the

southwest. The Piaui sector hosts two veins, which have now been

drilled over a strike length of 500m and 200m vertical depth. Plans

are now being finalised to cross cut to this sector from the Senna

Vein later this year.

The potential of Palito both along strike, at

depth and now laterally is very evident. From Pele in the east and

Piaui in the west, the deposit now comprises a series of veins

within a 1,000m wide corridor. Over the next 12 months, we will be

expanding the Palito orebody considerably as we access these new

sectors.

The reduction in revenues that we will

experience in 2022 will impact the level of cash that can be

generated and have necessitated restricting discretionary

expenditure including exploration activity. I hope that this will

be temporary and that we can pick up on some of exciting

exploration opportunities with funding being provided by

operational cash-flow as gold production grows.

Whilst the last two years have been tough

operationally due to global supply chain issues and impacts of

Covid, we are confident in Serabi’s future. The Palito orebody

remains the engine room to our production base but with a

turnaround expected at São Chico this year and the material growth

from Coringa, our strategy remains to turn Serabi into a

multi-asset gold miner with production approaching 100koz within

the next few years.”

Directorate Change

Mr Sean Harvey, who has served as a Director of

Serabi since 2011 and was Chairman of the Company for the period

from March 2011 to June 2017, has advised his intention to step

down from the Board at the AGM. Sean’s knowledge and experience has

been a significant asset to the Company over the last eleven years

and has always ensured lively and insightful debate at Board

meetings. On behalf of the Board, we are grateful for the time and

effort he has contributed to Serabi, the assistance and guidance he

has provided to management and I am sure that he will continue to

be a strong supporter of the Company.

Recommendation and importance of

vote

The Directors consider that the resolutions set

out in the Notice being put to the AGM are in the best interests of

the Company and its Shareholders and are most likely to promote the

success of the Company for the benefit of the Shareholders as a

whole.

Accordingly, the Directors unanimously recommend

that Shareholders vote in favour of the proposed resolutions as

they intend to do in respect of their own holdings, where relevant,

amounting to an aggregate of 1,262,345 Ordinary Shares,

representing approximately 1.67% of the Company's Ordinary Shares

in issue at the date of this document.

(Signed) "Nicolas Bañados"

Nicolas Bañados

Non-executive Chairman”

ENDS

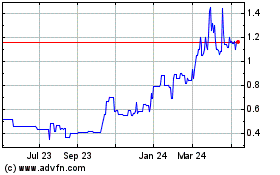

Serabi Gold (TSX:SBI)

Historical Stock Chart

From Dec 2024 to Jan 2025

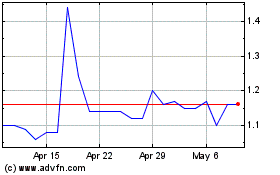

Serabi Gold (TSX:SBI)

Historical Stock Chart

From Jan 2024 to Jan 2025