Updated Coringa PEA Confirms Improved

Economics

Serabi Gold plc (“Serabi” or the

“Company”) (AIM:SRB, TSX:SBI, OTCQX:SRBIF), the Brazilian

focused gold mining and development company, is pleased to announce

the results of an updated Preliminary Economic Assessment (the

“Updated PEA”) for its currently producing, 100%-owned Coringa Gold

Project (“Coringa” or “the Project”), located in Para State,

Brazil. (All financial amounts are expressed in U.S. dollars unless

otherwise indicated).

At the beginning of 2024, it was decided by

Serabi’s management to prepare the Updated PEA that reflects the

Company’s current operating plan for Coringa. The Company commenced

development of Coringa in June 2021 and first gold was produced in

July 2022, and since then 18,458oz have been produced. The current

operations have materially improved the understanding of the

geology, and in particular, the amenability of the deposit to

ore-sorting technology. This has allowed management to adopt a plan

utilising the existing process plant capacity at Palito Complex in

preference to the construction of a full stand-alone process plant

at Coringa, which is significantly cheaper on initial capital,

carries less operational risk and does not compromise the mine

development plan or production rates of Coringa.

HIGHLIGHTS

-

Annual production is estimated at 28,000oz in 2025, and then

averages 36,000oz per year between 2026 and 2031 with an 11-year

mine life until 2034

-

Average Life of Mine (“LOM”) All-In Sustaining Cost (“AISC”) of

$1,241/oz including royalties and refining costs using the Base

Case gold price.

-

The updated Mineral Resource Inventory at Coringa, upon which the

Updated PEA is based were as follows:

-

Measured & Indicated Resources (M&I) 795kt @ 7.03g/t gold

(179koz contained);

-

Inferred Resources 1,454kt @ 5.81g/t gold (271koz contained);

- Mine plan utilises

145koz M&I and 241koz Inferred which equates to 81% of the

total M&I resource inventory and 89% of the inferred

resource.

-

Average LOM gold grades from the mine of 5.38 g/t, which are

increased to 8.50 g/t after ore sorting, producing a total gold

production of 363koz.

-

Under the Base Case scenario, the operation underscores robust

economics:

-

Post-tax NPV10% of $145M;

-

Average annual free cash flow of $19M;

-

Sustaining Life of Mine (“LOM”) capital expenditures of $87M to be

funded from project cash-flow;

-

Mining is by underground shrinkage stoping using a cut-off grade of

3.16 g/t gold. Resource widths and grades within the Updated PEA

mine plan have been further diluted to 1 metre minimum mining

widths.

An interview with Mike Hodgson by Crux

Investor can be accessed here:

https://youtu.be/gnWhxMMfMB8

An interview with Mike Hodgson by BRR

Media can be accessed here :

https://brrmedia.news/Coringa_PEA

Mike Hodgson, CEO of Serabi,

commented:

“In Phase 1 of our growth plan, Serabi is

focused on developing and growing our business and building a

strong gold production base in Brazil. The publication of these

very encouraging results of the Updated PEA is a major milestone in

achieving this objective. Since the original PEA prepared by Global

Resource Engineering (“GRE”), effective 6 September 2019 (“GRE

PEA”), was issued, a number of factors, including the reduction in

trucking costs and the success with ore-sorting changed our view of

the best way to maximise returns from Coringa. Whilst we have

communicated the perceived benefits to investors for some time, we

historically had no independent study that supported this. The

Updated PEA now addresses this. The Updated PEA has an NPV10% of

$145M compared with the GRE PEA result of only $31M indicating the

improved economics of this revised strategy.

The Updated PEA demonstrates superior economics

to the GRE PEA, supporting an initial 11-year mine life and a

fully-ramped up mine production that will average approximately

34,000 ounces per annum. Combined with an expectation of production

from Palito of ~25,000 ounces per annum, Serabi should reach our

initial target of 60,000 ounces per annum for the 2026 fiscal year,

which maximises the capacity of the Palito Complex with the best

feed grades possible. Phase 2 of our growth plan will focus on

brownfield exploration in 2025 and 2026 which will determine the

quantum and timing of the next phase of Serabi’s growth, while

Phase 3 of our growth plan will determine whether we add additional

processing capacity at Palito Complex or build a stand-alone

operation at Coringa.

The Base Case uses an average gold price of

$2,100/oz and calculates an NPV10% of $145M. Looking at a scenario

using the average 6-month gold price of $2,280/oz, the NPV10%

improves to $170M, and using the spot gold price of $2,600/oz the

NPV10% is a stand-out $211M.

The Updated PEA demonstrates the robust

viability of our strategy and we believe there is still plenty of

upside. First, the grade uplift of 1.6 times from ROM to sorted ore

is conservative and test-work indicates this can be significantly

enhanced with improvements in controlling and reducing the

production of fines in the crushing circuit. This will result in

better grades, reduced mass and offer the opportunity for

accelerated production. The Updated PEA also does not consider the

longer-term growth potential we believe in at Coringa, and this

will be a high priority for us in 2025. The Base Case economic

analysis indicates an AISC of $1,241/oz. Whilst we have reported a

consolidated AISC for the first six months of 2024 of $1,782/oz,

this has been adversely affected by the lower mined grades and

therefore, production generated from Palito compared with 2022 and

2023, further exacerbated by the accelerated mine development

undertaken at Coringa. By returning Palito to an average mined

grade of 5.5 g/t to 6.0 g/t and with the expectation of an average

AISC for Coringa of below $1,300/oz, on this basis we forecast an

average future AISC for the Company of between $1,300/oz and

$1,360/oz.

The total sustaining capital requirement for the

development of the project in 2025, including further mine

development, is estimated at approximately $14 million. This and

all future sustaining and development capital projected in the

Updated PEA will be funded from the Company’s operational cash

flow. With Coringa located in close proximity to our existing

Palito Complex and based on existing operational cost data at

Coringa, we have provided NCL with actual cost information of the

past few years. This entails that from a cost perspective, the data

used in compiling the Updated PEA is significantly more robust than

might normally be the case with PEA studies.”

Table 1 – Summary of Updated PEA Results

(in Millions)

|

Gold Price (per ounce) |

$1,950 |

BASE CASE$2,100 |

$2,280 |

SPOT$2,600 |

|

Pre-tax NPV5% |

$193 |

$230 |

$275 |

$356 |

|

Pre-tax NPV10% |

$151 |

$181 |

$217 |

$281 |

|

Post-tax NPV5% |

$159 |

$184 |

$214 |

$267 |

|

Post-tax NPV10% |

$125 |

$145 |

$169 |

$211 |

|

Project Post-tax Cash Flow |

$210 |

$242 |

$281 |

$350 |

|

Avg. Annual Free Cash Flow |

$16 |

$19 |

$22 |

$27 |

|

Avg. Gross Revenue |

$52 |

$56 |

$61 |

$69 |

The Updated PEA was completed by NCL Ingeniería

y Construcción SpA (“NCL”) of Santiago, Chile, Serabi’s independent

engineering consultant.

The Base Case considers the operation from 1

January 2025 onwards. All prior development and capital

expenditures including 2024 expenditures on the classification

plant, of which US$5 million has been spent to date, are considered

sunk costs and are not included in the evaluation.

This technical report is a preliminary economic

assessment and partially utilises inferred mineral resources.

Inferred mineral resources are considered too speculative,

geologically, to have the economic considerations applied to them

that would enable them to be categorized as mineral reserves and

there is no certainty that the preliminary economic assessment will

be realized. Mineral resources that are not mineral reserves do not

have demonstrated economic viability.

An updated Mineral Resource estimate has been

made using a gold price of $1,950/oz. As of September 2024,

Serabi's median analyst consensus long-term gold price was

approximately $2,200/oz. As of September 28, 2024, the 12-month

trailing average LBMA (AM Fix) gold price was approximately

$2,189/oz. The Base Case utilises a constant gold price of

$2,100/oz and a constant exchange rate of 5.5 BRL per 1.00 USD in

the economic analysis completed for the Updated PEA. Sensitivities

are also shown for the 36-month trailing average LBMA (AM Fix) gold

price of $1,950/oz the 6-month trailing average LBMA (AM Fix) gold

price of $2,280/oz and current spot gold price estimate of

$2,600/oz.

Implications of the Updated PEA Results

for the Consolidated Production and AISC

The Updated PEA demonstrates that over its life,

Coringa will produce on average 36,000oz per annum from 2026 to

2031 (with a range of 29,000oz to 41,000oz over the LOM) at an

average LOM AISC of $1,241/oz.

On 30 June 2024, Serabi reported a Group AISC of

$1,782/oz for the production of 18,010 ounces, of which 9,837oz was

produced at Palito and 8,623oz at Coringa.

During this period, the AISC for Palito Complex

has been adversely affected by the lower grade and therefore lower

production generated from the mined ore tonnage. An average mined

grade of 4.63g/t compares with an average mined grade of 6.08g/t

and 6.15g/t for 2023 and 2022, respectively. The calculated AISC

for Palito for the 6-month period to 30 June of $1,822/oz is

estimated to be $1,534/oz had an average grade of 5.5g/t been

achieved and $1,406/oz at an average grade of 6.0g/t. Such an

increase in average grades would raise annual Palito production for

the same mined tonnage to between 22,000oz and 24,000oz.

By inference, the AISC for Coringa for the same

6-month period was $1,739/oz, reflecting the on-going investment

and prioritisation of mine development over stope production. This

compares to the average LOM AISC projected by the Updated PEA of

$1,241/oz.

With production of 22,000oz to 24,000oz per

annum from Palito and an average production from Coringa of

36,000oz between 2026 and 2031, the Company projects sustainable

production of approximately 60,000oz going forward. With this

assumption, the average AISC would be $1,400/oz to $1,550/oz for

Palito (dependent on grade) and $1,241 for Coringa resulting in a

consolidated average AISC of between $1,300/oz and $1,360/oz.

Further Information

The Coringa project consists of the Coringa gold

deposit and currently comprises four discrete ore bodies which are

included in the mine plan. Other potential ore bodies have been

identified and subject to further evaluation, could extend the

current life of the project. In addition, the Coringa deposit is

hosted within an 8km zone of past artisanal mining activity

comprising a series of shallow pits which exploited the soft,

near-surface oxidised ore but were abandoned at about 20 to 25

metre depths when the artisanal miners encountered the underlying

hard rock sulphide ore.

The access to Serra and three production levels

have been already developed. The Updated PEA anticipates that the

project development will continue with the establishment of mine

portals providing access to the Galena & Mae de Leite (“GAMDL”)

and Meio & Como Quieto (“MCQ”) sectors of the deposit with

access to the Demetrio sector being undertaken later in the mine

life. NCL have considered 2024 as the start of the ramp-up period

which continues through 2025 with the initial development of the

GAMDL and MCQ sectors with 2026 being the first year at full

long-term mining rates. The primary crusher and ore sorter at

Coringa have already been acquired with assembly being completed

prior to commissioning in early Q4-2024.

The full NI 43-101 compliant Technical Report,

supporting the economic results and including the updated mineral

resource statement is being prepared by NCL and is required to be

published with 45 days of this announcement. A further news release

will be made when it becomes available with copies available on the

Company’s website and on SEDAR.

Table 2 – Coringa Updated PEA - Base

Case Metrics

|

|

Unit |

Amount |

|

Gold Price |

$/oz |

$2,100 |

|

Cut-off grade |

g/t |

3.16 |

|

Run of Mine (ROM) Material to Process |

Tonnes |

2,232,919 |

|

Mining Method |

Method |

Shrinkage Stoping |

|

Annual Throughput at 100% Capacity |

Tonnes |

215,000 |

|

Ore Sorter Efficiency (Tonnes) |

% |

61% |

|

Ore Sorter Upgrade |

x |

1.59 |

|

Process Gold Recovery |

% |

97% |

|

Total Gold Production (Recovered) |

Ounces |

363,108 |

|

Mine Life |

Years |

11 |

|

Sustaining Capital Expenditures |

$M |

$87 |

|

Mine Closure Costs |

$M |

$1 |

|

Cash Operating Costs (inc. Royalty + TC/RCs) |

$/oz |

$965 |

|

All In Sustaining Cost (inc. Royalty + TC/RCs) |

$/oz |

$1,241 |

|

Exchange Rate |

R$:US$ |

5.5 |

|

Royalties |

% |

4.00% |

|

Profits Tax Rate |

% |

34% |

*Base Case Metrics are from year 2025+

Coringa Updated Mineral

Resource

The following table sets out the Company’s

Canadian Securities Administrators National Instrument 43-101 (“NI

43-101”) compliant indicated mineral resources of 179,000oz and

inferred mineral resources of 271,000oz estimated as of 6 April

2024. This resource estimate is an update on the estimation issued

by the Company on 6 September 2019 and takes account of additional

drilling results and updated geological interpretation.

Table 3 - Coringa Updated Mineral

Resource Estimate

|

Classification |

Quantity |

Grade |

Contained Metal |

|

|

Gold |

Gold |

|

000 't |

g/t |

000' oz |

|

Measured Resources |

172 |

8.96 |

49 |

|

Indicated Resources |

623 |

6.49 |

130 |

|

Measured & Indicated Resources |

795 |

7.03 |

179 |

|

Inferred Resources |

1,454 |

5.81 |

271 |

|

(1) Mineral Resources are not Mineral Reserves and

have not demonstrated economic viability. Mineral Resources are

reported inclusive of Mineral Reserves. All figures are rounded to

reflect the relative accuracy of the estimates. Mineral Resources

are reported within classification domains inclusive of in-situ

dilution at a cut-off grade of 3.16g/t gold assuming an underground

extraction scenario, an operating cost of $107/t for mining,

crushing and sorting, sorting efficiency of 61% of the tonnes and

1.59 upgrade factor, $88/t for hauling to Palito, processing at

Palito plant and site costs, metallurgical recovery of 97%, 4% on

royalties and 2.3% for refining, insurance, freight and sales, and

a gold price of $1,950/troy oz.(2) Serabi is the

operator and owns 100% of the Coringa Gold Project such that gross

and net attributable mineral resources are the same. The mineral

resource estimate was prepared by NCL Ingeniería y Construcción SpA

in accordance with the standard of CIM and Canadian National

Instrument 43-101, with an effective date of 6 April 2024 by Mr

Nicolás Fuster, who is a Qualified Person under the Canadian

National Instrument 43-101.(3) NCL believes that

the resource estimates shown in the table above meets the CIM

standards for a resource estimate based on CIM Standards of Mineral

Resources and Reserves Definitions and Guidelines adopted by the

CIM council 10 May, 2014 |

The updated mineral resource has been calculated

using an assumption of a 0.7m minimum mining width and using a

cut-off of 3.16 g/t. The mine plan uses a 1.0m minimum mining

width. By comparison the previous estimation undertaken in 2019 by

GRE reported an Indicated Resource of 195,000oz and an Inferred

Resource of 346,000oz. However, this was calculated using at 2g/t

Au COG and an average 0.7m mining width. Following 2 years of

operational activity, the Company prefers to apply a 1.0m minimum

mining width, which is more dilutive, but feels is appropriate.

Mineral Resources Considered in the

Updated PEA

The Updated PEA and the new technical report

that NCL will produce supersedes the previous Preliminary Economic

Assessment produced by GRE dated 19 October 2019.

Empirical findings following two years of

underground operations at Coringa have led the company to consider

more dilution in the mining operation. The GRE PEA did not have the

benefit of these findings and used an average resource minimum

mining width of 0.7m. This meant some resources had widths less

than 0.7m. NCL have taken the view that a 0.7m minimum mining width

should be applied, which means resources with a width less than 0.7

metre are diluted to a 0.7m width. Furthermore, resources included

in the PEA have been further diluted at 0.0 g/t gold grade to a

mineable width of 1.0m.

The following table is provided to illustrate

the utilisation of the NI 43-101 compliant mineral resources within

the mine plan assumed in the Updated PEA and used to derive the

average mined grade. Of the total 2,233kt of ROM feed to be

delivered to the crushing plant 74kt (3%) will be derived from the

Measured Resources, 274kt (12%) will be derived from the Indicated

Resources and 915kt (41%) will be derived from the Inferred

Resource. An additional 969kt (43%) of dilution at a grade of 0g/t

is also included.

Table 4 – Mineral Resources Considered

in the Updated PEA

|

Classification |

Quantity |

Grade |

Contained Metal |

|

|

Gold |

Gold |

|

000 't |

g/t |

000' oz |

|

Measured Resources |

74 |

15.32 |

37 |

|

Indicated Resources |

274 |

12.31 |

109 |

|

Inferred Resources |

915 |

8.19 |

241 |

|

Dilution |

969 |

- |

0 |

|

Measured & Indicated Resources |

2,233 |

5.38 |

386 |

Comparison of Updated PEA to GRE

PEA

The Updated PEA envisions a more economically

robust mine plan than the GRE PEA forecasting a post-tax NPV10% of

$145M vs $31M.

Table 5 – Comparison of Updated PEA to

GRE PEA

|

|

|

Updated PEA2024 |

GRE PEA2019 |

$ Change |

% Change |

|

Gold Price |

US$/oz |

$2,100 |

$1,275 |

$825 |

65% |

|

Pre-tax NPV5% |

US$M |

$230 |

$56 |

$175 |

313% |

|

Pre-tax NPV10% |

US$M |

$181 |

$37 |

$144 |

387% |

|

Post-tax NPV5% |

US$M |

$184 |

$47 |

$137 |

290% |

|

Post-tax NPV10% |

US$M |

$145 |

$31 |

$114 |

371% |

|

Project Post-tax Cash Flow |

US$M |

$242 |

$72 |

$171 |

238% |

|

Average Annual Free Cash Flow |

US$M |

$19 |

$12 |

$7 |

62% |

|

Average Gross Revenue |

US$M |

$56 |

$43 |

$12 |

29% |

|

Total Gold Production (Recovered) |

Ounces |

363,108 |

288,046 |

75,062 |

26% |

|

Mine Life |

Years |

11 |

9 |

2 |

22% |

Qualified Persons and Quality

Control

The scientific and technical information (“the

Technical Information”) contained in this news release pertaining

to the Coringa gold project has been reviewed and approved by the

following qualified persons under National Instrument 43-101 –

Standards of Disclosure for Mineral Projects ("NI 43-101") in

accordance with the rules of the Canadian Institute of Mining,

Metallurgy and Petroleum ("CIM"), which is an internationally

recognised standard pursuant to the AIM Rules.

- Mr. Carlos Guzmán, RM CMC, FAusIMM,

Principal/Project Director, NCL

- Mr. Gustavo Tapia, RM CMC,

Metallurgical and Process Consultant, GT Metallurgy

- Mr. Nicolás Fuster, RM CMC,

MAusIMM, Geologist

The Technical Information is extracted from

information that has been compiled by Mr Guzmán, Mr Tapia and

Mr Fuster who have carried out the assignment on behalf of the

firm NCL Ingeniería y Construcción SpA (“NCL”). Mr Guzmán, Mr Tapia

and Mr Fuster are each familiar with NI 43-101 and, by reason of

education, experience and professional registration, fulfil the

requirements of a Qualified Person as defined in NI 43-101 and for

the purposes of the AIM Rules. Mr Guzmán, Mr Tapia and Mr Fuster

are responsible for the preparation of the Preliminary Economic

Assessment. Mr Guzmán, Mr Tapia and Mr Fuster have all consented to

the publication of the Preliminary Economic Assessment and Mineral

Resources estimate and the inclusion of the information contained

in this announcement in the form and context in which it

appears.

The PEA study was completed by NCL who is

responsible for the preparation of the overall study including mine

design, mine capital cost, mine operating cost, costing for the

process plant replacement, refurbishment and operating,

construction and operating costs for the tailings management

facilities and economic models.

NCL is not an associate or affiliate neither of

Serabi, nor of any associated company, or any joint-venture

company. NCL’s fees for this Technical Report are not dependent in

whole or in part on any prior or future engagement or understanding

resulting from the conclusions of this report. These fees are in

accordance with standard industry fees for work of this nature, and

NCL’s previously provided estimates are based solely on the

approximate time needed to assess the various data and reach

appropriate conclusions. This report is based on information known

to NCL as of 3 October 2024.

The information contained within this

announcement is deemed by the Company to constitute inside

information as stipulated under the Market Abuse Regulations (EU)

No. 596/2014 as it forms part of UK Domestic Law by virtue of the

European Union (Withdrawal) Act 2018.

The person who arranged for the release of this

announcement on behalf of the Company was Andrew Khov, Vice

President, Investor Relations & Business Development.

About Serabi Gold plcSerabi Gold plc is a gold

exploration, development and production company focused on the

prolific Tapajós region in Para State, northern Brazil. The Company

has consistently produced 30,000 to 40,000 ounces per year with the

Palito Complex and is planning to double production in the coming

years with the construction of the Coringa Gold project. Serabi

Gold plc recently made a copper-gold porphyry discovery on its

extensive exploration licence. The Company is headquartered in the

United Kingdom with a secondary office in Toronto, Ontario,

Canada.

Enquiries

SERABI GOLD plcMichael

Hodgson t

+44 (0)20 7246 6830Chief

Executive m

+44 (0)7799 473621

Clive

Line t

+44 (0)20 7246 6830Finance

Director m

+44 (0)7710 151692

Andrew Khov

m

+1 647 885 4874Vice President, Investor Relations & Business

Development e

contact@serabigold.com

www.serabigold.com

BEAUMONT CORNISH LimitedNominated

Adviser & Financial AdviserRoland Cornish / Michael

Cornish t

+44 (0)20 7628 3396

PEEL HUNT LLPJoint UK

BrokerRoss

Allister t

+44 (0)20 7418 9000

TAMESIS PARTNERS LLPJoint UK

BrokerCharlie Bendon/ Richard

Greenfield t

+44 (0)20 3882 2868

CAMARCOFinancial PR -

EuropeGordon Poole / Emily

Hall t

+44 (0)20 3757 4980

HARBOR ACCESS Financial PR – North

AmericaJonathan Patterson / Lisa

Micali t

+1 475 477 9404

Copies of this announcement are available from

the Company's website at www.serabigold.com.

See

www.serabigold.com for more information

and follow us on twitter @Serabi_Gold

GLOSSARY OF TERMS

The following is a glossary of technical

terms:

|

“actinolite” |

amphibole silicate mineral commonly found in metamorphic rocks,

including those surrounding cooled intrusive igneous rocks |

|

“Ag” |

means silver. |

|

“alkalic porphyry” |

A class of copper-porphyry mineral deposits characterised by

disseminated mineralisation within and immediately adjacent to

silica-saturated to silica-undersaturated alkalic intrusive centres

and being copper/gold/molybdenum-rich. |

|

“albite” |

is a plagioclase feldspar mineral |

|

“aplite” |

An intrusive igneous rock in which the mineral composition is the

same as granite, but in which the grains are much finer |

|

“argillic alteration” |

is hydrothermal alteration of wall rock which introduces clay

minerals including kaolinite, smectite and illite |

|

“AISC” |

means All-In Sustaining Cost – a non IFRS performance measurement

established by the World Gold Council |

|

“ANM” |

means the Agencia Nacional de Mineral. |

|

“Au” |

means gold. |

|

“assay” |

in economic geology, means to analyse the proportions of metal in a

rock or overburden sample; to test an ore or mineral for

composition, purity, weight or other properties of commercial

interest. |

|

“biotite” |

A phyllosilicate mineral composed of a silicate of iron,

magnesium, potassium, and aluminum found in crystalline rocks and

as an alteration mineral. |

|

“breccia” |

a rock composed of large angular broken fragments of minerals or

rocks cemented together by a fine-grained matrix |

|

“brecciation” |

Describes the process where large angular broken fragments of

minerals or rocks become cemented together by a fine-grained

matrix. |

|

“CIM” |

means the Canadian Institute of Mining, Metallurgy and

Petroleum. |

|

“CIP” or “Carbon in Pulp” |

means a process used in gold extraction by addition of

cyanide. |

|

“chalcopyrite” |

is a sulphide of copper and iron. |

|

“copper porphyry” |

copper ore body formed from hydrothermal fluids. These fluids will

be predated by or associated with are vertical dykes of porphry

intrusive rocks |

|

“Cu” |

means copper. |

|

“cut-off grade” |

the lowest grade of mineralised material that qualifies as ore in a

given deposit; rock of the lowest assay included in an ore

estimate. |

|

“dacite porphyry intrusive” |

a silica-rich igneous rock with larger phenocrysts (crystals)

within a fine-grained matrix |

|

“deposit” |

is a mineralised body which has been physically delineated by

sufficient drilling, trenching, and/or underground work, and found

to contain a sufficient average grade of metal or metals to warrant

further exploration and/or development expenditures; such a deposit

does not qualify as a commercially mineable orebody or as

containing ore reserves, until final legal, technical, and economic

factors have been resolved. |

|

“electromagnetics” |

is a geophysical technique tool measuring the magnetic field

generated by subjecting the sub-surface to electrical

currents. |

|

“epidote” |

is a calcium aluminium iron sorosilicate mineral |

|

“garimpo” |

is a local artisanal mining operation |

|

“garimpeiro” |

is a local artisanal miner. |

|

“geochemical” |

refers to geological information using measurements derived from

chemical analysis. |

|

“geophysical” |

refers to geological information using measurements derived from

the use of magnetic and electrical readings. |

|

“geophysical techniques” |

include the exploration of an area by exploiting differences in

physical properties of different rock types. Geophysical methods

include seismic, magnetic, gravity, induced polarisation and other

techniques; geophysical surveys can be undertaken from the ground

or from the air. |

|

“gold equivalent” |

refers to quantities of materials other than gold stated in units

of gold by reference to relative product values at prevailing

market prices. |

|

“gossan” |

is an iron-bearing weathered product that overlies a sulphide

deposit. |

|

“grade” |

is the concentration of mineral within the host rock typically

quoted as grams per tonne (g/t), parts per million (ppm) or parts

per billion (ppb). |

|

“g/t” |

means grams per tonne. |

|

“granodiorite” |

is an igneous intrusive rock like granite. |

|

“hectare” or a “ha” |

is a unit of measurement equal to 10,000 square metres. |

|

“hematite” |

is a common iron oxide compound |

|

“igneous” |

is a rock that has solidified from molten material or magma. |

|

“indicated mineral resource” |

is that part of a mineral resource for which quantity, grade or

quality, densities, shape and physical characteristics can be

estimated with a level of confidence sufficient to allow the

appropriate application of technical and economic parameters, to

support mine planning and evaluation of the economic viability of

the deposit. The estimate is based on detailed and reliable

exploration and testing information gathered through appropriate

techniques from locations such as outcrops, trenches, pits,

workings and drill holes that are spaced closely enough for

geological and grade continuity to be reasonably assumed. |

|

“inferred mineral resource” |

is that part of a mineral resource for which quantity and grade or

quality can be estimated on the basis of geological evidence and

limited sampling and reasonably assumed, but not verified,

geological and grade continuity. The estimate is based on limited

information and sampling gathered through appropriate techniques

from locations such as outcrops, trenches, pits, workings and drill

holes. |

|

“IP” |

refers to induced polarisation, a geophysical technique whereby an

electric current is induced into the sub-surface and the

conductivity of the sub-surface is recorded. |

|

“intrusive” |

is a body of rock that invades older rocks. |

|

“lithocap” |

Lithocaps are subsurface, broadly stratabound alteration domains

that are laterally and vertically extensive. They form when acidic

magmatic-hydrothermal fluids react with wallrocks during ascent

towards the paleosurface. |

|

“measured mineral resource” |

is that part of a mineral resource for which quantity, grade or

quality, densities, shape, and physical characteristics are so well

established that they can be estimated with confidence sufficient

to allow the appropriate application of technical and economic

parameters, to support production planning and evaluation of the

economic viability of the deposit. The estimate is based on

detailed and reliable exploration, sampling and testing information

gathered through appropriate techniques from locations such as

outcrops, trenches, pits, workings and drill holes that are spaced

closely enough to confirm both geological and grade

continuity. |

|

“mineralisation” |

the concentration of metals and their chemical compounds within a

body of rock. |

|

“mineralised” |

refers to rock which contains minerals e.g. iron, copper,

gold. |

|

“mineral reserve” |

is the economically mineable part of a measured or indicated

mineral resource demonstrated by at least a preliminary feasibility

study. This study must include adequate information on mining,

processing, metallurgical, economic and other relevant factors that

demonstrate, at the time of reporting, that economic extraction can

be justified. A mineral reserve includes diluting materials and

allowances for losses that may occur when the material is

mined. |

|

“mineral resource” |

is a concentration or occurrence of diamonds, natural solid

inorganic material or natural fossilised organic material including

base and precious metals, coal, and industrial minerals in or on

the Earth’s crust in such form and quantity and of such a grade or

quality that it has reasonable prospects for economic extraction.

The location, quantity, grade, geological characteristics and

continuity of a mineral resource are known, estimated or

interpreted from specific geological evidence and knowledge. |

|

“Mo-Bi-As-Te-W-Sn” |

Molybdenum-Bismuth-Arsenic-Tellurium-Tungsten-Tin |

|

“magnetite” |

Magnetic mineral composed of iron oxide found in intrusive rocks

and as an alteration mineral. |

|

“monzodiorite” |

Is an intrusive rock formed by slow cooling of underground

magma. |

|

“monzogranite” |

a biotite rich granite, often part of the later-stage emplacement

of a larger granite body. |

|

“mt” |

means million tonnes. |

|

“NI 43-101” |

means Canadian Securities Administrators’ National Instrument

43-101 – Standards of Disclosure for Mineral Projects. |

|

“ore” |

means a metal or mineral or a combination of these of sufficient

value as to quality and quantity to enable it to be mined at a

profit. |

|

“oxides” |

are near surface bed-rock which has been weathered and oxidised by

long-term exposure to the effects of water and air. |

|

“paragenesis” |

Is a term used to describe the sequence on relative phases of

origination of igneous and metamorphic rocks and the deposition of

ore minerals and rock alteration. |

|

“phyllic alteration” |

is a hydrothermal alteration zone in a permeable rock that has been

affected by circulation of hydrothermal fluids |

|

“porphry” |

any of various granites or igneous rocks with coarse grained

crystals |

|

“ppm” |

means parts per million. |

|

“proterozoic” |

means the geological eon (period) 2.5 billion years ago to 541

million years ago |

|

“pyrite” |

an iron sulphide mineral |

|

“quartz-alunite ± kaolinite” |

Alunite is a hydroxylated aluminium potassium sulfate mineral. It

presence is typical in areas of advanced argillic alteration and

usually accompanied by the presence of quartz (a crystalline silica

mineral) and sometimes kaolinite.(a clay mineral). |

|

“saprolite” |

is a weathered or decomposed clay-rich rock. |

|

“scapolites” |

are a group of rock-forming silicate minerals composed of

aluminium, calcium, and sodium silicate with chlorine, carbonate

and sulfate |

|

“sulphide” |

refers to minerals consisting of a chemical combination of sulphur

with a metal. |

|

“tailings” |

are the residual waste material that it is produced by the

processing of mineralised rock. |

|

“tpd” |

means tonnes per day. |

|

“vein” |

is a generic term to describe an occurrence of mineralised rock

within an area of non-mineralised rock. |

|

“VTEM” |

refers to versa time domain electromagnetic, a particular variant

of time-domain electromagnetic geophysical survey to prospect for

conductive bodies below surface. |

|

“vuggy” |

a geological feature characterised by irregular cavities or holes

within a rock or mineral, often formed by the dissolution or

removal of minerals leaving behind empty spaces |

Assay ResultsAssay results reported within this

release include those provided by the Company's own on-site

laboratory facilities at Palito and have not yet been independently

verified. Serabi closely monitors the performance of its own

facility against results from independent laboratory analysis for

quality control purpose. As a matter of normal practice, the

Company sends duplicate samples derived from a variety of the

Company's activities to accredited laboratory facilities for

independent verification. Since mid-2019, over 10,000 exploration

drill core samples have been assayed at both the Palito laboratory

and certified external laboratory, in most cases the ALS laboratory

in Belo Horizonte, Brazil. When comparing significant assays with

grades exceeding 1 g/t gold, comparison between Palito versus

external results record an average over-estimation by the Palito

laboratory of 6.7% over this period. Based on the results of this

work, the Company's management are satisfied that the Company's own

facility shows sufficiently good correlation with independent

laboratory facilities for exploration drill samples. The Company

would expect that in the preparation of any future independent

Reserve/Resource statement undertaken in compliance with a

recognized standard, the independent authors of such a statement

would not use Palito assay results without sufficient duplicates

from an appropriately certificated laboratory.

Forward-looking statementsCertain statements in

this announcement are, or may be deemed to be, forward looking

statements. Forward looking statements are identified by their use

of terms and phrases such as ‘‘believe’’, ‘‘could’’, “should”

‘‘envisage’’, ‘‘estimate’’, ‘‘intend’’, ‘‘may’’, ‘‘plan’’, ‘‘will’’

or the negative of those, variations or comparable expressions,

including references to assumptions. These forward-looking

statements are not based on historical facts but rather on the

Directors’ current expectations and assumptions regarding the

Company’s future growth, results of operations, performance, future

capital and other expenditures (including the amount, nature and

sources of funding thereof), competitive advantages, business

prospects and opportunities. Such forward looking statements reflect

the Directors’ current beliefs and assumptions and are based on

information currently available to the Directors. Several factors

could cause actual results to differ materially from the results

discussed in the forward-looking statements including risks

associated with vulnerability to general economic and business

conditions, competition, environmental and other regulatory

changes, actions by governmental authorities, the availability of

capital markets, reliance on key personnel, uninsured and

underinsured losses and other factors, many of which are beyond the

control of the Company. Although any forward-looking statements

contained in this announcement are based upon what the Directors

believe to be reasonable assumptions, the Company cannot assure

investors that actual results will be consistent with such forward

looking statements.

Qualified Persons StatementThe scientific and

technical information contained within this announcement has been

reviewed and approved by Michael Hodgson, a Director of the

Company. Mr Hodgson is an Economic Geologist by training with over

30 years' experience in the mining industry. He holds a BSc (Hons)

Geology, University of London, a MSc Mining Geology, University of

Leicester and is a Fellow of the Institute of Materials, Minerals

and Mining and a Chartered Engineer of the Engineering Council of

UK, recognizing him as both a Qualified Person for the purposes of

Canadian National Instrument 43-101 and by the AIM Guidance Note on

Mining and Oil & Gas Companies dated June 2009.

NoticeBeaumont Cornish Limited, which is

authorised and regulated in the United Kingdom by the Financial

Conduct Authority, is acting as nominated adviser to the Company in

relation to the matters referred herein. Beaumont Cornish Limited

is acting exclusively for the Company and for no one else in

relation to the matters described in this announcement and is not

advising any other person and accordingly will not be responsible

to anyone other than the Company for providing the protections

afforded to clients of Beaumont Cornish Limited, or for providing

advice in relation to the contents of this announcement or any

matter referred to in it.

Neither the Toronto Stock Exchange, nor any

other securities regulatory authority, has approved or disapproved

of the contents of this news release

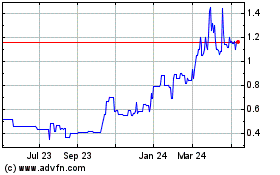

Serabi Gold (TSX:SBI)

Historical Stock Chart

From Dec 2024 to Jan 2025

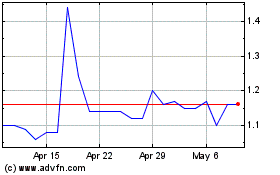

Serabi Gold (TSX:SBI)

Historical Stock Chart

From Jan 2024 to Jan 2025