Serabi exceeds production guidance for 2022

January 17 2023 - 3:15AM

For immediate release

17 January

2023

Serabi Gold

plc(“Serabi” or

the “Company”)

Serabi exceeds production guidance for

2022

Serabi Gold plc (AIM:SRB, TSX:SBI), the Brazilian-focused gold

mining and development company, is pleased to report operational

results for the final quarter of 2022 and provide a review of its

development and exploration activities.

HIGHLIGHTS

• Fourth quarter gold

production totalled 7,798 ounces, taking annual production to

31,819 ounces, exceeding the annual production guidance of 30,000

ounces. • The Coringa mine development

continued to progress well, with 1,791 metres of development

completed during the year, approximately 1,000 metres of which was

in ore. The main ramp has now reached the 290mRL, which is under

development.

Mike Hodgson, CEO of Serabi,

commented:

“The company has ended the year with a very

satisfactory 7,800 ounces produced for this final quarter, which

sees the total gold produced for the year just short of 32,000

ounces, comfortably ahead of the revised 2022 guidance of 30,000

ounces. The fourth quarter has been somewhat transitional as we

have been moving some mining crews and fleet from the Sao Chico

orebody over to Coringa. To date, the Coringa deposit has been in a

development phase and as we begin 2023 will we see the first

production from stoping, and this will result in an increase in the

level of Coringa ore being delivered to the Palito plant. It was

therefore particularly pleasing to maintain steady mine output from

Palito Operations, even with reduced levels of manpower and

equipment.

“It is an exciting time for the Company, and we

look forward to 2023 being a year of improving production. Having

‘flat-lined’ for the past 2 years, 2023 should see Coringa really

begin to contribute as well as improved output from Palito

operations. The rate of the Coringa production growth remains

subject to the on-going licencing process. Over the year, we have

drilled over 17,000 metres of underground exploration drilling in

and around the Palito mine, stepping out and down on known veins.

As a result, it is our intention to publish an updated Independent

NI 43-101 Mineral Reserve and Mineral Resource Estimate during the

first half of the year. In addition, we will be keeping

stakeholders updated on progress with the planned greenfield

exploration programmes following the discovery of the Matilda

copper-molybdenum porphyry during 2022.”

OPERATIONAL RESULTS

Total production for the fourth quarter of 2022

was 7,798 ounces, bringing total production for the year to 31,819

ounces, which includes a fourth quarter and annual contribution

from Coringa of 443 and 1,013 ounces respectively.

Total ore mined from the Palito Complex during

the fourth quarter was 38,293 tonnes at 6.20 grammes per tonne

(“g/t”) compared to 43,180 tonnes at 6.28 g/t of gold for the third

quarter of 2022. Total ore mined for the year was 163,506 tonnes at

6.15 g/t, compared with 170,261 tonnes at 6.59 g/t for 2021.

Development ore produced from Coringa generated a total of 7,654

tonnes at 4.78 g/t in the year.

42,692 tonnes of run of mine (“ROM”) ore were

processed through the plant during the final quarter, with an

average grade of 6.05 g/t of gold, compared with 44,867 tonnes at

6.34 g/t in the third quarter. 172,404 tonnes of ROM at 6.14 g/t

were processed for the year, which included 5,729 tonnes of Coringa

ore with a grade of 5.68 g/t.

A total of 2,245 metres of horizontal

development has been completed at Palito during the final quarter

of which 1,233 metres was ore development. The balance is the ramp,

cross cuts and stope preparation development. Horizontal

development at Coringa totalled 645 metres during the fourth

quarter.

|

SUMMARY PRODUCTION STATISTICS FOR 2022 AND

2021 |

|

|

|

Qtr 1 |

Qtr 2 |

Qtr 3 |

Qtr 4 |

Full Year |

Qtr 1 |

Qtr 2 |

Qtr 3 |

Qtr 4 |

Full Year |

|

2022 |

2022 |

2022 |

2022 |

2022 |

2021 |

2021 |

2021 |

2021 |

2021 |

|

Group |

|

|

|

|

|

|

|

|

|

|

|

| Gold

production (1)(2) |

Ounces |

7,062 |

8,418 |

8,542 |

7,798 |

31,819 |

8,087 |

9,048 |

9,035 |

7,678 |

33,848 |

| Mined

ore |

Tonnes |

40,606 |

44,008 |

46,863 |

42,264 |

173,741 |

40,371 |

43,051 |

42,240 |

44,599 |

170,261 |

|

|

Gold grade (g/t) |

5.95 |

6.26 |

6.22 |

6.01 |

6.14 |

6.27 |

7.12 |

7.18 |

5.81 |

6.59 |

| Milled

ore |

Tonnes |

41,357 |

43,488 |

44,867 |

42,692 |

172,404 |

41,462 |

43,679 |

41,995 |

43,663 |

170,799 |

|

|

Gold

grade (g/t) |

5.72 |

6.43 |

6.34 |

6.05 |

6.14 |

6.27 |

7.09 |

7.20 |

5.90 |

6.61 |

|

Palito Complex |

|

|

|

|

|

|

|

|

|

|

|

| Gold

production (1)(2) |

Ounces |

7,062 |

8,418 |

7,972 |

7,355 |

30,807 |

8,087 |

9,048 |

9,035 |

7,678 |

33,848 |

| Mined

ore |

Tonnes |

40,606 |

44,008 |

43,180 |

38,293 |

163,506 |

40,371 |

43,051 |

42,240 |

44,599 |

170,261 |

|

|

Gold grade (g/t) |

5.84 |

6.26 |

6.28 |

6.20 |

6.15 |

6.27 |

7.12 |

7.18 |

5.81 |

6.59 |

| Milled

ore |

Tonnes |

41,357 |

43,488 |

42,257 |

39,573 |

165,502 |

41,462 |

43,679 |

41,995 |

43,663 |

170,799 |

|

|

Gold grade (g/t) |

5.72 |

6.43 |

6.30 |

6.17 |

6.14 |

6.27 |

7.09 |

7.20 |

5.90 |

6.61 |

|

Horizontal development |

Metres |

2,938 |

3,353 |

2,458 |

2,245 |

10,994 |

3,573 |

2,961 |

2,842 |

3,318 |

12,694 |

|

Coringa |

|

|

|

|

|

|

|

|

|

|

|

| Gold

production (1)(2) |

Ounces |

|

|

570 |

443 |

1,013 |

|

|

|

|

|

| Mined

ore |

Tonnes |

|

|

3,683 |

3,971 |

7,654 |

|

|

|

|

|

|

|

Gold grade (g/t) |

|

|

5.46 |

4.15 |

4.78 |

|

|

|

|

|

| Milled

ore |

Tonnes |

|

|

2,610 |

3,119 |

5,729 |

|

|

|

|

|

|

|

Gold grade (g/t) |

|

|

7.00 |

4.58 |

5.68 |

|

|

|

|

|

|

Horizontal development |

Metres |

212 |

302 |

632 |

645 |

1,791 |

|

|

|

|

|

- The table may not

sum due to rounding.

- Production numbers are subject to

change pending final assay analysis from refineries.

Mine performance in the final quarter of 2022 was impacted by

reduced output from the Sao Chico orebody reflecting the decision

taken mid-year to move some crews and fleet to Coringa in readiness

for increased Coringa production in 2023. Whilst planned output

from the Palito orebody was increased to offset the Sao Chico

output, total mined tonnage from Palito Operations nonetheless

reduced by 4,900 tonnes for the quarter.The extensive underground

exploration drilling programme of 2022 has seen over 17,000 metres

of drilling completed. Large step outs have been tested on the

veins of Chico de Santa, G3 Central, G3 North and Senna at depth.

The plan has been to drill at least 250 metre depth extensions

below all sectors, as well as strike extensions where access has

been possible. As a result, a significant effort has been made

during the second part of 2022 to compile these results and update

the drill hole database and the geological models for the ore zones

at Palito and Sao Chico. The company is working with consultant NCL

who will prepare a new NI 43-101 Technical Report comprising

updated Mineral Resource and Mineral Reserve estimates during the

first half of 2023. FINANCE UPDATE Cash balances

at the end of December 2022 were US$7.2 million with a further cash

receipt of US$2.2 million being received in early January for a

sale of copper/gold concentrate completed in December. This

compares with a cash balance of US$10.3 million at the end of

September 2022. 2023 PRODUCTION GUIDANCE The

Company forecasts combined production from the Palito Complex

operations and Coringa Project of between 33,500 and 35,000 ounces

of gold during 2023. The information contained within this

announcement is deemed by the Company to constitute inside

information as stipulated under the Market Abuse Regulations (EU)

No. 596/2014 as it forms part of UK Domestic Law by virtue of the

European Union (Withdrawal) Act 2018. The person who arranged for

the release of this announcement on behalf of the Company was Clive

Line, Director. Enquiries: Serabi Gold plc Michael

Hodgson Tel: +44 (0)20 7246 6830 Chief Executive Mobile: +44

(0)7799 473621 Clive Line Tel: +44 (0)20 7246 6830 Finance Director

Mobile: +44 (0)7710 151692 Email: contact@serabigold.com Website:

www.serabigold.com Beaumont Cornish LimitedNominated Adviser and

Financial Adviser Roland Cornish / Michael Cornish Tel: +44 (0)20

7628 3396 Peel Hunt LLPJoint UK Broker Ross Allister / Alexander

Allen Tel: +44 (0)20 7418 9000 Tamesis Partners LLPJoint UK Broker

Charlie Bendon / Richard Greenfield Tel: +44 (0)20 3882 2868

Camarco Financial PR

Gordon Poole / Emily Hall Tel: +44(0) 20 3757 4980 Copies of this

announcement are available from the Company's website at

www.serabigold.com. Neither the Toronto Stock Exchange, nor any

other securities regulatory authority, has approved or disapproved

of the contents of this announcement. See

www.serabigold.com for more information

and follow us on twitter @Serabi_GoldGLOSSARY OF

TERMS “Ag” means silver.

“Au” means gold. “assay” in

economic geology, means to analyse the proportions of metal in a

rock or overburden sample; to test an ore or mineral for

composition, purity, weight or other properties of commercial

interest. “CIM” means the Canadian Institute of

Mining, Metallurgy and Petroleum. “chalcopyrite”

is a sulphide of copper and iron. “Cu” means

copper. “cut-off grade” the lowest grade of

mineralised material that qualifies as ore in a given deposit; rock

of the lowest assay included in an ore estimate.

“dacite porphyry

intrusive” a silica-rich igneous rock with larger

phenocrysts (crystals) within a fine-grained matrix

“deposit” is a mineralised body which has been

physically delineated by sufficient drilling, trenching, and/or

underground work, and found to contain a sufficient average grade

of metal or metals to warrant further exploration and/or

development expenditures; such a deposit does not qualify as a

commercially mineable ore body or as containing ore reserves, until

final legal, technical, and economic factors have been resolved.

“electromagnetics” is a geophysical technique tool

measuring the magnetic field generated by subjecting the

sub-surface to electrical currents. “garimpo” is a

local artisanal mining operation “garimpeiro” is a

local artisanal miner. “geochemical” refers to

geological information using measurements derived from chemical

analysis. “geophysical” refers to geological

information using measurements derived from the use of magnetic and

electrical readings. “geophysical

techniques” include the exploration of an area by

exploiting differences in physical properties of different rock

types. Geophysical methods include seismic, magnetic, gravity,

induced polarisation and other techniques; geophysical surveys can

be undertaken from the ground or from the air.

“gossan” is an iron-bearing weathered product that

overlies a sulphide deposit. “grade” is the

concentration of mineral within the host rock typically quoted as

grams per tonne (g/t), parts per million (ppm) or parts per billion

(ppb). “g/t” means grams per tonne.

“granodiorite” is an igneous intrusive rock

similar to granite. “hectare” or a

“ha” is a unit of measurement equal to 10,000

square metres. “igneous” is a rock that has

solidified from molten material or magma. “IP”

refers to induced polarisation, a geophysical technique whereby an

electric current is induced into the sub-surface and the

conductivity of the sub-surface is recorded.

“intrusive” is a body of rock that invades older

rocks. "Indicated Mineral Resource is that part of

a Mineral Resource for which quantity, grade or quality, densities,

shape and physical characteristics can be estimated with a level of

confidence sufficient to allow the appropriate application of

technical and economic parameters, to support mine planning and

evaluation of the economic viability of the deposit. The estimate

is based on detailed and reliable exploration and testing

information gathered through appropriate techniques from locations

such as outcrops, trenches, pits, workings and drill holes that are

spaced closely enough for geological and grade continuity to be

reasonably assumed. "Inferred Mineral Resource” is

that part of a Mineral Resource for which quantity and grade or

quality can be estimated on the basis of geological evidence and

limited sampling and reasonably assumed, but not verified,

geological and grade continuity. The estimate is based on limited

information and sampling gathered through appropriate techniques

from locations such as outcrops, trenches, pits, workings and drill

holes. “Inferred Mineral Resource” ‟ is that part

of a Mineral Resource for which quantity and grade or quality can

be estimated on the basis of geological evidence and limited

sampling and reasonably assumed, but not verified, geological and

grade continuity. The estimate is based on limited information and

sampling gathered through appropriate techniques from locations

such as outcrops, trenches, pits, workings and drill holes.

“mineralisation” the concentration of metals and

their chemical compounds within a body of rock.

“mineralised” refers to rock which contains

minerals e.g. iron, copper, gold. "Mineral

Resource” is a concentration or

occurrence of diamonds, natural solid inorganic material, or

natural solid fossilized organic material including base and

precious metals, coal, and industrial minerals in or on the Earth's

crust in such form and quantity and of such a grade or quality that

it has reasonable prospects for economic extraction. The location,

quantity, grade, geological characteristics and continuity of a

Mineral Resource are known, estimated or interpreted from specific

geological evidence and knowledge. “Mineral

Reserve” is the economically mineable part of a Measured

or Indicated Mineral Resource demonstrated by at least a

Preliminary Feasibility Study. This Study must include adequate

information on mining, processing, metallurgical, economic and

other relevant factors that demonstrate, at the time of reporting,

that economic extraction can be justified. A Mineral Reserve

includes diluting materials and allowances for losses that may

occur when the material is mine

“Mo-Bi-As-Te-W-Sn”

Molybdenum-Bismuth-Arsenic-Tellurium-Tungsten-Tin

“monzogranite” a biotite rich granite, often part

of the later-stage emplacement of a larger granite body.

“mt” means million tonnes. “ore”

means a metal or mineral or a combination of these of sufficient

value as to quality and quantity to enable it to be mined at a

profit. “oxides” are near surface bed-rock which

has been weathered and oxidised by long term exposure to the

effects of water and air. “ppm” means parts per

million. “Probable Mineral Reserve” is the

economically mineable part of an Indicated and, in some

circumstances, a Measured Mineral Resource demonstrated by at least

a Preliminary Feasibility Study. This Study must include adequate

information on mining, processing, metallurgical, economic, and

other relevant factors that demonstrate, at the time of reporting,

that economic extraction can be justified. “Proven Mineral

Reserve” is the economically mineable part of a Measured

Mineral Resource. A Proven Mineral Reserve implies a high degree of

confidence in the Modifying Factors “saprolite” is

a weathered or decomposed clay-rich rock.

“sulphide” refers to minerals consisting of a

chemical combination of sulphur with a metal.

“vein” is a generic term to describe an occurrence

of mineralised rock within an area of non-mineralised rock.

“VTEM” refers to versa time domain

electromagnetic, a particular variant of time-domain

electromagnetic geophysical survey to prospect for conductive

bodies below surface. Assay ResultsAssay results

reported within this release include those provided by the

Company's own on-site laboratory facilities at Palito and these

will not have been independently verified. Serabi closely monitors

the performance of its own facility against results from

independent laboratory analysis for quality control purpose. As a

matter of normal practice, the Company sends duplicate samples

derived from a variety of the Company's activities to accredited

laboratory facilities for independent verification. Since mid-2019,

over 10,000 exploration drill core samples have been assayed at

both the Palito laboratory and certified external laboratory, in

most cases the ALS laboratory in Belo Horizonte, Brazil. When

comparing significant assays with grades exceeding 1 g/t gold,

comparison between Palito versus external results record an average

over-estimation by the Palito laboratory of 6.7% over this period.

Based on the results of this work, the Company's management are

satisfied that the Company's own facility shows sufficiently good

correlation with independent laboratory facilities for exploration

drill samples. The Company would expect that in the preparation of

any future independent Reserve/Resource statement undertaken in

compliance with a recognised standard, the independent authors of

such a statement would not use Palito assay Qualified

Persons StatementThe scientific and technical information

contained within this announcement has been reviewed and approved

by Michael Hodgson, a Director of the Company. Mr Hodgson is an

Economic Geologist by training with over 26 years' experience in

the mining industry. He holds a BSc (Hons) Geology, University of

London, a MSc Mining Geology, University of Leicester and is a

Fellow of the Institute of Materials, Minerals and Mining and a

Chartered Engineer of the Engineering Council of UK, recognising

him as both a Qualified Person for the purposes of Canadian

National Instrument 43-101 and by the AIM Guidance Note on Mining

and Oil & Gas Companies dated June 2009. Forward

Looking StatementsCertain statements in this announcement

are, or may be deemed to be, forward looking statements. Forward

looking statements are identified by their use of terms and phrases

such as ‘‘believe’’, ‘‘could’’, “should” ‘‘envisage’’,

‘‘estimate’’, ‘‘intend’’, ‘‘may’’, ‘‘plan’’, ‘‘will’’ or the

negative of those, variations, or comparable expressions, including

references to assumptions. These forward-looking statements are not

based on historical facts but rather on the Directors’ current

expectations and assumptions regarding the Company’s future growth,

results of operations, performance, future capital and other

expenditures (including the amount, nature and sources of funding

thereof), competitive advantages, business prospects and

opportunities. Such forward looking statements reflect the

Directors’ current beliefs and assumptions and are based on

information currently available to the Directors. A number of

factors could cause actual results to differ materially from the

results discussed in the forward-looking statements including risks

associated with vulnerability to general economic and business

conditions, competition, environmental and other regulatory

changes, actions by governmental authorities, the availability of

capital markets, reliance on key personnel, uninsured and

underinsured losses and other factors, many of which are beyond the

control of the Company. Although any forward-looking statements

contained in this announcement are based upon what the Directors

believe to be reasonable assumptions, the Company cannot assure

investors that actual results will be consistent with such forward

looking statements. ENDS

- Q4 2022 Operational Update v7

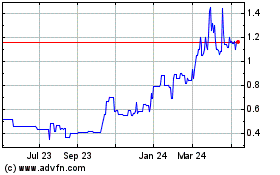

Serabi Gold (TSX:SBI)

Historical Stock Chart

From Dec 2024 to Jan 2025

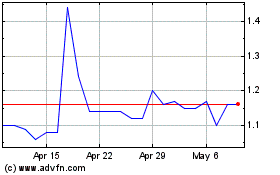

Serabi Gold (TSX:SBI)

Historical Stock Chart

From Jan 2024 to Jan 2025