Serabi Forms Exploration Alliance with Vale

Serabi Gold plc

(AIM:SRB,TSX:SBI) (“Serabi”), the

Brazilian-focused gold mining and development company,

is pleased to announce the signing of a

strategic exploration alliance (“Exploration Alliance”) with Vale

S.A., through its subsidiary Salobo Metais S.A.,

(both “Vale”) focused on its Matilda

prospect and other large regional targets in the Tapajos region of

Para, Brazil.

Highlights

- Exploration Alliance focused on the discovery of large-scale

copper projects within Serabi’s Palito Complex tenement area

- Vale represents an excellent partner being Brazilian based and

one of the world’s largest diversified mining companies

- Exploration Alliance structured over a number of phases:

- Phase 1:

Vale to sole fund up to US$5.0 million exploration programme.

- Phase 2:

Vale may elect to continue exploration activities and to sole fund

one or more selected copper projects to Pre-feasibility Study

(“PFS”) stage

- Phase 3:

Vale will have an option to, acquire a 75% shares of a legal entity

to be incorporated by Serabi (“JV Company”), . Immediately after

the incorporation of the JV Company, Serabi shall transfer to the

JV Company the copper project. Serabi shall sell 75% of the JV

Company ownership to Vale for US$5 million (“Exercise Price”). Vale

will continue to sole fund the JV by capital contributions to

completion of a Definitive Feasibility Study (“DFS”), while Serabi

retains a 25% interest.

- Phase 4:

Vale can acquire an additional 15% interest in the JV Company or a

further payment of the higher of US$5 million or 1.5% of the net

present value of the project, taking their interest to 90%. Serabi

then has a put option to sell their remaining 10% interest in the

JV Company for a further US$10 million and a 1.5% Net Smelter

Royalty (“NSR”)

- The JV

Company may acquire additional copper projects from Serabi, in

which case Serabi will be entitled to additional payments of the

higher of US$5 million or 1.5% of the net present value of the

project for each, when a DFS has been completed

Michael Hodgson CEO of Serabi

commented:

“Making the discovery of the Matilda porphyry

prospect in 2022 was a major milestone for Serabi. However,

bringing in a partner with the expertise and resources of Vale,

will enable us to properly evaluate Matilda and the other

significant targets within our tenement area, and move them forward

more quickly. The Exploration Alliance is focused on large scale

copper projects and allows Serabi to maintain its attention on its

gold exploration targets.

“Vale represents an excellent partner for Serabi

and we are delighted to be working with them to begin unlocking the

potential of the Tapajos Region.”

Key elements of the

Exploration Alliance

The Exploration Alliance is primarily focussed

on opportunities for the discovery of copper deposits within the

exploration tenements held by Serabi around the Palito and Sao

Chico mines (the “Palito Complex tenements”), which cover more than

61,000 hectares. This follows the discovery of Copper - Molybdenum

porphyry mineralisation at the Matilda prospect in July 2022 (see

news release 5 July 2022) and the identification of a number of

other high priority exploration targets.

PHASE 1 –

- Vale will fund

an exploration programme of up to US$5.0 million over the Palito

Complex tenements. Phase 1 is expected to last no more than 12

months and the budget is anticipated to be sufficient to finance up

to 15,000 meters of diamond drilling during that time.

PHASE 2 –

- Following on

from the results of Phase 1, and if Vale decides to continue

exploration activities, Vale will fund all further work to progress

one or more copper projects identified in the Palito Complex

tenements to the stage of a PFS.

- The Phase 2

programme is for a minimum of two years but may be extended (i)

annually up to five years, provided the average annual funding by

Vale over that period is US$2 million of more, or (ii) to ten

years, if funding by Vale during the first five years is US$20

million or more.

PHASE 3 –

- After completion

of a PFS, Vale may notify Serabi that it wishes to progress the

relevant copper project. In that case Vale will incorporate a JV

Company into which it will transfer the mineral rights relating to

that copper project. Vale will pay to Serabi US$5 million, for a

75% share of the JV Company. Vale may require the JV

Company to acquire further copper projects that have completed a

PFS, for further payments of US$5 million each, fully funded by

Vale.

- Phase 3 begins

for each project upon transfer of the relevant mineral rights to

the JV Company. During Phase 3, Vale will continue to fund all

activities required for the production of a DFS for each copper

project.

- The Phase 3

programme requires expenditures of at least US$3 million per annum

with dilution provisions if the minimum expenditures are not met.

Phase 3 for a specific copper project will come to an end upon the

completion of a DFS for that copper project.

PHASE 4 –

- At the end of

Phase 3, and if both parties wish to continue, each will be

required to fund their pro-rata share of the expenditures of the JV

Company. At the end of Phase 3, for 90 days from delivery of the

DFS, Vale has a call option to acquire from Serabi a further 15%

interest in the JV Company for a payment of the higher of US$5

million or 1.5% of the net present value of the project (using

consensus commodity prices and a pre-agreed discount rate of 11%).

Should Vale exercise its call option, Serabi has a put option to

require Vale to purchase from Serabi, its remaining 10% interest in

the JV Company for a further payment of US$10 million and the

issuance of a 1.5% net smelter royalty over all projects held by

the JV Company.

During Phases 1 and 2 Serabi is expected to be

the operator of the exploration programmes and will receive a 9%

fee of the total amount paid by Vale for managing these mineral

exploration activities.

Other Details of the

Agreement

Following the incorporation of the JV Company

some other copper projects may still be within the Phase 2 stage of

evaluation and Vale shall continue to be responsible for the

funding of these projects up to and including the completion of any

additional PFS (end of Phase 2) and DFS (end of Phase3). The JV

Company will have the option to acquire any additional copper

projects following satisfactory completion of the respective PFS by

paying Serabi a further US$5 million as the option exercise price.

The option exercise price payable by the JV Company will be funded

by Vale by a non-dilutive issue of equity in the JV Company. Vale

will continue to provide funding to the JV Company for all the

Phase 3 activities for that copper project and for the completion

of a DFS. Should Vale wish to continue with such additional copper

project, Vale will fund the payment to Serabi of the higher of US$5

million or 1.5% of the net present value of the project (using

consensus commodity prices and a discount rate of 11%).

in addition to all option payments, all Phase 2 and Phase 3

expenditures incurred by the JV Company will also be funded by Vale

with a non-dilutive issue of equity in the JV Company.

The Parties can elect, at any time, to exclude

specific areas from the Exploration Alliance and those areas will

revert to Serabi in full. If the Exploration Alliance has completed

a PFS on any potential copper project but such project is not

deemed to be a copper project, (considered to contain a resource of

more than 75,000 tons (seventy-five thousand tons) of contained

copper and with copper plus molybdenum value being greater than the

value of gold), Serabi shall be permitted to develop such a project

at its own cost, in which case, Vale shall have a matching right on

sales of the copper products that are generated from that project

for a period of 15 years from the date of first commercial

production.

During Phase 1 and Phase 2, the work programmes

will be overseen by a working committee, comprising 2

representatives from Valeand 2 representatives from Serabi. Vale

shall have a casting vote over all the decisions made by the

Working Committee. Upon the formation of a JV Company all decisions

will be delegated to the Board of Directors and management of the

JV Company.

The sum of all funding by Vale to Serabi

equivalent to the Mineral Exploration Expenses incurred for the

conduction of the Mineral Exploration during Phases 1 and 2 are

considered as the acquisition price of Vale’s Earn-in Option on

Phase 3.

Each of the parties has provided to the other,

representations and warranties as would be customary for a

transaction of this nature.

The information contained within this

announcement is deemed by the Company to constitute inside

information as stipulated under the Market Abuse Regulations (EU)

No. 596/2014 as it forms part of UK Domestic Law by virtue of the

European Union (Withdrawal) Act 2018.

The person who arranged for the release of this

announcement on behalf of the Company was Clive Line, Director.

Enquiries

SERABI GOLD plcMichael

Hodgson t

+44 (0)20 7246 6830Chief

Executive m

+44 (0)7799 473621

Clive

Line t

+44 (0)20 7246 6830Finance

Director m

+44 (0)7710 151692

e

contact@serabigold.com

www.serabigold.com

BEAUMONT CORNISH

LimitedNominated Adviser & Financial

AdviserRoland Cornish / Michael

Cornish t

+44 (0)20 7628 3396

PEEL HUNT LLPJoint UK

BrokerRoss

Allister t

+44 (0)20 7418 9000

TAMESIS PARTNERS LLPJoint

UK BrokerCharlie Bendon/ Richard

Greenfield t

+44 (0)20 3882 2868

CAMARCOFinancial PRGordon

Poole / Emily

Hall t

+44 (0)20 3757 4980

Copies of this announcement are available from

the Company's website at www.serabigold.com.

See

www.serabigold.com for more information

and follow us on twitter @Serabi_Gold

GLOSSARY OF TERMS

The following is a glossary of technical

terms:

|

“Ag” |

means silver. |

|

“Au” |

means gold. |

|

“assay” |

in economic geology, means to analyse the proportions of metal in a

rock or overburden sample; to test an ore or mineral for

composition, purity, weight or other properties of commercial

interest. |

|

“CIM” |

means the Canadian Institute of Mining, Metallurgy and

Petroleum. |

|

“chalcopyrite” |

is a sulphide of copper and iron. |

|

“Cu” |

means copper. |

|

“cut-off grade” |

the lowest grade of mineralised material that qualifies as ore in a

given deposit; rock of the lowest assay included in an ore

estimate. |

|

“dacite porphyry intrusive” |

a silica-rich igneous rock with larger phenocrysts (crystals)

within a fine-grained matrixi |

|

“deposit” |

is a mineralised body which has been physically delineated by

sufficient drilling, trenching, and/or underground work, and found

to contain a sufficient average grade of metal or metals to warrant

further exploration and/or development expenditures; such a deposit

does not qualify as a commercially mineable ore body or as

containing ore reserves, until final legal, technical, and economic

factors have been resolved. |

|

“electromagnetics” |

is a geophysical technique tool measuring the magnetic field

generated by subjecting the sub-surface to electrical

currents. |

|

“garimpo” |

is a local artisanal mining operation |

|

“garimpeiro” |

is a local artisanal miner. |

|

“geochemical” |

refers to geological information using measurements derived from

chemical analysis. |

|

“geophysical” |

refers to geological information using measurements derived from

the use of magnetic and electrical readings. |

|

“geophysical techniques” |

include the exploration of an area by exploiting differences in

physical properties of different rock types. Geophysical methods

include seismic, magnetic, gravity, induced polarisation and other

techniques; geophysical surveys can be undertaken from the ground

or from the air. |

|

“gossan” |

is an iron-bearing weathered product that overlies a sulphide

deposit. |

|

“grade” |

is the concentration of mineral within the host rock typically

quoted as grams per tonne (g/t), parts per million (ppm) or parts

per billion (ppb). |

|

“g/t” |

means grams per tonne. |

|

“granodiorite” |

is an igneous intrusive rock similar to granite. |

|

“hectare” or a “ha” |

is a unit of measurement equal to 10,000 square metres. |

|

“igneous” |

is a rock that has solidified from molten material or magma. |

|

“IP” |

refers to induced polarisation, a geophysical technique whereby an

electric current is induced into the sub-surface and the

conductivity of the sub-surface is recorded. |

|

“intrusive” |

is a body of rock that invades older rocks. |

|

“mineralisation” |

the concentration of metals and their chemical compounds within a

body of rock. |

|

“mineralised” |

refers to rock which contains minerals e.g. iron, copper,

gold. |

|

“Mo-Bi-As-Te-W-Sn” |

Molybdenum-Bismuth-Arsenic-Tellurium-Tungsten-Tin |

|

“monzogranite” |

a biotite rich granite, often part of the later-stage emplacement

of a larger granite body. |

|

“mt” |

means million tonnes. |

|

“ore” |

means a metal or mineral or a combination of these of sufficient

value as to quality and quantity to enable it to be mined at a

profit. |

|

“oxides” |

are near surface bed-rock which has been weathered and oxidised by

long term exposure to the effects of water and air. |

|

“ppm” |

means parts per million. |

|

“saprolite” |

is a weathered or decomposed clay-rich rock. |

|

“sulphide” |

refers to minerals consisting of a chemical combination of sulphur

with a metal. |

|

“vein” |

is a generic term to describe an occurrence of mineralised rock

within an area of non-mineralised rock. |

|

“VTEM” |

refers to versa time domain electromagnetic, a particular variant

of time-domain electromagnetic geophysical survey to prospect for

conductive bodies below surface. |

Assay ResultsAssay results reported within this

release include those provided by the Company's own on-site

laboratory facilities at Palito and have not yet been independently

verified. Serabi closely monitors the performance of its own

facility against results from independent laboratory analysis for

quality control purpose. As a matter of normal practice, the

Company sends duplicate samples derived from a variety of the

Company's activities to accredited laboratory facilities for

independent verification. Since mid-2019, over 10,000 exploration

drill core samples have been assayed at both the Palito laboratory

and certified external laboratory, in most cases the ALS laboratory

in Belo Horizonte, Brazil. When comparing significant assays with

grades exceeding 1 g/t gold, comparison between Palito versus

external results record an average over-estimation by the Palito

laboratory of 6.7% over this period. Based on the results of this

work, the Company's management are satisfied that the Company's own

facility shows sufficiently good correlation with independent

laboratory facilities for exploration drill samples. The Company

would expect that in the preparation of any future independent

Reserve/Resource statement undertaken in compliance with a

recognised standard, the independent authors of such a statement

would not use Palito assay results without sufficient duplicates

from an appropriately certificated laboratory.

Forward-looking statementsCertain statements in

this announcement are, or may be deemed to be, forward looking

statements. Forward looking statements are identified by their use

of terms and phrases such as ‘‘believe’’, ‘‘could’’, “should”

‘‘envisage’’, ‘‘estimate’’, ‘‘intend’’, ‘‘may’’, ‘‘plan’’, ‘‘will’’

or the negative of those, variations or comparable expressions,

including references to assumptions. These forward-looking

statements are not based on historical facts but rather on the

Directors’ current expectations and assumptions regarding the

Company’s future growth, results of operations, performance, future

capital and other expenditures (including the amount, nature and

sources of funding thereof), competitive advantages, business

prospects and opportunities. Such forward looking statements reflect

the Directors’ current beliefs and assumptions and are based on

information currently available to the Directors. A number of

factors could cause actual results to differ materially from the

results discussed in the forward-looking statements including risks

associated with vulnerability to general economic and business

conditions, competition, environmental and other regulatory

changes, actions by governmental authorities, the availability of

capital markets, reliance on key personnel, uninsured and

underinsured losses and other factors, many of which are beyond the

control of the Company. Although any forward-looking statements

contained in this announcement are based upon what the Directors

believe to be reasonable assumptions, the Company cannot assure

investors that actual results will be consistent with such forward

looking statements.

Qualified Persons StatementThe scientific and

technical information contained within this announcement has been

reviewed and approved by Michael Hodgson, a Director of the

Company. Mr Hodgson is an Economic Geologist by training with over

30 years' experience in the mining industry. He holds a BSc (Hons)

Geology, University of London, a MSc Mining Geology, University of

Leicester and is a Fellow of the Institute of Materials, Minerals

and Mining and a Chartered Engineer of the Engineering Council of

UK, recognizing him as both a Qualified Person for the purposes of

Canadian National Instrument 43-101 and by the AIM Guidance Note on

Mining and Oil & Gas Companies dated June 2009.

Neither the Toronto Stock Exchange, nor any other securities

regulatory authority, has approved or disapproved of the contents

of this news release

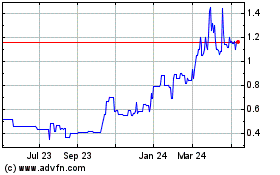

Serabi Gold (TSX:SBI)

Historical Stock Chart

From Dec 2024 to Jan 2025

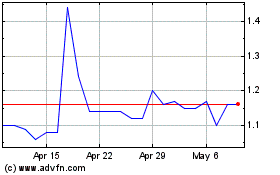

Serabi Gold (TSX:SBI)

Historical Stock Chart

From Jan 2024 to Jan 2025