Shopify Completes Offering of Class A Subordinate Voting Shares Including Full Exercise of Over-Allotment Option

September 19 2019 - 8:23AM

Business Wire

Shopify Inc. (NYSE:SHOP)(TSX:SHOP) (“Shopify”) today announced

that it has completed its previously announced offering of Class A

subordinate voting shares (the “Offering“) at a price to the public

of US$317.50 per share. An aggregate of 2,185,000 Class A

subordinate voting shares, which includes the full exercise of the

over-allotment option of 285,000 Class A subordinate voting shares,

were sold by Shopify for aggregate gross proceeds, before

underwriting discounts and offering costs, of US$693,737,500.

Shopify expects to use its net proceeds from the Offering to

strengthen its balance sheet, providing flexibility to fund its

growth strategies. Pending their use, Shopify intends to invest the

net proceeds from the Offering in short-term, investment-grade,

interest-bearing instruments or hold them as cash.

Credit Suisse and Morgan Stanley led the Offering.

The Class A subordinate voting shares were offered in each of

the provinces and territories of Canada, other than Québec, by way

of a prospectus supplement dated September 16, 2019 to Shopify’s

short form base shelf prospectus dated August 3, 2018. The Class A

subordinate voting shares were also offered in the United States

pursuant to a prospectus supplement to Shopify’s registration

statement on Form F-10 (the “Registration Statement”) filed with

the U.S. Securities and Exchange Commission (the “SEC“) under the

U.S./Canada Multijurisdictional Disclosure System. The prospectus

supplements, the base shelf prospectus and the Registration

Statement contain important detailed information about the

Offering. Copies of the Canadian prospectus supplements and the

base shelf prospectus can be found on SEDAR at www.sedar.com, and

copies of the U.S. prospectus supplements and the Registration

Statement can be found on EDGAR at www.sec.gov. Copies of such

offering documents may also be obtained from Credit Suisse

Securities (USA) LLC, Attention: Prospectus Department, Eleven

Madison Avenue, 3rd floor, New York, NY 10010, Telephone:

1-800-221-1037 or e-mail: usa.prospectus@credit-suisse.com; Credit Suisse

Securities (Canada), Inc., Attention: Olivier Demet, 1 First

Canadian Place, Suite 2900, Toronto, Ontario M5X 1C9, Telephone:

416-352-4749 or e-mail: Olivier.demet@credit-suisse.com; or Morgan Stanley

& Co. LLC, Attention: Prospectus Department, 180 Vaick Street,

2nd floor, New York, NY 10014.

No securities regulatory authority has either approved or

disapproved the contents of this news release. This news release

shall not constitute an offer to sell or the solicitation of an

offer to buy, nor shall there be any sale of these securities in

any province, state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to the registration or

qualification under the securities laws of any such province, state

or jurisdiction.

About Shopify

Shopify is the leading multi-channel commerce platform.

Merchants use Shopify to design, set up, and manage their stores

across multiple sales channels, including mobile, web, social

media, marketplaces, brick-and-mortar locations, and pop-up shops.

The platform also provides merchants with a powerful back-office

and a single view of their business, from payments to shipping. The

Shopify platform was engineered for reliability and scale, making

enterprise-level technology available to businesses of all sizes.

Headquartered in Ottawa, Canada, Shopify currently powers over

800,000 businesses in approximately 175 countries and is trusted by

brands such as Unilever, Kylie Cosmetics, Allbirds, MVMT, and many

more.

Forward-looking Statements

This press release contains forward-looking information and

forward-looking statements within the meaning of applicable

securities laws (“forward-looking statements“), including

statements with regard to Shopify’s proposed use of proceeds from

the Offering. Words such as “expects”, “continue”, “will”, “plans”,

“anticipates” and “intends” or similar expressions are intended to

identify forward-looking statements. These forward-looking

statements are subject to the inherent uncertainties in predicting

future results and conditions and no assurance can be given that

the proceeds of the offering will be used on the terms described.

Allocation of the proceeds of the Offering is subject to numerous

factors, many of which are beyond Shopify’s control, including,

without limitation, market conditions and the risk factors and

other matters set forth in Shopify’s filings with the SEC and the

securities commissions or similar securities regulatory authorities

in each of the provinces and territories of Canada. Shopify

undertakes no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as may be required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190919005488/en/

INVESTORS: Katie Keita Senior Director, Investor Relations

613-241-2828 (ext. 1024) IR@shopify.com

MEDIA: Julie Nicholson Director of Communications 416-238-6705

(ext. 302) press@shopify.com

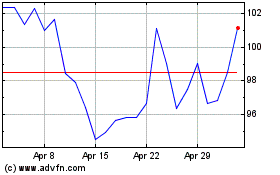

Shopify (TSX:SHOP)

Historical Stock Chart

From Dec 2024 to Jan 2025

Shopify (TSX:SHOP)

Historical Stock Chart

From Jan 2024 to Jan 2025