Stella-Jones Announces Private Offering of C$400 Million of 7-Year Senior Unsecured Notes

September 26 2024 - 4:25PM

Stella-Jones Inc. (TSX: SJ) (“Stella-Jones” or the “Company”)

announced today that it has priced an inaugural offering of

Canadian dollar denominated senior unsecured notes.

Stella-Jones will issue C$400 million aggregate

principal amount of senior unsecured notes due October 1st, 2031,

bearing interest at the rate of 4.312% per annum, payable

semi-annually until maturity (the “Notes”). The Company intends to

use the net proceeds from the offering to repay existing

indebtedness under its revolving credit facilities, and any balance

will be used for general corporate purposes.

The Notes are being offered in Canada through an

agency syndicate consisting of TD Securities Inc., CIBC World

Markets Inc. and RBC Dominion Securities Inc., as joint lead agents

and bookrunners, along with Merrill Lynch Canada Inc. and Scotia

Capital Inc., as co-managers. The offering is expected to close on

October 1st, 2024, subject to customary closing conditions.

The Notes will be unsecured obligations of

Stella-Jones, will rank equally and pari passu with the other

present and future unsecured and unsubordinated obligations of

Stella-Jones, and will be issued pursuant to a trust indenture, as

supplemented by a first supplemental indenture, each to be dated

the date of closing of the offering. Payment of the Notes will be

guaranteed on an unsecured basis by certain wholly-owned

subsidiaries of Stella-Jones. The Notes have been assigned a

provisional rating of “BBB”, with a stable trend, by DBRS

Limited.*

The Notes will be offered on a private placement

basis in each of the provinces of Canada in reliance upon

exemptions from the prospectus requirements of applicable

securities laws. The Notes have not been, and will not be,

registered under the Securities Act of 1933, as amended (the “U.S.

Securities Act”), or any state securities laws and may not be

offered or sold in the United States absent registration or an

applicable exemption from the registration requirements of the U.S.

Securities Act.

This press release shall not constitute an offer

to sell or a solicitation of an offer to buy any of the Notes in

the United States or any other jurisdiction where such offering or

sale would be unlawful.

* Credit ratings are not recommendations to

purchase, hold or sell such securities as such ratings are not a

comment upon the market price of the securities or their

suitability for a particular investor.

ABOUT STELLA-JONES

Stella-Jones Inc. (TSX: SJ) is a leading North

American manufacturer of pressure-treated wood products, focused on

supporting infrastructure that is essential to the delivery of

electrical distribution and transmission, and the operation and

maintenance of railway transportation systems. It supplies the

continent’s major electrical utilities and telecommunication

companies with wood utility poles and North America’s Class 1,

short line and commercial railroad operators with railway ties and

timbers. It also supports infrastructure with industrial products,

namely wood for railway bridges and crossings, marine and

foundation pilings, construction timbers and coal tar-based

products. Additionally, the Company manufactures and distributes

premium treated residential lumber and accessories to Canadian and

American retailers for outdoor applications, with a significant

portion of the business devoted to servicing Canadian customers

through its national manufacturing and distribution network.

CAUTION REGARDING FORWARD-LOOKING

INFORMATION

This press release contains information and

statements of a forward-looking nature, including statements

regarding the timing and completion of the proposed offering of

Notes and the expected use of the net proceeds of the offering.

These statements are based on suppositions and uncertainties as

well as on management's best possible evaluation of future events,

including those referenced in the Company’s continuous disclosure

filings (available on SEDAR+ at sedarplus.ca). The completion of

the proposed offering of Notes is subject to general market and

other conditions and there can be no assurance that the proposed

offering will be completed or that the terms of the proposed

offering will not be modified. As a result, readers are advised

that actual results may differ from expected results. Unless

required to do so under applicable securities legislation, the

Company does not assume any obligation to update or revise

forward-looking statements to reflect new information, future

events or other changes after the date hereof.

|

Head Office 3100 de la Côte-Vertu Blvd., Suite 300

Saint-Laurent, Québec H4R 2J8 Tel.: (514) 934-8666 Fax: (514)

934-5327 |

Exchange Listings The Toronto Stock Exchange Stock

Symbol: SJ Transfer Agent and Registrar

Computershare Investor Services Inc. |

Investor Relations Silvana Travaglini Senior

Vice-President and Chief Financial Officer Tel.: (514) 934-8660

Fax: (514) 934-5327 stravaglini@stella-jones.com |

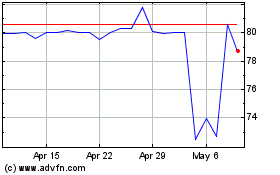

Stella Jones (TSX:SJ)

Historical Stock Chart

From Nov 2024 to Dec 2024

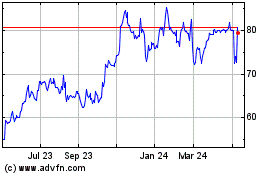

Stella Jones (TSX:SJ)

Historical Stock Chart

From Dec 2023 to Dec 2024