- 2024 consolidated production of copper, silver, gold and zinc

exceeded annual production guidance while lead production met

guidance.

- Bolivar mine 2024 copper production met guidance and exceeded

guidance on silver and gold, primarily driven by 10% higher

throughput rates compared to 2023.

- Yauricocha mine annual production of copper, zinc, silver and

gold exceeded 2024 production guidance while lead production met

guidance, due to strong Q4 2024 average throughput rates of 3,945

tonnes per day (“tpd”) (31% increase from Q4 2023).

Sierra Metals Inc. (TSX: SMT | OTCQX: SMTSF | BVL: SMT)

(“Sierra Metals” or the “Company”) reports fourth quarter (“Q4

2024”) and full year 2024 production results from its two

underground mines in Latin America: the Yauricocha polymetallic

mine (“Yauricocha”) in Peru and the copper-producing Bolivar mine

(“Bolivar”) in Mexico.

Ernesto Balarezo, CEO of Sierra Metals, commented, “Sierra

Metals’ strong production results in 2024 are a testament to the

hard work of our entire team and more proof of the momentum we are

seeing across our business. Overall, our strong operating

performance -- underpinned by our commitment to safety -- resulted

in total production exceeding guidance for 2024.”

Mr. Balarezo continues, “As we begin the new year, the

investments we have made at our operations have set the stage for

significant value creation in 2025 and beyond. In 2025, we expect

to increase throughput rates and grow resources at both of our

mines. Longer-term, we anticipate upside potential through ongoing

exploration and optimization of the ore body below the 1120 level

at Yauricocha and the potential for mineral resource expansion at

Bolivar through near-mine exploration and district-scale study

work.”

“At current metal prices we expect to generate strong operating

cash flows that will fund our capital investment program and

service our debt obligations. Most importantly, I believe we are

poised to continue delivering strong long-term value for all

shareholders.”

Consolidated Production Results

2024 Guidance

Year Ended

Q4 2024

Q3 2024

Q4 2023

(Top End)

December 31, 2024

Tonnes processed (t)

797,774

668,647

673,846

2,732,352

Daily throughput (tpd)(1)

9,118

7,641

7,701

7,807

Copper production (000 lb)

13,533

11,009

12,096

43,300

44,320

Zinc production (000 lb)

12,301

11,184

9,629

44,500

44,889

Silver production (000 oz)

544

503

468

1,750

1,861

Gold Production (oz)

4,009

3,973

4,708

11,600

15,925

Lead production (000 lb)

2,381

2,537

2,481

11,800

11,020

1

Calculated at 87.5 days for each of the

quarters and 350 days for the twelve-month periods assuming

scheduled maintenance related shutdowns during the reporting

periods.

Consolidated throughput during 2024 was more than 2.7 million

tonnes, an 11% increase when compared to 2023. Consolidated copper,

zinc and silver production was 10%, 3% and 1%, respectively, higher

than in 2023, while gold and lead production was slightly lower.

When comparing annual consolidated production results to 2024

guidance, copper, silver, gold and zinc exceeded guidance while

lead met guidance.

Throughput in Q4 2024 was a record 798 thousand tonnes, 18%

higher than in Q4 2023. This was driven by Bolivar having 10%

higher throughput rates and Yauricocha, now primarily mining below

the 1120 level, increasing throughput rates by 31%. Yauricocha Q4

2024 production of copper, zinc and silver were 29%, 28%, and 20%,

respectively, higher than Q4 2023 with gold production flat and

lead production lower by 4% on a quarter over quarter basis. When

comparing Bolivar Q4 2024 production to Q4 2023, copper was flat,

silver was 9% higher and gold lower by 19%.

Yauricocha Mine, Peru

With Yauricocha now primarily mining below the 1120 level, which

allows the Company to have access to most of its resources, the

increase in tonnage has been possible. The mine’s throughput rates

in Q4 2024 averaged a record 3,945 tpd, which is 10% higher than

its annual permitted capacity of 3,600 tpd (the operating consents

for Yauricocha allow for an excess of 10% over the permitted

capacity). The increase in throughput rates is due to the increase

in access to the number of mining zones below the 1120 level when

compared to just mining above that level during Q4 2023. Head

grades were similar quarter over quarter but expected to improve as

the mining increases in the higher-grade Esperanza copper zone. The

increase in copper recovery was primarily due to improvements in

the circulation processing and reagents used in the plant.

A summary of production from Yauricocha for Q4 2024 and

full-year 2024 is provided below:

2024 Guidance

Year Ended

Q4 2024 Q3 2024 Q4 2023

(Top End)

December 31, 2024

Tonnes processed (t)

345,161

266,917

263,851

1,105,912

Daily throughput (tpd)(1)

3,945

3,050

3,015

3,160

Copper grade

1.04

%

1.01

%

1.09

%

0.89

%

Zinc grade

2.04

%

2.34

%

2.12

%

2.25

%

Silver grade (g/t)

43.11

43.83

48.29

40.85

Gold Grade (g/t)

0.39

0.35

0.51

0.36

Lead grade

0.50

%

0.65

%

0.60

%

0.63

%

Copper recovery

82.31

%

79.35

%

70.72

%

77.92

%

Zinc recovery

79.35

%

81.31

%

79.75

%

81.95

%

Silver recovery

72.62

%

74.70

%

70.74

%

72.21

%

Gold Recovery

22.27

%

20.43

%

78.08

%

19.69

%

Lead recovery

62.92

%

66.41

%

21.78

%

72.14

%

Copper production (000 lb)

6,500

4,695

5,036

15,700

16,866

Zinc production (000 lb)

12,301

11,184

9,629

44,500

44,889

Silver production (000 oz)

348

281

289

1,000

1,049

Gold Production (oz)

953

612

951

2,400

2,501

Lead production (000 lb)

2,381

2,537

2,481

11,800

11,020

1

Calculated at 87.5 days for each

of the quarters and 350 days for the twelve-month periods assuming

scheduled maintenance related shutdowns during the reporting

periods.

Bolivar Mine, Mexico

Bolivar processed an average of 5,173 tpd in Q4 2024, which is

3% higher than its nameplate capacity of 5,000 tpd. In Q4 2024, the

Company increased the level of ore hauling to the plant with the

start-up of a new integration tunnel and by developing and

increasing the number of operating stopes from three to nine by the

end of the year. All of these initiatives increased ore

availability to the plant which allowed the mine to operate above

nameplate capacity. When comparing Q4 2024 to Q4 2023 lower copper

head grades due to the sequencing of the mine were offset by higher

throughput, resulting in metal production flat quarter over

quarter. Head grades are expected to improve with mining in now

higher-grade zones. With the initiatives completed in Q4 along with

operational improvements in the grinding and flotation circuits in

the plant, Bolivar expects throughput rates to continue to be above

nameplate capacity of 5,000 tpd in 2025.

A summary of production from Bolivar for Q4 2024 and full year

2024 is provided below:

2024 Guidance

Year Ended

Q4 2024

Q3 2024

Q4 2023

(Top End)

December 31, 2024

Tonnes processed (t)

452,613

401,730

409,995

1,626,440

Daily throughput (tpd)(1)

5,173

4,591

4,686

4,647

Copper grade

0.77

%

0.78

%

0.84

%

0.84

%

Silver grade (g/t)

15.92

20.14

16.56

18.69

Gold grade (g/t)

0.32

0.38

0.42

0.38

Copper recovery

91.20

%

91.50

%

92.62

%

91.36

%

Silver recovery

84.31

%

85.53

%

82.38

%

83.03

%

Gold recovery

66.67

%

69.38

%

68.39

%

67.01

%

Copper production (000 lb)

7,033

6,314

7,060

27,600

27,454

Silver production (000 oz)

196

222

179

750

812

Gold production (oz)

3,056

3,361

3,757

9,200

13,424

1

Calculated at 87.5 days for each of the

quarters and 350 days for the twelve-month periods assuming

scheduled maintenance related shutdowns during the reporting

periods.

2025 Guidance

As announced on December 5, 2024, the Company expects Yauricocha

production in 2025 to be primarily below the 1120 level,

complemented by the recent discovery of a new high-grade zone in

the upper part of the mine. A number of investments made in 2024

and planned during 2025 should continue to maintain throughput

rates beyond the permitted capacity of 3,600 tpd. As it has been

mentioned earlier, the operating consents for Yauricocha allow for

an excess of 10% over the permitted capacity. The expected increase

in production should be from higher head grades and higher

throughput rates. At Bolivar, Sierra Metals expects to successfully

complete a series of initiatives to increase throughput rates,

while forecasting slightly lower grades across all metals, mainly

driven by the mine sequencing schedule.

At Yauricocha, there are significant exploration opportunities

below the 1120 level as the ore body appears open in all directions

and operating in that area will give Sierra Metals the opportunity

to meaningfully explore the area more rapidly with the goal of

increasing the life of the mine and improve mining sequencing.

At Bolivar, ongoing near-mine exploration and district-scale

study work has the potential to significantly expand the resource

at the mine as well as providing additional upside through

prospective opportunities.

Expectations in 2025 are to reap the benefits of mining below

the 1120 level at Yauricocha while putting in the place the

foundation for future growth at Bolivar through expansion of the

tailings facilities.

A summary of 2025 production guidance compared to full year 2024

production results on consolidated basis and by mine follows:

Production Guidance

Consolidated

2025 Guidance

2024

Low

High

Actual

Copper production (000 lbs)

44,600

48,500

44,320

Zinc production (000 lbs)

53,600

58,400

44,889

Silver production (oz)

1,900

2,060

1,861

Gold production (oz)

10,200

11,100

15,925

Lead production (000 lbs)

13,700

15,000

11,020

Yauricocha

2025 Guidance

2024

Low

High

Actual

Copper production (000 lbs)

19,500

21,100

16,866

Zinc production (000 lbs)

53,600

58,400

44,889

Silver production (oz)

1,220

1,320

1,049

Gold production (oz)

2,800

3,000

2,501

Lead production (000 lbs)

13,700

15,000

11,020

Bolivar

2025 Guidance

2024

Low

High

Actual

Copper production (000 lbs)

25,100

27,400

27,454

Silver production (oz)

680

740

812

Gold production (oz)

7,400

8,100

13,424

Cost Guidance

Also announced on December 5, 2024, was the Company’s cost

guidance for 2025:

Cash Costs (1) AISC (1) Low High

Low High Yauricocha $/CuEq (2)

$

2.42

$

2.59

$

2.91

$

3.11

Bolivar $/CuEq (2)

$

2.64

$

2.77

$

3.45

$

3.62

(1)

This is a non-IRFS performance measure,

see the Non-IFRS Performance Measures section in the latest

MD&A dated November 5, 2024.

(2)

Copper equivalent pounds (CuEq) were

calculated using the following metals prices: $4.18/lb copper,

$1.23/lb zinc, $28.50/oz silver, $2,237/oz gold and $0.95/lb

lead.

Conference Call and Webcast

Management will host a conference call and webcast to discuss Q4

2024 and full year 2024 financial and operating results on March

20, 2025 at 11:00 am (Eastern). Details are as follows:

- Webcast:

- English version – HERE

- Spanish version - HERE

- Telephone:

- Canada/US toll free: 1-844-763-8274

- Other dial-in: +1-647-484-8814

About Sierra Metals

Sierra Metals is a Canadian mining company focused on copper

production with additional base and precious metals by-product

credits at its Yauricocha Mine in Peru and Bolivar Mine in Mexico.

The Company is intent on safely increasing production volume and

growing mineral resources. Sierra Metals has recently had several

new key discoveries and still has many more exciting brownfield

exploration opportunities in Peru and Mexico that are within close

proximity to the existing mines. Additionally, the Company has

large land packages at each of its mines with several prospective

regional targets providing longer-term exploration upside and

mineral resource growth potential.

Forward Looking Statements

This press release contains forward-looking information within

the meaning of Canadian securities legislation. Forward-looking

information relates to future events or the anticipated performance

of Sierra Metals and reflect management's expectations or beliefs

regarding such future events and anticipated performance based on

an assumed set of economic conditions and courses of action. In

certain cases, statements that contain forward-looking information

can be identified by the use of words such as "plans", "expects",

"is expected", "budget", "scheduled", "estimates", "forecasts",

"intends", "anticipates", "believes" or variations of such words

and phrases or statements that certain actions, events or results

"may", "could", "would", "might", or "will be taken", "occur" or

"be achieved" or the negative of these words or comparable

terminology. By its very nature forward-looking information

involves known and unknown risks, uncertainties and other factors

that may cause actual performance of Sierra Metals to be materially

different from any anticipated performance expressed or implied by

such forward-looking information.

Forward-looking information is subject to a variety of risks and

uncertainties, which could cause actual events or results to differ

from those reflected in the forward-looking information, including,

without limitation, the risks described under the heading "Risk

Factors" in the Company's annual information form dated March 15,

2024 for its fiscal year ended December 31, 2023 and other risks

identified in the Company's filings with Canadian securities

regulators, which are available at www.sedarplus.ca.

The risk factors referred to above are not an exhaustive list of

the factors that may affect any of the Company's forward-looking

information. Forward-looking information includes statements about

the future and is inherently uncertain, and the Company's actual

achievements or other future events or conditions may differ

materially from those reflected in the forward-looking information

due to a variety of risks, uncertainties and other factors. The

Company's statements containing forward-looking information are

based on the beliefs, expectations, and opinions of management on

the date the statements are made, and the Company does not assume

any obligation to update such forward-looking information if

circumstances or management's beliefs, expectations or opinions

should change, other than as required by applicable law. For the

reasons set forth above, one should not place undue reliance on

forward-looking information.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250115480147/en/

For further information regarding Sierra Metals, please visit

www.sierrametals.com or contact:

Investor Relations Sierra Metals Inc. +1 (866) 721-7437

info@sierrametals.com

Media Relations John Vincic Principal Oakstrom Advisors

+1 (647) 402-6375 john@oakstrom.com

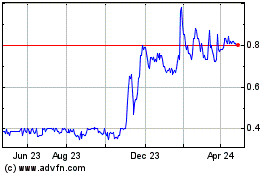

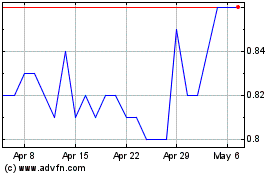

Sierra Metals (TSX:SMT)

Historical Stock Chart

From Feb 2025 to Mar 2025

Sierra Metals (TSX:SMT)

Historical Stock Chart

From Mar 2024 to Mar 2025