Kaplan Fox Seeks to Recover Losses for Investors Who Purchased SunOpta Inc. Securities During Expanded Class Period

February 13 2008 - 4:49PM

Marketwired

NEW YORK, NY has filed a class action suit in the United States

District Court for the Southern District of New York against

SunOpta Inc. ("SunOpta" or the "Company")(NASDAQ: STKL) (TSX: SOY)

and certain of its executives that alleges violations of the

Securities Exchange Act of 1934 on behalf of purchasers of SunOpta

securities during the period May 8, 2007 through January 25, 2008.

Previously filed complaints commenced the class period on August 8,

2007.

The Complaint alleges that throughout the Class Period,

defendants failed to disclose material adverse facts about the

Company's financial well-being, business relationships, and

prospects. Specifically, it is alleged that defendants failed to

disclose the following: (1) that defendants materially artificially

inflated the Company's financial results, which resulted in an

overstatement of the Company's profitability; (2) that the

Company's financial statements were not prepared in accordance with

Generally Accepted Accounting Principles ("GAAP"); (3) that the

Company lacked adequate internal and financial controls; (4) that,

as a result of the foregoing, the Company's financial statements

were materially false and misleading at all relevant times; and (5)

that, as a result of the foregoing, the Company's statements about

its future business prospects were lacking in any reasonable basis

when made.

It is further alleged that on January 24, 2008, after the market

closed, the Company shocked investors when it reported its

anticipated financial results for 2007, disclosing for the first

time that it expected to incur material write-downs and provisions

in the range of $12 million to $14 million, which the Company

attributed to write-downs of inventory within the SunOpta Fruit

Group's berry operations, as well as difficulties in collecting for

services and equipment provided to a customer of the SunOpta

BioProcess Group. It is further alleged that the Company disclosed

that it would likely restate financial results from previous

quarters in 2007.

On January 25, 2008, the Company's shares declined $3.51 per

share, or approximately 37%, on heavier than usual trading volume,

to close at $6.05 per share.

If you are a member of the proposed Class, you may move the

court no later than March 28, 2008 to serve as a lead plaintiff for

the Class. You need not seek to become a lead plaintiff in order to

share in any possible recovery.

Plaintiff seeks to recover damages on behalf of the Class and is

represented by Kaplan Fox & Kilsheimer LLP. Our firm, with

offices in New York, San Francisco, Los Angeles, Chicago and New

Jersey, has many years of experience in prosecuting investor class

actions and actions involving financial fraud. For more information

about Kaplan Fox & Kilsheimer LLP, or to review a copy of the

complaint filed in this action, you may visit our website at

www.kaplanfox.com.

If you have any questions about this Notice, the action, your

rights, or your interests, please e-mail us at mail@kaplanfox.com

or contact:

Frederic S. Fox Joel B. Strauss Donald R. Hall Jeffrey P.

Campisi KAPLAN FOX & KILSHEIMER LLP 850 Third Avenue, 14th

Floor New York, New York 10022 (800) 290-1952 (212) 687-1980 Fax:

(212) 687-7714 E-mail address: mail@kaplanfox.com Laurence D. King

KAPLAN FOX & KILSHEIMER LLP 350 Sansome Street, Suite 400 San

Francisco, California 94104 (415) 772-4700 Fax: (415) 772-4707

E-mail address: mail@kaplanfox.com

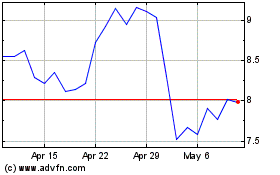

SunOpta (TSX:SOY)

Historical Stock Chart

From Apr 2024 to May 2024

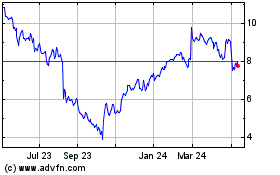

SunOpta (TSX:SOY)

Historical Stock Chart

From May 2023 to May 2024