STEP Energy Services Ltd. (the “Company” or “STEP”) is pleased to

announce its financial and operating results for the three months

ended March 31, 2023. The following press release should be read in

conjunction with the management’s discussion and analysis

(“MD&A”) and unaudited condensed consolidated interim financial

statements and notes thereto as at March 31, 2023 (the “Financial

Statements”). Readers should also refer to the “Forward-looking

information & statements” legal advisory and the section

regarding “Non-IFRS Measures and Ratios” at the end of this press

release. All financial amounts and measures are expressed in

Canadian dollars unless otherwise indicated. Additional information

about STEP is available on the SEDAR website at www.sedar.com,

including the Company’s Annual Information Form for the year ended

December 31, 2022 dated March 1, 2023 (the “AIF”).

CONSOLIDATED HIGHLIGHTS

FINANCIAL REVIEW

|

($000s except percentages and per share amounts) |

Three months ended |

|

March 31, |

|

March 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

Consolidated revenue |

$ |

263,368 |

|

$ |

219,539 |

|

|

Net income |

$ |

19,656 |

|

$ |

9,173 |

|

|

Per share-basic |

$ |

0.27 |

|

$ |

0.14 |

|

|

Per share-diluted |

$ |

0.26 |

|

$ |

0.13 |

|

|

Adjusted EBITDA (1) |

$ |

45,352 |

|

$ |

36,990 |

|

|

Adjusted EBITDA % (1) |

|

17 |

% |

|

17 |

% |

|

Free Cash Flow (1) |

|

17,070 |

|

|

16,172 |

|

(1) Adjusted EBITDA and Free Cash Flow are

non-IFRS financial measures, Adjusted EBITDA % is a non-IFRS

financial ratio. These metrics are not defined and have no

standardized meaning under IFRS. See Non-IFRS Measures and

Ratios.

OPERATIONAL REVIEW

|

($000s except days, proppant, pumped, horsepower and units) |

Three months ended |

|

March 31, |

March 31, |

|

|

|

2023 |

|

2022 |

|

Fracturing services |

|

|

|

|

|

Fracturing operating days (2) |

|

473 |

|

615 |

|

Proppant pumped (tonnes) |

|

510,000 |

|

601,000 |

|

Active horsepower (“HP”), ended (3) |

|

380,000 |

|

380,000 |

|

Total HP, ended |

|

490,000 |

|

490,000 |

|

Coiled tubing services |

|

|

|

|

|

Coiled tubing operating days (2) |

|

1,263 |

|

1,075 |

|

Active coiled tubing units, ended |

|

21 |

|

16 |

|

Total coiled tubing units, ended |

|

35 |

|

29 |

(2) An operating day is defined as any coiled

tubing or fracturing work that is performed in a 24-hour period,

exclusive of support equipment.(3) Active horsepower denotes units

active on client work sites. An additional 20-25% of this amount is

required to accommodate equipment maintenance cycles.

|

($000s except shares) |

|

March 31 |

December 31, |

|

|

|

2023 |

|

2022 |

|

Cash and cash equivalents |

$ |

1,237 |

$ |

2,785 |

|

Working capital (including cash and cash equivalents) (1) |

$ |

64,665 |

$ |

66,580 |

|

Total assets |

$ |

642,200 |

$ |

682,532 |

|

Total long-term financial liabilities (1) |

$ |

152,215 |

$ |

168,746 |

|

Net debt (1) |

$ |

133,042 |

$ |

142,224 |

|

Shares outstanding |

|

71,617,464 |

|

71,589,626 |

(1) Working Capital, Total long-term financial

liabilities and Net debt are non-IFRS financial measures. They are

not defined and have no standardized meaning under IFRS. See

Non-IFRS Measures and Ratios.

FIRST QUARTER 2023

HIGHLIGHTS

- Consolidated

revenue for the three months ended March 31, 2023 of $263.4

million, increased 20% from $219.5 million as at three months ended

March 31, 2022 and increased 5% from $251.4 million as at three

months ended December 31, 2022.

- Generated net

income for the three months ended March 31, 2023 of $19.7 million,

or $0.26 per diluted share, compared to $9.2 million, or a $0.13

per diluted share in the same period of 2022 and $16.7 million or a

$0.23 per diluted share for the three months ended December 31,

2022. Included in income for three months ended March 31, 2023, was

a share based compensation recovery of $5.1 million, compared to an

expense of $4.4 million during the three months ended December 31,

2022.

- For the three

months ended March 31, 2023, Adjusted EBITDA was $45.4 million or

17% of revenue compared to $36.9 million or 17% of revenue in Q1

2022 and $48.6 million or 19% in Q4 2022.

- Free Cash Flow

for the three months ended March 31, 2023 was $17.1 million

compared to $16.2 million in Q1 2022 and $22.4 million in Q4

2022.

- STEP made

significant progress on debt reduction while also investing into

the long-term sustainability of the business.

- The Company had

Net debt of $133.0 million at March 31, 2023, compared to $142.2

million at December 31, 2022.

- The Company

invested $26.6 million into its capital equipment, including $6.3

million into the Company’s first Tier 4 dual fuel fleet conversion

that was started in Q4 2022. The Company had eight Tier 4 dual fuel

units in the field at the end of Q1, providing diesel substitution

rates of up to 85%.

FIRST QUARTER 2023 OVERVIEW The

first quarter of 2023 was among STEP’s best quarters. Revenue of

$263.4 million and Adjusted EBITDA of $45.4 million were the

Company’s best first quarter results, driven by strong performance

in coiled tubing and Canadian fracturing. Effective January 1,

2023, Adjusted EBITDA reflects the expensing of fracturing fluid

ends in Canada, which added $2.8 million in expense to the quarter.

Fluid ends have a useful life that is based on an expected number

of pumping hours, which is now being realized in a period less than

12 months as daily pumping hours and equipment utilization

increases. These results showed significant year over year

improvement and were flat sequentially.

Commodity price volatility was a factor in

industry activity levels, particularly for natural gas weighted

producers. Natural gas prices, as measured by the U.S. benchmark

Henry Hub, retreated from Q4 2022 levels, averaging $2.65 / mmBTU

in Q1 2023, down 53% sequentially and going as low as $1.93. West

Texas Intermediate (WTI), the benchmark U.S. oil price, saw less

volatility, with the Q1 average of $76.12 down 7.8% sequentially,

although prices dipped below $70/barrel late in the quarter.

Despite the commodity price volatility, the rig count in Canada

rose by 34, or 18%, from Q4 2022. The rig count in the oil rich

Permian basin, home of STEP’s three U.S. fracturing crews, is up 3

rigs from 353 rigs at the year end, in contrast to the broader U.S.

market which has dropped 31 rigs from Q4 20221.

The first quarter saw constructive news for long

term energy investments. The B.C. government and the Blueberry

River First Nation (BRFN) agreed on a framework for resource

development, which has already led to increased licencing activity

in the Montney. The Montney is a critical source of natural gas for

LNG Canada and Woodfibre LNG, which are on track for start up in

2025 and 2027 respectively. The Cedar LNG facility also received

approval from the B.C. and federal governments, with the final

investment decision (“FID”) expected later this year. These three

facilities are anticipated to export 2.8 bcf/day of clean, safe and

secure Canadian natural gas. In the U.S., the resumption of exports

from the Freeport LNG facility immediately put a floor under

natural gas prices and two additional projects (Plaquemines LNG and

Port Arthur LNG) also reached a positive FID. These facilities are

expected to add 3.1 bcf/day of LNG capacity to the U.S. export LNG

market if they are completed in 2027 as forecasted.

STEP’s fracturing activity in the quarter was

mixed, with strong Canadian results offset by lower U.S. results.

The Canadian fracturing service line produced its best top line

revenue in the Company’s history, generating $138.0 million on

296,000 tonnes of proppant pumped. Q1 2023 activity in the U.S.

fracturing service line was heavily impacted by shifting client

schedules related to drilling issues and commodity price pressures.

Coiled tubing operating days set a new quarterly record, with the

service line operating nine units in Canada and eleven units in the

U.S.

Net income was $19.7 million in Q1 2023 ($0.26

diluted earnings per share), sequentially higher than the $16.7

million in Q4 ($0.23 diluted earnings per share) and the $9.2

million in Q1 2022 ($0.13 diluted earnings per share). Net income

included $2.9 million in finance costs (Q4 2022 ‐ $3.0 million, Q1

2022 ‐ $3.3 million) and a recovery of $5.3 million in share‐based

compensation (Q4 2022 ‐ $4.4 million expense, Q1 2022 ‐ $5.5

million expense).

Free Cash Flow was $17.1 million in Q1 2023,

sequentially lower than the $22.4 million in Q4 2022 but higher

than the $16.2 million in Q1 2022. Free Cash Flow was negatively

impacted by a $4.2 million payment made to a foreign tax authority

in connection with an ongoing tax dispute. It is of the view of the

Company that this tax claim is without merit. The Free Cash Flow

enabled STEP to reduce net debt to $133.0 million at the close of

Q1 2023 from $142.4 million at close of Q4 2022. This debt

reduction was accomplished while investing $26 million into capital

expenditures during Q1 2023. STEP has now reduced debt by nearly

$180 million from peak levels in 2018. The reduction in debt and

improvement in Adjusted EBITDA meant that the Company had a

12-month trailing Funded Debt to Adjusted Bank EBITDA of 0.70:1.00,

well under the limit of 3.00:1 in the Company’s Credit Facilities

(as defined in Capital Management – Debt below).

1 Baker Hughes North America Rotary Rig Count,

May 5, 2023

MARKET OUTLOOK The announcement

by the OPEC+ group of oil producing nations in early April to

voluntarily reduce production provided support to commodity markets

that were rattled by concerns over the stability of the global

banking system and global recession fears. West Texas Intermediate

oil prices have stabilized above $70 barrel to start the second

quarter, providing greater certainty for oil and liquids producers.

Natural gas prices are anticipated to remain soft through the

shoulder season, but the futures prices show a steady strengthening

through the latter half of 2023. The long-term outlook for oilfield

services is very constructive. The structural under-investment in

hydrocarbon production capacity through the last seven years has

been exacerbated by geopolitical tensions, forcing governments and

policy makers to confront the realty that oil and gas will be a key

part of the energy mix for many years. STEP is proud to work in

Canada and the U.S., countries that have the natural resources, the

regulatory frameworks, and the technical expertise to deliver safe

and affordable energy to the world.

Canada Canadian activity levels

have been strong to date in Q2 2023, as warm, dry weather

conditions in April allowed for the spillover work from Q1 to be

completed. These conditions have also led to extreme wildfire risk

in STEP’s operating areas, which may have some impact on client

work programs. STEP has an emergency response plan in place to

protect Company personnel and property and does not anticipate any

harm to its operations.

Spring break up is having less of an impact than

it traditionally has in Canada as clients recognize the value of

working in the second quarter. As activity and service intensity in

the WCSB continues to increase, the second quarter is increasingly

seen by clients and service providers as an opportunity to load

level capital spending and activity. The intense pace of the first

quarter, often accompanied by extreme weather conditions, typically

moderates in the second quarter, reducing operating costs and the

strain on the service infrastructure.

Pricing is anticipated to remain stable through

the second quarter and the remainder of the year. Inflationary

pressures have largely eased, although lingering supply chain

constraints can still produce unusual delays, particularly for

equipment maintenance related items.

The Company’s first Tier 4 dual fuel fleet

modernization is expected to be completed by the close of the

second quarter. The performance of the Tier 4 equipped units

already in the field has been exemplary, with diesel substitution

rates consistently above 80%, relative to a Tier 2 diesel engine.

These high substitution rates bring immediate cost and emission

reduction benefits to STEP’s clients, as well as providing higher

profitability to STEP.

The second half of the year is anticipated to

remain highly utilized for fracturing and coiled tubing, with much

of the calendar already booked with client commitments. The low

natural gas prices have led to some primarily dry gas focused work

being delayed into the later part of the year, although the impact

has been relatively modest to date. Many gas producers have a high

liquids content, which is more closely aligned with WTI pricing,

insulating them from the most severe impacts of the low natural gas

prices.

United StatesSTEP’s fracturing

activity levels in the U.S. have returned to typical levels in the

second quarter, recovering from the client delays that dominated

the first quarter. The downtime in Q1 allowed for more robust

preventative maintenance and some optimization to be completed on

the idle fleets, which has been rewarded with very high pumping

efficiencies across STEP’s three fracturing fleets in the second

quarter. Coiled tubing activity continues to remain strong into the

second quarter, with demand outpacing supply in some regions.

Following a volatile period in Q1 where

fracturing pricing temporarily came under pressure from

undisciplined competitors, pricing in the second quarter has

recovered and is expected to hold into the back half of the year.

Pricing for coiled tubing services has been stable and is expected

to stay in line for the balance of the year.

Second half visibility in the U.S. region

continues to improve. The rig count in the Permian, home of STEP’s

three fracturing crews, has steadily increased following the OPEC+

announcement, reflecting increased confidence by E&Ps that oil

prices are expected to stay stable in the near term. STEP’s three

fracturing crews are well placed in this market and are expected to

see steady utilization through the balance of the year. Weak

natural gas prices may limit opportunity for growth in the U.S.

fracturing market, deferring STEP’s plan to field a fourth fleet

until market conditions improve. Demand for STEP’s industry leading

coiled tubing services is expected to remain strong.

CANADIAN FINANCIAL AND OPERATIONS

REVIEW

STEP has a fleet of 16 coiled tubing units in

the WCSB, all of which are designed to service the deepest wells in

the basin. STEP’s fracturing business primarily focuses on the

deeper, more technically challenging plays in Alberta and northeast

British Columbia. STEP has 282,500 fracturing HP of which

approximately 132,500 HP has dual-fuel capability. STEP deploys or

idles coiled tubing units and fracturing horsepower as dictated by

the market’s ability to support targeted utilization and economic

returns.

|

($000’s except per day, days, units, proppant pumped and HP) |

Three months ended |

|

|

March 31, |

|

March 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

Revenue: |

|

|

|

|

|

Fracturing |

$ |

139,576 |

|

$ |

119,014 |

|

|

Coiled tubing |

|

34,859 |

|

|

27,798 |

|

|

|

|

174,435 |

|

|

146,812 |

|

|

Expenses |

|

138,609 |

|

|

124,689 |

|

|

Results from operating activities |

$ |

35,826 |

|

$ |

22,123 |

|

|

Adjusted EBITDA (1) |

$ |

44,776 |

|

$ |

31,867 |

|

|

Adjusted EBITDA % (1) |

|

26 |

% |

|

22 |

% |

|

Sales mix (% of segment revenue) |

|

|

|

|

|

Fracturing |

|

80 |

% |

|

81 |

% |

|

Coiled tubing |

|

20 |

% |

|

19 |

% |

|

Fracturing services |

|

|

|

|

|

Number of fracturing operating days (2) |

|

312 |

|

|

395 |

|

|

Proppant pumped (tonnes) |

|

296,000 |

|

|

323,000 |

|

|

Stages completed |

|

4,360 |

|

|

4,761 |

|

|

Horsepower (“HP”) |

|

|

|

|

|

Active pumping HP, end of period |

|

215,000 |

|

|

215,000 |

|

|

Total pumping HP, end of period (3) |

|

282,500 |

|

|

282,500 |

|

|

Coiled tubing services |

|

|

|

|

|

Number of coiled tubing operating days (2) |

|

572 |

|

|

561 |

|

|

Active coiled tubing units, end of period |

|

9 |

|

|

8 |

|

|

Total coiled tubing units, end of period |

|

16 |

|

|

16 |

|

(1) Adjusted EBITDA is a non-IFRS financial

measure and Adjusted EBITDA % are non-IFRS financial ratios. They

are not defined and have no standardized meaning under IFRS. See

Non-IFRS Measures and Ratios.(2) An operating day is defined as any

coiled tubing or fracturing work that is performed in a 24-hour

period, exclusive of support equipment. (3) Active horsepower

denotes units active on client work sites. An additional 20-25% of

this amount is required to accommodate equipment maintenance

cycles.

FIRST QUARTER 2023 COMPARED TO FIRST

QUARTER 2022

Revenue for the three months ended March 31,

2023 was $174.4 million compared to $146.8 million for the same

period of the prior year. Favourable weather conditions and proper

client alignment resulted in steady utilization in both service

lines. Fracturing revenue set records for the quarter with four

large fracturing crews operating primarily in the gas and

condensate rich areas of Montney while the smaller low-pressure

crew was active in the oil rich Cardium and Viking formations.

Proppant pricing was higher quarter over quarter resulting in

increased revenue per operating day, however this was offset by the

number of fracturing operating days which decreased to 312 for Q1

of 2023 from 395 during the same period of 2022. Coil tubing

revenue benefited from cold weather extending into March allowing

for a longer operating cycle and saw operating days increase to 572

for Q1 2023 from 561 during the comparable period of 2022.

Adjusted EBITDA for the first quarter of 2023

was $44.8 million (26% of revenue) versus $31.9 million (22% of

revenue) in the first quarter of 2022. The year over year

improvement in results is a reflection of the improved industry

conditions, which provided STEP the opportunity to increase pricing

for its services.

UNITED STATES FINANCIAL AND OPERATIONS

REVIEW

STEP has a fleet of 19 coiled tubing units in

the Permian and Eagle Ford basins in Texas, the Bakken shale in

North Dakota, and the Uinta-Piceance and Niobrara-DJ basins in

Colorado. The U.S. fracturing business has 207,500 fracturing HP,

of which 80,000 HP is Tier 4 diesel and 50,250 HP has direct

injection dual-fuel capabilities. The U.S. fracturing business

primarily operates in the Permian and Eagle Ford basins in Texas.

The Company deploys or idles coiled tubing units and fracturing

horsepower as dictated by the market’s ability to support targeted

utilization and economic returns.

|

($000’s except per day, days, units, proppant pumped and HP) |

Three months ended |

|

|

March 31, |

|

March 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

Revenue: |

|

|

|

|

|

Fracturing |

$ |

49,317 |

|

$ |

49,667 |

|

|

Coiled tubing |

|

39,616 |

|

|

23,060 |

|

|

|

|

88,933 |

|

|

72,727 |

|

|

Expenses |

|

96,056 |

|

|

71,031 |

|

|

Results from operating activities |

$ |

(7,123 |

) |

$ |

1,696 |

|

|

Adjusted EBITDA (1) |

$ |

4,816 |

|

$ |

9,822 |

|

|

Adjusted EBITDA % (1) |

|

5 |

% |

|

14 |

% |

|

Sales mix (% of segment revenue) |

|

|

|

|

|

Fracturing |

|

55 |

% |

|

68 |

% |

|

Coiled tubing |

|

45 |

% |

|

32 |

% |

|

Fracturing services |

|

|

|

|

|

Number of fracturing operating days(2) |

|

161 |

|

|

220 |

|

|

Proppant pumped (tonnes) |

|

214,000 |

|

|

278,000 |

|

|

Stages completed |

|

1,001 |

|

|

1,122 |

|

|

Horsepower (“HP”) |

|

|

|

|

|

Active pumping HP, end of period |

|

165,000 |

|

|

165,000 |

|

|

Total pumping HP, end of period (3) |

|

207,500 |

|

|

207,500 |

|

|

Coiled tubing services |

|

|

|

|

|

Number of coiled tubing operating days (2) |

|

691 |

|

|

514 |

|

|

Active coiled tubing units, end of period |

|

12 |

|

|

8 |

|

|

Total coiled tubing units, end of period |

|

19 |

|

|

13 |

|

(1) Adjusted EBITDA is a non-IFRS financial

measure and Adjusted EBITDA % is non-IFRS financial ratios. They

are not defined and have no standardized meaning under IFRS. See

Non-IFRS Measures and Ratios.(2) An operating day is defined as any

coiled tubing or fracturing work that is performed in a 24-hour

period, exclusive of support equipment. (3) Active horsepower

denotes units active on client work sites. An additional 15-20% of

this amount is required to accommodate equipment maintenance

cycles.

FIRST QUARTER 2023 COMPARED TO FIRST

QUARTER 2022

Revenue for the three months ended March 31,

2023 was $88.9 million compared to $72.7 million at March 31, 2022.

The 22% increase over the $72.7 million of revenue generated for

the same period in 2022 was the result of higher operating days for

coiled tubing services. The additional units acquired last year

enabled STEP to deploy more fleets and benefit from the improved

macro-economic environment and overall oilfield activity

levels.

U.S. fracturing was impacted by shifting client

schedules related to drilling delays resulting in a year-over-year

decrease in operating days along with a decrease in proppant pumped

for the first quarter of 2023. A more robust preventative

maintenance program was completed on the idle fleets during Q1

which resulted in higher operating costs despite the lower activity

levels.

U.S. operations generated Adjusted EBITDA of

$4.8 million (5% of revenue) for first quarter 2023 versus $9.8

million (14% of revenue) in the first quarter of 2022. Lower

operating days and higher operating costs were the primary factors

in the year over year change in financial results.CORPORATE

FINANCIAL REVIEW

The Company’s corporate activities are separated

from Canadian and U.S. operations. Corporate operating expenses

include expenses related to asset reliability and optimization

teams, as well as general and administrative costs which include

costs associated with the executive team, the Board of Directors,

public company costs and other activities that benefit Canadian and

U.S. operating segments collectively.

|

($000’s) |

Three months ended |

|

|

March 31, |

|

March 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

Expenses: |

|

|

|

|

|

Operating expenses |

|

485 |

|

|

571 |

|

|

Selling, general and administrative |

|

(1,466 |

) |

|

8,722 |

|

|

Results from operating activities |

$ |

981 |

|

$ |

(9,293 |

) |

|

Add: |

|

|

|

|

|

Depreciation |

|

221 |

|

|

138 |

|

|

Share-based compensation |

|

(5,442 |

) |

|

4,457 |

|

|

Adjusted EBITDA (1) |

$ |

(4,240 |

) |

$ |

(4,698 |

) |

|

Adjusted EBITDA % (1) |

|

(2% |

) |

|

(2% |

) |

(1) Adjusted EBITDA is a non-IFRS financial

measure and Adjusted EBITDA % is a non-IFRS financial ratio. They

are not defined and have no standardized meaning under IFRS. See

Non-IFRS Measures and Ratios.

FIRST QUARTER 2023 COMPARED TO FIRST

QUARTER 2022

For the three months ended March 31, 2023, STEP

had a recovery from corporate activities of $1.0 million compared

to expenses of $9.3 million for the same period in 2022 due to the

mark to market adjustment on cash settled share-based compensation

in the current period. This expense was $9.9 million lower in Q1

2023 relative to Q1 2022, as the Company’s share price decreased by

$1.97 from December 31, 2022 to March 31, 2023 compared to a share

price increase of $1.19 during the same period of the prior year.

NON-IFRS MEASURES AND RATIOS

This Press Release includes terms and

performance measures commonly used in the oilfield services

industry that are not defined under IFRS. The terms presented are

intended to provide additional information and should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with IFRS. These non-IFRS

measures have no standardized meaning under IFRS and therefore may

not be comparable to similar measures presented by other issuers.

The non-IFRS measures should be read in conjunction with the

Company’s quarterly financial statements and Annual Financial

Statements and the accompanying notes thereto.

“Adjusted EBITDA” is a financial measure not

presented in accordance with IFRS and is equal to net (loss) income

before finance costs, depreciation and amortization, (gain) loss on

disposal of property and equipment, current and deferred income tax

provisions and recoveries, equity and cash settled share-based

compensation, transaction costs, foreign exchange forward contract

(gain) loss, foreign exchange (gain) loss, and impairment losses.

“Adjusted EBITDA %” is a non-IFRS ratio and is calculated as

Adjusted EBITDA divided by revenue. Adjusted EBITDA and Adjusted

EBITDA % are presented because they are widely used by the

investment community as they provide an indication of the results

generated by the Company’s normal course business activities prior

to considering how the activities are financed and the results are

taxed. The Company uses Adjusted EBITDA and Adjusted EBITDA %

internally to evaluate operating and segment performance, because

management believes they provide better comparability between

periods. The following table presents a reconciliation of the

non-IFRS financial measure of Adjusted EBITDA to the IFRS financial

measure of net income.

|

($000s except percentages) |

Three months ended |

|

|

March 31, |

|

March 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

Net income |

$ |

19,656 |

|

$ |

9,173 |

|

|

Add (deduct): |

|

|

|

|

|

Depreciation and amortization |

|

20,774 |

|

|

17,072 |

|

|

Gain on disposal of equipment |

|

(273 |

) |

|

(818 |

) |

|

Finance costs |

|

2,900 |

|

|

3,317 |

|

|

Income tax expense |

|

6,169 |

|

|

2,560 |

|

|

Share-based compensation – Cash settled |

|

(6,418 |

) |

|

5,166 |

|

|

Share-based compensation – Equity settled |

|

1,322 |

|

|

340 |

|

|

Foreign exchange loss |

|

170 |

|

|

180 |

|

|

Unrealized loss on derivatives |

|

1,052 |

|

|

- |

|

|

Adjusted EBITDA |

$ |

45,352 |

|

$ |

36,990 |

|

|

Adjusted EBITDA % |

|

17 |

% |

|

17 |

% |

“Free Cash Flow” is a financial measure not

presented in accordance with IFRS and is equal to net cash provided

by operating activities adjusted for changes in non-cash Working

Capital from operating activities, sustaining capital expenditures,

term loan principal repayments and lease payments (net of sublease

receipts). The Company may deduct or include additional items in

its calculation of Free Cash Flow that are unusual, non-recurring

or non-operating in nature. Free Cash Flow is presented as this

measure is widely used in the investment community as an indication

of the level of cash flow generated by ongoing operations.

Management uses Free Cash Flow to evaluate the adequacy of

internally generated cash flows to manage debt levels, invest in

the growth of the business or return capital to shareholders. The

following table presents a reconciliation of the non-IFRS financial

measure of Free Cash Flow to the IFRS financial measure of net cash

provided by operating activities.

|

($000s) |

Three months ended |

|

|

March 31, |

|

March 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

Net cash provided by (used in) operating activities |

$ |

45,836 |

|

$ |

(16,843 |

) |

|

Add (deduct): |

|

|

|

|

|

Changes in non-cash Working Capital from operating activities |

|

(12,203 |

) |

|

50,805 |

|

|

Sustaining capital |

|

(14,702 |

) |

|

(8,911 |

) |

|

Term loan principal repayments |

|

- |

|

|

(6,988 |

) |

|

Lease payments (net of sublease receipts) |

|

(1,861 |

) |

|

(1,891 |

) |

|

Free Cash Flow |

$ |

17,070 |

|

$ |

16,172 |

|

“Working Capital”, “Total long-term financial

liabilities” and “Net debt” are financial measures not presented in

accordance with IFRS. “Working Capital” is equal to total current

assets less total current liabilities. “Total long-term financial

liabilities” is comprised of loans and borrowings, long-term lease

obligations and other liabilities. “Net debt” is equal to loans and

borrowings before deferred financing charges less cash and cash

equivalents and CCS derivatives. The data presented is intended to

provide additional information about items on the statement of

financial position and should not be considered in isolation or as

a substitute for measures prepared in accordance with IFRS.

The following table represents the composition

of the non-IFRS financial measure of Working Capital (including

cash and cash equivalents).

|

($000s) |

|

March 31, |

|

December 31, |

|

|

|

|

|

2023 |

|

|

2022 |

|

|

Current assets |

|

$ |

213,106 |

|

$ |

256,361 |

|

|

Current liabilities |

|

|

(148,441 |

) |

|

(189,781 |

) |

|

Working Capital (including cash and cash equivalents) |

|

$ |

64,665 |

|

$ |

66,580 |

|

The following table presents the composition of

the non-IFRS financial measure of Total long-term financial

liabilities.

|

($000s) |

|

March 31, |

December 31, |

|

|

|

|

2023 |

|

2022 |

|

Long-term loans |

|

$ |

130,577 |

$ |

140,794 |

|

Long-term leases |

|

|

12,225 |

|

13,860 |

|

Other long-term liabilities |

|

|

9,413 |

|

14,092 |

|

Total long-term financial liabilities |

|

$ |

152,215 |

$ |

168,746 |

The following table presents the composition of

the non-IFRS financial measure of Net debt.

|

($000s) |

|

March 31, |

|

December 31, |

|

|

|

|

|

2023 |

|

|

2022 |

|

|

Loans and borrowings |

|

$ |

130,577 |

|

$ |

140,794 |

|

|

Add back: Deferred financing costs |

|

|

2,450 |

|

|

2,704 |

|

|

Less: Cash and cash equivalents |

|

|

(1,237 |

) |

|

(2,785 |

) |

|

Less: CCS Derivatives liability |

|

|

1,252 |

|

|

1,511 |

|

|

Net debt |

|

$ |

133,042 |

|

$ |

142,224 |

|

RISK FACTORS AND RISK

MANAGEMENT

The oilfield services industry involves many

risks, which may influence the ultimate success of the Company. The

risks and uncertainties set out in the AIF and Annual MD&A are

not the only ones the Company is facing. There are additional risks

and uncertainties that the Company does not currently know about or

that the Company currently considers immaterial which may also

impair the Company’s business operations and can cause the price of

the Common Shares to decline. Readers should review and carefully

consider the disclosure provided under the heading “Risk Factors”

in the AIF and “Risk Factors and Risk Management” in the Annual

MD&A, both of which are available on www.sedar.com, and the

disclosure provided in this Press Release under the headings

“Market Outlook”. In addition, global and national risks associated

with inflation or economic contraction may adversely affect the

Company by, among other things, reducing economic activity

resulting in lower demand, and pricing, for crude oil and natural

gas products, and thereby the demand and pricing for the Company’s

services. Other than as supplemented in this Press Release, the

Company’s risk factors, and management thereof has not changed

substantially from those disclosed in the AIF and Annual

MD&A.

FORWARD-LOOKING INFORMATION &

STATEMENTS

Certain statements contained in this Press

Release constitute “forward-looking statements” or “forward-looking

information” within the meaning of applicable securities laws

(collectively, “forward-looking statements”). These statements

relate to the expectations of management about future events,

results of operations and the Company’s future performance (both

operational and financial) and business prospects. All statements

other than statements of historical fact are forward-looking

statements. The use of any of the words “anticipate”, “plan”,

“contemplate”, “continue”, “estimate”, “expect”, “intend”,

“propose”, “might”, “may”, “will”, “shall”, “project”, “should”,

“could”, “would”, “believe”, “predict”, “forecast”, “pursue”,

“potential”, “objective” and “capable” and similar expressions are

intended to identify forward-looking statements. These statements

involve known and unknown risks, uncertainties and other factors

that may cause actual results or events to differ materially from

those anticipated in such forward-looking statements. While the

Company believes the expectations reflected in the forward-looking

statements included in this Press Release are reasonable, such

statements are not guarantees of future performance or outcomes and

may prove to be incorrect and should not be unduly relied upon.

In particular, but without limitation, this

Press Release contains forward-looking statements pertaining to:

2023 industry conditions and outlook, including the effect of

Russia related sanctions and OPEC+ supply limitations, recovery in

demand for oil and gas, industry production discipline, and other

macroeconomic factors the effect of new LNG facilities as well as

the resumption of U.S. LNG exports; OPEC+’s production as it

relates to oil prices; anticipated 2023 utilization levels,

commodity prices, and pricing for the Company’s services; recession

risk, including its effect on oil prices; the deferral of the

Company’s plans to field a fourth fracturing fleet in the U.S.;

timing of completion of the Company’s tier 4 DBG fracturing fleet

and anticipated substitution rates in the Company’s dual fuel

fleets; the effect of resumed industrial activity on Blueberry

River First Nation territorial lands; the effect of

under-investment in hydrocarbon production; supply and demand for

the Company’s and its competitors’ services, including the ability

for the industry to respond to demand increases; the effect of

inflation and related cost increases; expected pricing for the

Company’s services; the impact of weather and break up on the

Company’s operations; the competitive labour market; the potential

for commodity price volatility; the effect of changes in work scope

on expected margins; the Company’s ability to meet all financial

commitments including interest payments over the next twelve

months; the Company’s plans regarding additional equipment; the

Company’s ability to manage its capital structure; expected debt

repayment and Funded Debt to Adjusted Bank EBITDA ratios; expected

income tax and derivative liabilities; adequacy of resources to

funds operations, financial obligations and planned capital

expenditures; the Company’s ability to retain its existing clients;

the monitoring of impairment, amount and age of balances owing, and

the Company’s financial assets and liabilities denominated in U.S.

dollars, and exchange rates; supply chain constraints impact on

new-build and refurbishment timelines; and the Company’s expected

compliance with covenants under its Credit Facilities and its

ability to satisfy its financial commitments thereunder.

The forward-looking information and statements

contained in this Press Release reflect several material factors

and expectations and assumptions of the Company including, without

limitation: the effect of macroeconomic factors, including global

energy security concerns and levels of oil and gas inventories;

market concerns regarding economic recession; levels of oil and gas

production and the effect of OPEC or OPEC+ related capacity and

related uncertainty on the market for the Company’s services; that

the Company will continue to conduct its operations in a manner

consistent with past operations; the Company will continue as a

going concern; the general continuance of current or, where

applicable, assumed industry conditions; pricing of the Company’s

services; the Company’s ability to market successfully to current

and new clients; predictable effect of seasonal weather and break

up on the Company’s operations; the Company’s ability to utilize

its equipment; the Company’s ability to collect on trade and other

receivables; the Company’s ability to obtain and retain qualified

staff and equipment in a timely and cost effective manner; levels

of deployable equipment; future capital expenditures to be made by

the Company; future funding sources for the Company’s capital

program; the Company’s future debt levels; the availability of

unused credit capacity on the Company’s credit lines; the impact of

competition on the Company; the Company’s ability to obtain

financing on acceptable terms; the Company’s continued compliance

with financial covenants; the amount of available equipment in the

marketplace; and client activity levels and spending. The Company

believes the material factors, expectations and assumptions

reflected in the forward-looking information and statements are

reasonable, but no assurance can be given that these factors,

expectations and assumptions will prove correct.

Actual results could differ materially from

those anticipated in these forward‐looking statements due to the

risk factors set forth under the heading “Risk Factors” in the AIF

and under the heading Risk Factors and Risk Management in this

Press Release and the Annual MD&A.

Any financial outlook or future orientated

financial information contained in this Press Release regarding

prospective financial performance, financial position or cash flows

is based on the assumptions about future events, including economic

conditions and proposed courses of action based on management’s

assessment of the relevant information that is currently available.

Projected operational information, including the Company’s capital

program, contains forward looking information and is based on a

number of material assumptions and factors, as are set out above.

These projections may also be considered to contain future oriented

financial information or a financial outlook. The actual results of

the Company’s operations will likely vary from the amounts set

forth in these projections and such variations may be material.

Readers are cautioned that any such financial outlook and future

oriented financial information contains herein should not be used

for purposes other than those for which it is disclosed herein.

The forward-looking information and statements

contained in this Press Release speak only as of the date of the

document, and none of the Company or its subsidiaries assumes any

obligation to publicly update or revise them to reflect new events

or circumstances, except as may be required pursuant to applicable

laws. The reader is cautioned not to place undue reliance on

forward-looking information.

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF

FINANCIAL POSITION

|

As at |

|

March 31, |

|

December 31, |

|

|

Unaudited (in thousands of Canadian dollars) |

|

|

2023 |

|

|

2022 |

|

|

ASSETS |

|

|

|

|

|

|

Current Assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

1,237 |

|

$ |

2,785 |

|

|

Trade and other receivables |

|

|

157,056 |

|

|

199,004 |

|

|

Income tax receivable |

|

|

- |

|

|

137 |

|

|

Inventory |

|

|

49,078 |

|

|

46,410 |

|

|

Prepaid expenses and deposits |

|

|

5,735 |

|

|

8,025 |

|

|

|

|

|

213,106 |

|

|

256,361 |

|

|

Property and equipment |

|

|

403,111 |

|

|

402,482 |

|

|

Right-of-use assets |

|

|

21,607 |

|

|

23,528 |

|

|

Intangible assets |

|

|

151 |

|

|

161 |

|

|

Other assets |

|

|

4,225 |

|

|

- |

|

|

|

|

$ |

642,200 |

|

$ |

682,532 |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

Current Liabilities |

|

|

|

|

|

|

Trade and other payables |

|

$ |

125,353 |

|

$ |

165,869 |

|

|

Current portion of lease obligations |

|

|

8,436 |

|

|

8,326 |

|

|

Current portion of other liabilities |

|

|

7,093 |

|

|

6,526 |

|

|

Income tax payable |

|

|

7,559 |

|

|

9,060 |

|

|

|

|

|

148,441 |

|

|

189,781 |

|

|

Deferred tax liabilities |

|

|

15,773 |

|

|

17,972 |

|

|

Lease obligations |

|

|

12,225 |

|

|

13,860 |

|

|

Other liabilities |

|

|

9,413 |

|

|

14,092 |

|

|

Loans and borrowings |

|

|

130,577 |

|

|

140,794 |

|

|

|

|

|

316,429 |

|

|

376,499 |

|

|

Shareholders' equity |

|

|

|

|

|

|

Share capital |

|

|

453,756 |

|

|

453,702 |

|

|

Contributed surplus |

|

|

34,111 |

|

|

32,843 |

|

|

Accumulated other comprehensive income |

|

|

14,996 |

|

|

16,236 |

|

|

Deficit |

|

|

(177,092 |

) |

|

(196,748 |

) |

|

|

|

|

325,771 |

|

|

306,033 |

|

|

|

|

$ |

642,200 |

|

$ |

682,532 |

|

CONDENSED CONSOLIDATED INTERM STATEMENTS OF NET

INCOME AND OTHER COMPREHENSIVE INCOME

|

|

|

|

For the three months ended March 31, |

|

Unaudited(in thousands of Canadian dollars, except per share

amounts) |

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

263,368 |

|

$ |

219,539 |

|

|

Operating expenses |

|

|

228,955 |

|

|

190,063 |

|

|

Gross profit |

|

|

34,413 |

|

|

29,476 |

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

|

4,729 |

|

|

14,950 |

|

|

Results from operating activities |

|

|

29,684 |

|

|

14,526 |

|

|

|

|

|

|

|

|

|

Finance costs |

|

|

2,900 |

|

|

3,317 |

|

|

Foreign exchange loss |

|

|

170 |

|

|

180 |

|

|

Unrealized loss on derivatives |

|

|

1,052 |

|

|

- |

|

|

Gain on disposal of property and equipment |

|

|

(273 |

) |

|

(818 |

) |

|

Amortization of intangible assets |

|

|

10 |

|

|

114 |

|

|

Income before income tax |

|

|

25,825 |

|

|

11,733 |

|

|

|

|

|

|

|

|

|

Income tax expense (recovery) |

|

|

|

|

|

|

Current |

|

|

8,352 |

|

|

- |

|

|

Deferred |

|

|

(2,183 |

) |

|

2,560 |

|

|

|

|

|

6,169 |

|

|

2,560 |

|

|

Net income |

|

|

19,656 |

|

|

9,173 |

|

|

|

|

|

|

|

|

|

Other comprehensive income |

|

|

|

|

|

|

Foreign currency translation loss |

|

|

(1,240 |

) |

|

(1,844 |

) |

|

Total comprehensive income |

|

$ |

18,416 |

|

$ |

7,329 |

|

|

Income per share: |

|

|

|

|

|

|

Basic |

|

$ |

0.27 |

|

$ |

0.14 |

|

|

Diluted |

|

$ |

0.26 |

|

$ |

0.13 |

|

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF

CASH FLOWS

|

|

|

For the three months ended March 31, |

|

Unaudited (in thousands of Canadian dollars) |

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

|

|

Operating activities: |

|

|

|

|

|

|

Net income |

|

$ |

19,656 |

|

$ |

9,173 |

|

|

Adjusted for the following: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

20,774 |

|

|

17,071 |

|

|

Share-based compensation (recovery) |

|

|

(5,096 |

) |

|

5,506 |

|

|

Unrealized foreign exchange loss |

|

|

114 |

|

|

290 |

|

|

Unrealized loss on derivatives |

|

|

1,052 |

|

|

- |

|

|

Gain on disposal of property and equipment |

|

|

(273 |

) |

|

(818 |

) |

|

Finance costs |

|

|

2,900 |

|

|

3,317 |

|

|

Income tax expense |

|

|

6,169 |

|

|

2,560 |

|

|

Income taxes paid |

|

|

(9,850 |

) |

|

- |

|

|

Cash finance costs paid |

|

|

(1,813 |

) |

|

(3,137 |

) |

|

Changes in non-cash working capital from operating activities |

|

|

12,203 |

|

|

(50,805 |

) |

|

Net cash provided by (used in) operating activities |

|

|

45,836 |

|

|

(16,843 |

) |

|

|

|

|

|

|

|

|

Investing activities: |

|

|

|

|

|

|

Purchase of property and equipment |

|

|

(25,992 |

) |

|

(11,714 |

) |

|

Proceeds from disposal of equipment and vehicles |

|

|

326 |

|

|

401 |

|

|

Changes in non-cash working capital from investing activities |

|

|

(9,304 |

) |

|

2,572 |

|

|

Net cash used in investing activities |

|

|

(34,970 |

) |

|

(8,741 |

) |

|

|

|

|

|

|

|

|

Financing activities: |

|

|

|

|

|

|

(Repayment) draws of loans and borrowings |

|

|

(10,526 |

) |

|

30,600 |

|

|

Repayment of obligations under finance lease |

|

|

(1,999 |

) |

|

(2,035 |

) |

|

Net cash provided by (used) in financing activities |

|

|

(12,525 |

) |

|

28,565 |

|

|

|

|

|

|

|

|

|

Impact of exchange rate changes on cash |

|

|

111 |

|

|

(42 |

) |

|

|

|

|

|

|

|

|

(Decrease) increase in cash and cash equivalents |

|

|

(1,548 |

) |

|

2,939 |

|

|

Cash and cash equivalents, beginning of period |

|

|

2,785 |

|

|

3,698 |

|

|

Cash and cash equivalents, end of period |

|

$ |

1,237 |

|

$ |

6,637 |

|

ABOUT STEP

STEP is an energy services company that provides

coiled tubing, fluid and nitrogen pumping and hydraulic fracturing

solutions. Our combination of modern equipment along with our

commitment to safety and quality execution has differentiated STEP

in plays where wells are deeper, have longer laterals and higher

pressures. STEP has a high-performance, safety-focused culture and

its experienced technical office and field professionals are

committed to providing innovative, reliable and cost-effective

solutions to its clients.

Founded in 2011 as a specialized deep capacity

coiled tubing company, STEP has grown into a North American service

provider delivering completion and stimulation services to

exploration and production (“E&P”) companies in Canada and the

U.S. Our Canadian services are focused in the Western

Canadian Sedimentary Basin (“WCSB”), while in the U.S., our

fracturing and coiled tubing services are focused in the Permian

and Eagle Ford in Texas, the Uinta-Piceance and Niobrara-DJ basins

in Colorado and the Bakken in North Dakota.

Our four core values; Safety,

Trust, Execution and

Possibilities inspire our team of professionals to

provide differentiated levels of service, with a goal of flawless

execution and an unwavering focus on safety.

For more information please

contact:

|

Steve GlanvillePresident and Chief Executive Officer |

|

Klaas DeemterChief Financial Officer |

|

|

|

Telephone: 403-457-1772 |

|

Telephone: 403-457-1772 |

|

|

Email: investor_relations@step-es.com Web:

www.stepenergyservices.com

STEP will host a conference call on Thursday,

May 11, 2023 at 9:00 a.m. MT to discuss the results for the First

Quarter of 2023.

To listen to the webcast of the conference call,

please click on the following URL:

https://viavid.webcasts.com/starthere.jsp?ei=1606160&tp_key=00bd569906.

You can also visit the Investors section of our

website at www.stepenergyservices.com and click on “Reports,

Presentations & Key Dates”.

To participate in the Q&A session, please

call the conference call operator at: 1-888-886-7786 (toll free) 15

minutes prior to the call’s start time and ask for “STEP Energy

Services First Quarter and 2023 Earnings Results Conference

Call”.

The conference call will be archived on STEP’s

website at www.stepenergyservices.com/investors.

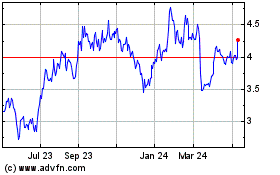

STEP Energy Services (TSX:STEP)

Historical Stock Chart

From Jan 2025 to Feb 2025

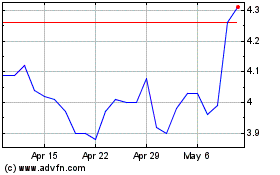

STEP Energy Services (TSX:STEP)

Historical Stock Chart

From Feb 2024 to Feb 2025