Steppe Gold Announces 2023 Annual Financial Results

April 01 2024 - 4:02PM

Steppe Gold Ltd. (TSX: STGO) (OTCQX:

STPGF) (FSE: 2J9) (“

Steppe Gold” or the

“

Company”) is pleased to announce its

financial results for the year ended December 31, 2023.

HIGHLIGHTS

Fourth quarter and year ended December

31, 2023 Highlights

(all figures in US$000’s unless stated

otherwise, except per unit figures which are in US$)

- Revenue for the

three months and year ended December 31, 2023 amounted to $14,677

and $54,239 on sales of 7,242 and 27,050 gold ounces and 17,673 and

71,367 silver ounces, respectively.

- Average realized

prices for the three months and year ended December 31, 2023 were

$1,977 and $1,948 per gold ounce and $20 and $21 per silver ounce,

respectively.

- Operating income

from mine operations before depreciation and depletion for the

three months and year ended December 31, 2023 was $7,906 and

$31,606, respectively.

- Adjusted EBITDA

after stream payments for the three months and year ended December

31, 2023 was $2,639 and $11,297, respectively.

- Site All in

Sustaining Costs were $984 and $839 per ounce sold respectively for

the three months and year ended December 31, 2023. All in

Sustaining Cost was $1,281 and $1,140 per ounce sold for the three

months and year ended December 31, 2023, respectively.

- During the three

months and year ended December 31, 2023, 244,501 and 726,059 tonnes

of ore were mined and 207,943 and 913,343 tonnes of ore were

stacked on the leach pad, respectively, with an average gold grade

of 0.87 g/t and 0.86 g/t, respectively, and an average silver grade

of 4.93 g/t and 4.24 g/t, respectively.

- As at December 31,

2023, the cash balance was $6,034 (including $28 recorded in

‘disposal group held for sale’); total bank debt, payables and

other debts (including liabilities of $959 recorded in ‘disposal

group held for sale’, but excluding convertible debentures and

stream arrangements) was $23,150 with net debt of $17,116.

- On May

11, 2023, the Company completed a private placement of 11,000,000

common shares resulted in $9,020 cash being raised.

- On March

21, 2024, the Company announced that it had entered into an amended

and restated gold prepay agreement of US$5 million.

-

The acquisition of Anacortes Mining Corp.

(“Anacortes”) was completed on June 28, 2023. As a

result, a further 19,437,948 common shares were issued to Anacortes

shareholders and a further 924,654 common shares were issued to the

advisors to the transaction.

-

On August 22, 2023, the Company announced the filing of a technical

report in respect of its 100% owned Tres Cruces Gold Oxide Project

located in Peru (the “Tres Cruces Project”).

- On July 11,

2023, the Company announced it had signed a binding term sheet with

Trade and Development Bank of Mongolia and affiliated entities for

$150,000 in financing to fully fund the construction and completion

of the Phase 2 Expansion at the ATO Gold Mine (the “Phase 2

Expansion”). The terms of the financing comprise three

tranches of $50,000 each for a total of $150,000, expected to be

funded in line with the planned construction phase of the Phase 2

Expansion. On August 30, 2023, the Company signed a loan agreement

for the first tranche of $50,000 and, on October 9, 2023, made its

first draw down of $9,600. The second draw down of $40,400 from the

project finance package was funded on March 20, 2024, with a total

of $50,000 now drawn from the first tranche of the $150,000 project

finance package since October 2023.

- On January 9, 2024,

the Company announced that it had entered into a turnkey

engineering, procurement and construction contract (the

“EPC Contract”) with Hexagon Build Engineering LLC

(“Hexagon Build”) for the Phase 2 Expansion.

- An announcement was

made on March 26, 2024 providing further details regarding the EPC

Contract and the Phase 2 Expansion, with a payment of $37,000 made

towards the Phase 2 Expansion, to include funding for procurement

of major long lead items, mobilization costs, early construction

works and foundational work. The major long lead items include the

flotations cells, grinding mills, cluster cyclones, thickener

units, filters and pumping systems.

- The Phase 2

Expansion is proceeding according to projected timelines and

budgets, with commissioning planned for Q1 2026.

- On January 22,

2024, the Company announced that it had entered into a binding term

sheet (the “Term Sheet”) pursuant to which Steppe

Gold, either directly or through a wholly-owned subsidiary, will

acquire all of the issued and outstanding common shares of Boroo

Gold LLC (“Boroo Gold”) in an all-share

transaction. The Term Sheet also provides Boroo Pte Ltd., or one of

its affiliates, the first right to acquire the Tres Cruces Project

at fair market value following the completion of the

transaction.

Outlook

With the landmark financing package secured and

the first tranche of $50,000 fully drawn down, the Company’s main

operational focus is execution of development of the Phase 2

Expansion with its EPC partners at Hexagon Build.

This will involve acceleration of the ordering

of long lead items, commencement of early construction and

foundational works and mobilization to site by Hexagon Build.

The potential acquisition of Boroo Gold is

proceeding well with the due diligence process now in the latter

stages. The Company is also in negotiations regarding the sale of

the Tres Cruces Project.

The Company’s consolidated financial results for

the year ended December 31, 2023 have been filed on SEDAR+. The

full version of the annual consolidated financial statements and

associated management's discussion & analysis can be viewed on

the Company's website at www.steppegold.com or under the Company's

profile on SEDAR + at www.sedarplus.ca.

Steppe Gold Ltd.

Steppe Gold is Mongolia’s premier precious

metals company.

For Further information, please

contact:Bataa Tumur-Ochir, Chairman and CEO

Jeremy South, Senior Vice President and Chief

Financial Officer

Shangri-La office, Suite 1201, Olympic Street19A, Sukhbaatar

District 1,Ulaanbaatar 14241, MongoliaTel: +976 7732 1914

Non-IFRS Performance

Measures

EBITDA is defined as earnings before interest,

taxes, depreciation and amortization. Adjusted EBITDA is defined as

adjusted earnings before interest, taxes, depreciation and

amortization. Further details of Non-IFRS Performance Measures

noted above can be found in the Company’s management's discussion

& analysis.

Cautionary Note Regarding

Forward-Looking Statements

This news release contains certain statements or

disclosures relating to the Company that are based on the

expectations of its management as well as assumptions made by and

information currently available to the Company which may constitute

forward-looking statements or information (“forward-looking

statements”) under applicable securities laws. All such statements

and disclosures, other than those of historical fact, which address

activities, events, outcomes, results, or developments that the

Company anticipates or expects may, or will, occur in the future

(in whole or in part) should be considered forward-looking

statements. In some cases, forward-looking statements can be

identified by the use of the words “continued”, “focus”,

“scheduled”, “will”, “potential”, “planned” and similar

expressions. In particular, but without limiting the foregoing,

this news release contains forward-looking statements pertaining to

the following: trading of the Company's common shares and business;

economic, and political conditions in Mongolia and Peru; and

discussion of future plans, projections, objectives, estimates and

forecasts and the timing related thereto, including with respect to

the ATO Gold Mine, the Phase 2 Expansion, the EPC Contract, the

Boroo Gold transaction and the sale of the Tres Cruces Project.

The forward-looking statements contained in this

news release reflect several material factors and expectations and

assumptions of the Company including, without limitation: exercise

of any termination rights under the Term Sheet; the negotiation of

definitive agreements in respect of the acquisition of Boroo Gold

and the sale of the Tres Cruces Project; material adverse effects

on the business, properties and assets of the Company; changes in

business plans and strategies; market and capital finance

conditions; risks inherent to any capital financing transactions;

changes in world commodity markets; currency fluctuations; costs

and supply of materials relevant to the mining industry; change in

government; and changes to regulations affecting the mining

industry.

The Company believes the material factors,

expectations and assumptions reflected in the forward-looking

statements are reasonable at this time, but no assurance can be

given that these factors, expectations and assumptions will prove

to be correct. The forward-looking statements included in this news

release are not guarantees of future performance and should not be

unduly relied upon. Such forward-looking statements involve known

and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward-looking statements, including, without

limitation: changes in world commodity markets, equity markets,

costs and supply of materials relevant to the mining industry;

changes in government; changes to regulations affecting the mining

industry; and certain other risks detailed from time to time in the

Company’s public disclosure documents, including, without

limitation, those risks identified in this news release and in the

Company’s annual information form dated April 1, 2024, copies of

which are available on the Company’s SEDAR+ profile at

www.sedarplus.ca. Readers are cautioned that the foregoing list of

factors is not exhaustive and are cautioned not to place undue

reliance on these forward-looking statements.

The forward-looking statements contained in this

news release are made as of the date hereof and the Company

undertakes no obligation to update publicly or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, unless so required by applicable

securities laws.

The Toronto Stock Exchange has not reviewed and

does not accept responsibility for the adequacy or accuracy of the

content of this news release.

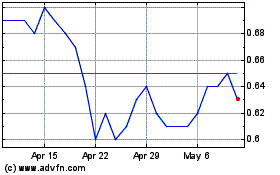

Steppe Gold (TSX:STGO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Steppe Gold (TSX:STGO)

Historical Stock Chart

From Feb 2024 to Feb 2025