STLLR Gold Inc. (TSX: STLR) (OTCQX: STLRF) (FSE: O9D)

(“STLLR” or the “Company”) announces the remaining

assay results from the infill and confirmatory drilling program at

the Jonpol Deposit at the Garrison (Eastern) area of the Tower Gold

Project in Timmins, Ontario, Canada.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240328162561/en/

Figure 1: Tower Gold Project - General

Location Map (Photo: Business Wire)

Table 1: Jonpol Drilling Highlights:

Hole ID

Deposit

Result

MGA23-156

Jonpol

1.19 g/t Au over 23.00 m (incl. 6.05

g/t Au over 2.00 m) &

2.09 g/t Au over 21.00 m (incl.

7.46 g/t Au over 3.20 m)

MGA23-157

Jonpol

1.34 g/t Au over 31.00 m (incl. 6.09

g/t Au over 2.00 m)

MGA23-193

Jonpol

1.58 g/t Au over 14.00 m (incl. 8.45

g/t Au over 2.00 m)

MGA23-194

Jonpol

3.15 g/t Au over 3.30 m (incl. 4.98 g/t

Au over 2.00 m) &

0.74 g/t Au over 28.70 m (incl. 1.88

g/t Au over 6.00 m)

“g/t Au”: grams per tonne gold;

“m”: metres

Tower Gold Project Update:

- 123,290 m, in 453 drill holes, of the 140,000 m infill drill

program completed have been released.

Keyvan Salehi, P.Eng., MBA, President, CEO, and Director of

STLLR, stated: “Results from the Jonpol Deposit drilling

improves our confidence in the resource block model. In addition,

the higher-grade intercepts from holes MGA23-156, MGA23-157,

MGA23-193, and MGA23-194 compared to the Tower MRE block model

estimate suggests the potential to expand the known mineralization

of the deposit.”

“We anticipate receiving the remaining assay results from our

Tower Gold Project drilling in the coming weeks and plan to update

the markets accordingly.”

Jonpol Deposit Drilling

The Jonpol Deposit is located on the eastern end (Garrison Area)

of the Tower Gold Project in Timmins, Ontario (See Figure 1 for the

Tower Gold Project - General Location Map). Mineralization at

Jonpol is associated with shear zones within mafic to ultramafic

rocks, and is modelled as four contiguous mineralized zones along

the Munro Fault, which is a splay from the regional

Destor-Porcupine Fault Zone (“DPFZ”). The 2023 drill program

at Jonpol was focused on the near-surface infill (up to 150 m below

the surface) and extensions of the Tower Gold Project Mineral

Resource Estimate1 (“Tower MRE”).

The results from this batch of drilling (please also refer to

the Company’s December 7, 2023 news release for the previous batch

of drilling at Jonpol) appear to confirm the continuity of the

Jonpol mineralization as estimated by the Tower MRE block model.

This is evident particularly with holes MGA23-164, MGA23-197 and

MGA23-199A. In addition:

- Drill holes MGA23-156 and MGA23-157 (See Figures 2, 3, &

4): Intersected grades that are higher than the Tower MRE block

model.

- Drill holes MGA23-193 and MGA23-194 (See Figures 2 &

3): Intersected near-surface mineralization and elevated grades

outside the Tower MRE block model.

- Drill holes MGA23-167 and MGA23-196: Geomechanical

drilling that will benefit future pit shell designs.

Overall, the drilling at Jonpol confirmed the resource block

model, potentially increasing the estimated grades locally in some

areas. The increased drill density (50 m drill-centre spacings)

provides additional confidence in the Tower MRE block model, with

the potential to upgrade the areas drilled to a higher resource

category and further define future geological models.

Table 2: Tower Gold – Jonpol Deposit: Drill

Intercepts

Zone

Hole Number

From

(m)

To

(m)

Interval

(m)

Graude

(g/t Au)

Metal Factor (g/t Au x

m)

Jonpol

MGA23-156

37.00

60.00

23.00

1.19

27.37

Jonpol

including

52.00

54.00

2.00

6.05

12.10

Jonpol

and

94.00

115.00

21.00

2.09

43.89

Jonpol

including

102.00

105.20

3.20

7.46

23.87

Jonpol

MGA23-157

27.00

58.00

31.00

1.34

41.54

Jonpol

including

29.00

31.00

2.00

6.09

12.18

Jonpol

MGA23-164

65.00

69.00

4.00

1.17

4.68

Jonpol

and

170.00

178.00

8.00

0.50

4.00

Jonpol

MGA23-167

Geomechanical; No significant

intervals

Jonpol

MGA23-193

60.50

74.50

14.00

1.58

22.05

Jonpol

including

60.50

62.50

2.00

8.45

16.90

Jonpol

and

86.50

97.60

11.10

0.48

5.33

Jonpol

MGA23-194

11.70

15.00

3.30

3.15

10.40

Jonpol

including

11.70

13.70

2.00

4.98

9.96

Jonpol

and

24.00

52.70

28.70

0.74

21.24

Jonpol

including

33.00

39.00

6.00

1.88

11.28

Jonpol

MGA23-196

Geomechanical; No significant

intervals

Jonpol

MGA23-197

No significant intervals

Jonpol

MGA23-199A

No significant intervals

Note: All intercepts are calculated using

a 0.30 g/t Au cut-off, a maximum of 5m internal dilution and no top

cap applied. Drill intercepts are not true widths.

Table 3: Tower Gold – Jonpol Deposit:

Resource Infill Drill Hole Details

Zone

Hole

Number

Easting

Northing

Elevation

Azimuth

Inclination

End

of Hole Depth (m)

Jonpol

MGA23-156

577928.098

5374330.467

282.14

150.03

-57.03

171.0

Jonpol

MGA23-157

578008.214

5374303.119

283.45

329.99

-57.02

87.0

Jonpol

MGA23-164

578412.65

5374417.027

289.038

155.01

-57.02

225.0

Jonpol

MGA23-167

577564.098

5374243.635

290.453

10.03

-75.10

147.0

Jonpol

MGA23-193

577229.846

5374063.905

303.824

149.94

-56.11

141.0

Jonpol

MGA23-194

577313.205

5374094.308

298.748

160.11

-58.02

141.0

Jonpol

MGA23-196

577363.087

5374059.865

298.25

179.97

-75.03

147.0

Jonpol

MGA23-197

577457.562

5374082.552

297.182

334.01

-57.10

171.0

Jonpol

MGA23-199A

577515.236

5374126.209

287.454

340.04

-57.14

60.0

Quality Control Procedures

NQ drill core is oriented and cut with half sent to ALS

Laboratories Inc. (ALS) for drying and crushing to -2 mm, with a

1.00 kg split pulverized to -75 µm (200#). ALS is an ISO 17025

accredited laboratory. A 50 g charge is Fire Assayed and analyzed

using an AAS finish for Gold. Samples above 10.00 g/t Au are

analyzed by Fire Assay with a gravimetric finish and selected

samples with visible gold or high-grade mineralization are assayed

by Metallic Screen Fire Assay on a 1.00 kg sample. STLLR inserts

independent certified reference material and blanks with the

samples and assays routine pulp repeats and coarse reject sample

duplicates, as well as completing routine third-party check assays

at Bureau Veritas Commodities Canada Ltd.

Qualified Person

John McBride, MSc., P.Geo., Vice President of Exploration for

STLLR, who is the “Qualified Person” as defined by NI 43-101 for

this project, has reviewed and approved of the technical disclosure

contained in this news release.

About STLLR Gold

STLLR Gold Inc. (TSX: STLR; OTCQX: STLRF; FSE: O9D) is a

Canadian gold development company actively advancing two

cornerstone gold projects in Canada: The Tower Gold Project in the

Timmins Mining Camp in Ontario and the Colomac Gold Project located

north of Yellowknife, Northwest Territories. Each of these two

projects has the potential for a long-life and large-scale

operation and are surrounded by exploration land with favorable

upside potential. STLLR’s experienced management team, with a track

record of successfully advancing projects and operating mines, is

working towards rapidly advancing these projects.

Forward-Looking Information

This news release contains “forward-looking information” within

the meaning of applicable Canadian securities legislation.

Forward-looking information includes, but is not limited to,

information with respect to timing of the updated Tower MRE,

confirmation of the Tower MRE block model, potential expansion of

the known mineralization at the Tower Gold Project, the timing of

the release of the assay results from Tower Gold project drilling,

the goals, synergies, strategies, opportunities, profile, mineral

resources and potential production, project timelines, prospective

shareholding, integration and comparables to other transactions,

the future financial or operating performance of STLLR and STLLR’s

mineral properties and project portfolios, the advancement of the

Tower Gold and Colomac Gold Projects, long-life and large-scale

potential of the Tower and Colomac Gold Projects and exploration

upside of the land packages. Generally, forward-looking information

can be identified by the use of forward-looking terminology such as

“accelerate”, “add” or “additional”, “advancing”, “anticipates” or

“does not anticipate”, “appears”, “believes”, “can be”,

“conceptual”, “confidence”, “continue”, “convert” or “conversion”,

“deliver”, “demonstrating”, “estimates”, “encouraging”, “expand” or

“expanding” or “expansion”, “expect” or “expectations”,

“fast-track”, “forecasts”, “forward”, “goal”, “improves”,

“increase”, “intends”, “justification”, “leading”, “plans”,

“potential” or “potentially”, “pro-forma”, “promise”,

“prospective”, “prioritize”, “reflects”, “re-rating”, “robust”,

“scheduled”, “stronger”, “suggesting” or “suggests”, “support”,

“updating”, “upside”, “will be” or “will consider”, “work towards”,

or variations of such words and phrases or state that certain

actions, events or results “may”, “could”, “would”, “might”, or

“will be taken”, “occur”, or “be achieved”.

Forward-looking information is based on the opinions and

estimates of management at the date the information is made, and is

based on a number of assumptions and is subject to known and

unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance or achievements of

STLLR to be materially different from those expressed or implied by

such forward-looking information, including risks associated with

required regulatory approvals, the exploration, development and

mining such as economic factors as they effect exploration, future

commodity prices, changes in foreign exchange and interest rates,

actual results of current exploration activities, government

regulation, political or economic developments, the ongoing wars

and their effect on supply chains, environmental risks, COVID-19

and other pandemic risks, permitting timelines, capex, operating or

technical difficulties in connection with development activities,

employee relations, the speculative nature of gold exploration and

development, including the risks of diminishing quantities of

grades of reserves, contests over title to properties, and changes

in project parameters as plans continue to be refined as well as

those risk factors discussed in the joint management information

circular of STLLR dated December 20, 2023, available on

www.sedarplus.ca. Although STLLR has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking information,

there may be other factors that cause results not to be as

anticipated, estimated or intended. There can be no assurance that

such information will prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such information. Accordingly, readers should not place undue

reliance on forward-looking information. STLLR does not undertake

to update any forward-looking information, except in accordance

with applicable securities laws.

1 For more information on the Tower MRE effective as of

September 7, 2022, please refer to the NI 43-101 technical report

titled “NI 43-101 Report & Preliminary Economic Assessment of

the Tower Gold Project Northeastern Ontario, Canada” dated November

29, 2022, which is available on STLLR Gold’s profile on SEDAR+

www.sedarplus.ca and www.stllrgold.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240328162561/en/

STLLR Gold Investor Relations +1 (416) 863-2105 |

investors@stllrgold.com | www.STLLRgold.com

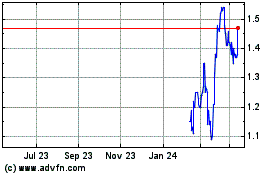

STLLR Gold (TSX:STLR)

Historical Stock Chart

From Nov 2024 to Dec 2024

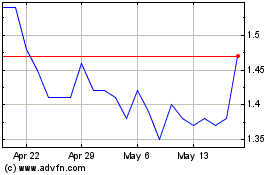

STLLR Gold (TSX:STLR)

Historical Stock Chart

From Dec 2023 to Dec 2024