South32 Maintains Option on the Sierra Mojada Project

May 01 2019 - 6:00AM

Silver Bull Resources, Inc. (OTCQB: SVBL, TSX: SVB) (“Silver Bull”)

is pleased to announce it has received notice from South32 that it

wishes to maintain its option on the Sierra Mojada Project by

funding an additional US$3 million in exploration. This will result

in aggregate funding of US$6 million at the completion of the

second year of the joint venture option described below.

Silver Bull has a drill program underway on the

project and a full update will be released to the market

shortly.

South32 Joint Venture Option:

In June 2018 Silver Bull signed an agreement with a wholly owned

subsidiary of South32 whereby Silver Bull has granted South32 an

option to form a 70/30 joint venture with respect to the Sierra

Mojada Project. To maintain the option in good standing, South32

must contribute minimum exploration funding of US$10 million

("Initial Funding") during a 4 year option period with minimum

aggregate exploration funding of US$3 million, US$6 million and

US$8 million to be made by the end of years 1, 2 and 3 of the

option period respectively. South32 may exercise its option to

subscribe for 70% of the shares of Minera Metalin S.A. De C.V.

("Metalin"), the wholly owned subsidiary of Silver Bull which holds

the claims in respect of the Sierra Mojada Project, by contributing

US$100 million to Metalin for Project funding, less the amount of

the Initial Funding contributed by South32 during the option

period.

About Silver Bull: Silver Bull

is a well-financed mineral exploration company whose shares are

listed on the Toronto Stock Exchange and trade on the OTCQB in the

United States, and is based out of Vancouver, Canada. The Sierra

Mojada Project is located 150 kilometers north of the city of

Torreon in Coahuila, Mexico, and is highly prospective for silver

and zinc.

About the Sierra Mojada

deposit: Sierra Mojada is an open pittable oxide deposit

with a NI43-101 compliant measured and indicated "global" resource

of 70.4 million tonnes grading 3.4% zinc and 38.6g/t silver at a

$13.50 NSR cutoff giving 5.35 billion pounds of zinc and 87.4

million ounces of silver. Included within the "global" resource is

a measured and indicated "high grade zinc zone" of 13.5 million

tonnes with an average grade of 11.2% zinc at a 6% cutoff, giving

3.336 billion pounds of zinc, and a measured and indicated "high

grade silver zone" of 15.2 million tonnes with an average grade of

114.9g/t silver at a 50g/t cutoff giving 56.3 million ounces of

silver. Mineralization remains open in the east, west, and

northerly directions. Approximately 60% of the current 3.2

kilometer mineralized body is at or near surface before dipping at

around 6 degrees to the east.

The technical information of this news release

has been reviewed and approved by Tim Barry, a Chartered

Professional Geologist (CPAusIMM), and a qualified person for the

purposes of National Instrument 43-101.

On behalf of the Board of Directors "Tim Barry"

Tim Barry, CPAusIMM Chief Executive Officer,

President and Director

INVESTOR RELATIONS: +1 604 687 5800

info@silverbullresources.com

Cautionary Note to U.S. Investors

concerning estimates of Measured, Indicated, and Inferred

Resources: This press release uses the terms "measured

resources", "indicated resources", and "inferred resources" which

are defined in, and required to be disclosed by, NI 43-101. We

advise U.S. investors that these terms are not recognized by the

United States Securities and Exchange Commission (the "SEC"). The

estimation of measured, indicated and inferred resources involves

greater uncertainty as to their existence and economic feasibility

than the estimation of proven and probable reserves. U.S. investors

are cautioned not to assume that measured and indicated mineral

resources will be converted into reserves. The estimation of

inferred resources involves far greater uncertainty as to their

existence and economic viability than the estimation of other

categories of resources. U.S. investors are cautioned not to assume

that estimates of inferred mineral resources exist, are

economically minable, or will be upgraded into measured or

indicated mineral resources. Under Canadian securities laws,

estimates of inferred mineral resources may not form the basis of

feasibility or other economic studies. Disclosure of "contained

ounces" in a resource is permitted disclosure under Canadian

regulations, however the SEC normally only permits issuers to

report mineralization that does not constitute "reserves" by SEC

standards as in place tonnage and grade without reference to unit

measures. Accordingly, the information contained in this press

release may not be comparable to similar information made public by

U.S. companies that are not subject NI 43-101. Cautionary

note regarding forward looking statements: This news

release contains forward-looking statements regarding future events

and Silver Bull's future results that are subject to the safe

harbors created under the U.S. Private Securities Litigation Reform

Act of 1995, the Securities Act of 1933, as amended (the

"Securities Act"), and the Securities Exchange Act of 1934, as

amended (the "Exchange Act"), and applicable Canadian securities

laws. Forward-looking statements include, among others, statements

regarding mineral resource estimates and timing of expected

drilling update. These statements are based on current

expectations, estimates, forecasts, and projections about Silver

Bull's exploration projects, the industry in which Silver Bull

operates and the beliefs and assumptions of Silver Bull's

management. Words such as "expects," "anticipates," "targets,"

"goals," "projects," "intends," "plans," "believes," "seeks,"

"estimates," "continues," "may," variations of such words, and

similar expressions and references to future periods, are intended

to identify such forward-looking statements. Forward-looking

statements are subject to a number of assumptions, risks and

uncertainties, many of which are beyond our control, including such

factors as the results of exploration activities and whether the

results continue to support continued exploration activities,

unexpected variations in ore grade, types and metallurgy,

volatility and level of commodity prices, the availability of

sufficient future financing, and other matters discussed under the

caption "Risk Factors" in our Annual Report on Form 10-K for the

fiscal year ended October 31, 2018, as amended, and our other

periodic and current reports filed with the SEC and available on

www.sec.gov and with the Canadian securities commissions available

on www.sedar.com. Readers are cautioned that forward-looking

statements are not guarantees of future performance and that actual

results or developments may differ materially from those expressed

or implied in the forward-looking statements. Any forward-looking

statement made by us in this release is based only on information

currently available to us and speaks only as of the date on which

it is made. We undertake no obligation to publicly update any

forward-looking statement, whether written or oral, that may be

made from time to time, whether as a result of new information,

future developments or otherwise.

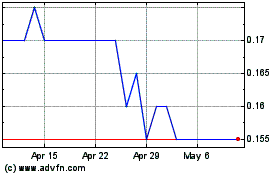

Silver Bull Resources (TSX:SVB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Silver Bull Resources (TSX:SVB)

Historical Stock Chart

From Jan 2024 to Jan 2025