Swiss Water Decaffeinated Coffee Inc. (

TSX– SWP)

(“Swiss Water” or “the company”), a leading specialty coffee

company and premium green coffee decaffeinator, today reported

financial results for the year ended December 31, 2021.

Three months and year ended December 31,

2021 Financial and Operational Highlights

-

Fourth quarter revenue was $35.1 million, an increase of 43% or

$10.6 million when compared to the same period in 2020. Full-year

revenue grew strongly and was $125.1 million, an increase of 28% or

$27.5 million.

-

Quarterly and annual volumes increased by 23% and 17%,

respectively, compared to the same periods in 2020 reflecting new

customer acquisition and organic growth with existing customers as

the food service economy continues to recover.

-

European business grew very strongly with volumes up by 70%

compared to the year ended December 31, 2020. Annual volumes in the

Asia Pacific and North American regions grew strongly at 30% and 5%

respectively.

-

Production volumes were high during the fourth quarter and capacity

utilization across the company’s three production lines exceeded 80

percent.

-

Fourth quarter Adjusted EBITDA1 was $2.1 million, compared to $1.2

million in the same quarter in 2020, representing an increase of

78%. Full-year Adjusted EBITDA grew strongly to $10.5 million

compared to $7.0 million in 2020, an increase of 50%.

-

Fourth quarter net income was $0.2 million, compared to a net loss

of $0.3 million in the same quarter in 2020, representing an

increase of $0.5 million or 175%. Full-year net income fell

to $0.5 million from $2.9 million in the same period in 2020 due to

increased depreciation, a non-cash loss on the extinguishment of

the convertible debenture and increased finance expenses.

-

Swiss Water initiated on-site construction of a second production

line in Delta, BC in July 2021. The foundation was completed in the

third quarter of 2021, and above ground construction commenced

during the fourth quarter. The project is currently on time and on

budget.

-

Inflationary pressure increased within the company’s variable cost

structure during the fourth quarter and led to an increase in

processing prices to enable maintenance of margins.

___________________________________

1 Adjusted EBITDA is defined in the ‘Non-IFRS Measures’ section

of the MD&A and is a “Non-GAAP Financial Measure” as defined by

CSA Staff Notice 52-306.

“We are very proud to report that our volumes,

revenues and adjusted EBITDA hit record levels in 2021.

Annual revenue exceeded $100 million for the first time, and

Adjusted EBITDA moved beyond $10 million for the first time in the

company’s history. Our existing customers are experiencing strong

growth in demand for their chemical free decaf offerings and

additionally, we have started to ship products to a number of new

out-of-home customers in North America. We are seeing very good

evidence in the marketplace that methylene chloride decaffeination

is declining in preference by roasters and consumers. Furthermore,

we are excited to share that our capacity utilization rate across

our three production lines exceeded 80% during the fourth quarter

and that these production rates drive solid profitability”, said

Frank Dennis, Swiss Water’s President and CEO. “As we look forward

into 2022 we are continuing to see a strong order book and we are

optimistic that, with maturing vaccination programs in most

developed countries, we will continue to see favourable trading

conditions in our key markets. On a more cautionary note, we are

continuing to experience a marked slowdown in coffee deliveries as

supply chain bottlenecks persist. Additionally, a rare double frost

occurred last July in Brazil increasing coffee futures prices

sharply through the fourth quarter which caused a significant

increase in working capital needs. We will pay close attention to

these emerging risks and increasing costs, with an increasing

expectation for further pricing actions and other mitigation

efforts. On a separate note, we commenced above ground construction

of our second line in Delta, BC during the fourth quarter and we

expect to commission this new line in 2023”, said Dennis.

Operational Highlights

The following table shows changes in volumes

during the three months and year ended December 31, 2021, compared

to the same periods in 2020.

|

Volumes |

3 months ended December 31, 2021 |

Year ended December 31, 2021 |

|

Change in total volumes |

+23% |

+17% |

|

By customer type |

|

|

|

Roasters |

-6% |

+1% |

|

Importers |

+69% |

+50% |

|

Specialty |

+34% |

+26% |

|

Commercial |

+14% |

+12% |

-

Total volumes in the fourth quarter and year ended 2021 improved by

23% and 17%, respectively, compared to the same periods in 2020.

Across all geographical markets, many of the company’s customers

are seeing strong consumer demand and are ordering in line, and in

some cases, ahead of pre-pandemic levels. Furthermore, volume

growth was enhanced during Q4 2021 as the company started to ship

products to some new out-of-home customers within North America.

Encouragingly, Swiss Water recorded 7% and 56% growth in its North

America and Asia Pacific regions respectively in the fourth quarter

of 2021, compared to the same periods in 2020. In Europe, volumes

increased by an impressive 72% during the three months ended

December 31, 2021.

-

As in the past, Swiss Water’s largest geographical market by volume

continues to be the United States, followed by Canada, Europe and

other international markets. By dollar value, for the year ended

December 31, 2021, 43% of sales were to customers in the United

States, 31% were to Canada, and the remaining 26% were to other

countries.

-

In September 2020, Swiss Water successfully completed its first

production run of commercial-grade coffee from its new Delta, BC

facility. During 2021, a significant portion of production volume

was transitioned to Delta, reducing some of the pressure on the

company’s legacy production assets in Burnaby, BC. The Delta

facility is now running smoothly on a 24/7 basis and contributed to

the fourth quarter capacity utilization rate exceeding 80% across

the company's three production lines.

Financial Highlights

|

In $000s except per share amounts |

3 months ended December 31 |

Year ended December 31 |

|

(unaudited) |

2021 |

|

2020 |

2021 |

|

2020 |

|

Sales |

$ |

35,129 |

|

$ |

24,512 |

|

$ |

125,076 |

|

$ |

97,571 |

| Gross

profit |

|

4,389 |

|

|

2,861 |

|

|

17,611 |

|

|

15,652 |

| Operating

income |

|

1,517 |

|

|

126 |

|

|

6,686 |

|

|

5,137 |

| Net

income (loss) |

|

241 |

|

|

(320 |

) |

|

496 |

|

|

2,949 |

| Adjusted

EBITDA1 |

|

2,111 |

|

|

1,186 |

|

|

10,533 |

|

|

7,042 |

| Net

income per share – basic2 |

$ |

0.03 |

|

$ |

(0.04 |

) |

$ |

0.05 |

|

$ |

0.32 |

|

Net income per share – diluted2 |

$ |

0.03 |

|

$ |

(0.04 |

) |

$ |

0.05 |

|

$ |

0.25 |

1 Adjusted EBITDA is defined in the ‘Non-IFRS

Measures’ section of the MD&A and is a “Non-GAAP Financial

Measure” as defined by CSA Staff Notice 52-306.2 Per-share

calculations are based on the weighted average number of shares

outstanding during the periods. Diluted earnings per share take

into account shares that may be issued upon conversion of

convertible debenture (until July 20, 2021), the exercise of

warrants, and RSUs as well as the impact on earnings from changes

in the fair market value of the embedded option in the convertible

debenture (until July 20, 2021) and conversion of RSUs and the

exercise of warrants.

-

Fourth quarter revenue increased by 43% over Q4 2020 to $35.1

million, and 12 month revenue increased by 28% to $125.1 million as

a result of increased volume growth in the periods and the effect

of higher green coffee prices, compared to the same periods in

2020.

-

Adjusted EBITDA for the three months and year ended December 31,

2021 was $2.1 million and $10.5 million

respectively, representing increases of 78% and 50%, compared

to the same periods in 2020. Operationally, the increase in

Adjusted EBITDA was driven by volume growth, efficiency gains due

to higher capacity utilization rates, and an increased financial

contribution from Seaforth. These gains were somewhat offset by an

increase in green coffee costs and incremental labour and

production expenses associated with operating at two

stand-alone facilities. The costs associated with running two

plants will cease when the company exits its Burnaby facility,

expected to occur at the end of June 2023.

-

Net Income declined during the 2021 fiscal year, despite the

significant increase in Adjusted EBITDA, to $0.5 million from $2.9

million in 2020. The change was driven primarily by the $2.1

million increase in depreciation and amortization resulting from

operating at two facilities, the non-cash loss of $1.4 million

on the extinguishment of the convertible debenture, and a $1.3

million increase in finance expense due to the higher debt needed

to finance the construction of the second production line in

Delta, as well as working capital investments driven by increasing

coffee prices.

NON-IFRS MEASURES

Adjusted EBITDA

We define Adjusted EBITDA as net income before

interest, depreciation, amortization, impairments, share-based

compensation, gains/losses on foreign exchange, gains/losses on

disposal of property and capital equipment, fair value adjustments

on embedded options, loss on extinguishment of debt, adjustment for

the impact of IFRS 16 - Leases, and provision for income taxes. Our

definition of Adjusted EBITDA also excludes unrealized gains and

losses on the undesignated portion of foreign exchange forward

contracts.

To help readers better understand our financial

results, the following table provides a reconciliation of net

income, an IFRS measure, to Adjusted EBITDA is as follows:

|

(In $000s) |

3 months ended December 31, |

Year ended December 31, |

|

(unaudited) |

2021 |

|

2020 |

|

2021 |

|

2020 |

|

|

Income (loss) for the period |

$ |

241 |

|

$ |

(320) |

|

$ |

496 |

|

$ |

2,949 |

|

|

Income taxes expense (recovery) |

|

128 |

|

|

(323) |

|

|

509 |

|

|

1,058 |

|

|

Income (loss) before tax |

$ |

369 |

|

$ |

(643) |

|

$ |

1005 |

|

$ |

4,007 |

|

|

Finance income |

|

(72) |

|

|

(118) |

|

|

(442) |

|

|

(488) |

|

|

Finance expenses |

|

1,189 |

|

|

1,061 |

|

|

4,364 |

|

|

3,087 |

|

|

Loss on extinguishment of debt |

|

(4) |

|

|

- |

|

|

1,381 |

|

|

- |

|

|

Depreciation & amortization |

|

1,095 |

|

|

1,653 |

|

|

6,208 |

|

|

4,677 |

|

|

Unrealized (gain) loss on foreign exchange forwards |

|

(183) |

|

|

(371) |

|

|

80 |

|

|

(48) |

|

|

Fair value loss (gain) on the embedded option |

|

- |

|

|

72 |

|

|

48 |

|

|

(1,328) |

|

|

(Gain) loss on foreign exchange |

|

214 |

|

|

43 |

|

|

7 |

|

|

(19) |

|

|

Share-based compensation expense (recovery) |

|

205 |

|

|

192 |

|

|

690 |

|

|

(129) |

|

|

Impact of IFRS 16 - Leases |

|

(702) |

|

|

(700) |

|

|

(2,808) |

|

|

(2,717) |

|

|

Adjusted EBITDA |

$ |

2,111 |

|

$ |

1,189 |

|

$ |

10,533 |

|

$ |

7,042 |

|

Company Profile

Swiss Water Decaffeinated Coffee Inc. is a

leading specialty coffee company and a premium green coffee

decaffeinator that employs the proprietary Swiss Water® Process to

decaffeinate green coffee without the use of solvents such as

methylene chloride. It also owns Seaforth Supply Chain Solutions

Inc., a green coffee handling and storage business. Both businesses

are located in the cities of Burnaby and Delta, British Columbia,

Canada.

Additional Information

A conference call to discuss Swiss Water’s

recent financial results will be held on March 31, 2022 at

10:00 am Pacific Time (1:00 pm Eastern Time). To access

the conference call, please dial 1-888-506-0062

(toll free) or 1-973-528-0011 (international); passcode:

624705. A replay will be available through April

14, 2022 at 1-877-481-4010 (toll free) or 1-919-882-2331

(international); passcode: 44930.

A more detailed discussion of Swiss Water

Decaffeinated Coffee Inc.’s recent financial results is provided in

the company’s Management Discussion and Analysis filed on SEDAR

(www.sedar.com) and the company’s website

(investor.swisswater.com).

For more information, please

contact:

Iain Carswell, Chief Financial OfficerSwiss

Water Decaffeinated Coffee Inc.Phone:

604.420.4050Email: investor-relations@swisswater.comWebsite:

investor.swisswater.com

Forward-Looking Statements

Certain statements in this press release may

constitute “forward-looking” statements that involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, levels of activity, performance or achievements to

be materially different from any future results, levels of

activity, performance or achievements expressed or implied by such

forward-looking statements. When used in this press release, such

statements may include such words as “may”, “will”, “expect”,

“believe”, “plan” and other similar terminology. These statements

reflect management’s current expectations regarding future events

and operating performance, as well as management’s current

estimates, but which are based on numerous assumptions and may

prove to be incorrect. These statements are neither promises nor

guarantees, but involve known and unknown risks and uncertainties,

including, but not limited to, risks related to processing volumes

and sales growth, operating results, the supply of utilities, the

supply of coffee, general industry conditions, commodity price

risks, technology, competition, foreign exchange rates,

construction timing, costs and financing of capital projects, a

potential impact of the COVID-19 pandemic, and general economic

conditions. The forward-looking statements and financial outlook

information contained herein are made as of the date of this press

release and are expressly qualified in their entirety by this

cautionary statement. Except to the extent required by applicable

securities law, Swiss Water undertakes no obligation to publicly

update or revise any such statements to reflect any change in

management’s expectations or in events, conditions, or

circumstances on which any such statements may be based, or that

may affect the likelihood that actual results will differ from

those described herein.

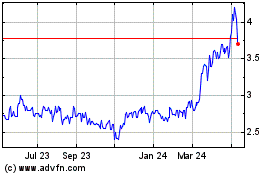

Swiss Water Decaffeinate... (TSX:SWP)

Historical Stock Chart

From Dec 2024 to Jan 2025

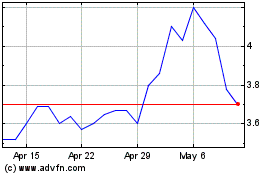

Swiss Water Decaffeinate... (TSX:SWP)

Historical Stock Chart

From Jan 2024 to Jan 2025