Blackstone Real Estate to Take Tricon Residential Private in $3.5 Billion Deal

January 19 2024 - 8:47AM

Dow Jones News

By Adriano Marchese

Blackstone Real Estate Partners agreed to acquire Canadian real

estate company Tricon Residential in a deal with an equity

transaction value of $3.5 billion.

In a joint statement, the companies said Blackstone Real Estate

Partners, in conjunction with Blackstone Real Estate Income Trust,

will acquire all outstanding common shares of Tricon for about

15.17 Canadian dollars, or $11.25, a share.

Tricon's stock has increased 4.9% over the last 12 months, and

closed on Thursday at C$11.65 in Toronto. In New York, the stock

closed at $8.63.

The transaction price represents a premium of 30% to Tricon's

closing share price in New York on Thursday and a 42% premium to

the volume-weighted average share price over the prior 90 days,

Tricon said.

Tricon owns, operates and develops a portfolio of about 38,000

single-family rental homes in the U.S. Sun Belt as well as

multi-family apartments in Canada. It also provides residential

services through its tech-enabled operating platform and operating

teams, serving communities in both countries.

Under the new ownership, Tricon plans to complete its $1 billion

development pipeline of new single-family rental homes in the U.S.

and $2.5 billion of new apartments in Canada.

It will also spend $1 billion of planned capital projects over

the next several years.

Once the transaction is complete, Tricon's shares will no longer

be listed on the New York Stock Exchange or the Toronto Stock

Exchange, but will remain headquartered in Toronto, Ontario.

Write to Adriano Marchese at adriano.marchese@wsj.com

(END) Dow Jones Newswires

January 19, 2024 09:32 ET (14:32 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

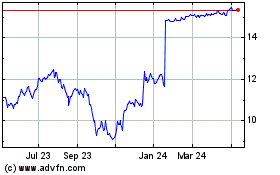

Tricon Residential (TSX:TCN)

Historical Stock Chart

From Dec 2024 to Jan 2025

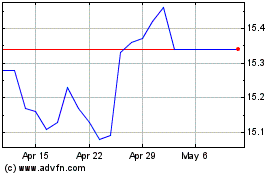

Tricon Residential (TSX:TCN)

Historical Stock Chart

From Jan 2024 to Jan 2025